Market Morsel: Corn price hits 6month high on low stocks

Market Morsel

The USDA released its World Supply and Demand Estimates (WASDE) report on Friday. There was very little to talk about in relation to wheat, which we haven’t already covered on EP3. However, corn did have some talking points, which caused the corn market to rally to six-month highs.

The USA is set to see its corn end-of-year stocks decline to 39.1mmt, a fall of 5mmt. This ia a pretty significant fall and results from a fall in of 7mmt to US corn harvest. These were drops that were higher than the trade was expecting.

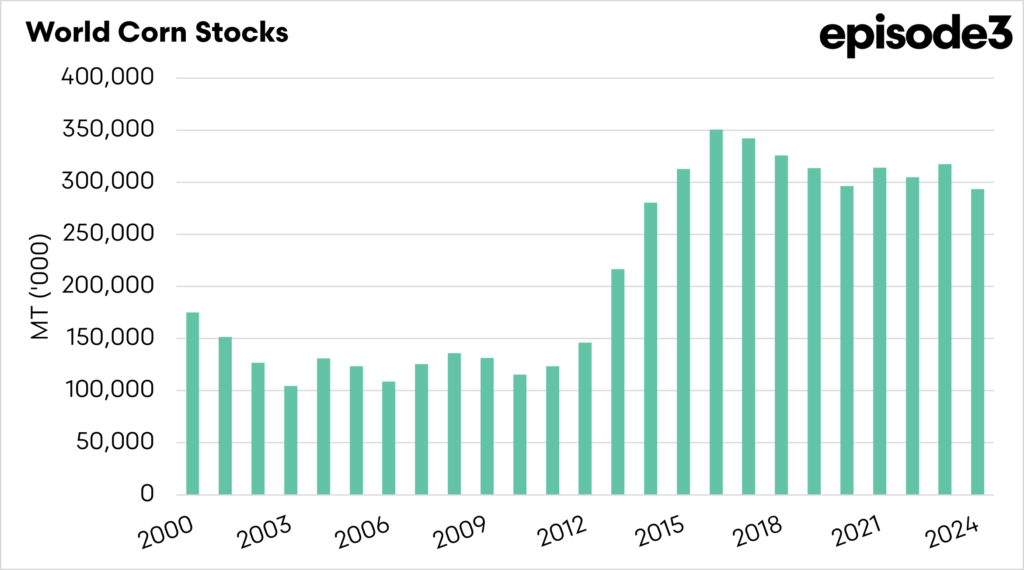

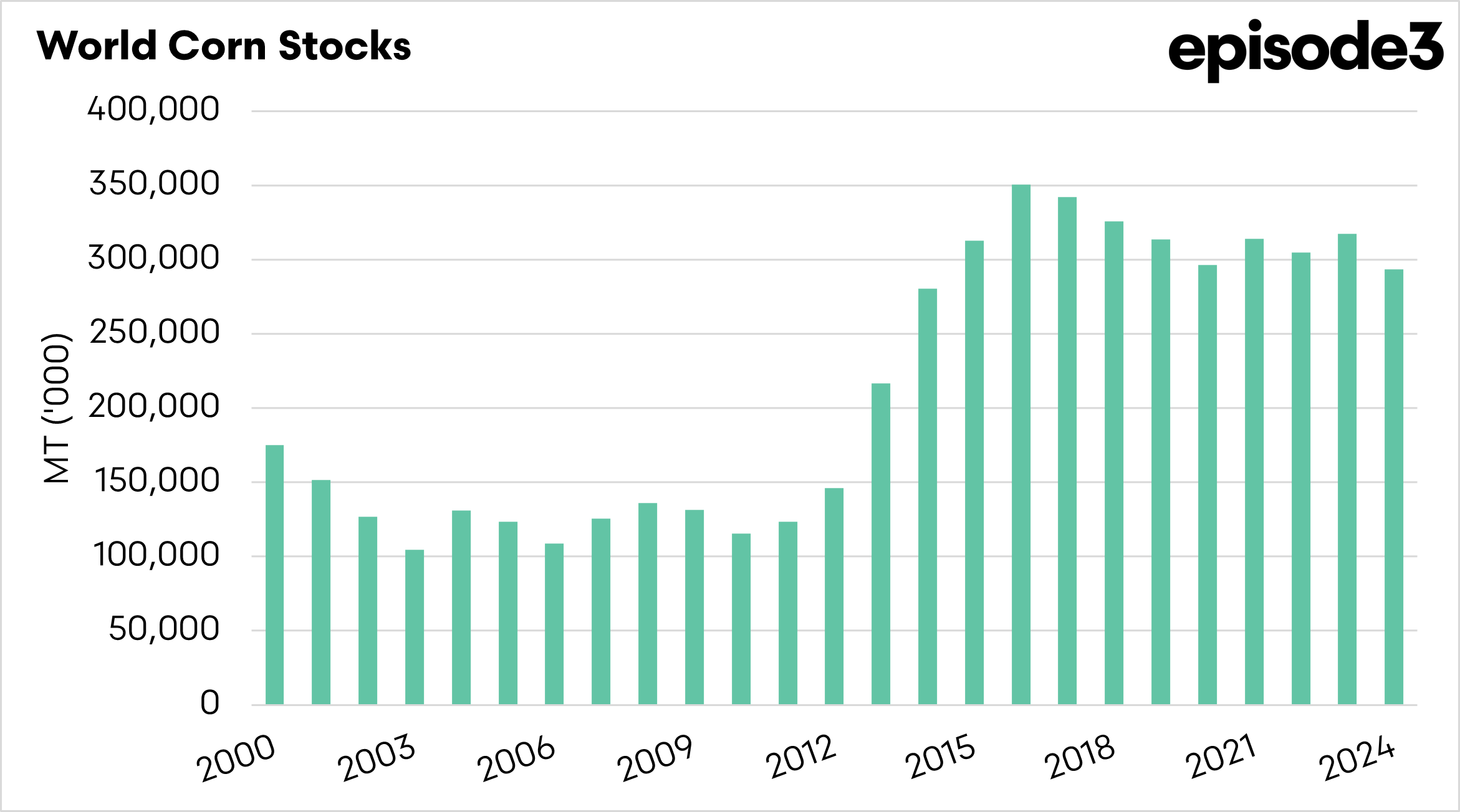

The world is also set to see its overall stocks decline, with the global end-of-year stocks falling to the lowest level since 2014.

Why is this important to us in Australia, with our wheat (and barley) crop?

