Market Morsel: Black Sea bonanza

Market Morsel

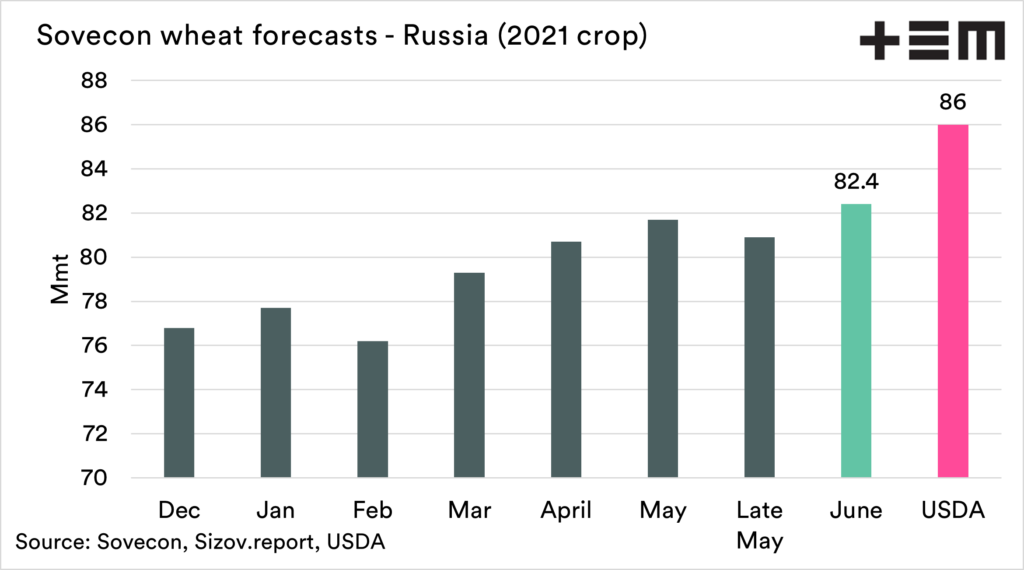

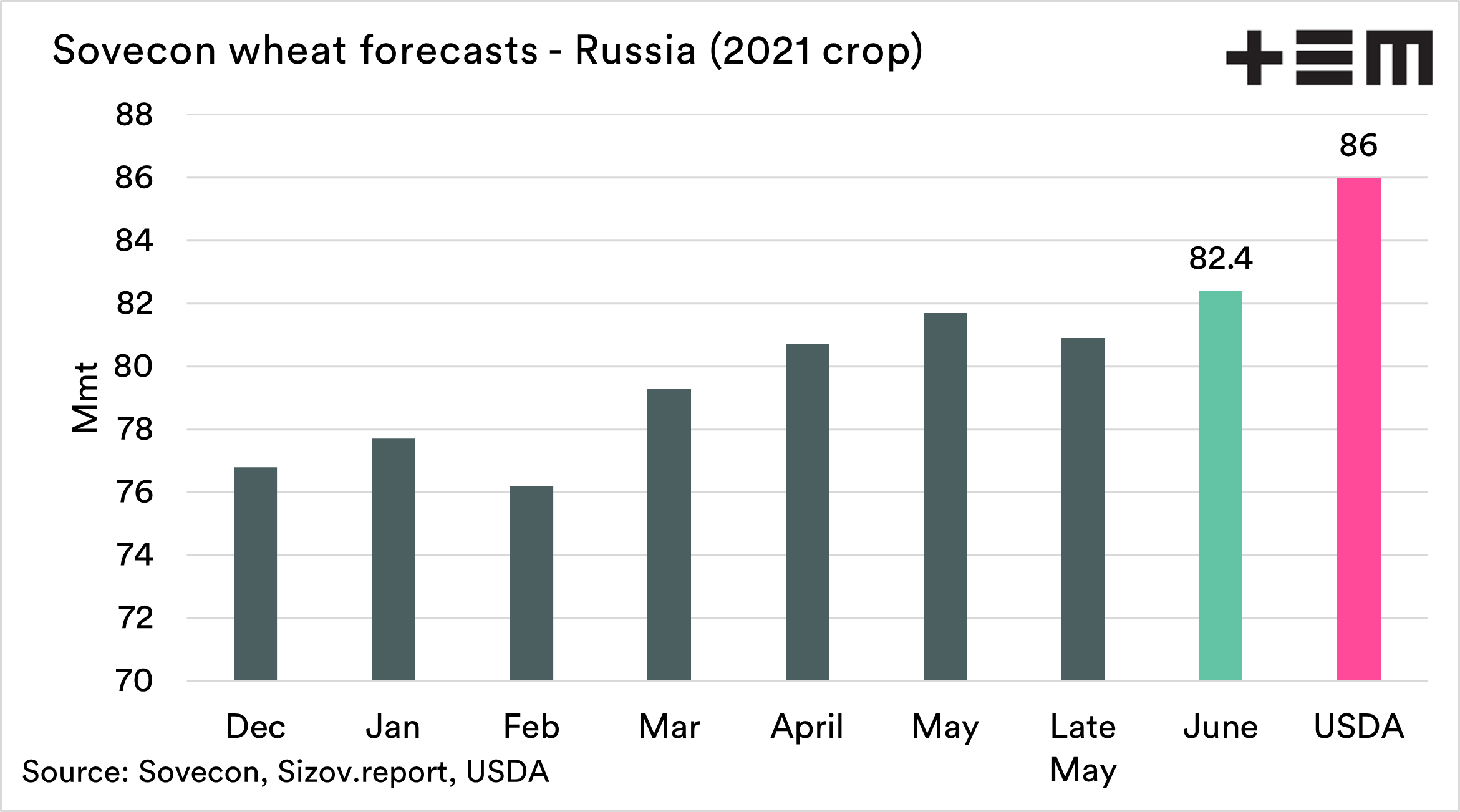

SovEcon, the leading Black Sea agricultural markets research firm, revised Russia’s and Ukraine’s crop forecasts:

Russia:

- Wheat crop estimate is up 1.5 MMT to 82.4 MMT (USDA: 86 MMT, ex. Crimea)

- Winter wheat conditions improved further on ample precipitation in May, first of all in the South, key growing and exporting region

- Spring wheat area estimate was revised higher thanks to rapid planting campaign

- Spring wheat conditions improved in the Center and the Volga Valley

- Spring wheat conditions deteriorated substantially in the Urals and Siberia, suffering from the drought

- Corn crop forecast has been upped by 1.2 MMT to 15.6 MMT on the bigger area and good starting conditions for plants development

- In 2020, Russia produced 85.9 MMT of wheat and 13.9 MMT of corn

- USDA 2021 crop estimates: wheat – 86 MMT (ex. Crimea), corn – 14.9 MMT. Crimea could harvest around 0.7 MMT of wheat this year.

Ukraine:

- Corn crop estimate is up by 0.2 MMT to 36.8 MMT on good starting crop conditions.

- Late seeding and the recent dryness in northern regions could be an issue for the corn crop

- Corn area estimate was left unchanged at 5.3 mln ha, marginally below the record level of 2020. The competition with sunflower is extremely strong this year

- Wheat crop has been upped by 0.3 MMT to 28.9 MMT on further improvement of crop conditions, especially in the South

- In 2020, Ukraine produced 30.3 MMT of corn and 24.9 MMT of wheat

- USDA 2021 crop estimates: corn – 37.5 MMT, wheat – 29.5 MMT (inc.Crimea)

