Market Morsel: Chicago pulls the rug from ASX.

Market Morsel

If using futures to lock in wheat pricing levels, Australian farmers have many different routes. They can use either local or overseas futures.

There is no one size fits all, and choice of exchange should be made on the prevailing conditions. The ASX contract is the local contract with the highest volume traded, and Chicago is typically the most relevant contract for Australian farmers hedging overseas.

The ASX contract provides an insight into the local conditions. So if conditions are terrible, it trades at a premium to overseas values and vice versa.

As the crop goes into the ground, we should be looking at forward pricing. ASX to Chicago is a good comparison, especially for the eastern states.

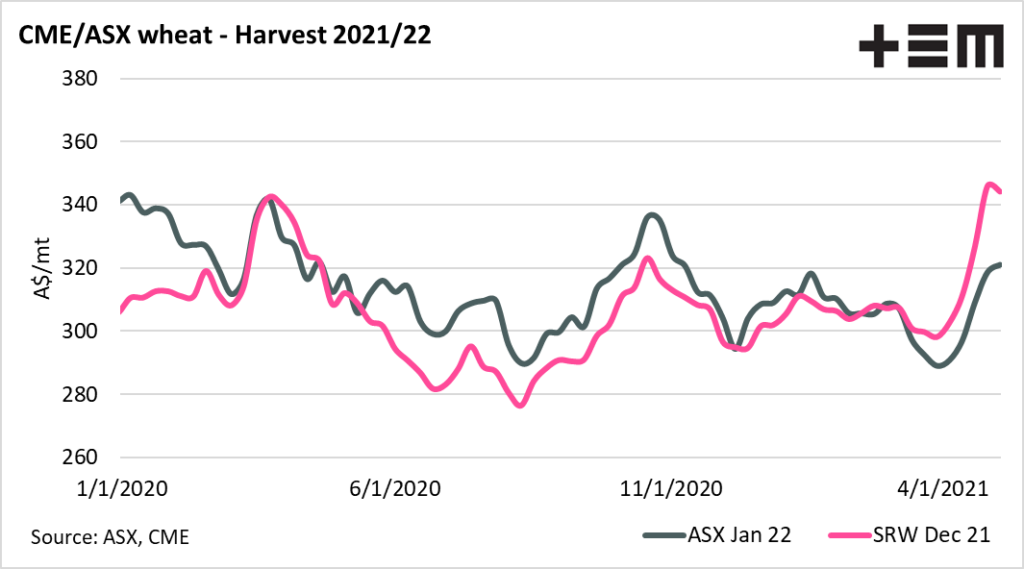

At present, the January 2021 ASX contract is trading at A$321/mt. Whilst this is a good price, it remains lower than the levels from October. The corresponding Chicago wheat futures contract (December) is trading at A$344/mt.

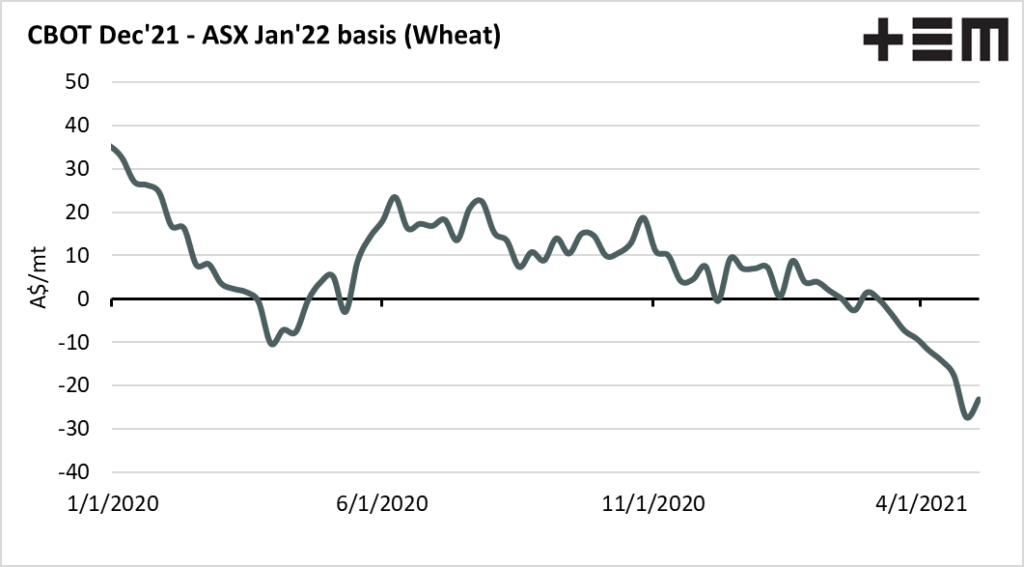

This places ASX wheat for the coming harvest at a discount. Australian wheat typically trades at a premium unless there is a very large crop.

If you use ASX you would be locking in an element of your basis, although there would still be a spread to your local price. Through locking in Chicago, you have the potential to capitalize on an improving basis.