Canola pricing heavily discounted vs overseas

The Snapshot

- Canola pricing has slipped in Australia in recent weeks, especially in the eastern states.

- In the West the price has remained quite stable.

- MATIF and ICE canola futures have gained and hit new contract peaks in recent weeks.

- The basis (premium/discount) between our pricing and overseas pricing has fallen massively.

- Typically we would be at a premium to ICE futures. In Port Kembla this premium has fallen to a discount of A$160.

The Detail

The canola crop is coming off with gusto. Traditionally the first crop to be harvested and generally the first to be sold. This year, it would be expected with the high prices that farmers won’t be holding onto the crop. That’s fair enough, but what is the pricing doing? Are we suffering from harvest pressure?

Firstly what is harvest pressure? It’s quite simple really, the majority of grower selling occurs during the harvest. Therefore what we see is buyers take their foot off the pedal, as they know that the supply is coming.

This doesn’t occur every year. In a drought, it is unlikely to really transpire as buyers get a bit of FOMO. In a year like this, where there is a big surplus, it is more likely.

So are we experiencing that in Canola?

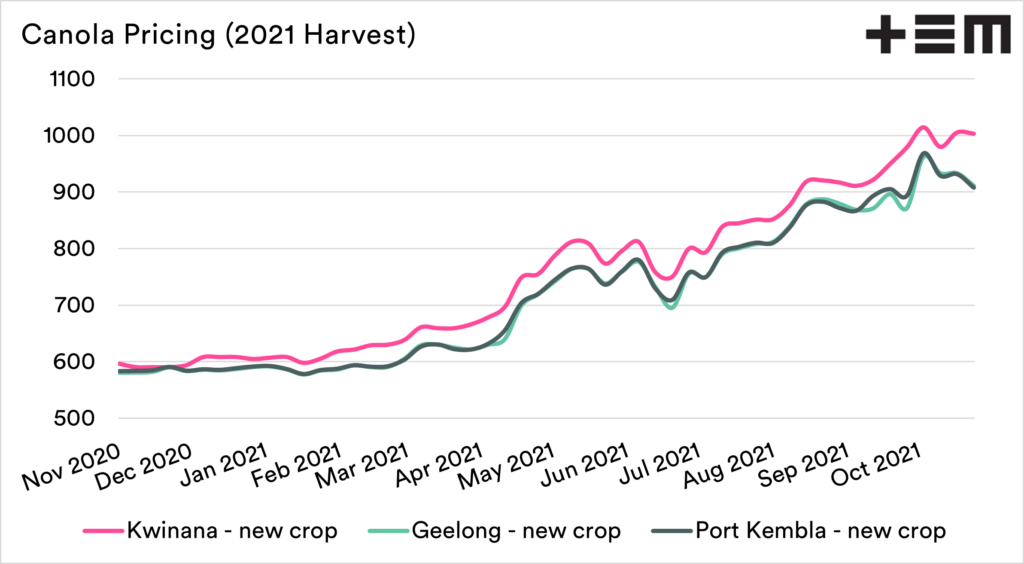

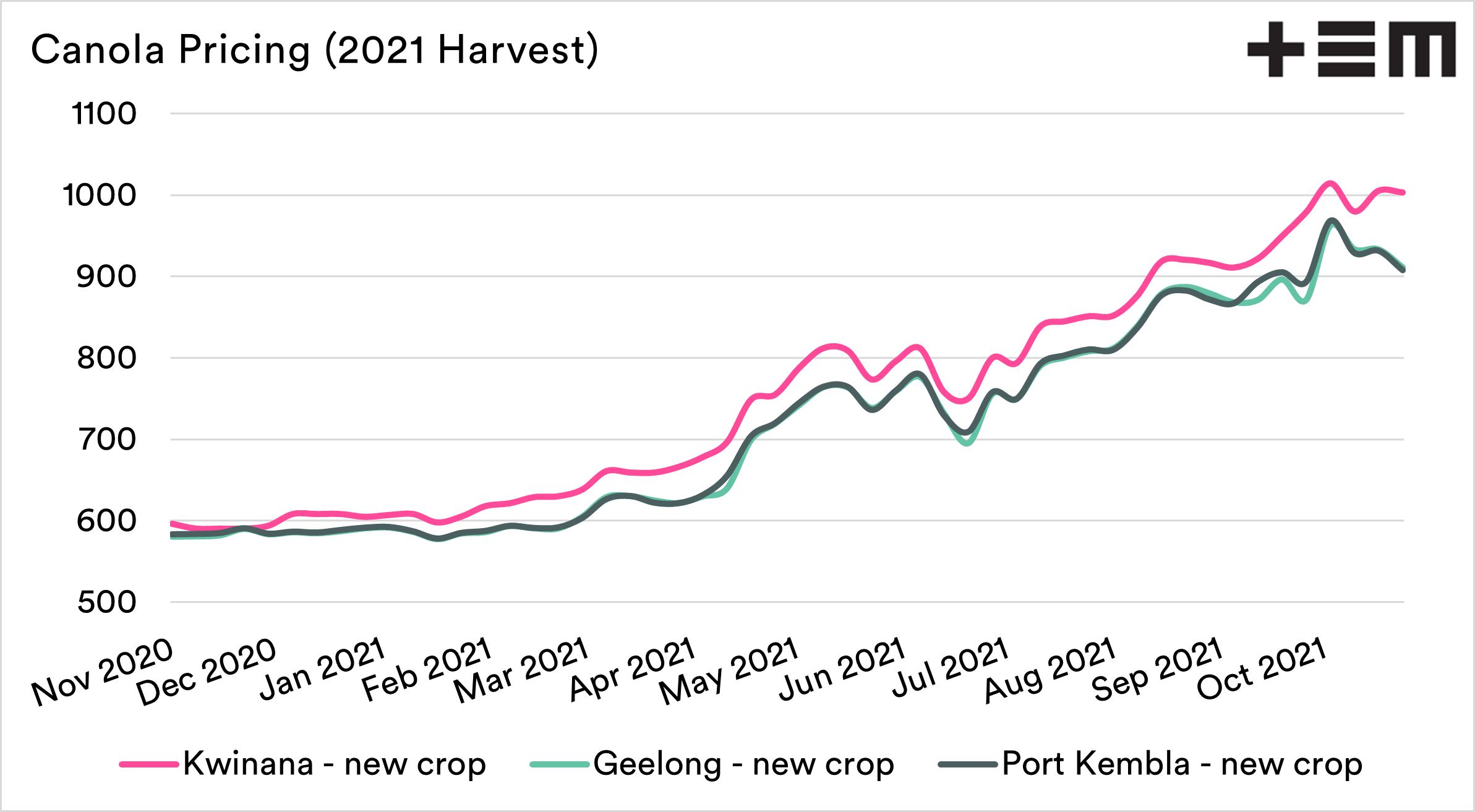

If we look at the pricing for canola around the country, we can see that there has been a dropping price in recent weeks.

The fall has been most felt in the eastern states. As an example, in Port Kembla, the canola price averaged A$963 for the first week of October. Last week it averaged A$911. In WA, the price has largely stayed stable in recent weeks

If you looked solely at this price, you might not think that it was all that bad, as it was starting from a high base. Let’s look at it a little closer.

Canola rising.

