Market Morsel: Australia to benefit from wet Germany?

Market Morsel

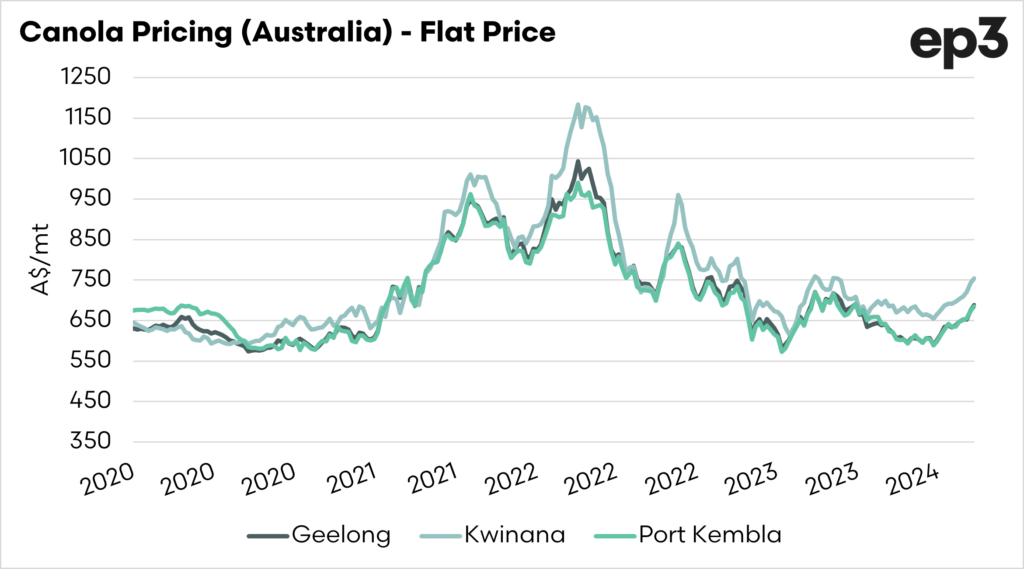

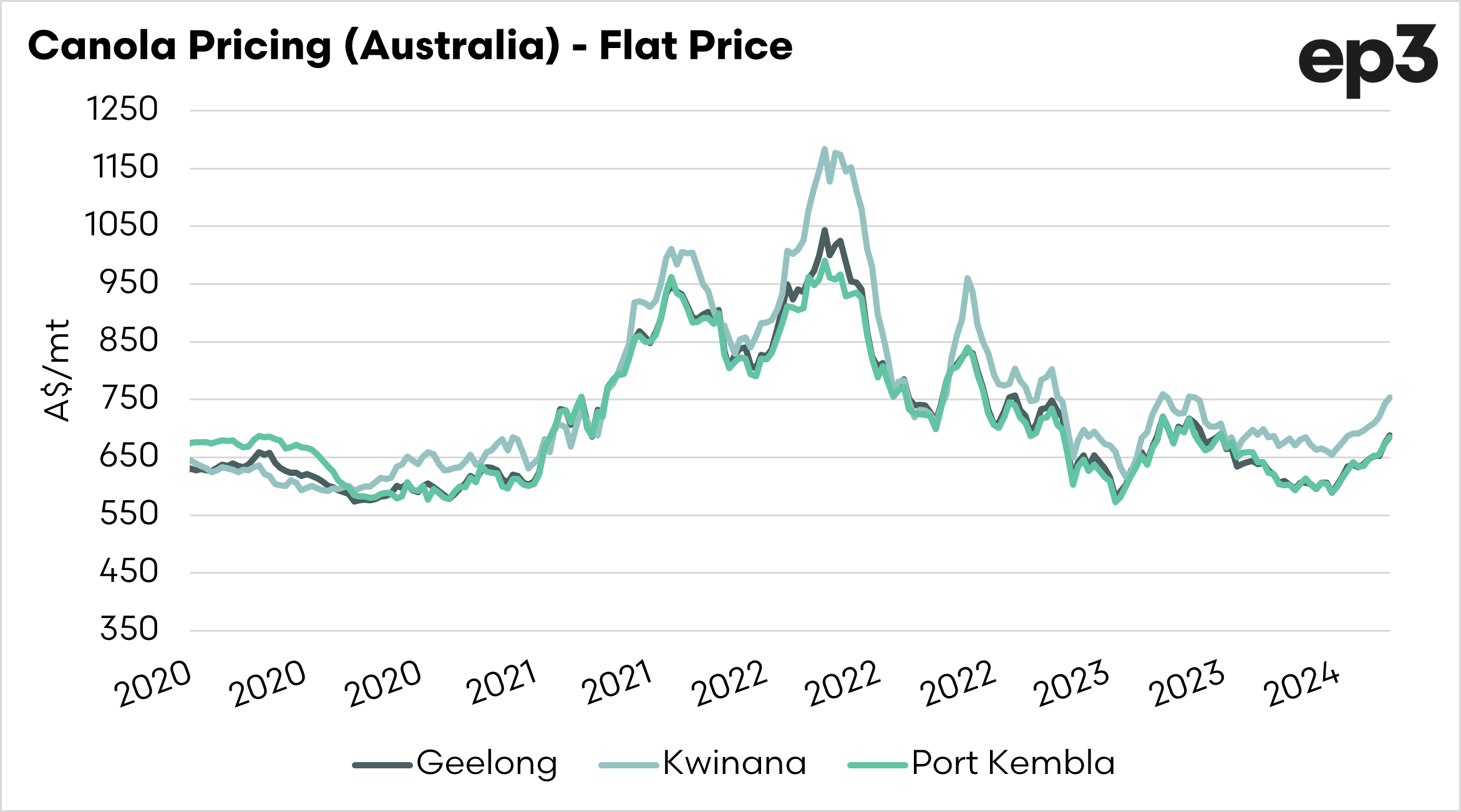

The canola market has been firing up a little recently, prices around the country have risen dramatically.

