Market Morsel: Basis should be low?

Market Morsel

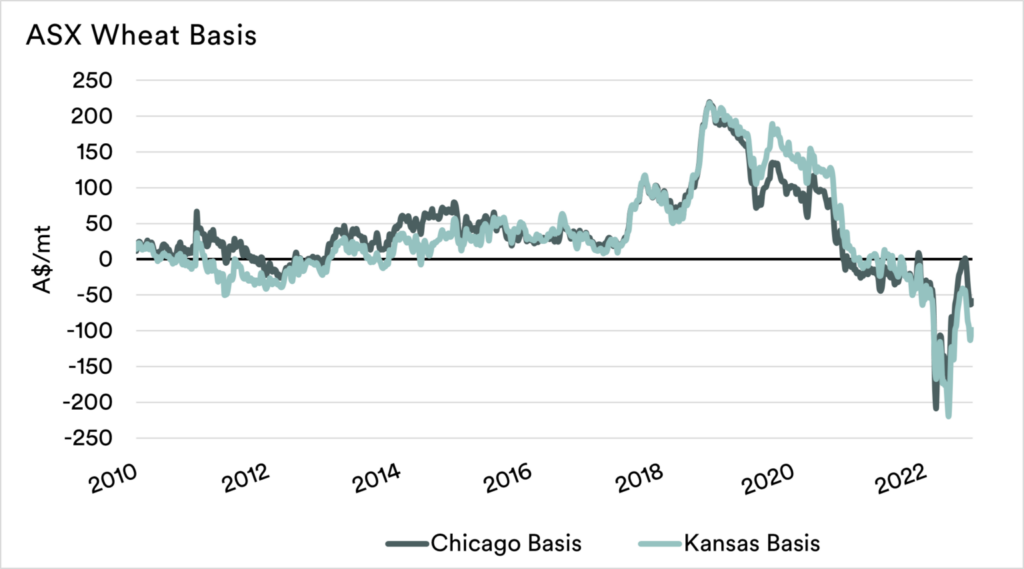

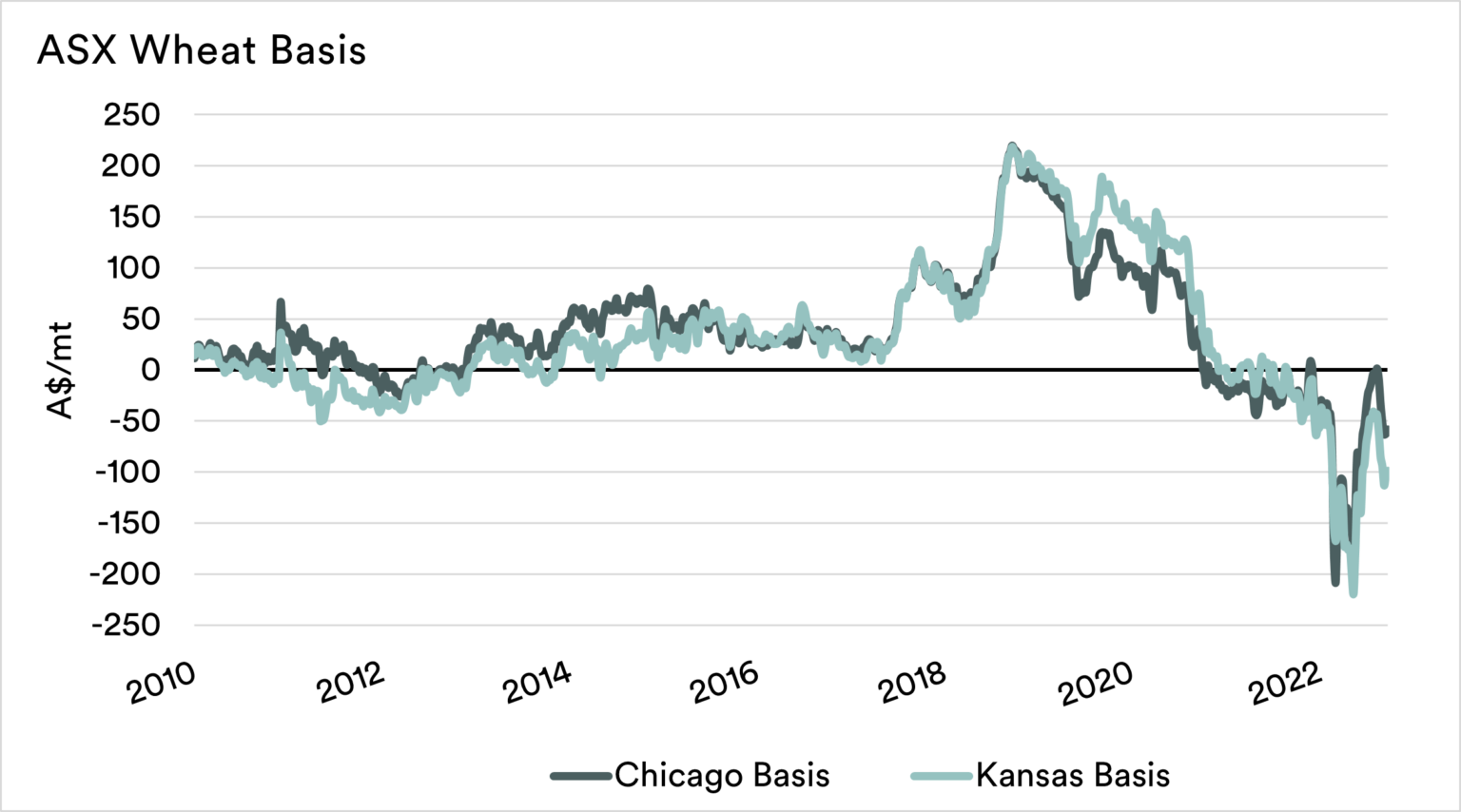

I have been discussing relative value for a long time. Australian wheat pricing levels have been languishing at large discounts relative to overseas values for quite some time.

There are many who discount this due to prices historically being strong at a local level, but I don’t agree with that sentiment (see here). It is our relative value that is the issue.

Looking through social media, it seems that the industry is back discussing basis, so it should be. Why do we think basis will continue to be weak?

