Market Morsel: Did we lose our opportunity to price wheat?

Market Morsel

Markets fluctuate, rising and falling. At the moment, the wheat market is definitely in the downward phase. So I ask the question, have we lost an opportunity to price using futures (or swaps)?

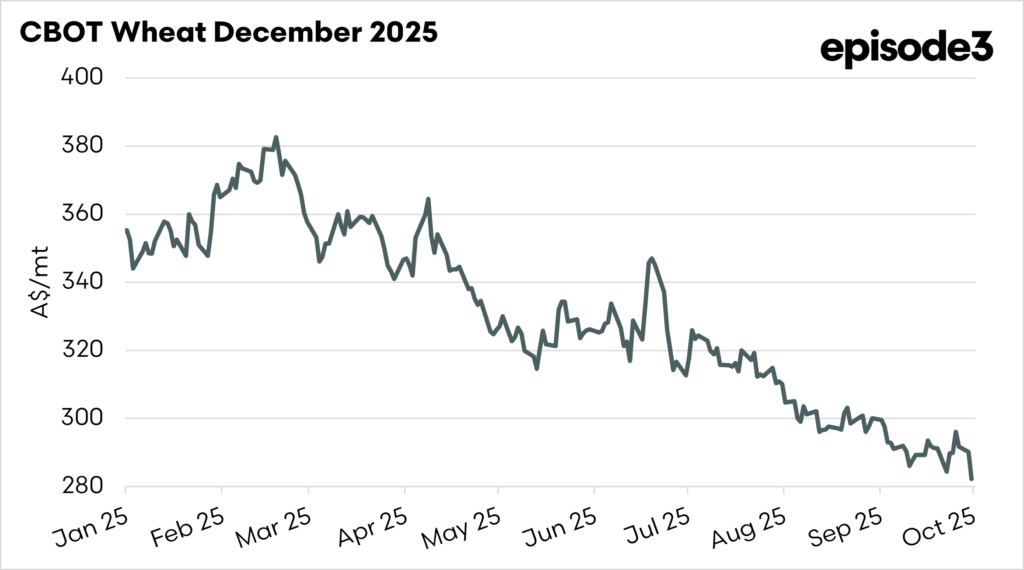

The first chart below shows the CBOT wheat price for the coming harvest from early last year to the present.

We can clearly see the downward trajectory since the start of the year. An Australian producer can use CBOT wheat futures (or swaps) to lock in their price. The farmer can sell CBOT wheat contracts to protect against further downside in the market.

If we look exclusively at the pricing from seeing to know, there were opportunities to lock in futures prices significantly higher than where they are now. The futures price in June reached a peak of A$345 but has since fallen to A$282, currently trading at A$63/mt, which producers have now lost.

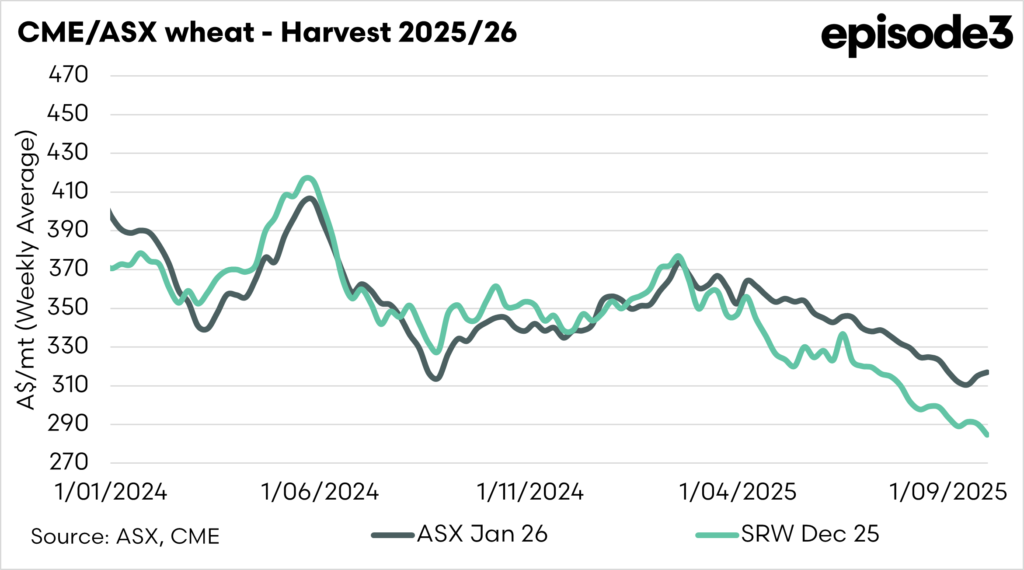

It is essential to note that this is just one aspect of pricing, and there is still a basis to be considered. Typically basis in Australia is a premium, above the CBOT price, although it can be negative.

This means that a farmer who sold futures in June at A$345 could close out their futures contract and sell physical, and receive a price likely above A$350, depending on where in the country they are.

As we move further into the year, we are seeing that stocks are pretty ample, and there is less uncertainty until the next global crop starts growing, which limits the potential for large upside potential.

In the coming weeks, we will be writing more articles on different price risk strategies and understanding how the market operates. At EP3, in combination with ACM, we want to ensure that farmers are informed with the right information to make strategic decisions.