Market Morsel: Driving the market

Market Morsel

Markets are related to one another, as an example we all see at the moment how energy prices impact upon fertilizer. We may see another example soon.

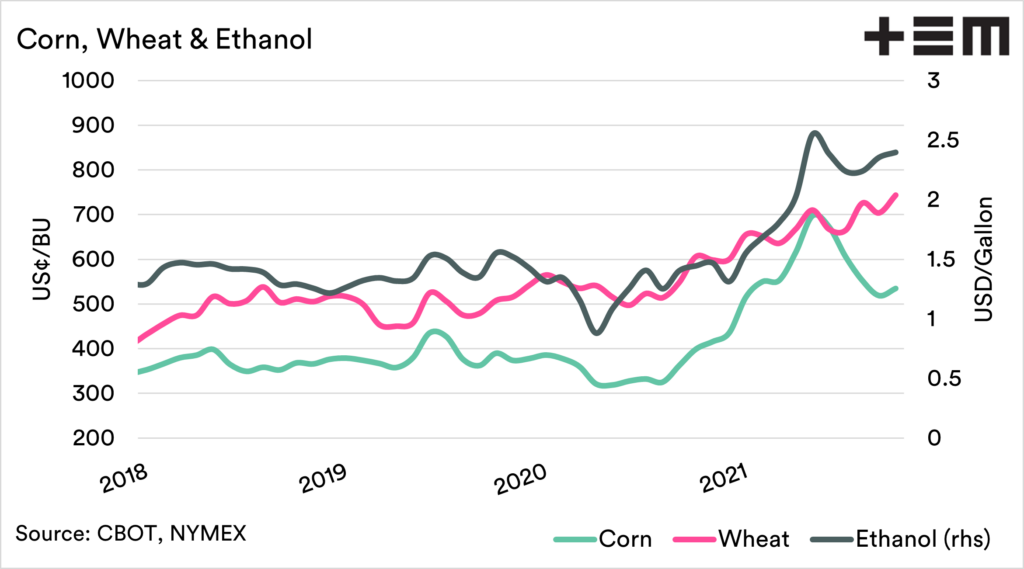

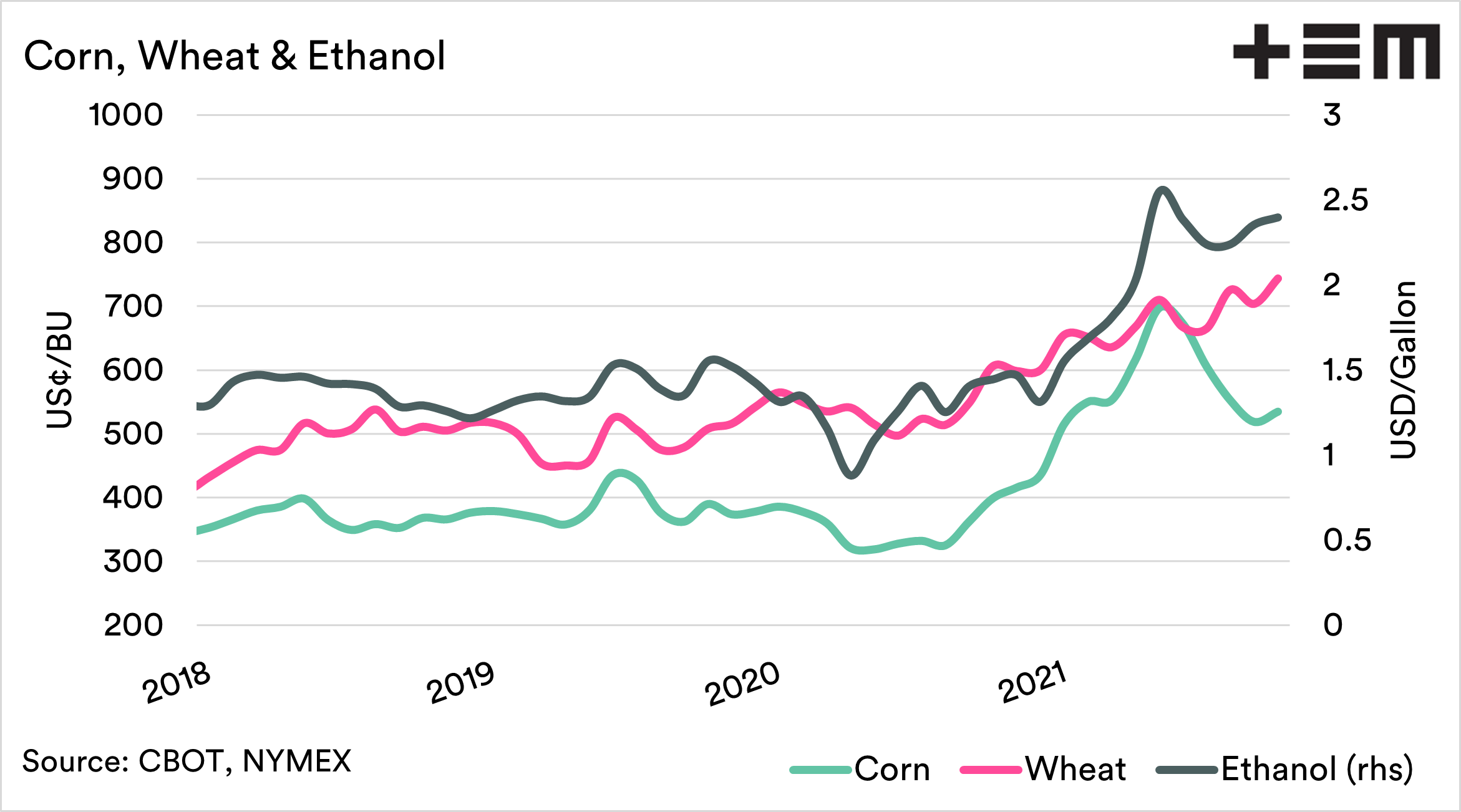

We have mentioned in the past the relationship between oil, ethanol and corn/wheat. You can read an explanation in the article ‘Don’t be crude’.

The summary is that corn is used to make ethanol in the US. If demand for ethanol rises, then corn in turns is positively impacted – which can flow through to wheat pricing.

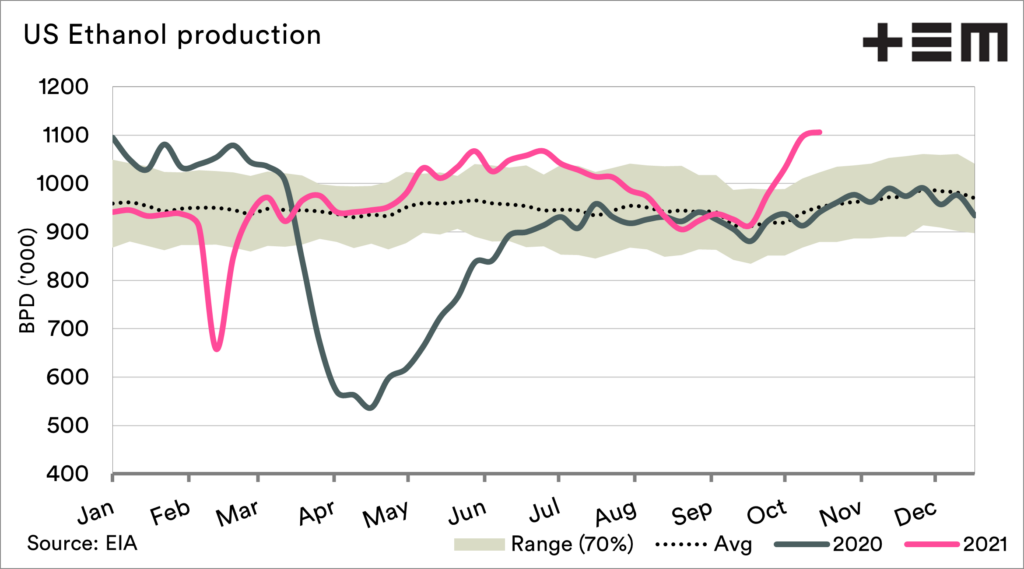

Ethanol is pumping at the moment, and demand is strong. In the last week, US ethanol production was the 2nd highest on record. Only a slight 2000 barrels less than the record.

Whilst Australia (more so NSW/VIC) is slowly coming out of lockdown, the rest of the world is moving on. Energy pricing as you will be aware from our recent articles are skyrocketing, and this is assisting ethanol demand and pricing.

I wrote an article earlier this week, outlining that harvest diesel pricing is at the second highest price since at least 2004 (see here). Whilst this is an annoyance to farmers, who will have a big bill coming their way soon, at least there is a silver lining that high energy costs can be beneficial to grain pricing.