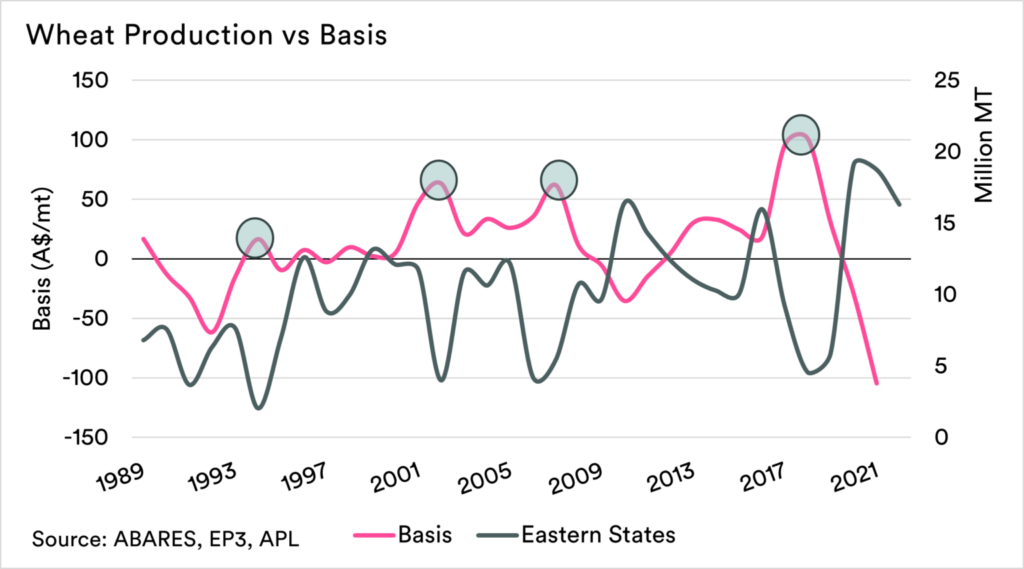

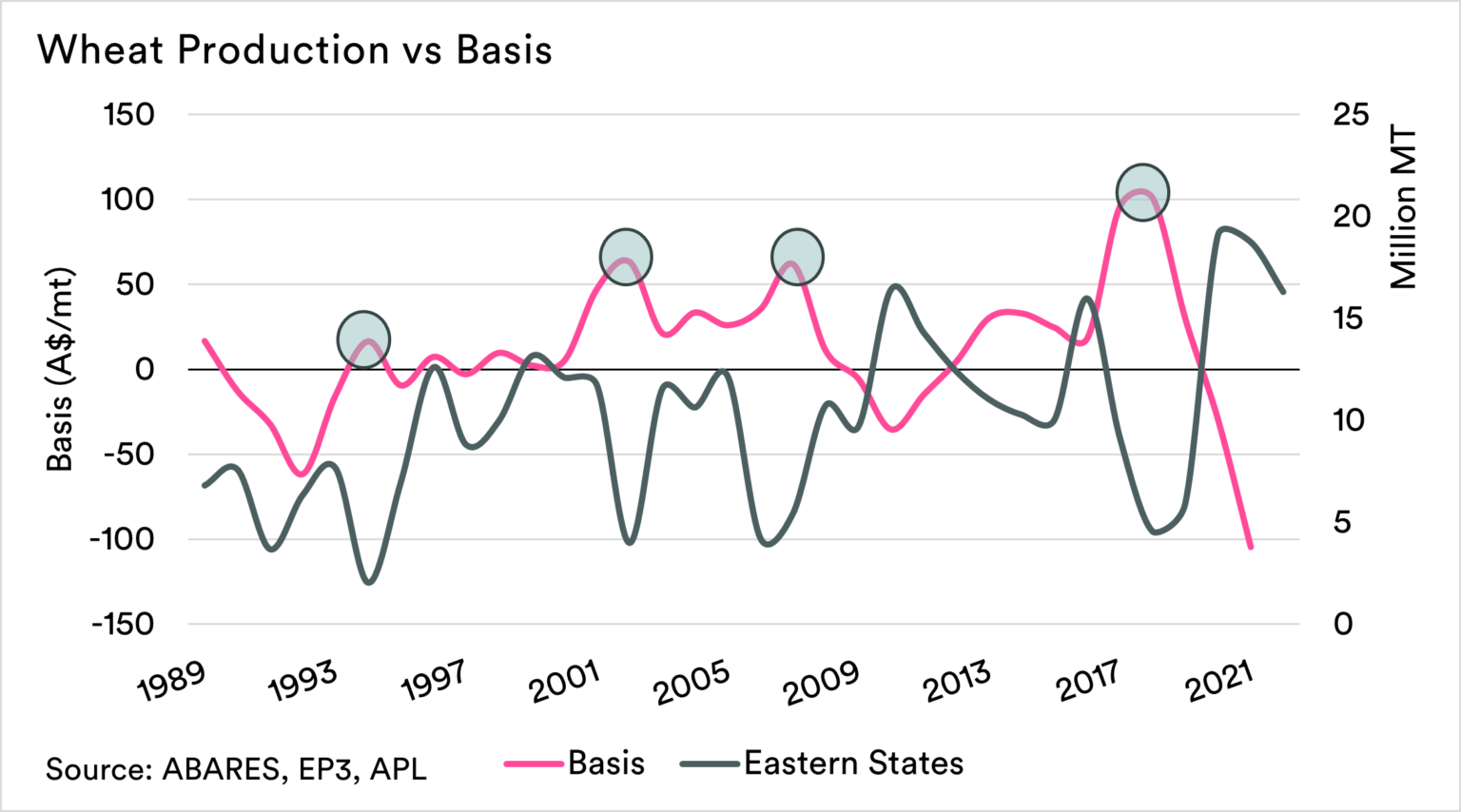

The basics of economics are why basis is so low. It’s supply and demand. When we have a small crop, we have high basis. When we have a large crop, we have low basis.

The second chart shows the relationship between crop production and basis (for eastern states).

Nationally this years crop is set to be large, with a large carry over from last season. This all adds to a nation full of grain. Whilst there are likely to be quality concerns due to wet weather in the east, it is still going to be large.

We expect that basis will likely remain weaker than average until at least the first quarter of 2023.

It’s as simple as that, but why?

- Logistics in a big crop become constrained.

- There is no fear of missing out; buyers know they can get the grain they want. They do not need to chase the price up.

Australia will produce large crops in the future (and poor ones). These last two years of discounted crops points toward a need to examine logistics to ensure that the supply chain is fit for its purpose.