Market Morsel: Bargain basement barley

Market Morsel

It’s now been over a year since the effective ban of barley into China, a country where the bulk of our barley has gone in recent years. One thing I hear quite often is that the ban hasn’t impacted the barley price.

I’m not convinced that is the case.

At EP3, we are lucky to have access to a lot of data in order to perform comparisons, and we spend a lot of time looking at other countries. I thought it was worth having a quick look at how our barley pricing compares to the rest of the world.

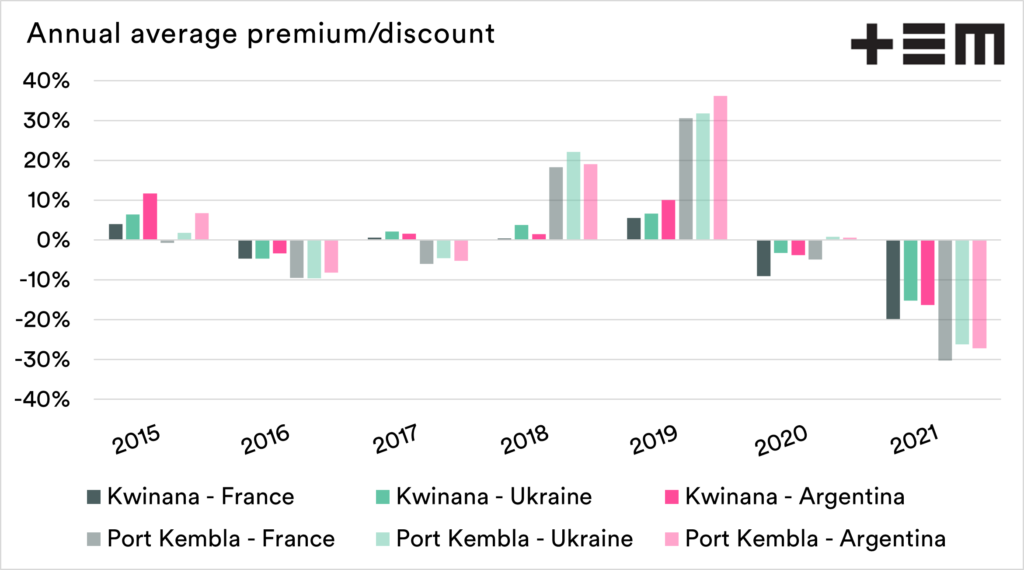

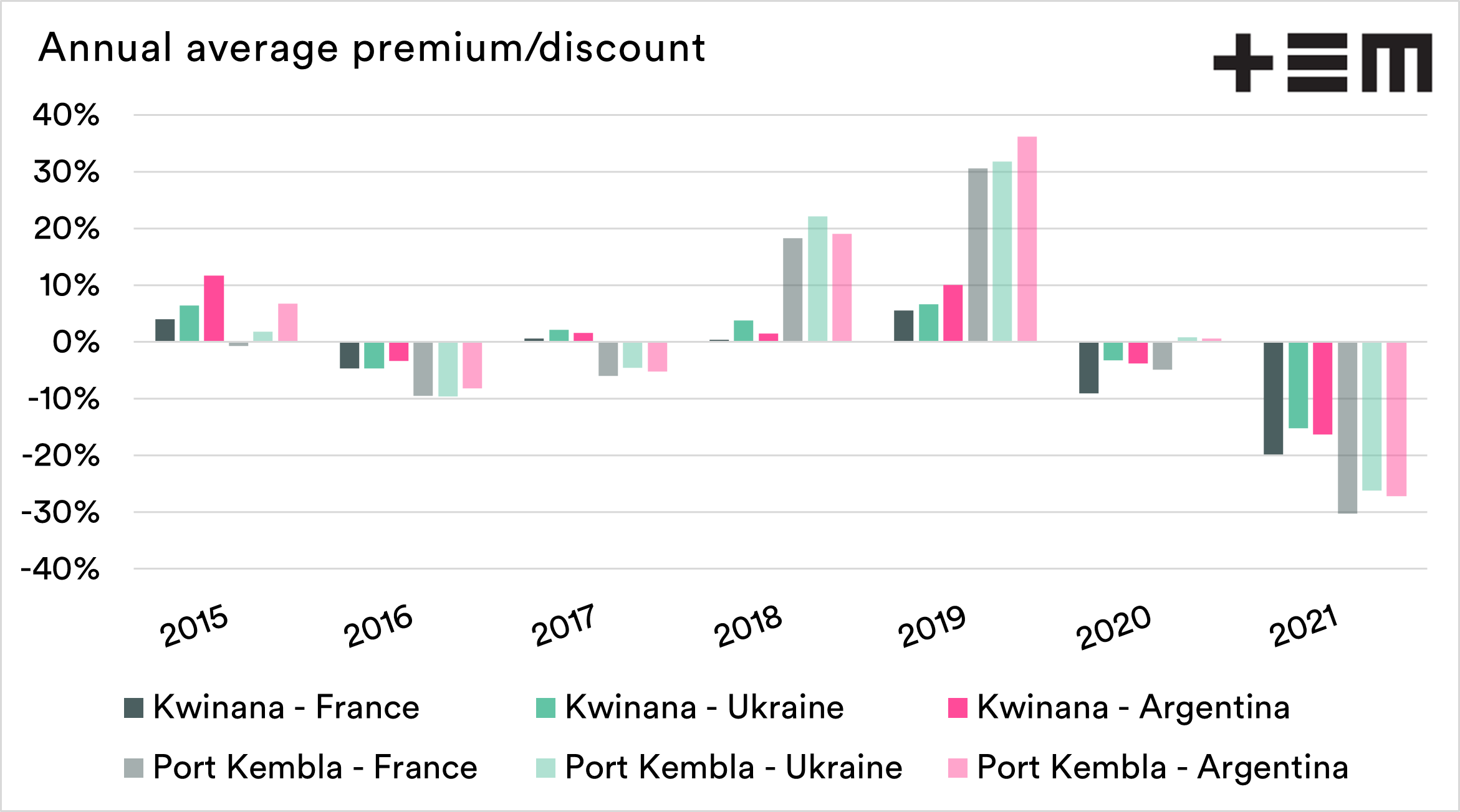

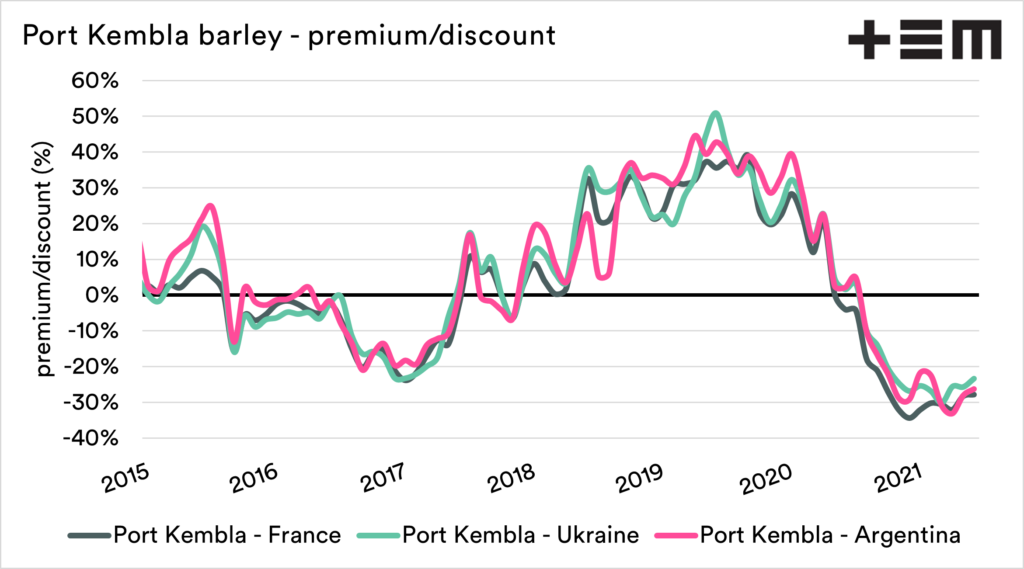

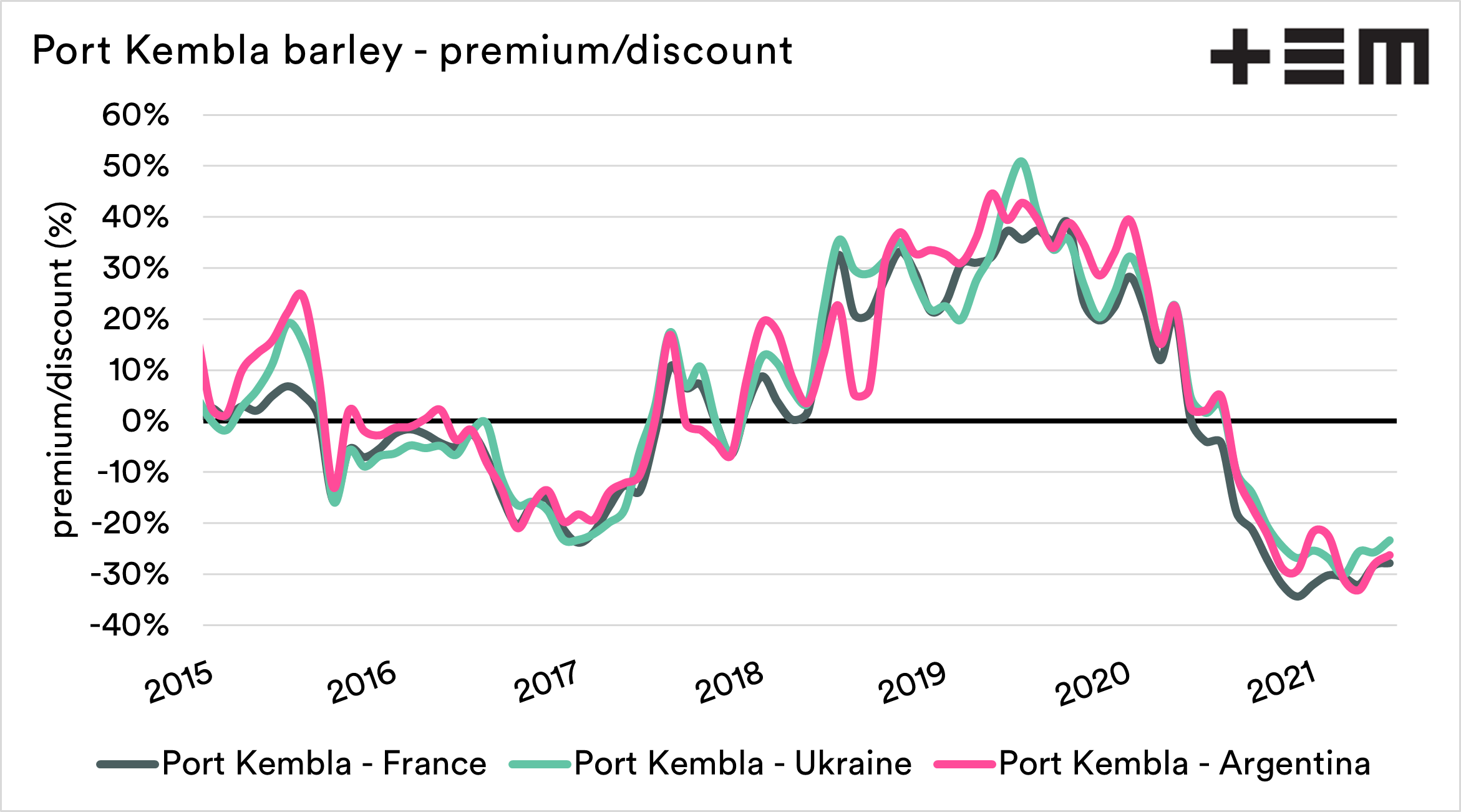

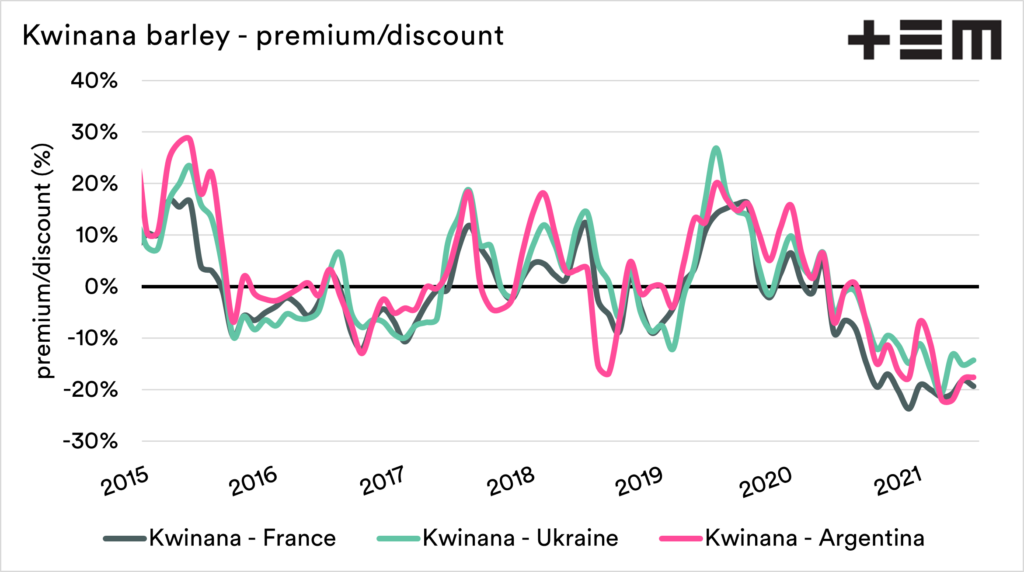

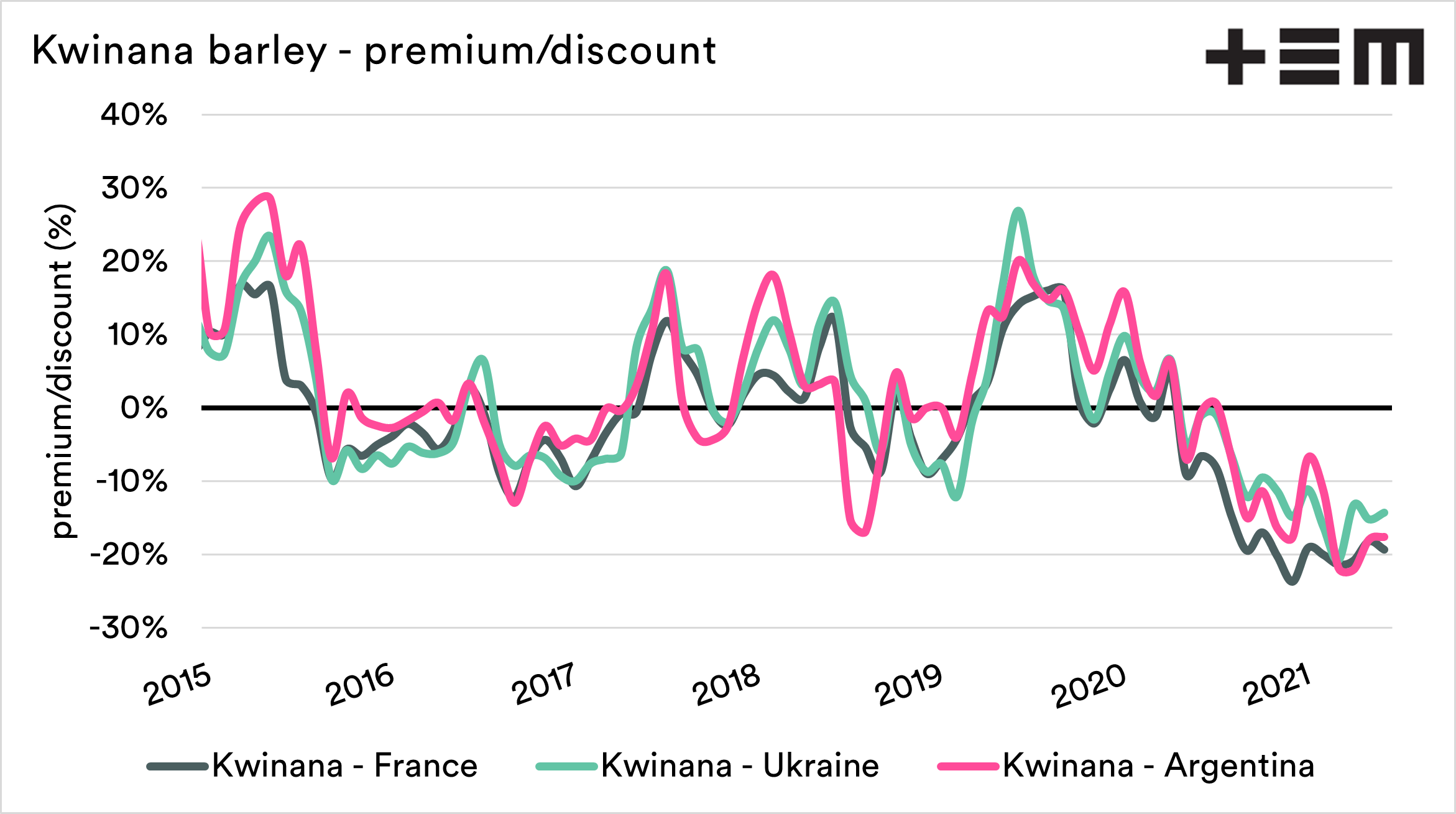

The charts below the premium/discount are displayed between Australia (Kwinana/Port Kembla) and a selection of competing origins (France, Ukraine and Argentina).

Our discount to overseas values has dropped to the lowest level since 2015.

There are some other factors; we would have seen our premium drop on the back of the move from drought to surplus on the east coast.

At the moment, our discount is larger in all port zones than it was in the aftermath of our record crop in 2016. Whilst we expect that after a drought year, we would start to see the premium erode, would it be as low if we still have China as a destination?

This year China is continuing to buy large quantities of barley, just not from us (see here). Competing origins are at a premium whilst also having a significant freight component to transport to China. As we have a geographic advantage, we would be the primary seller to China had we not been locked out.

Australian farmers have been lucky in the past year that barley values on a flat price have remained around the long term average due to high overseas values. We have another four years of this ban, and I don’t think we have seen the worse of this tariff yet.

Don’t kid yourself that we have gotten away unhurt from losing China. We are discounted.