Market Morsel: Canola – A west side story.

Market Morsel

The canola market has been fantastic for Australian farmers over the past year. The failure of Canada was a huge driver of our pricing. This caused our pricing to rise to high levels, and then Putin invaded Ukraine, providing more support as the world went low on sun oil.

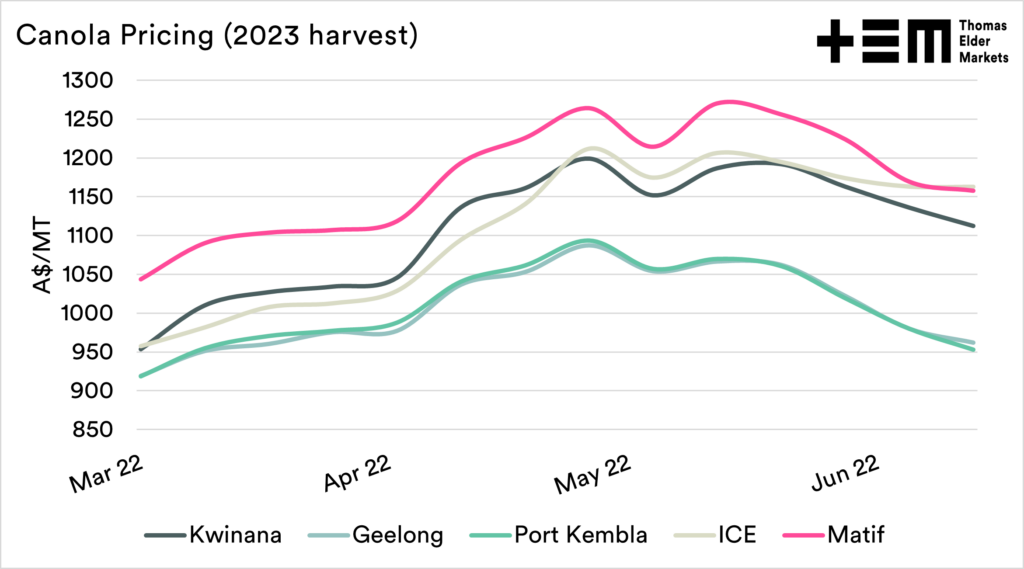

The first chart below shows the new crop canola price since the start of March, alongside the corresponding futures price (ICE and Matif).

Kwinana, largely export-orientated, has maintained a close relationship with ICE futures. However, the east coast, which has a larger domestic focus, has an increased discount.