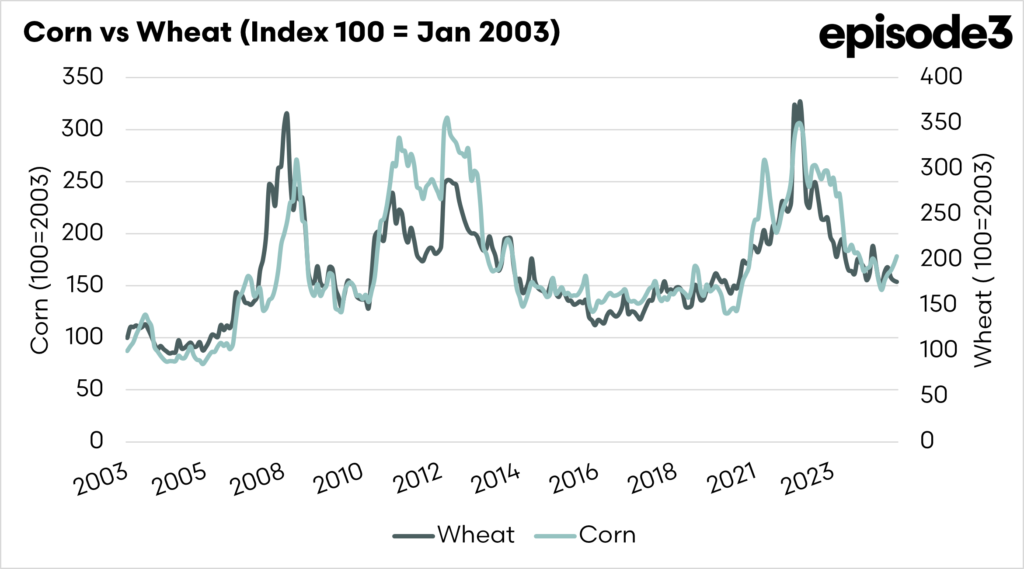

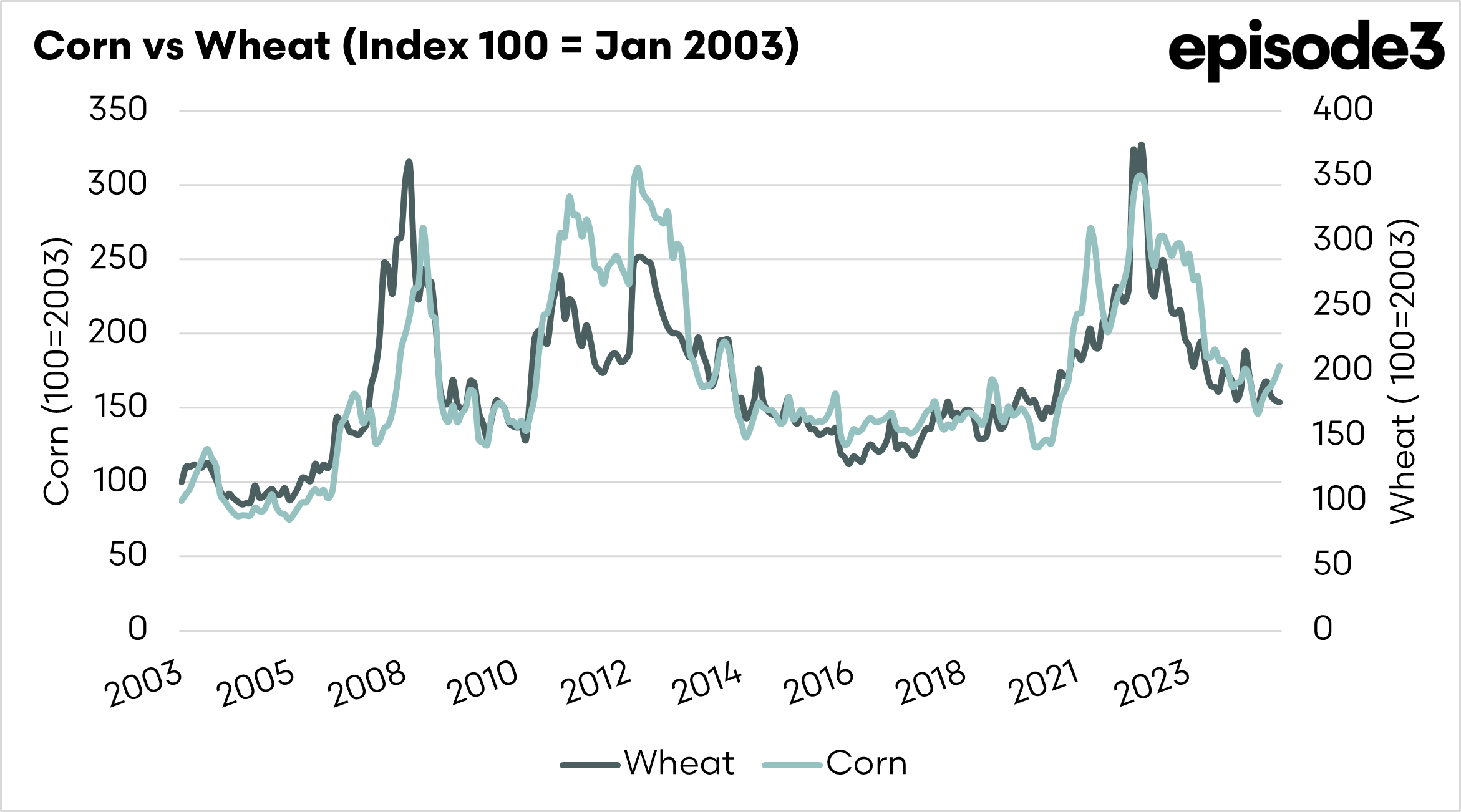

Corn and wheat/barley are both replaceable (to an extent). Corn and wheat have a substitution effect; they can be used for the same purposes, whether animal feed or biofuel production. If one commodity gets too expensive, then buyers will substitute for the other.

