Market Morsel: Black Friday sale on Aussie Wheat.

Market Morsel

Wet weather is the big talking point at the moment. We have written a lot about the changing spreads. The higher protein grades will move to a more significant premium, and lower grades are heavily discounted.

If you are lucky to miss the rain and have high protein levels, then that is great, and you’ll be rewarded. In the eastern states, the reality is that lower protein levels are likely to be the mainstay of production.

This means that the discount is really the biggest concern, and it is not looking good. The trade is pricing in for a large volume of low-quality wheat.

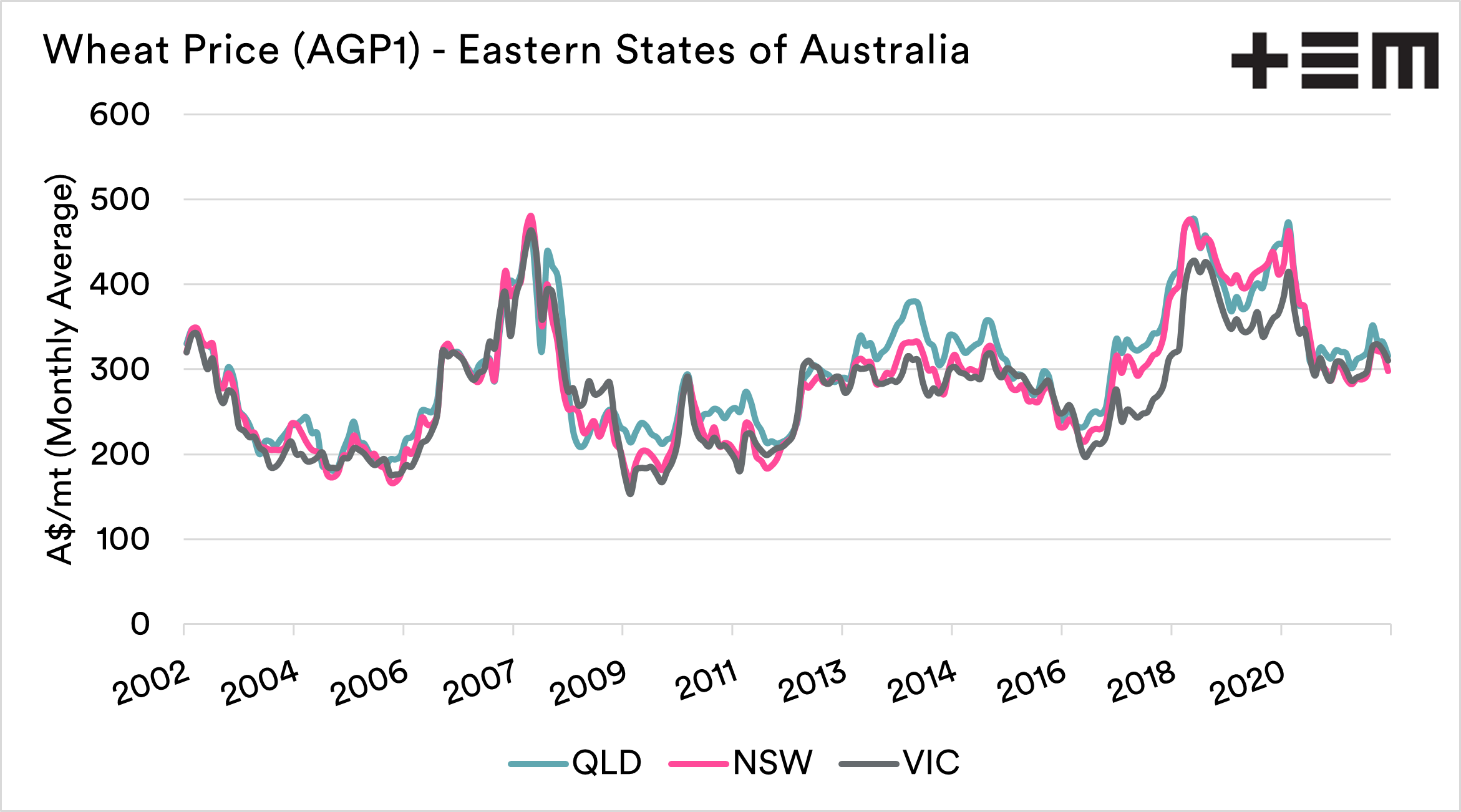

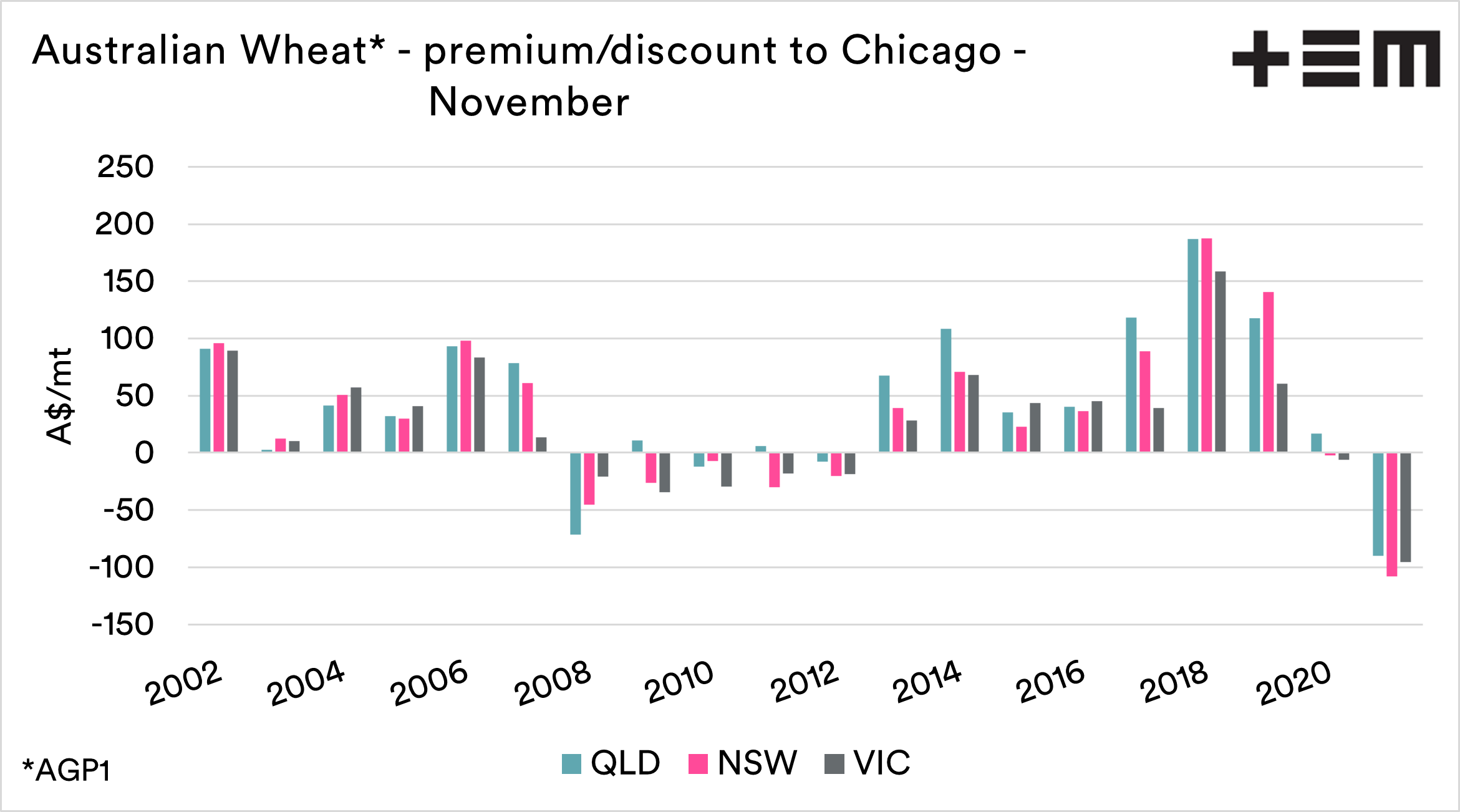

I have chosen AGP as a decent representative of feed quality wheat.

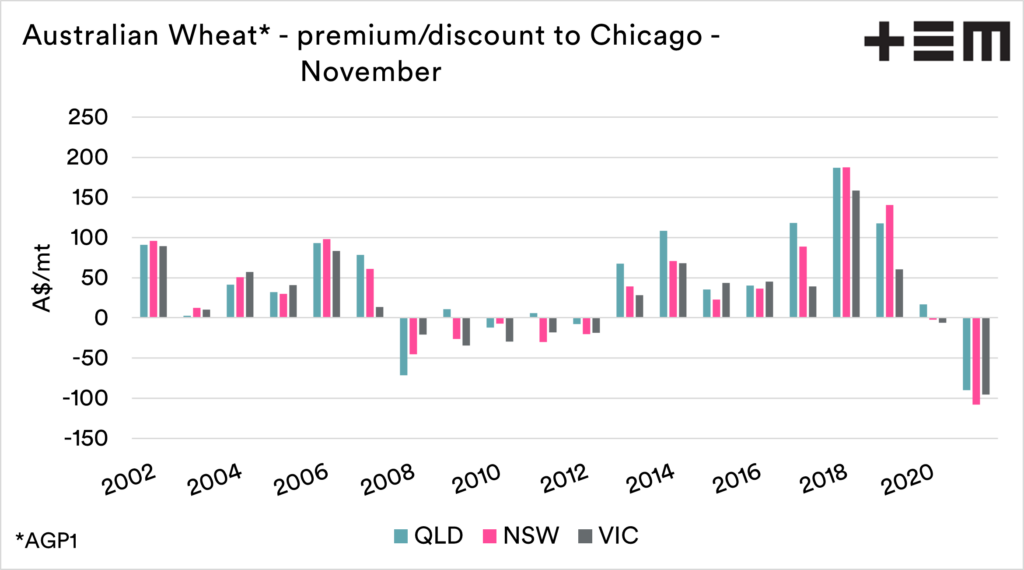

The first chart below shows the AGP1 price for the eastern states since 2002. The current price is sitting around the 60th percentile for that period. So basically, prices are slightly higher than average, but it is important to consider that this doesn’t take into account inflation. If we converted to ‘real’ prices, the pricing level would be lower – but that is a discussion for another day.

