Market Morsel: Canola the golden child?

Canola pricing

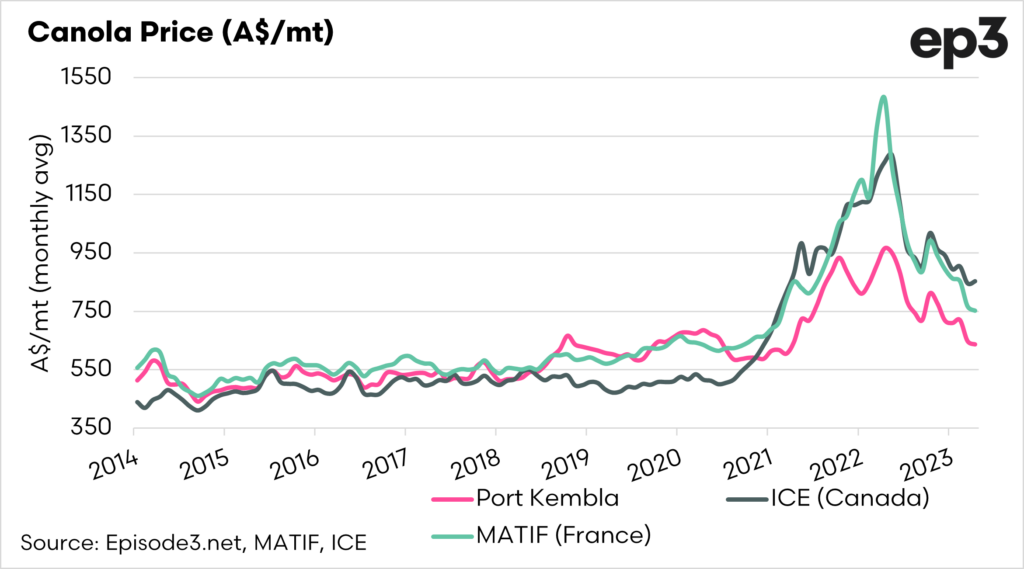

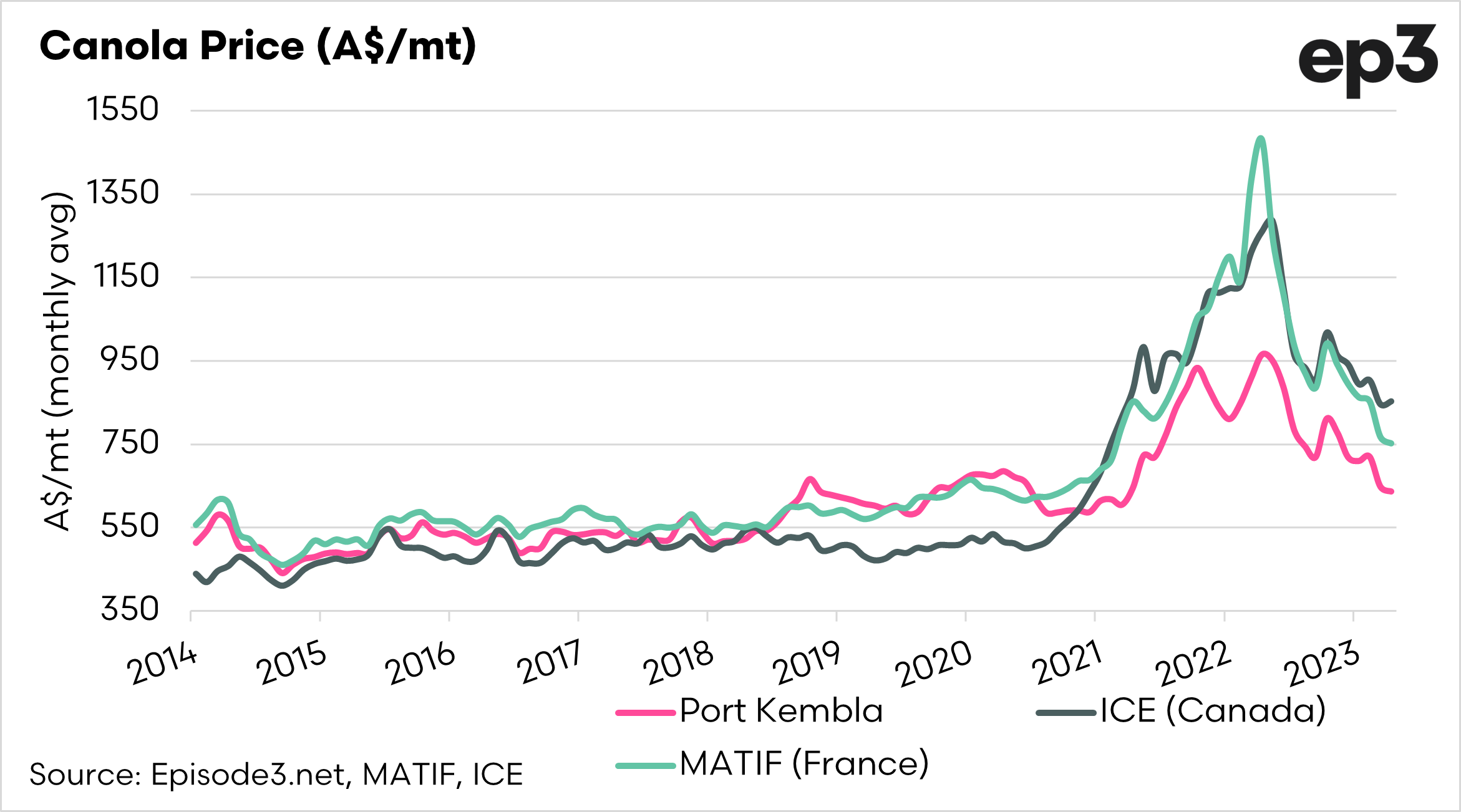

The canola market has been on fire for the past two years. We have seen a major decline in pricing; at EP3, we have pointed out for a long time that Canola around A$1000/mt was not the new floor. Prices were going to move back closer to longer-term averages.

