Market Morsel: Chinese Cancel Culture.

Market Morsel

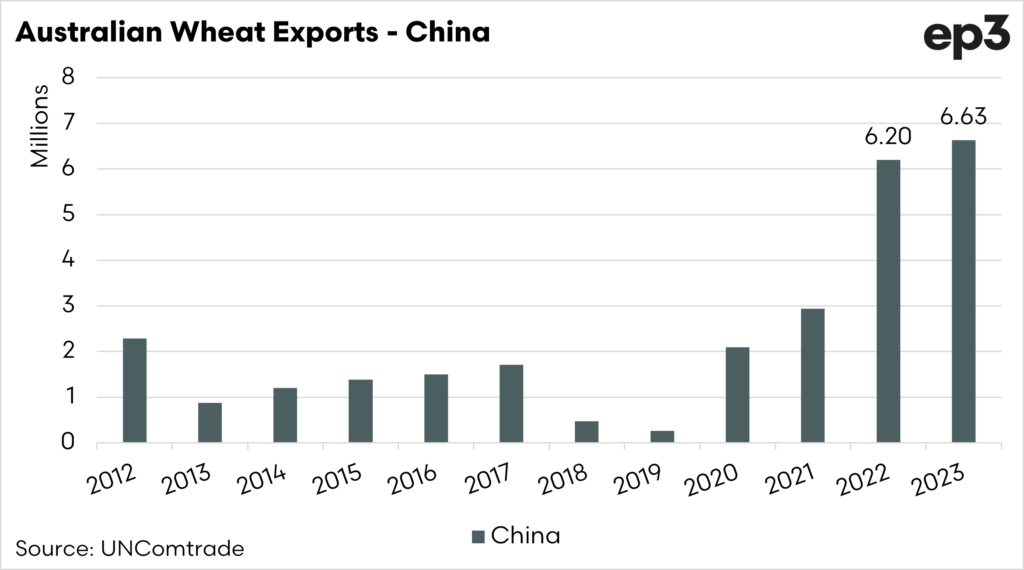

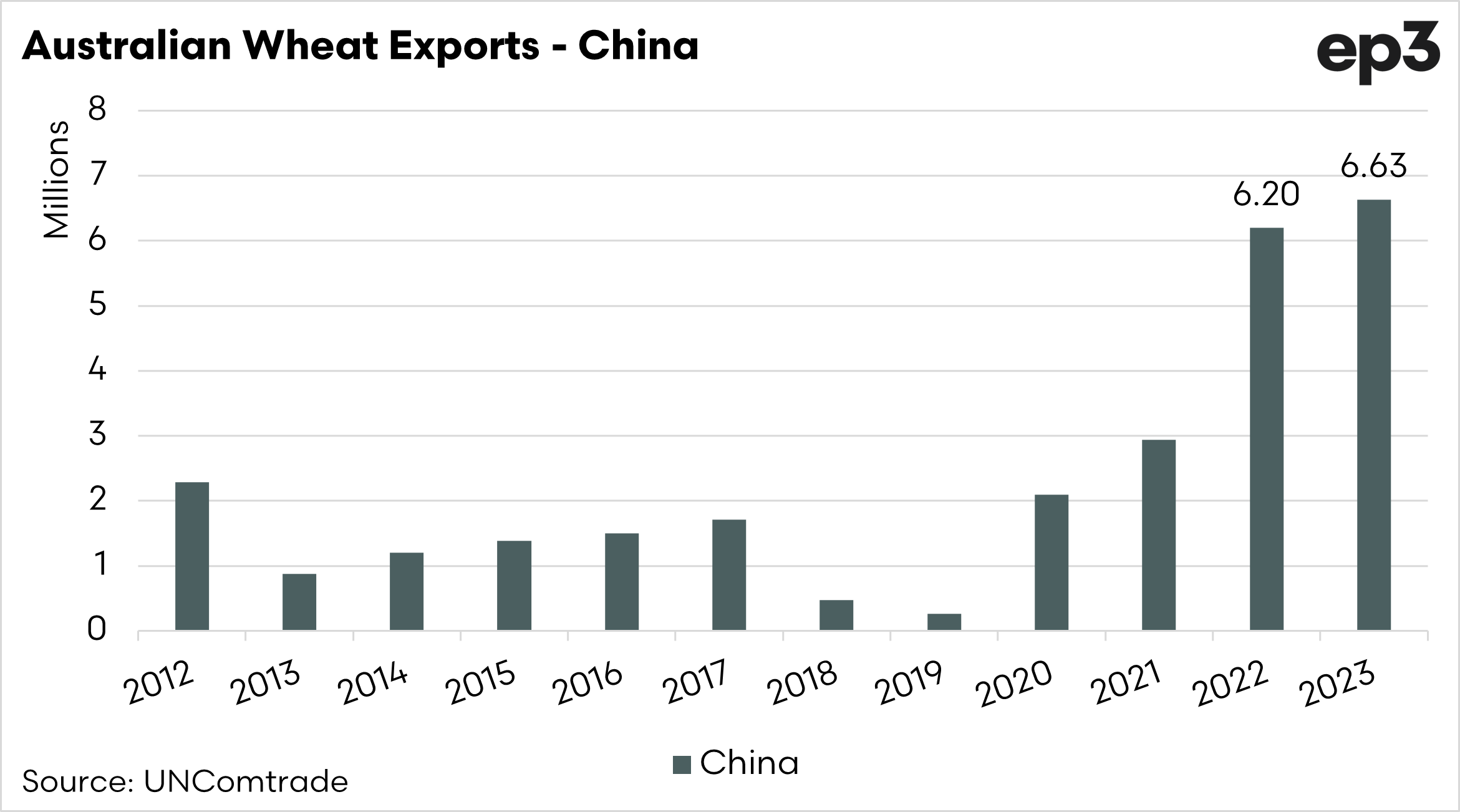

Last week, I wrote about how China had become the largest market for Australian wheat. This year, they had big tonnage on order, but some news came out last night. They cancelled or delayed 1mmt of Australian what for Feb/April delivery.

It is not unusual for China to cancel cargoes. In the US the USDA has a very good reporting system for the grain trade, and they report on sales and cancellations.

Recently, China cancelled half a million tonnes of wheat from the USA, and it seems they may have cancelled 1mmt from Australia.

So why have they cancelled/delayed? Well, it could be for any number of reasons.

- The wheat market has fallen in recent months. Do Chinese buyers hope to delay cargoes and/or washout, then buy into a cheaper market?