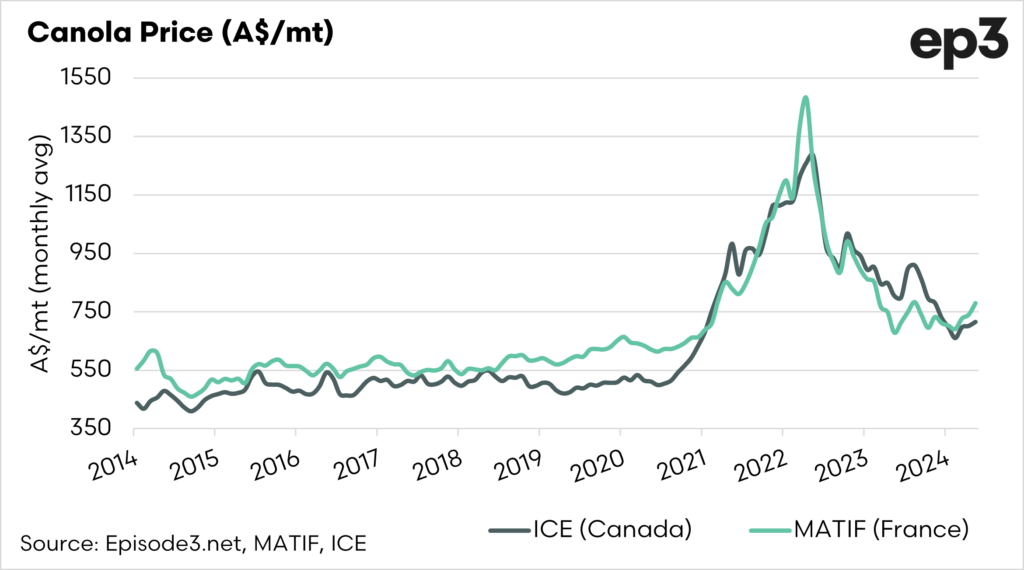

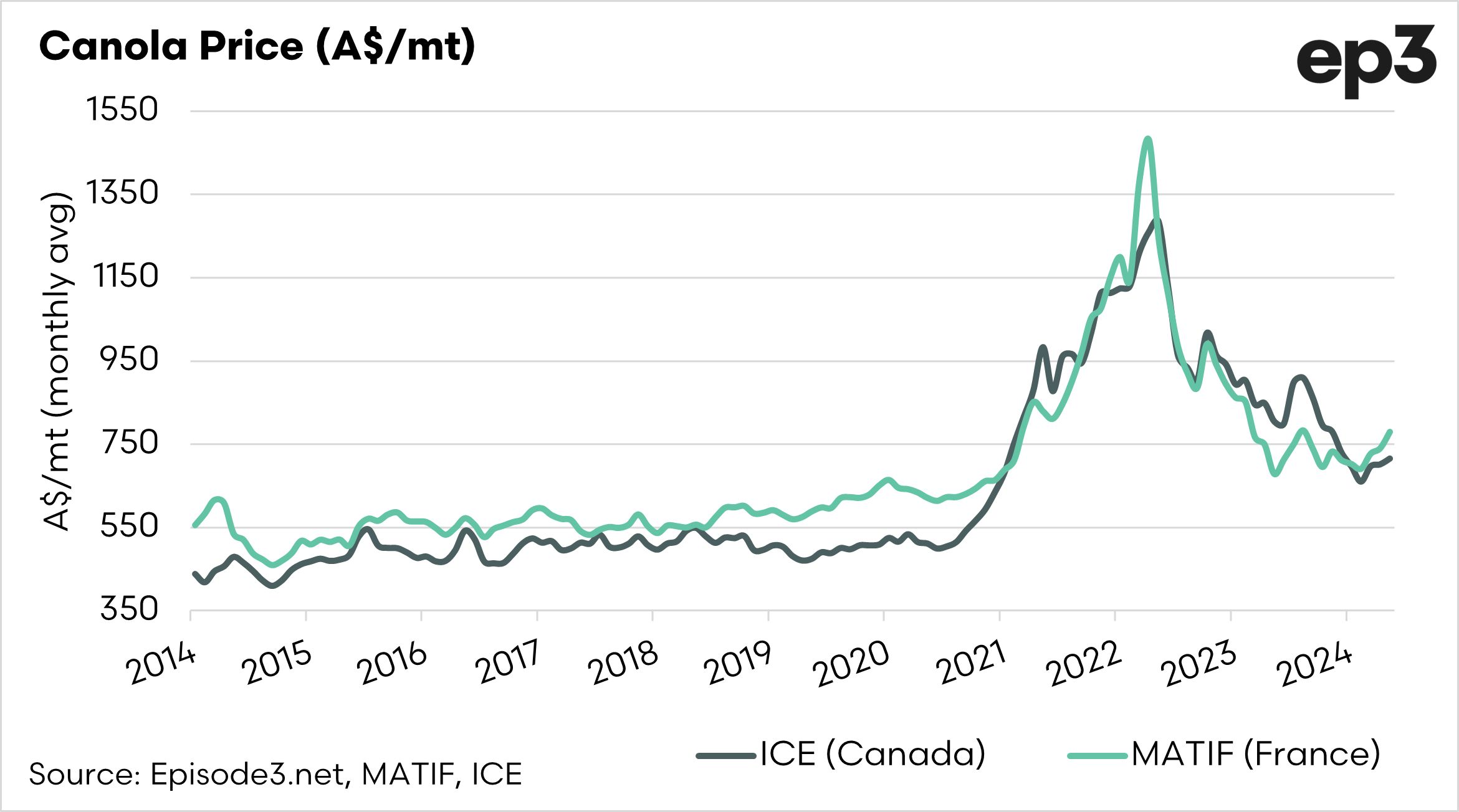

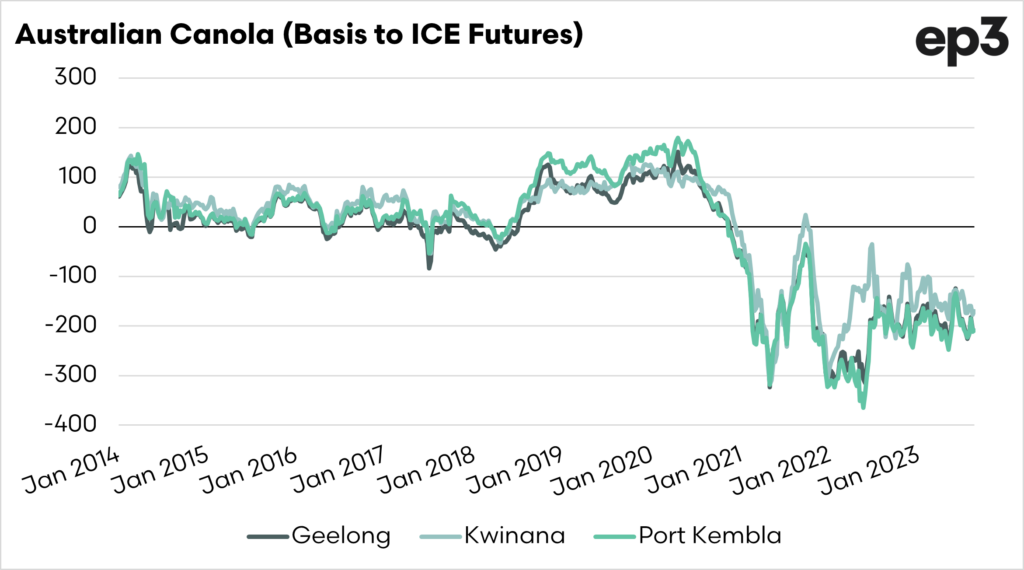

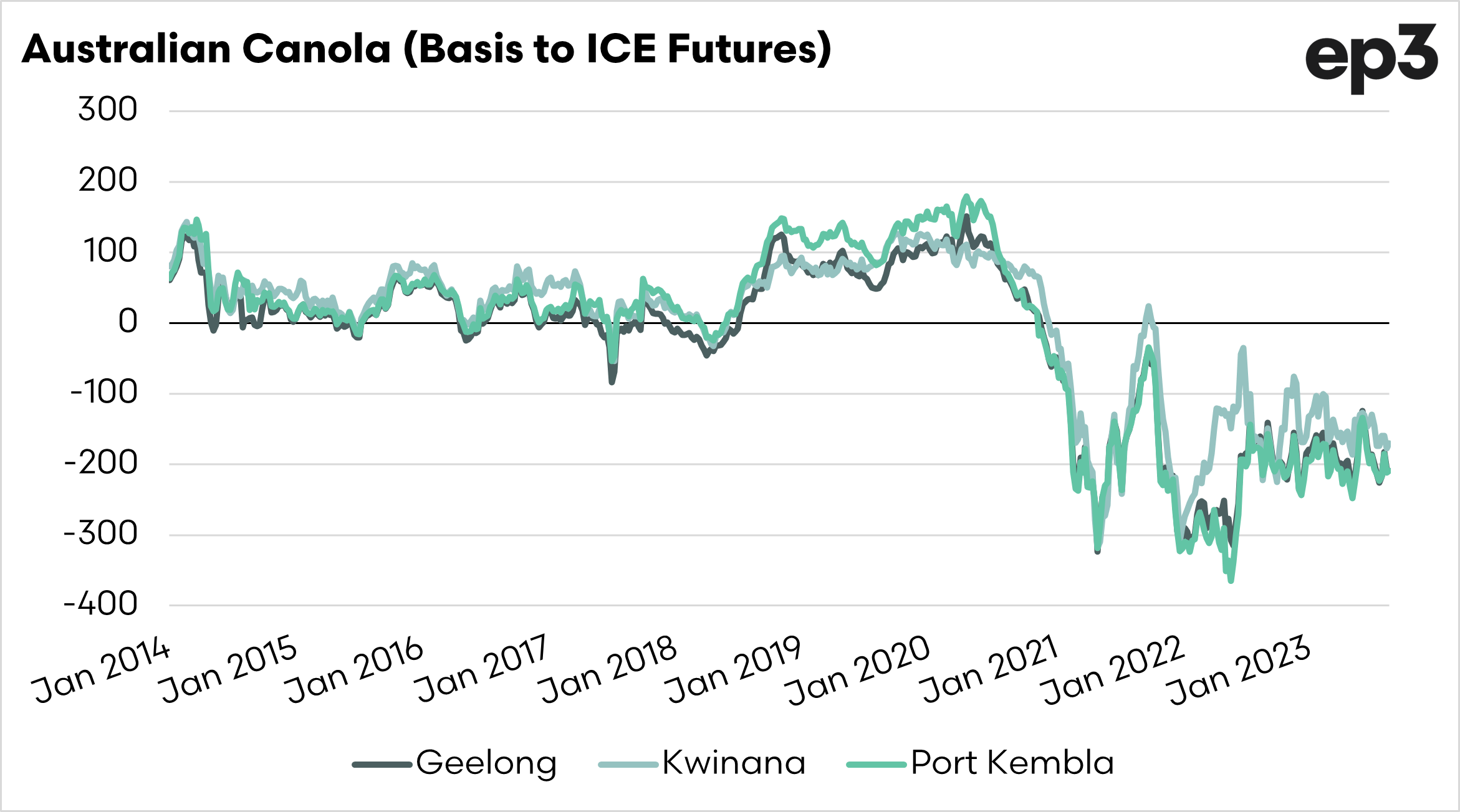

Geelong is up A$36, Port Kembla A$35 and Kwinana A$44. A nice little rise to occur during seeding. If we look at future values, the MATIF contract (French) has risen the furthest, up A$40, while ICE (Canada) has only gained A$14. These values are all monthly average values from April to May.

The current values we are experiencing in Australia, on either side of A$700, depending on which side of the country you are on, are traditionally very good and attractive numbers.

According to overseas contacts, there seem to be strong old-crop canola stocks in Canada, which is stymying some of the potential from the Canadian market. The European market has been dogged by moist conditions from the heavy autumn rains. Acres of rapeseed are declining, such as in Germany which reported this week that area for rapeseed was down 5.8% to 1.1m hectares.

This is important for Australia, especially Western Australia, as our biggest and most important destination for canola for use in biofuels. If France/Germany have reduced crops, then it makes our canola valuable. Especially in comparison to Canada, as we have large volumes of non-GM , which makes the end meal more valuable.