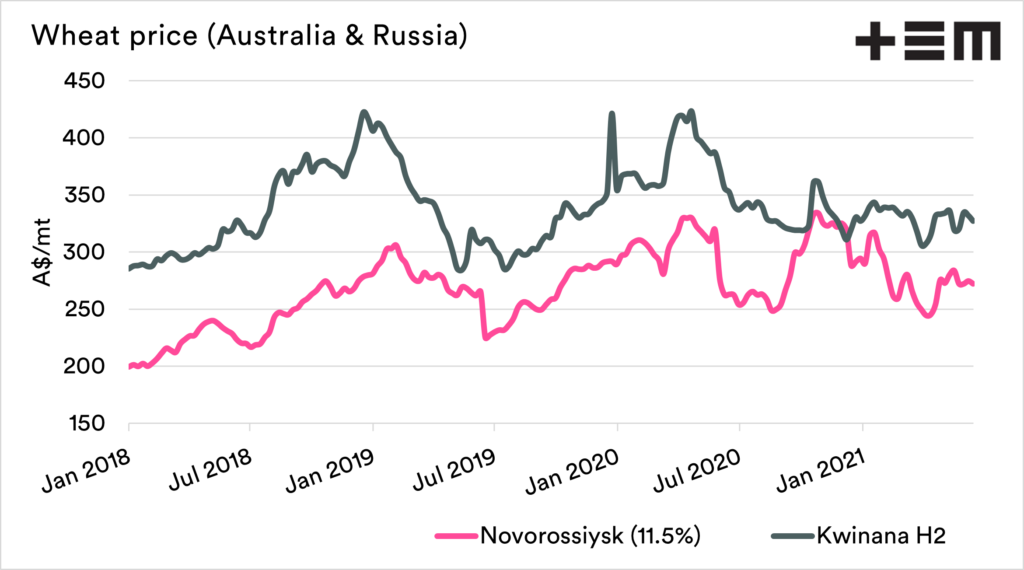

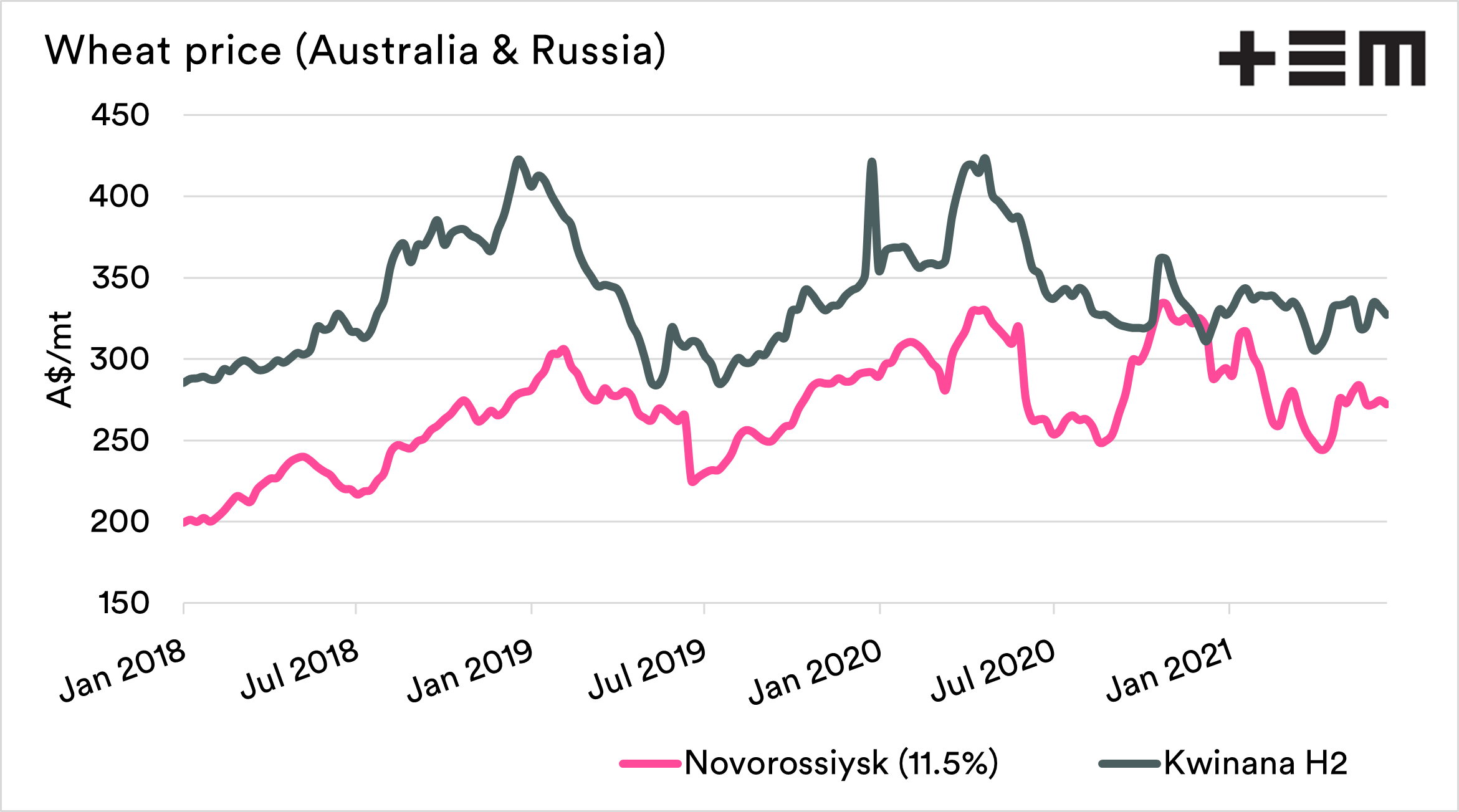

This year, the Black Sea could grow another bumper grain crop thanks to the area expansion and good weather. Wheat from Russia and Ukraine will be a serious threat to European & Australian wheat again.

A record-high Ukraine’s corn crop will imply tough competition in China’s market for US corn. Before the current season, Ukraine has been the largest seller of corn to China for several years.