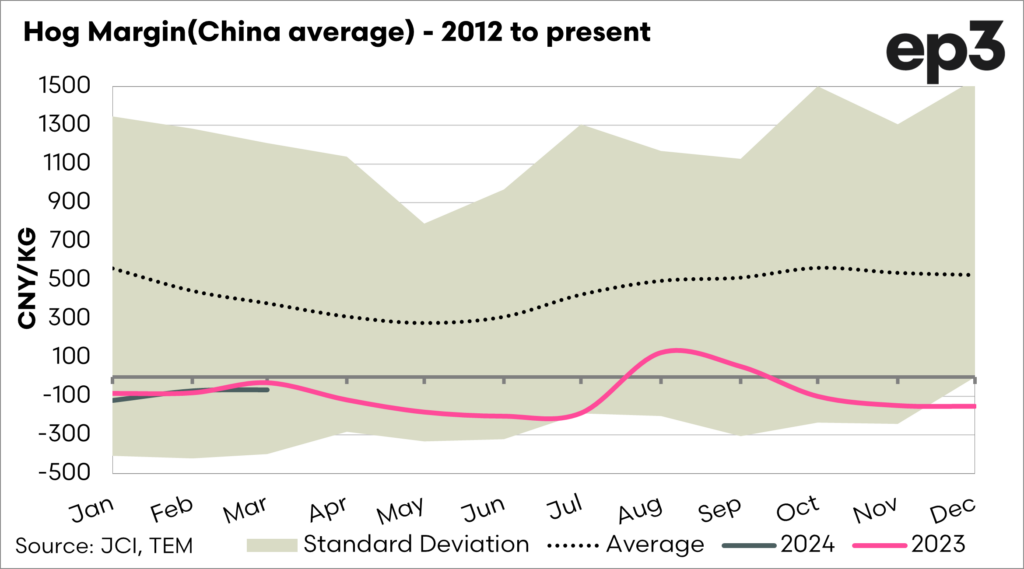

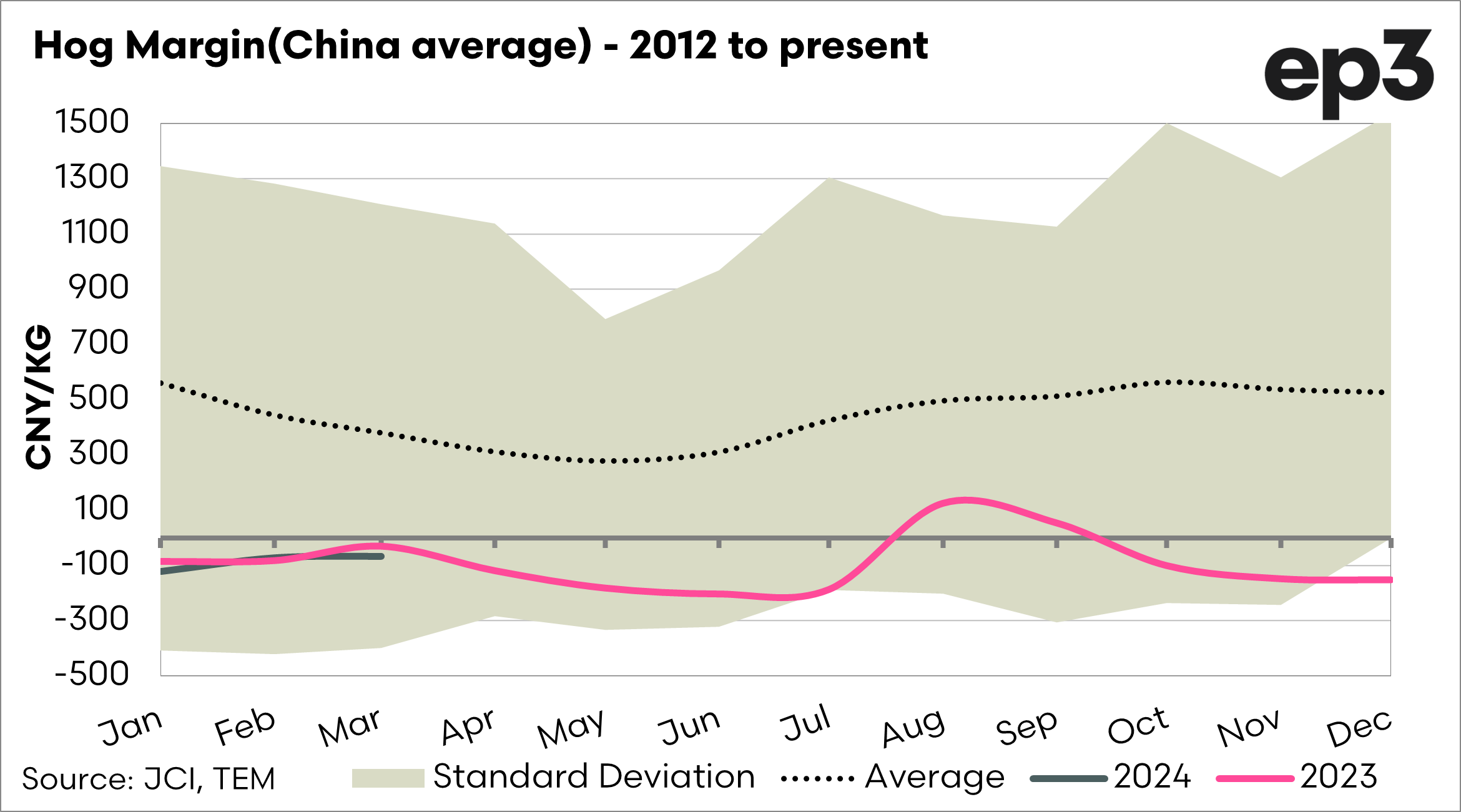

- Is the demand for grain in China falling? If we look at hog margins in China (see chart), they are in negative territory, which could signal a move to destocking.

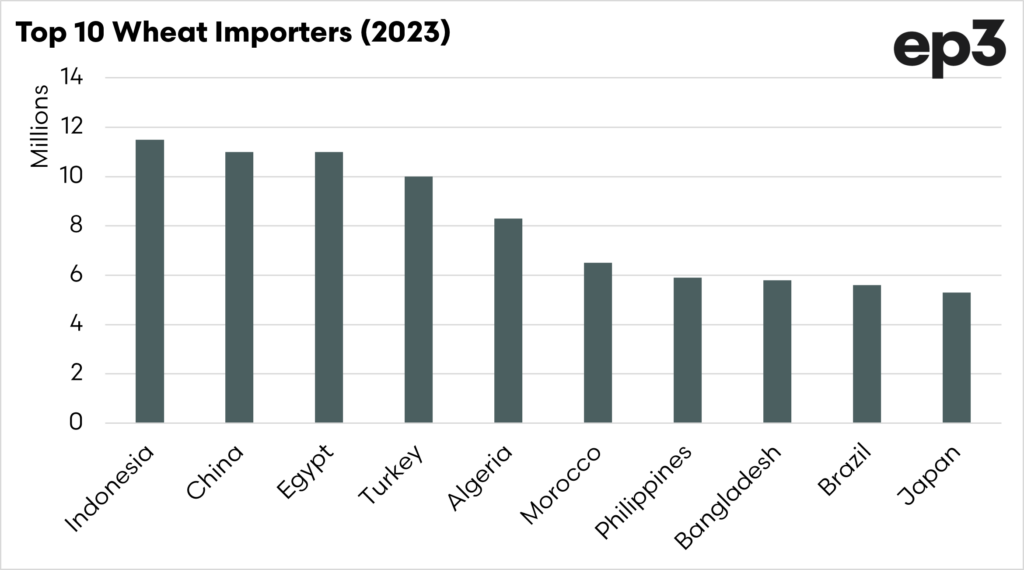

In 2022, China imported 6.2mmt and 6.6mmt in 2023. Australia was forecast to export 20mmt of wheat in 2024. So a million tonnes cancelled is significant.

The reality is that other buyers will swallow up any grain sold, as the shipping stem is pretty much full for the coming months.

Regardless of the reason, the news of cancellations is a bearish indicator as it signals a drop in demand for China. In 2023, according to the USDA, China was the joint second largest importer of wheat, alongside Egypt. The largest buyer was Indonesia.

I was asked today if farmers should consider reducing wheat acres, it is so long until harvest that I wouldn’t be making decisions based on this one event.