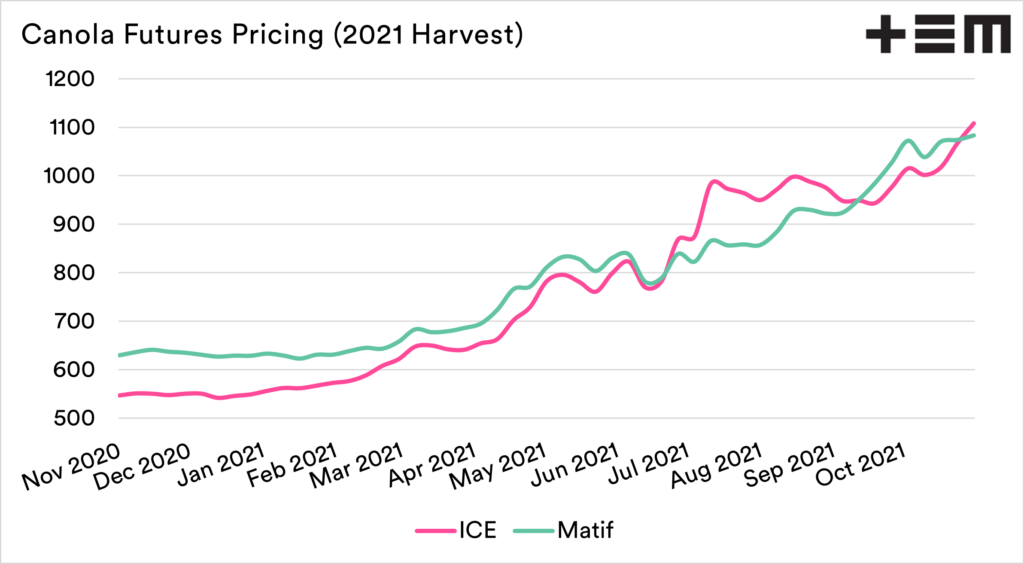

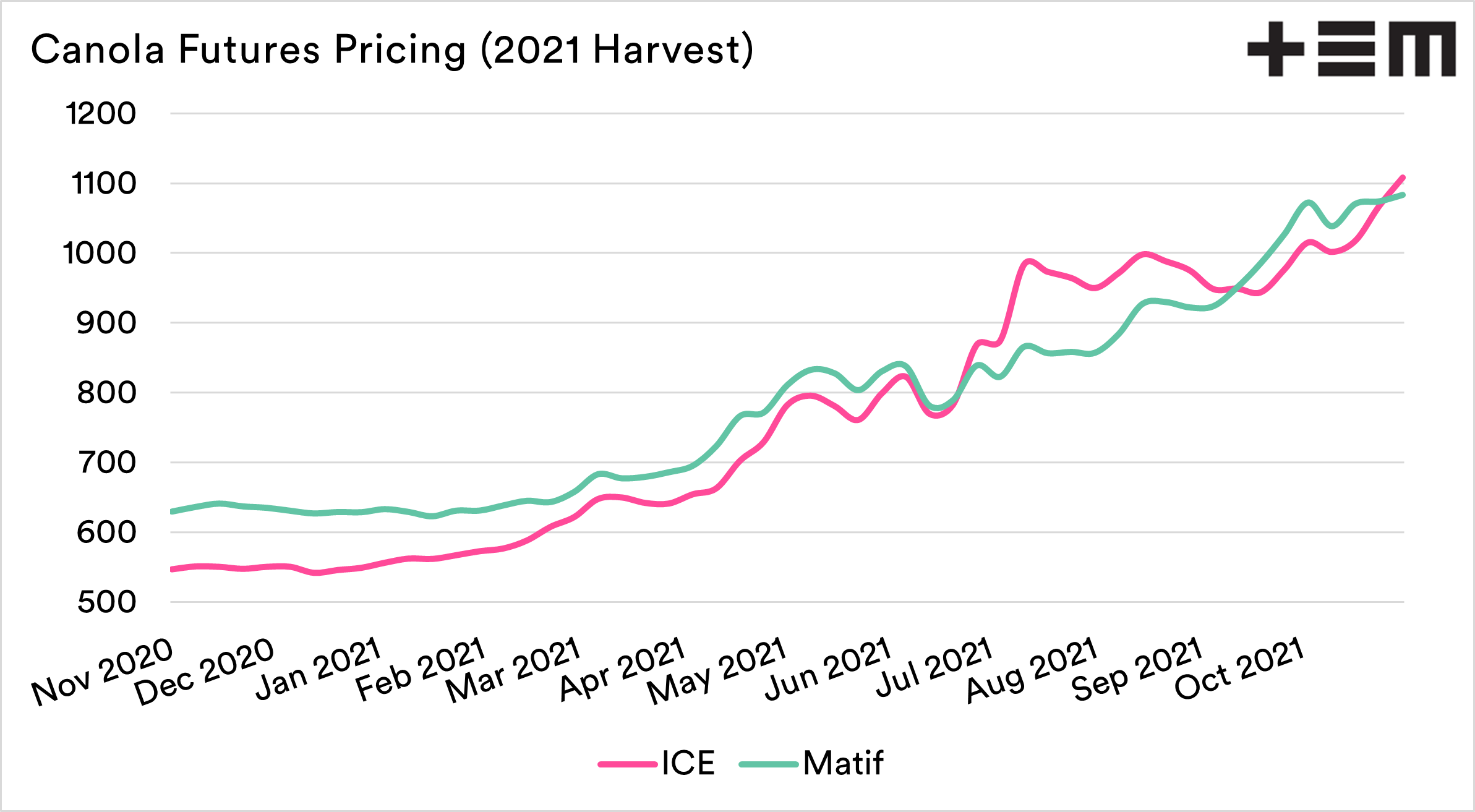

As an exporter, our canola price is based on the price of futures, plus (or minus) our basis. The chart shows the futures price for our harvest for ICE (Canada) and MATIF (France). We can see that they have been tracking each other pretty closely for most of the year.

