Market Morsel: Bye Bye Bye

Market Morsel

Our markets over time move in line with the futures market. So even if you don’t use futures to manage your price risk management, it’s essential to keep an eye on them.

One of the challenges is to know which contract to use for price risk management. In general*, when managing risk using a futures exchange with a high correlation is used.

It has to be noted, though, that a long term correlation is not necessarily the best. The correlation between pricing can and does change on an annual basis. It’s important to look at the correlation and use some present conditions knowledge to dictate which contract you use.

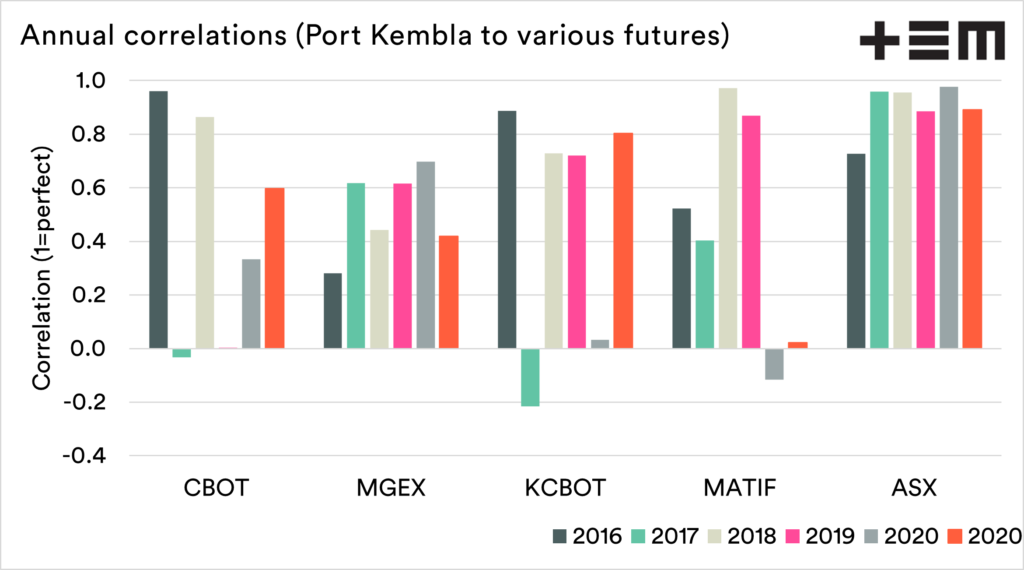

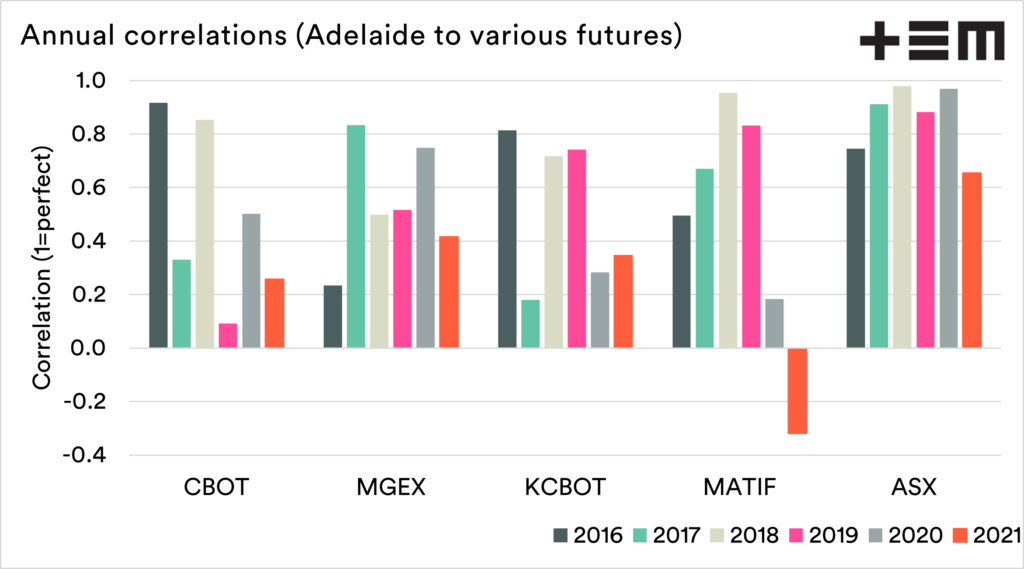

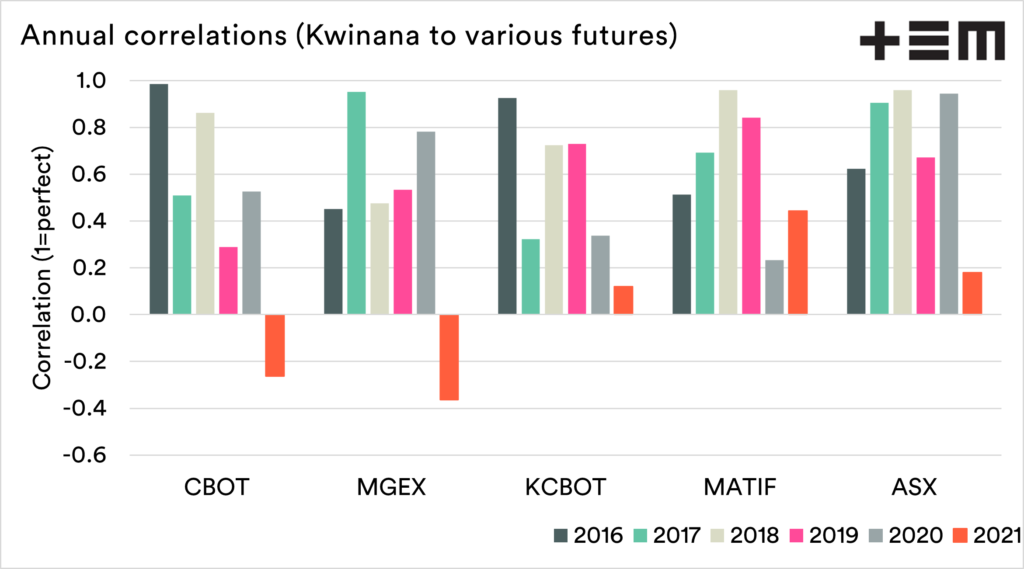

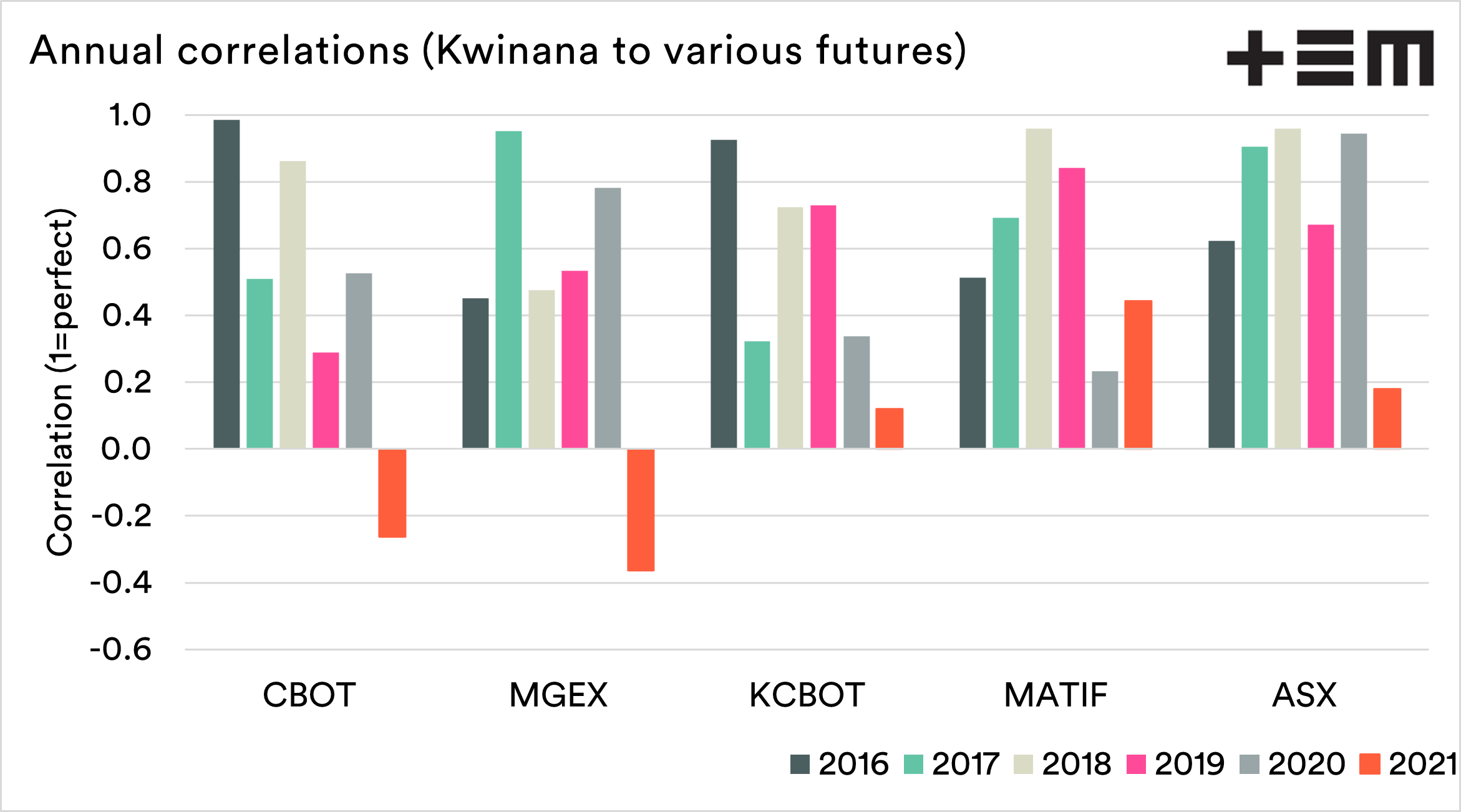

The charts below show the annual correlations (based on monthly averages) for Port Kembla, Adelaide and Kwinana against some of the major exchanges.

A few notes on each chart:

Port Kembla has maintained a strong correlation with the ASX wheat futures contract, making sense as it is an east coast contract. During the recent drought, with high basis levels, the correlation with overseas futures diverged.

Adelaide also maintains a relatively strong correlation with ASX. In recent years, the relationship with overseas futures has been quite volatile, from very high correlations to very low correlations.

Kwinana has diverged from historical relationships so far in 2021. Wheat pricing has a weak or negative correlation with both most overseas futures and the ASX contract.

On the east coast, if you are looking to hedge using a contract with a lower variation from physical pricing, then historically, ASX is the way to go, and that makes sense. A point to note is that using ASX effectively locks a large proportion of the Australian basis.

However, on the West Coast, the answer is not clear-cut and should be examined on a season by season basis.

*In some situations, you may want to use contracts that are negatively correlated, but we’ll leave that for today.