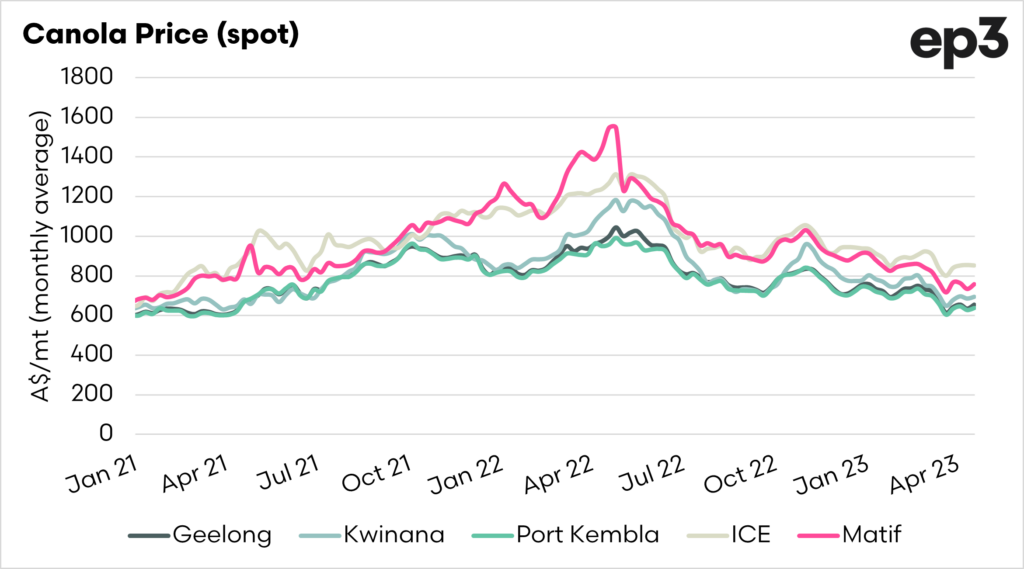

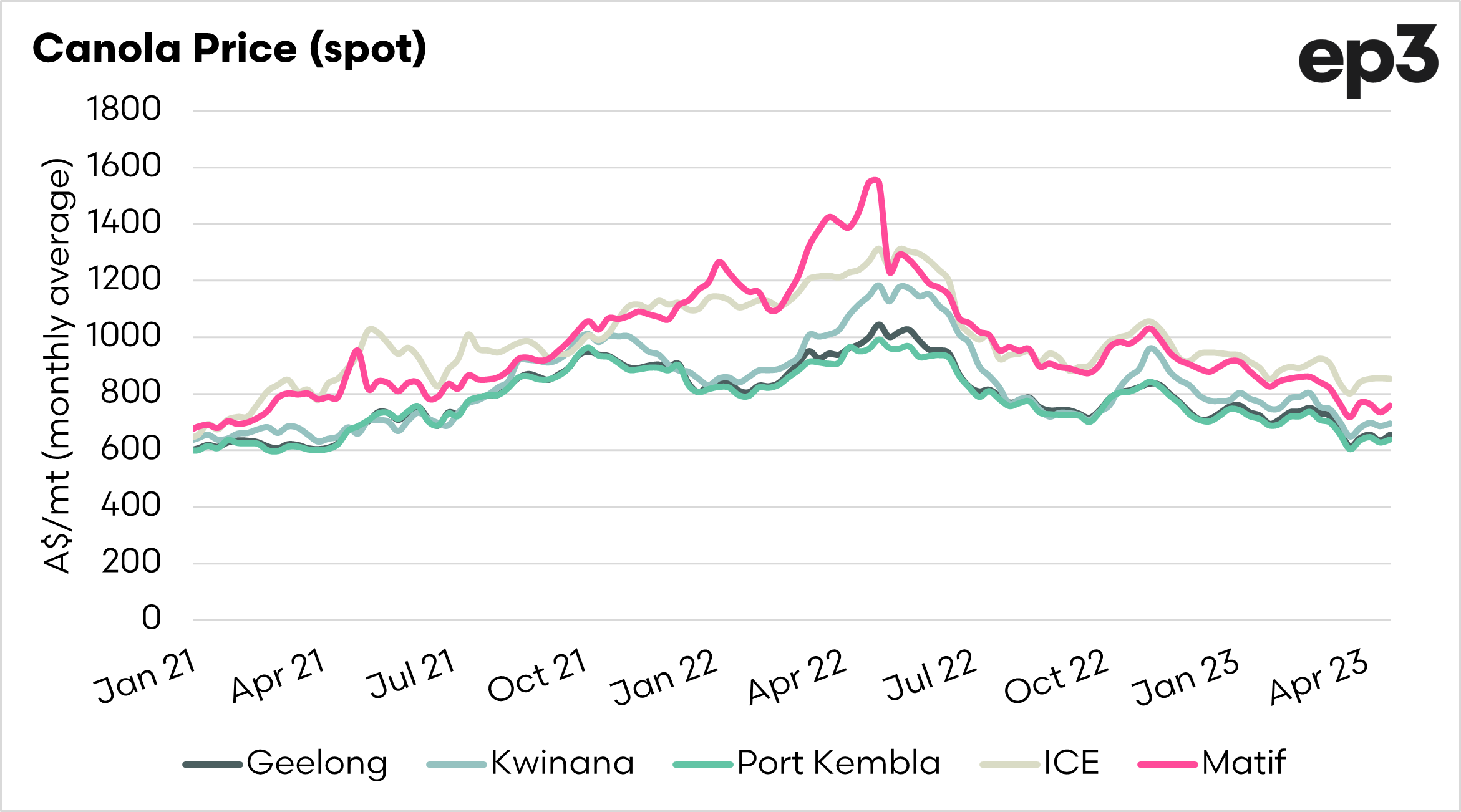

The chart below shows the spot canola prices for a selection of Australian ports and the futures markets. We are well off the highs. If you forget the past two years, we are looking pretty.

One thing to note is that Australian values are discounted to Canada. In the years up to 2021, Australian values would typically be at a premium. If Canada has a large crop, and Australia moves back to more normal production levels, then we could see basis return to a premium.

Canada is the driver.