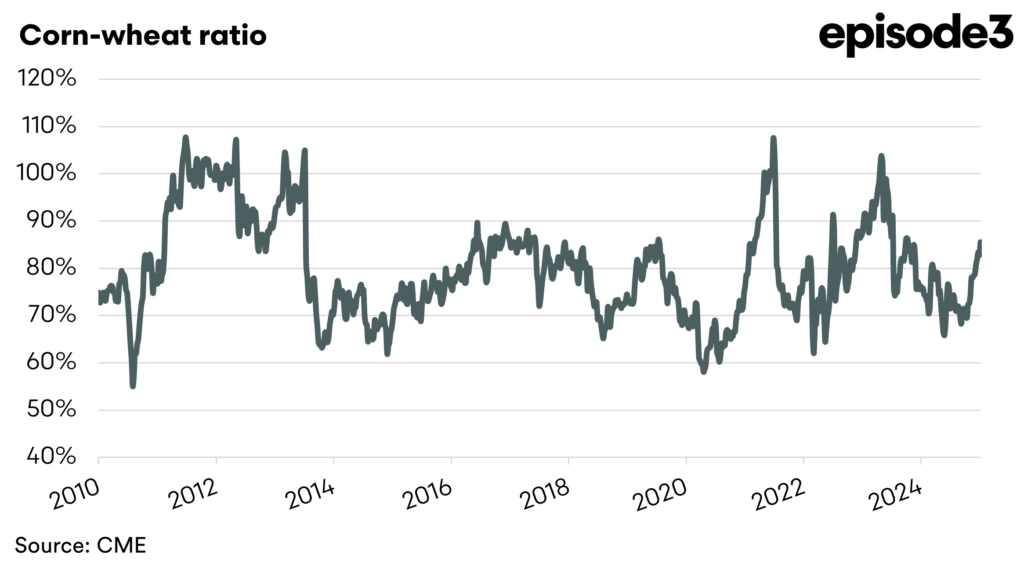

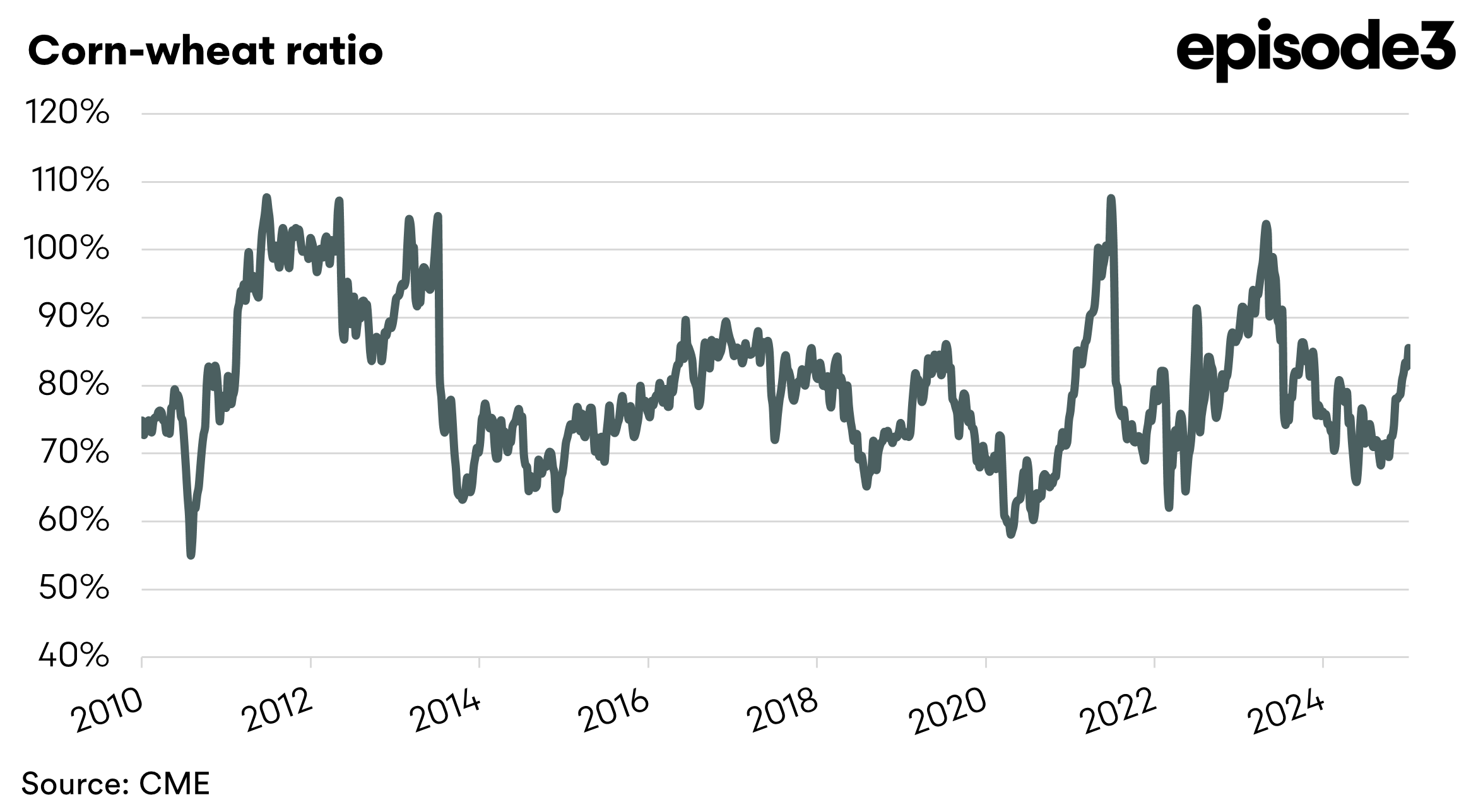

Historically, wheat and corn have tended to follow a very similar pattern of pricing (see chart below). So if corn rises dramatically, then we will likely see a little flow into the wheat market.

In the third chart below, the corn-wheat ratio is shown. At present, the price of corn is 86% of the price of wheat. This is on the higher end of the range, where the expected range would be around 75-80%. This could potentially see some demand switching to wheat because wheat is nutritionally superior to corn.

It’s still early in the year, but this is some good news that corn stocks are down. Supply drives prices, and we are looking for a reduction.