Market Morsel: Betting on falling prices?

Market Morsel

Speculators are a divisive part of agricultural trading. There are those who hate them because they drive the market up and down fairly quickly. This is one of the reasons why we need them; they add liquidity to the market.

Speculators are those who don’t take possession of the commodity; they just aim to make money off of the change in value. This can be by going short, betting on falling prices or going long, betting on rising prices.

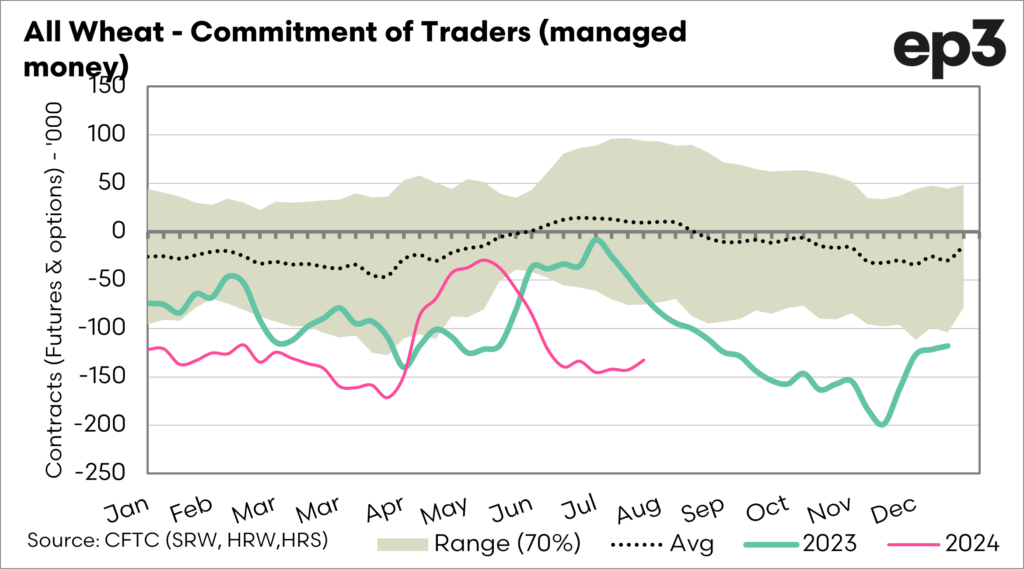

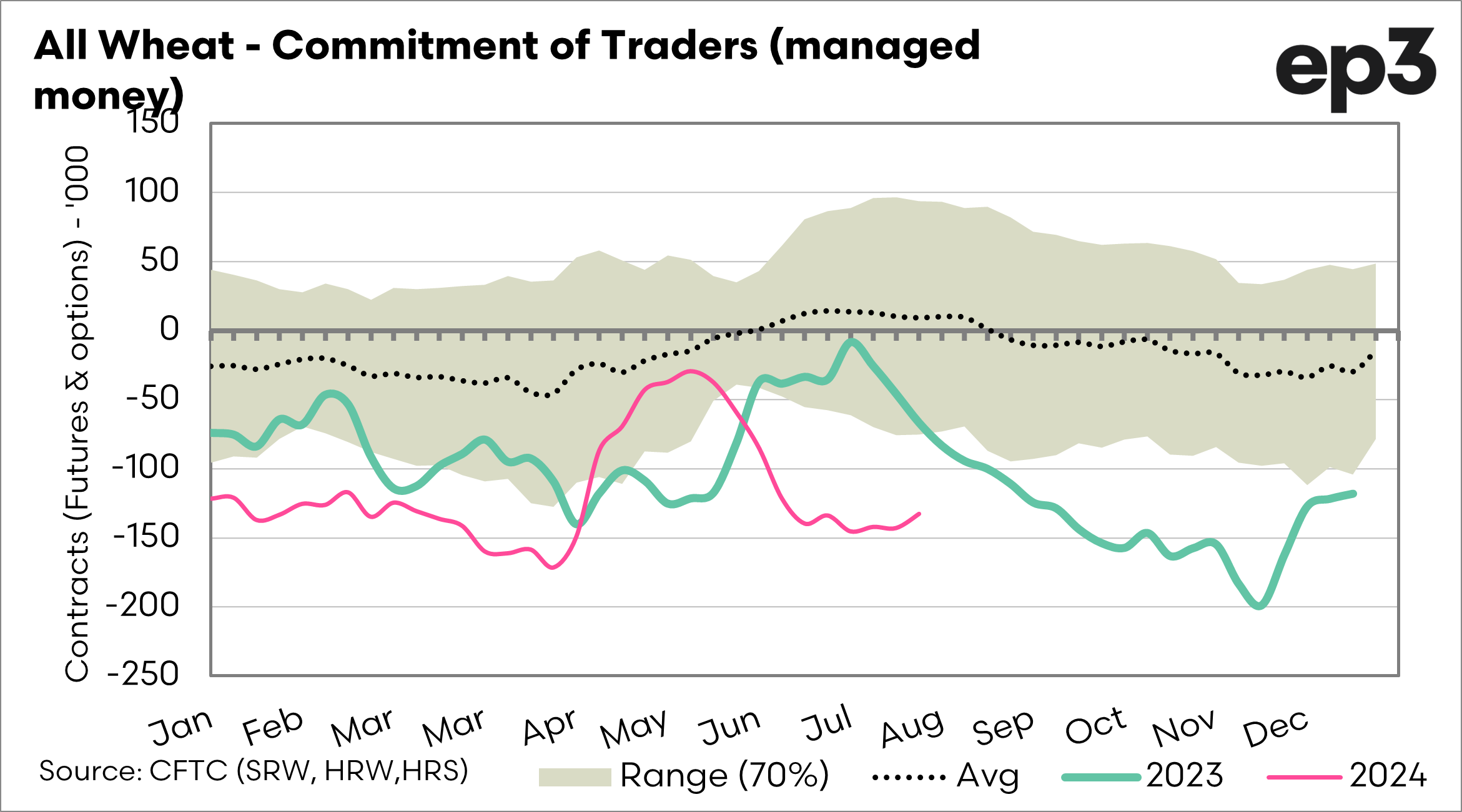

If we look at the wheat, they reduced their net short in May, when the market was rallying hard, in fact, it rallied hard because the speculators had to close their positions.

Since then, the market has fallen, and they have started to increase their ‘bets’ on the market, falling further.