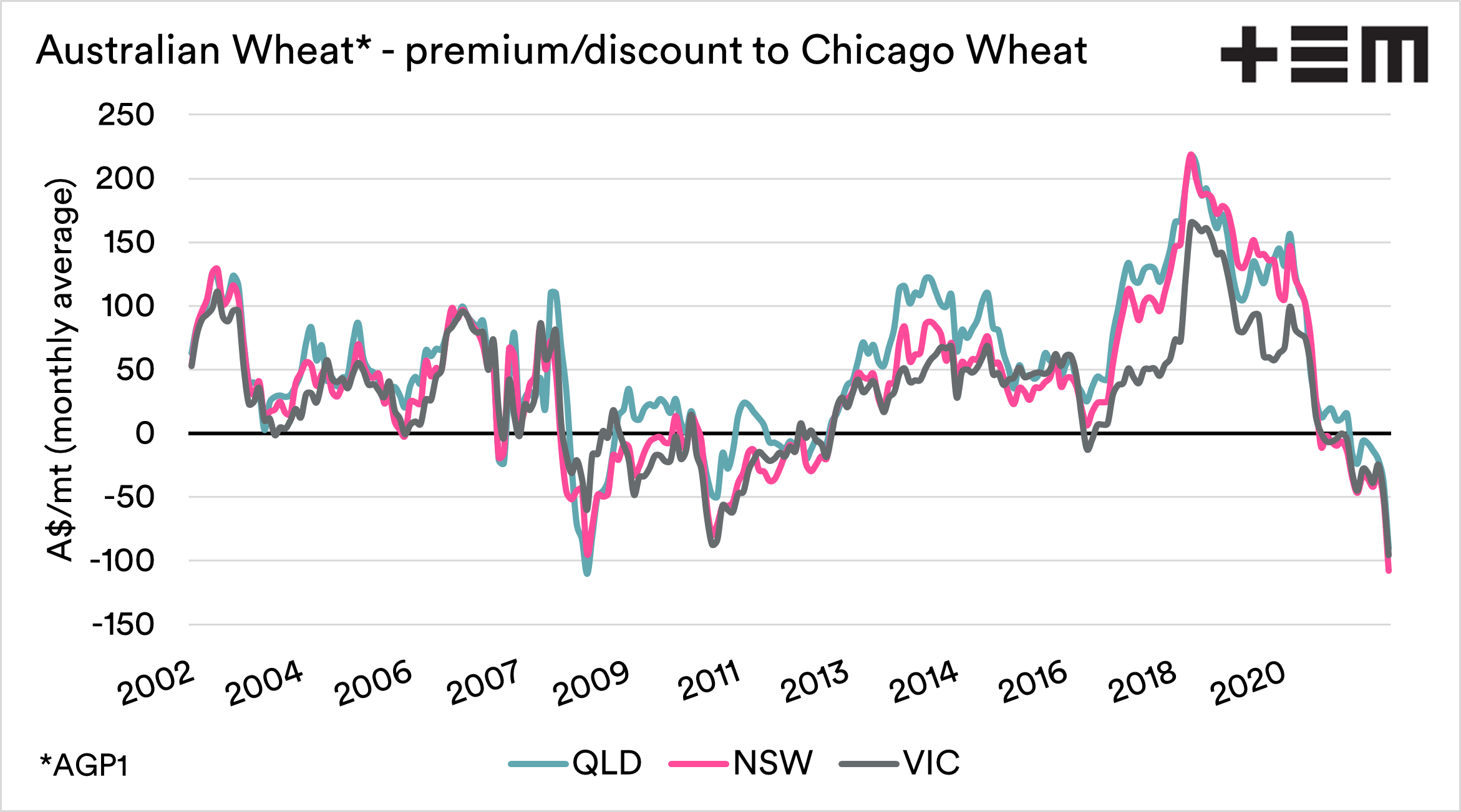

The important factor to examine is our relative value. The second chart shows the monthly basis (premium/discount) to Chicago wheat futures. In NSW/VIC, November has the largest discount since 2002, and in Queensland the 2nd largest discount.

The majority of Australian grain is sold during and immediately after harvest, so the third chart shows our relative pricing compared to the last 19 Novembers. It is overwhelmingly the largest discount that Australia has faced in lower quality wheat.