In recent weeks, the pricing levels in both regions have grown steadily to hit new peaks. If we recall the previous chart, our price hasn’t been doing the same.

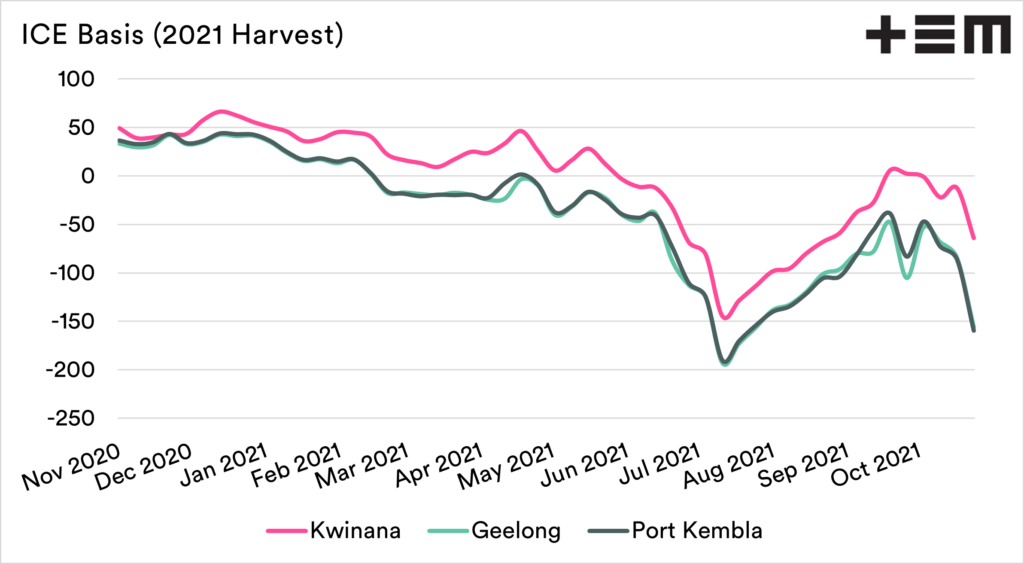

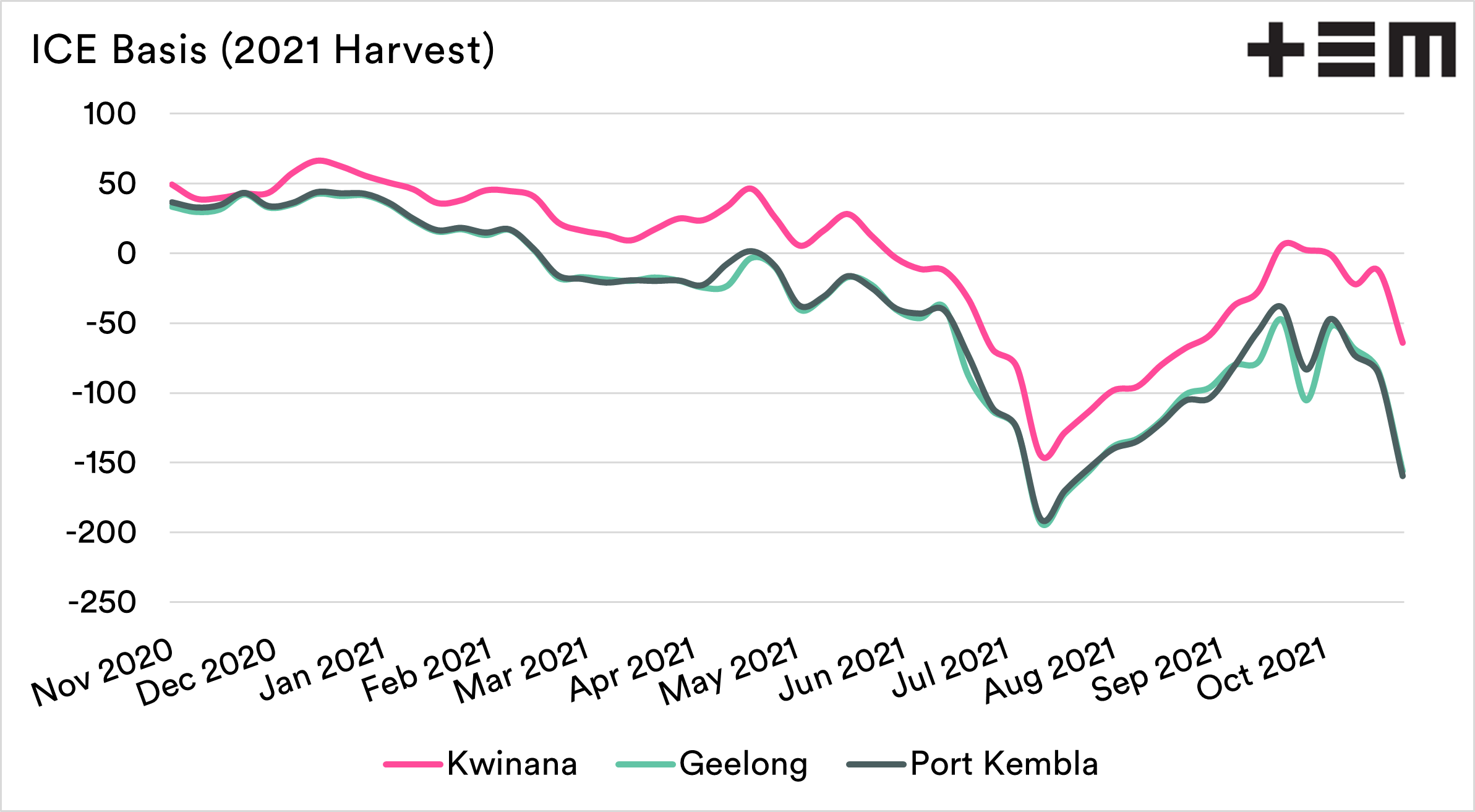