Canada is the largest exporter of canola in the world, and what happens to their crop will have a direct impact on our pricing. If they have a drought, we are in for good times, and likely vice versa.

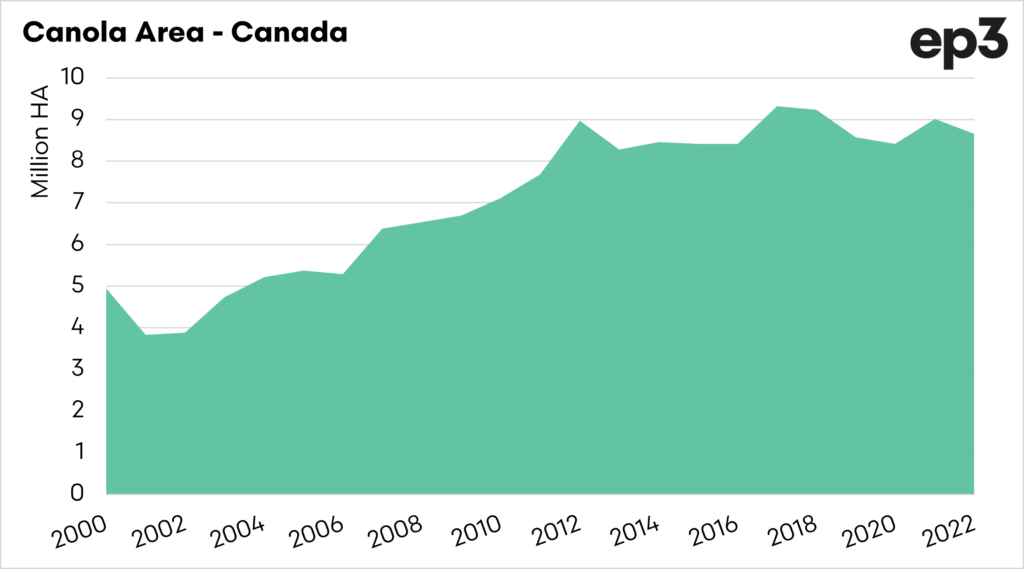

The first chart below shows the recently updated acreage for Canada, and it is sitting just above the long-term average at 8.7m ha.