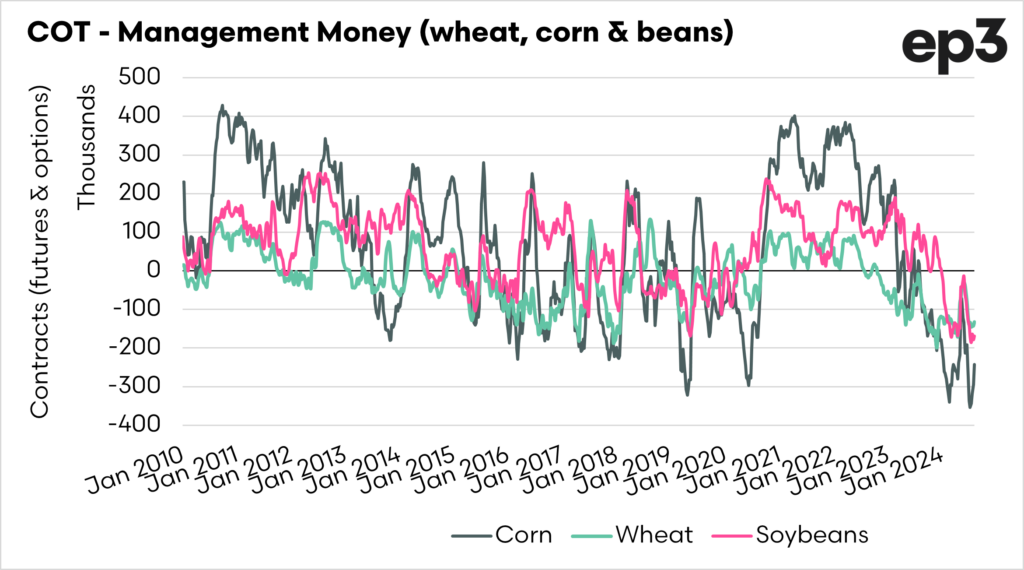

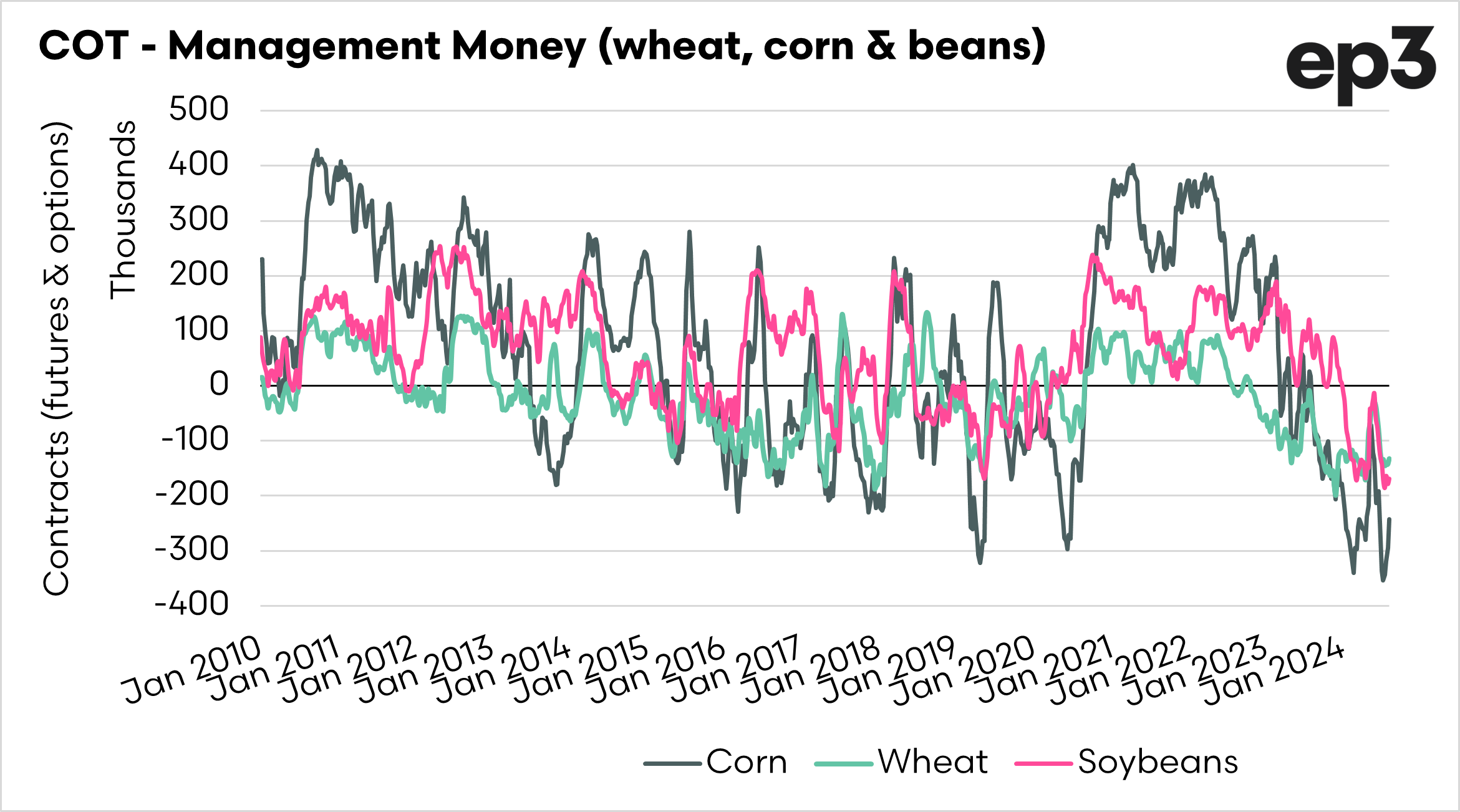

If we look at the second chart below, we will see the positions for wheat, soybeans, and corn. We can see that speculators are betting heavily on falling markets across all of them. If we look back, we can see that they had strong bets on prices rising during the period when the invasion of Ukraine was new news.