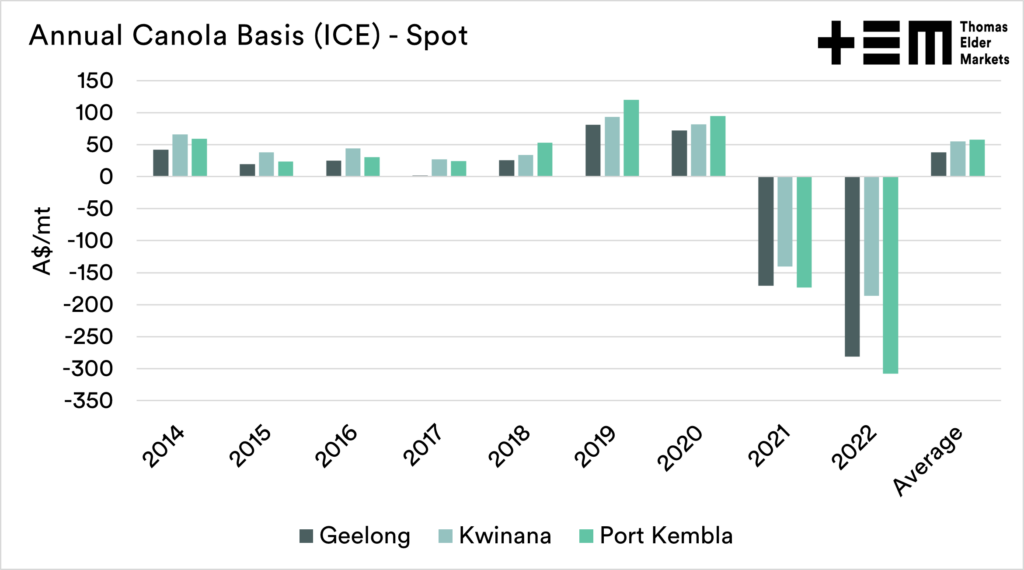

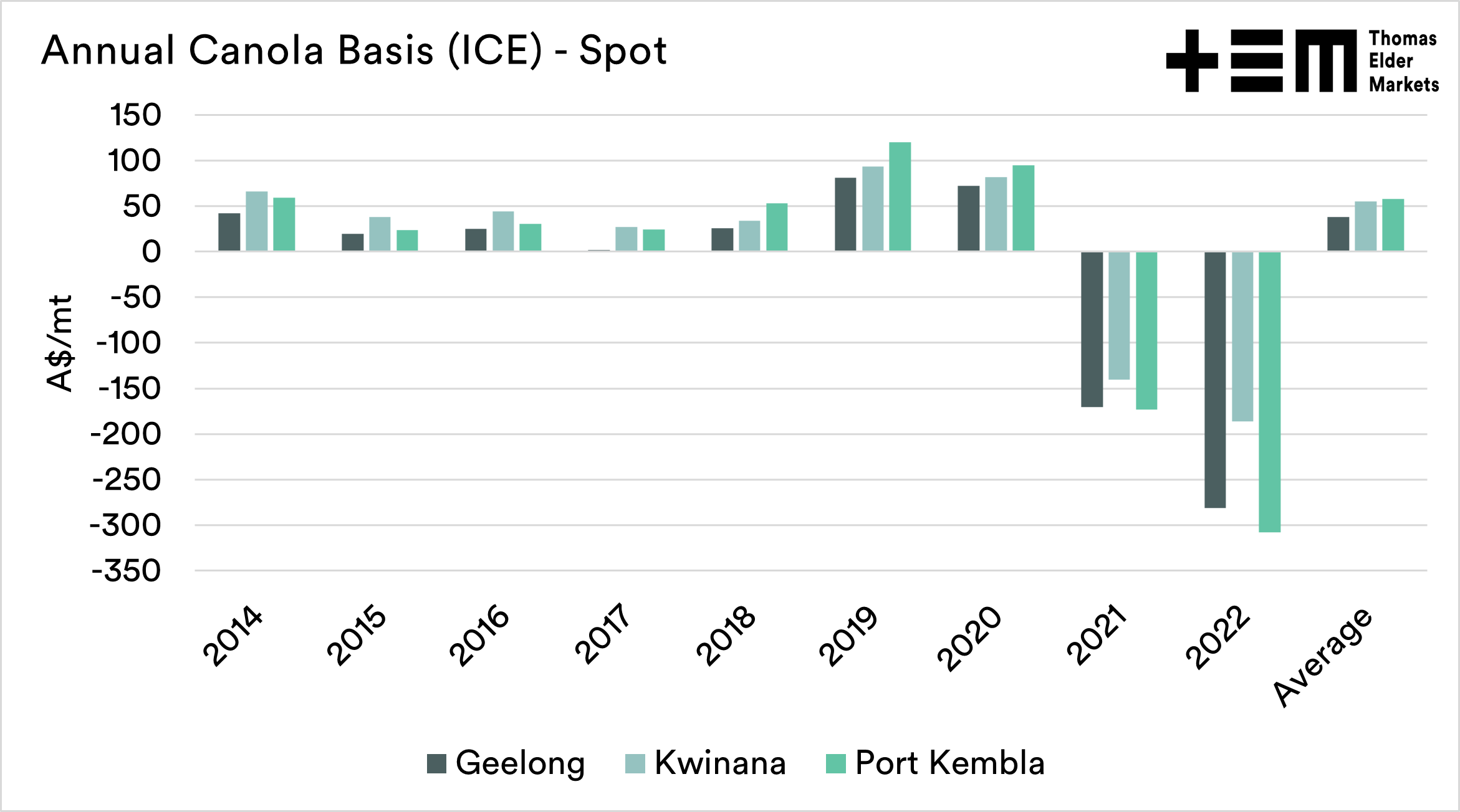

Let’s compare the typical market in the second chart. Generally, the canola market in Australia will trade at a premium to ICE futures. In reality, due to the Canadian drought, it makes sense that we fall to a discount. Essentially, it was actually a drought premium for them. This is similar to what occurred in Australia during the 2018 and 2019 drought – the market paid to keep canola in the domestic market.

The east coast is currently trading for the new crop at a huge discount, but the west is pretty much at normal levels. The question is whether it matters if we are at a discount on the east coast and still receiving good prices.