Market Morsel: Canola rises in the West.

Market Morsel

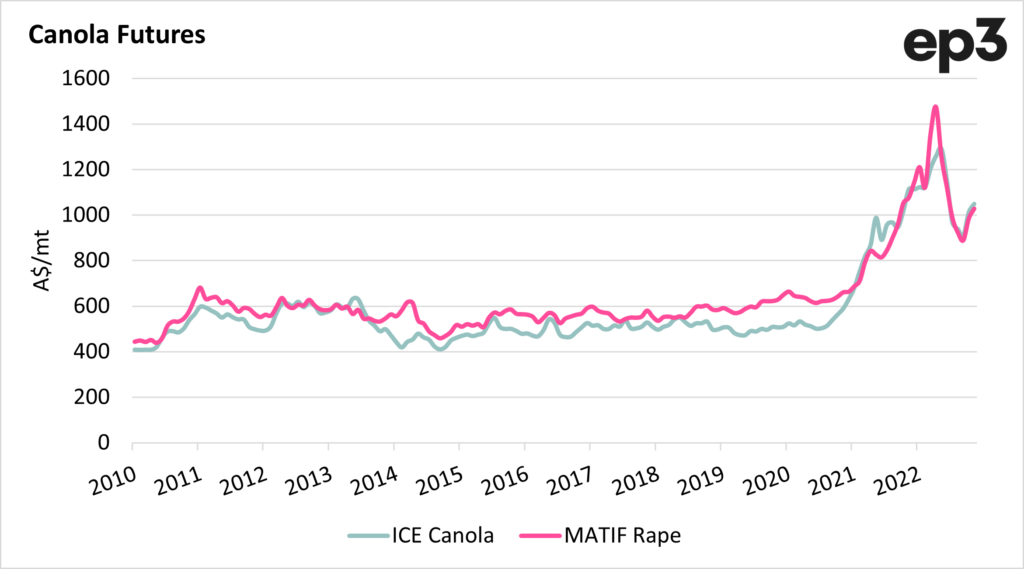

It’s remarkable to think how high canola prices have been over the past year. The first chart below shows France and Canada’s spot canola futures markets. Generally, over the past decade or so, the market has traded around the A$400 to A$600 mark.

The futures market overseas lost a lof of ground from its peak highs but still remains above A$1000/mt, a 15% rise from the September lows.

As always, at EP3, we think it is important to look at relative value. How does our pricing compare to other values, whether that is physical or futures markets.

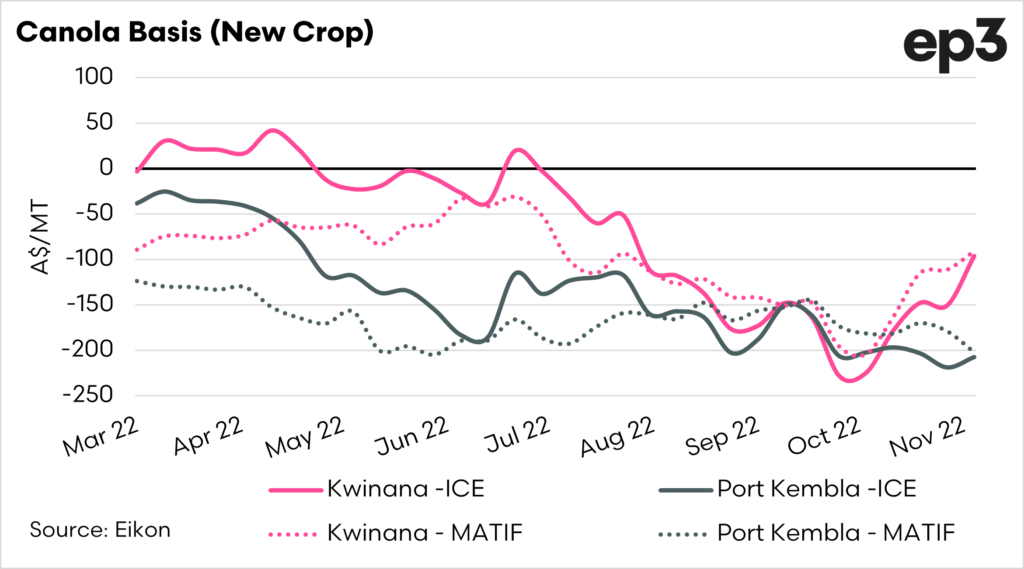

The second chart below displays the new crop canola price for a selection of ports around Australia alongside the futures markets. They are showing similar trends of movements, as they should. The futures markets in France and Canada have continued to maintain a strong premium.

It seems that the west coast is the area narrowing the gap, whereas the eastern states are maintaining strong discounts.

Since September, Kwinana values have been up 11%. Geelong and Port Kembla have only managed a rise of 3% and 5%.

Typically Australian canola has been priced at a premium to Canadian supplies. The question is, when will it return to premiums? Logistics is a constraint, but also so is the volume of the crop likely to be harvested.

So canola prices in Australia are historically high but are also at the same time as a historically high discount.