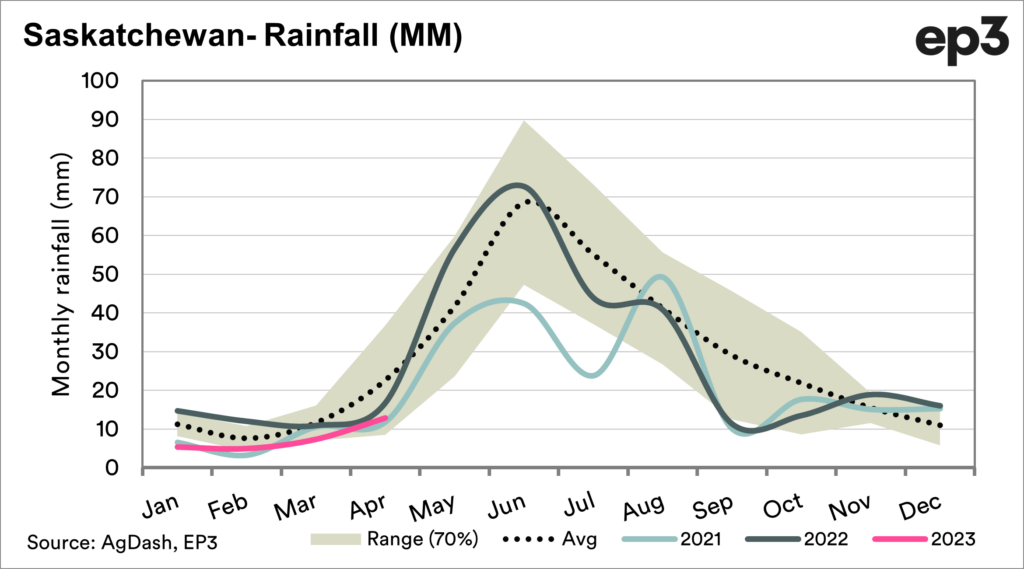

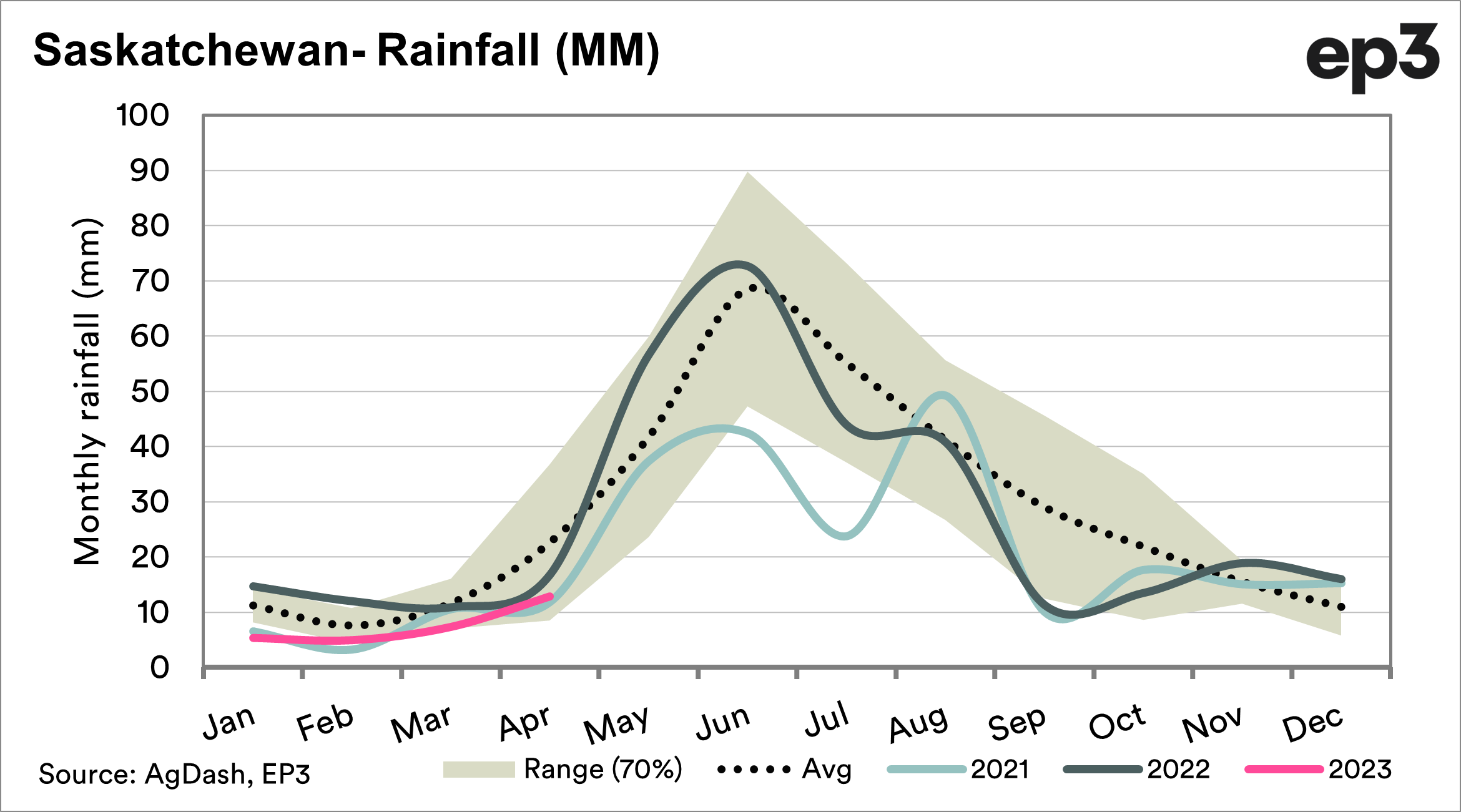

The second chart shows the rainfall for Saskatchewan, which is currently below average. However, the crop is primarily made in May and June, so we will keep an eye on the weather there.