Market Morsel: Canola having quick rise.

Market Morsel

The canola market has started to fire up in recent times. French rapeseed hit 20-month highs overnight.

The European rapeseed crop was down yearly, at 9.9mmt versus 10.2mmt last year. It is, however, important to note that canola/rape does not operate in isolation, it is impacted by other factors such as the other oilseeds.

Overnight Palm, one of the most important oilseeds, rose because Malaysian stocks were lower than expected.

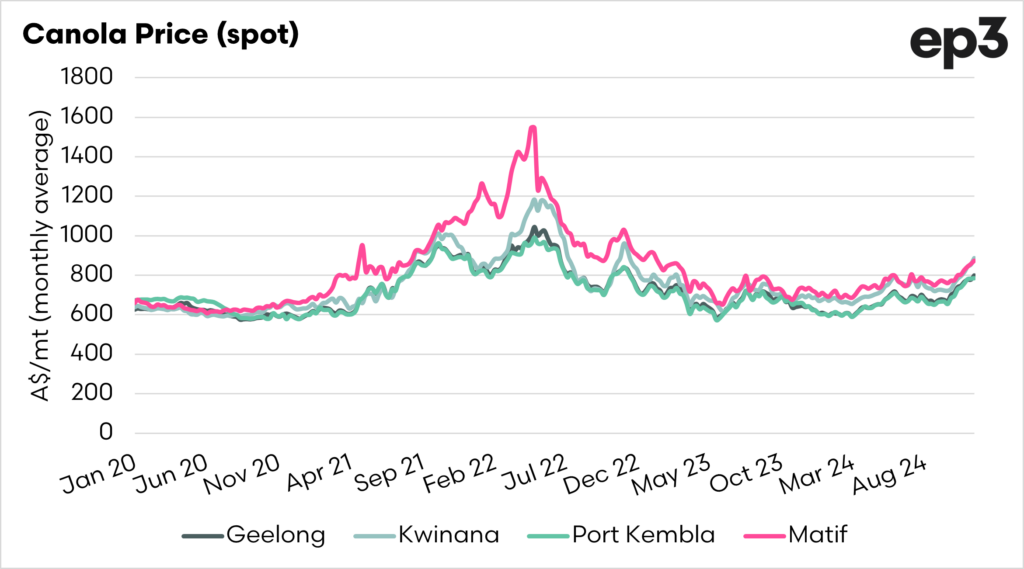

The first chart below shows the flat price of canola for a few Australian ports, along with Matif canola, converted to A$. Matif tends to trade at a premium to Australian canola. The price has fited in recent months, and Australian prices have followed, but how closely?

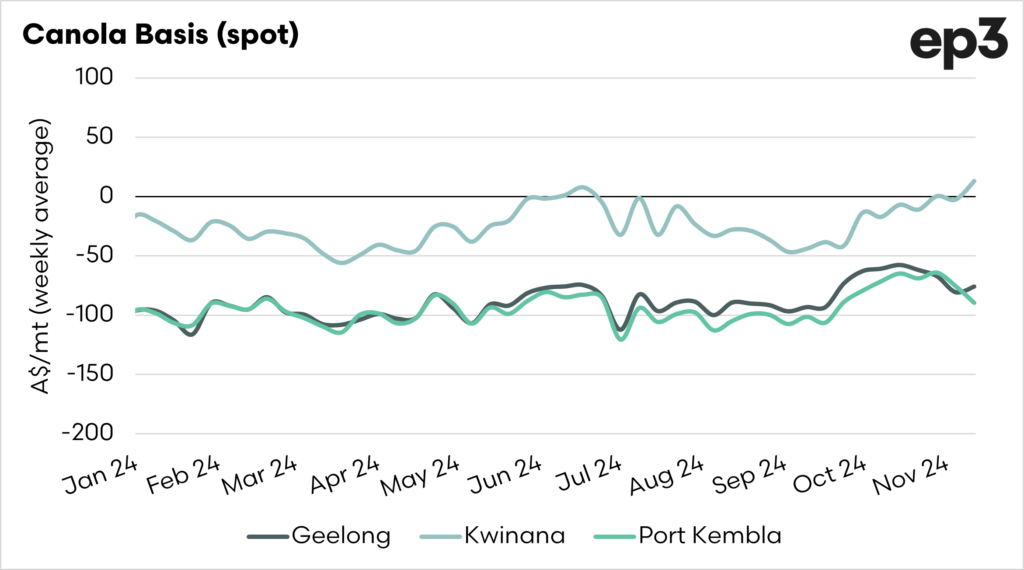

The second chart shows the basis levels of these ports and Matif. The basis level in Kwinana (largely export) has increased, however, the more domestically focused ports have seen their basis levels fall. In part this is due to the lack of preharvest selling, and large volumes are currently coming onto the market.

The good news for farmers is that prices are largely holding up. We still don’t expect the prices rises to the scale that we saw a couple of years ago, but the prices are still healthy.