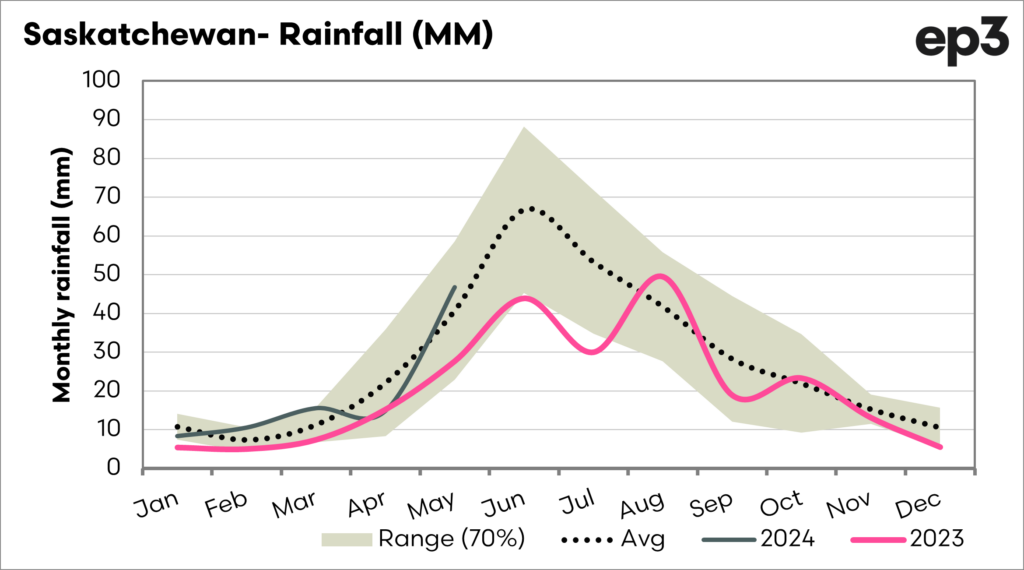

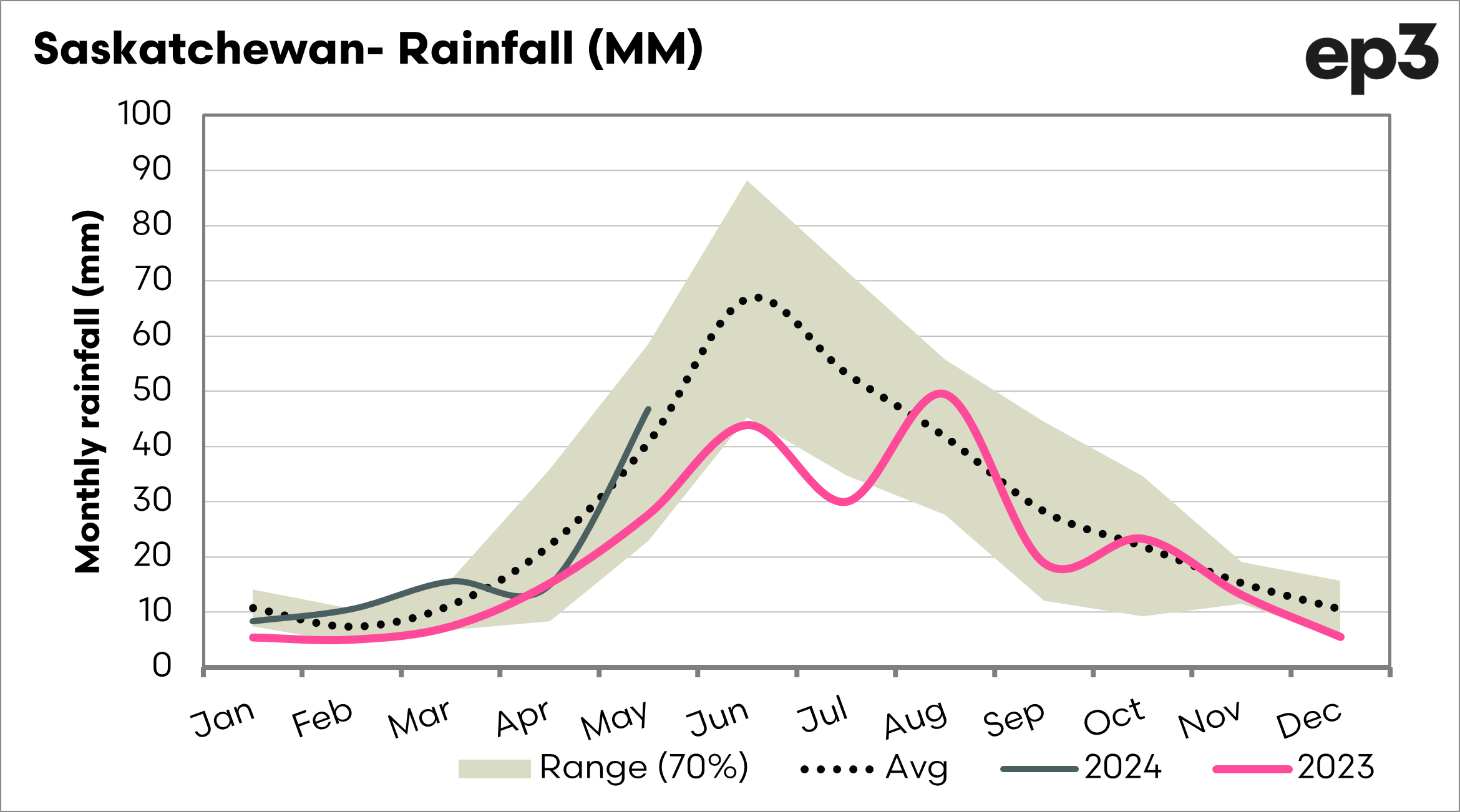

In canada, there were concerns about dryness in the canola crop. The majority is grown in Saskatchewan, and the rainfall has moved to a move average condition. It is still one to watch as the key growing period comes soon.

Currently, Australian canola prices remain trading at a significant discount to ICE futures. This may change if the Canadian crop goes okay and the European crop demands our canola.