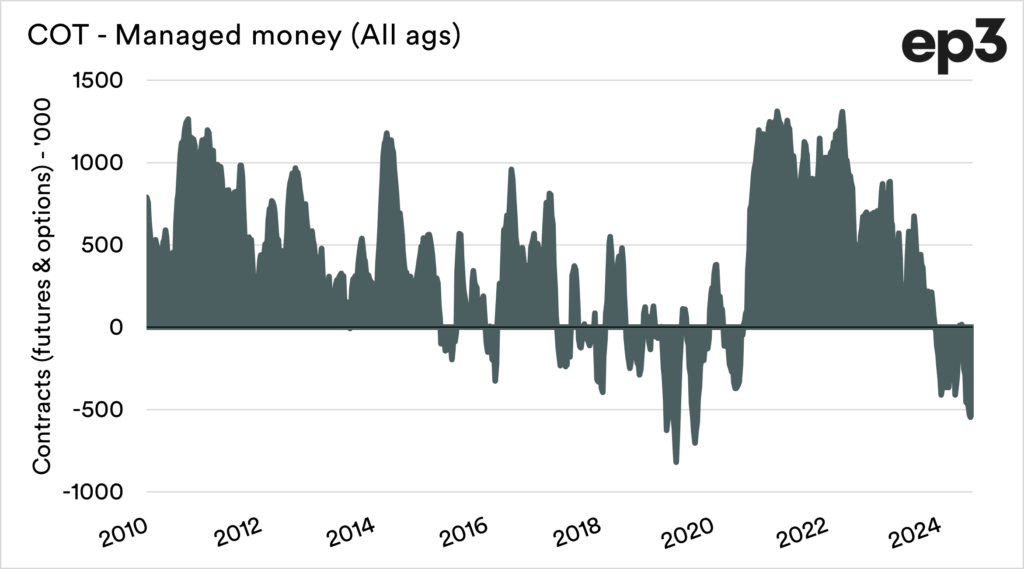

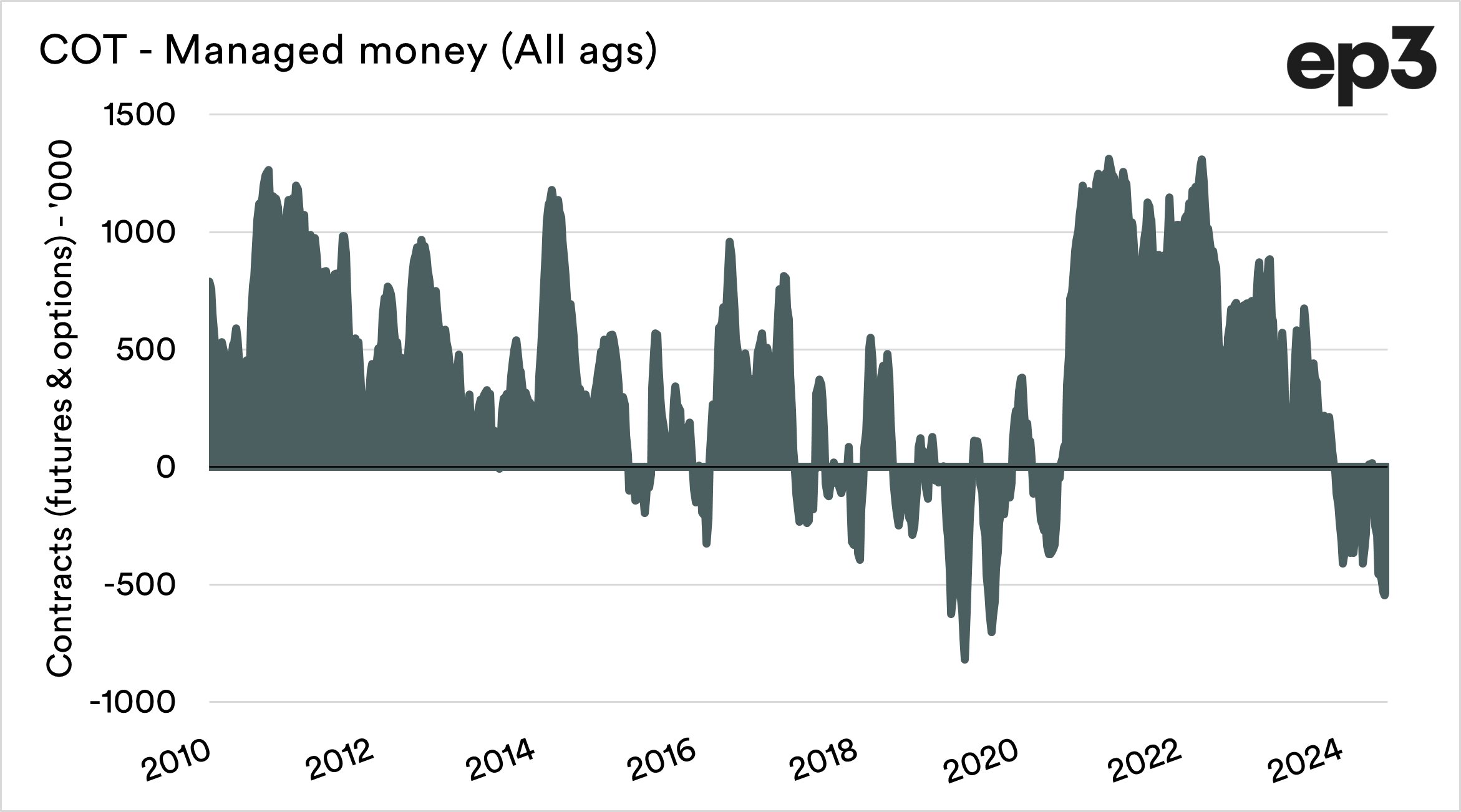

The third chart shows the speculator’s positions across all agricultural commodities. The net short is not far from record levels. This means that in general, speculators are bearish on agricultural commodities.

Love them or hate them, the speculators have a big impact on the market. They are a necessary evil.