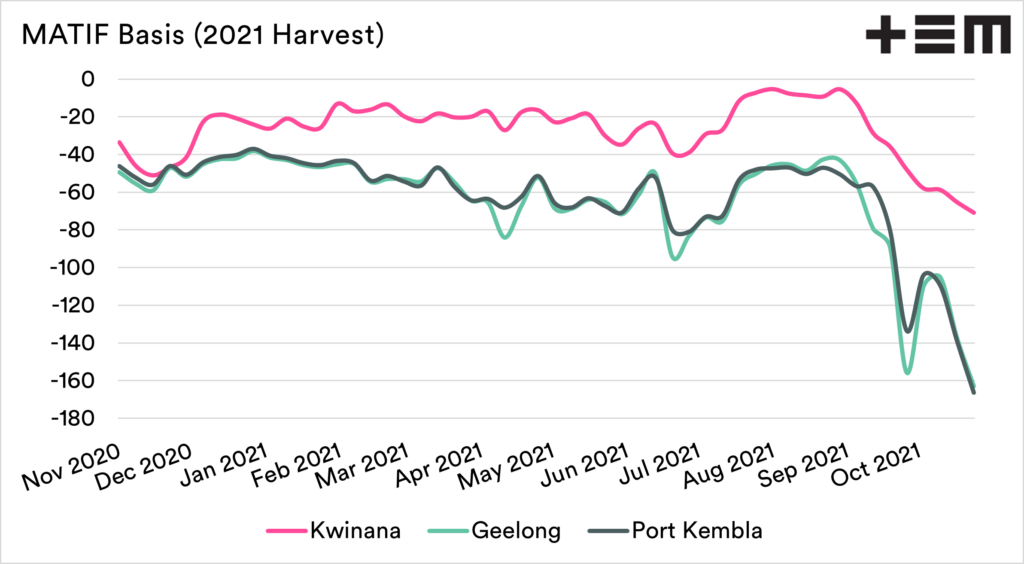

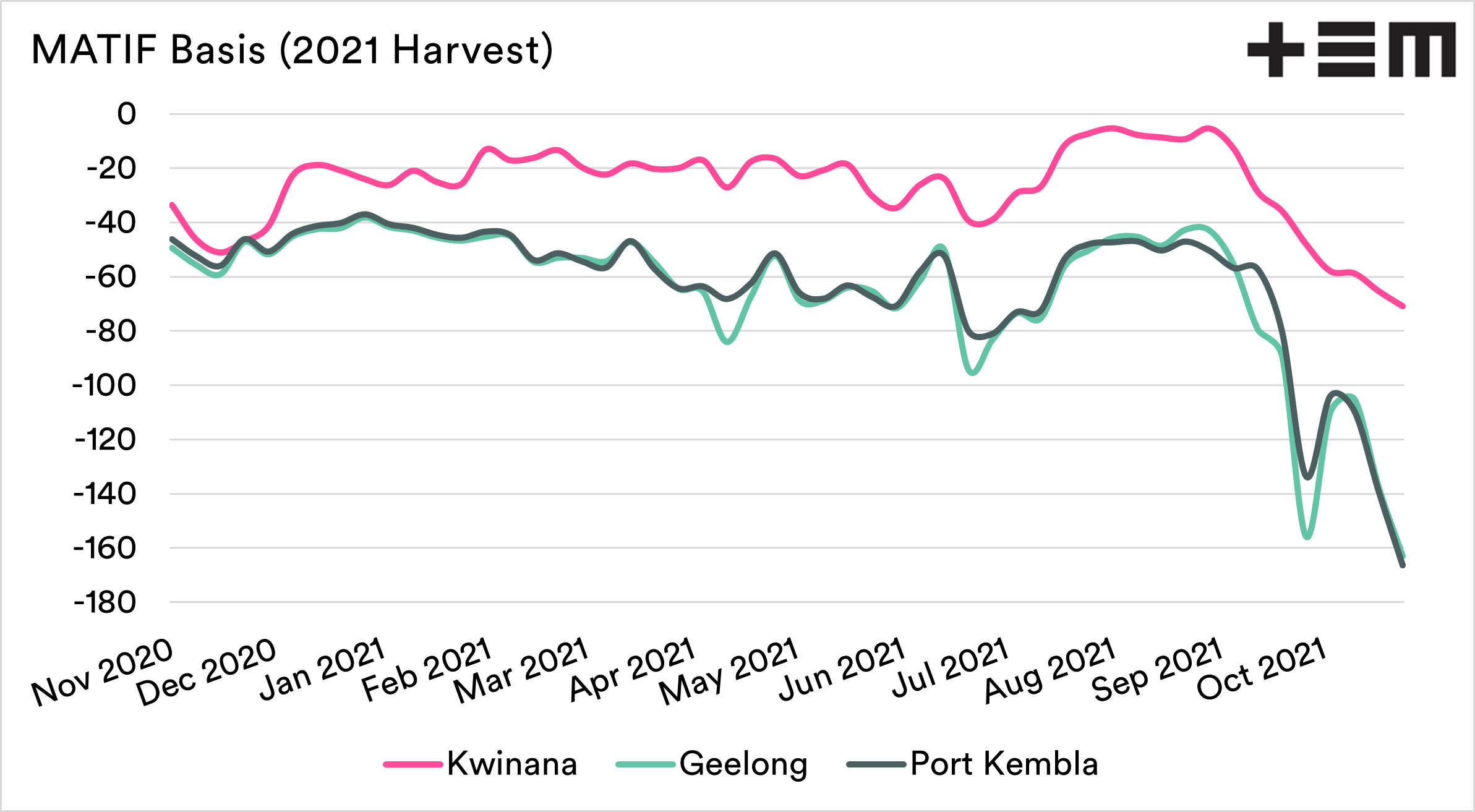

Our basis deteriorates.

The charts below display our basis level compared to both futures markets. We can see that our basis is coming under pressure.

So whilst the local market hasn’t fallen massively (overall), our comparative pricing to overseas futures has fallen.

This is why we tend to look beyond the straight advertised number to determine whether the price is actually good or not. At the moment, we are heavily discounted to the major futures contracts.