Market Morsel: EU/US government the biggest risk to grain?

Market Morsel

The world is quite frankly in a bit of a precarious place. We live in the lucky country, but there is a lot of volatility around the world. People worldwide are struggling with rapidly rising costs, and fuel remains one of them.

In South America, there have been protests due to the increasing costs of fuel and fertilizer. The Sri Lankan government is falling to pieces and warning that the economic crisis there will lead to a threat of starvation. This is the risk that rapid inflation can have.

Governments worldwide are examining their options to determine the best balance between supporting farmers and food security/affordability.

Biofuels

One of the options and a potential risk for grain prices are changes to biofuel mandates. These biofuel mandates have assisted global grain pricing over the past two decades; a removal would assist in moving more grain to food. However, this would remove a large block of demand and see declining prices for grain.

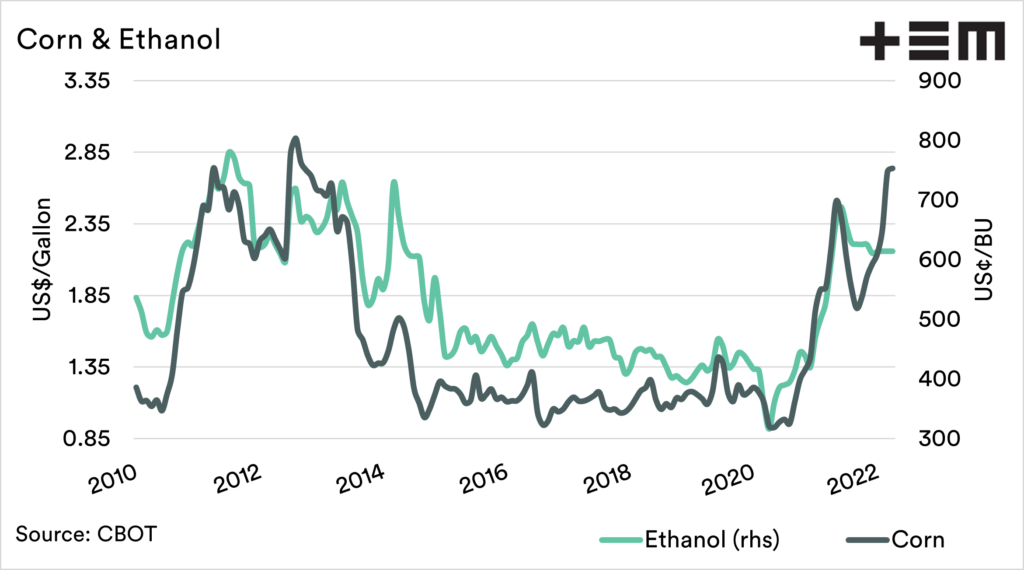

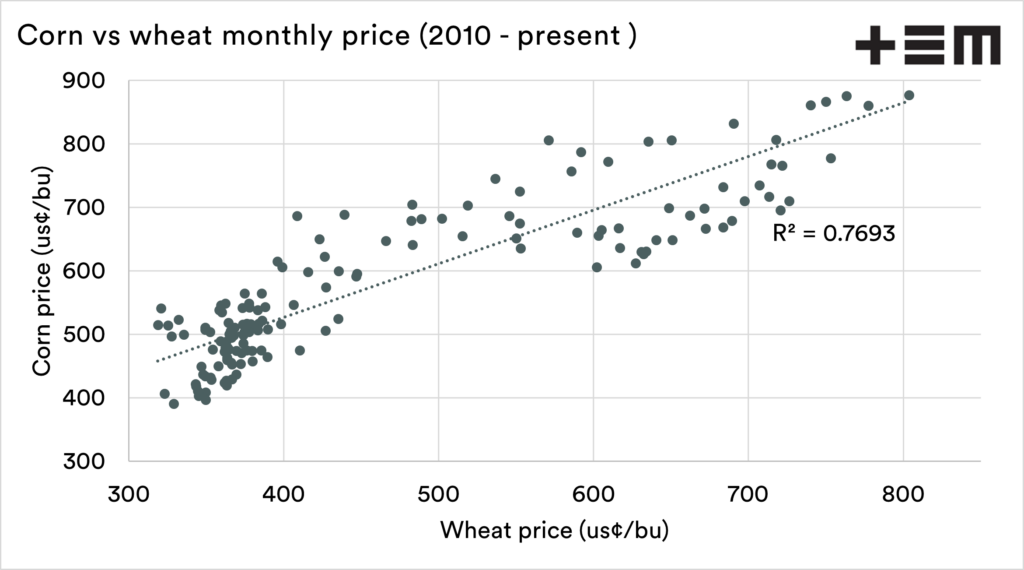

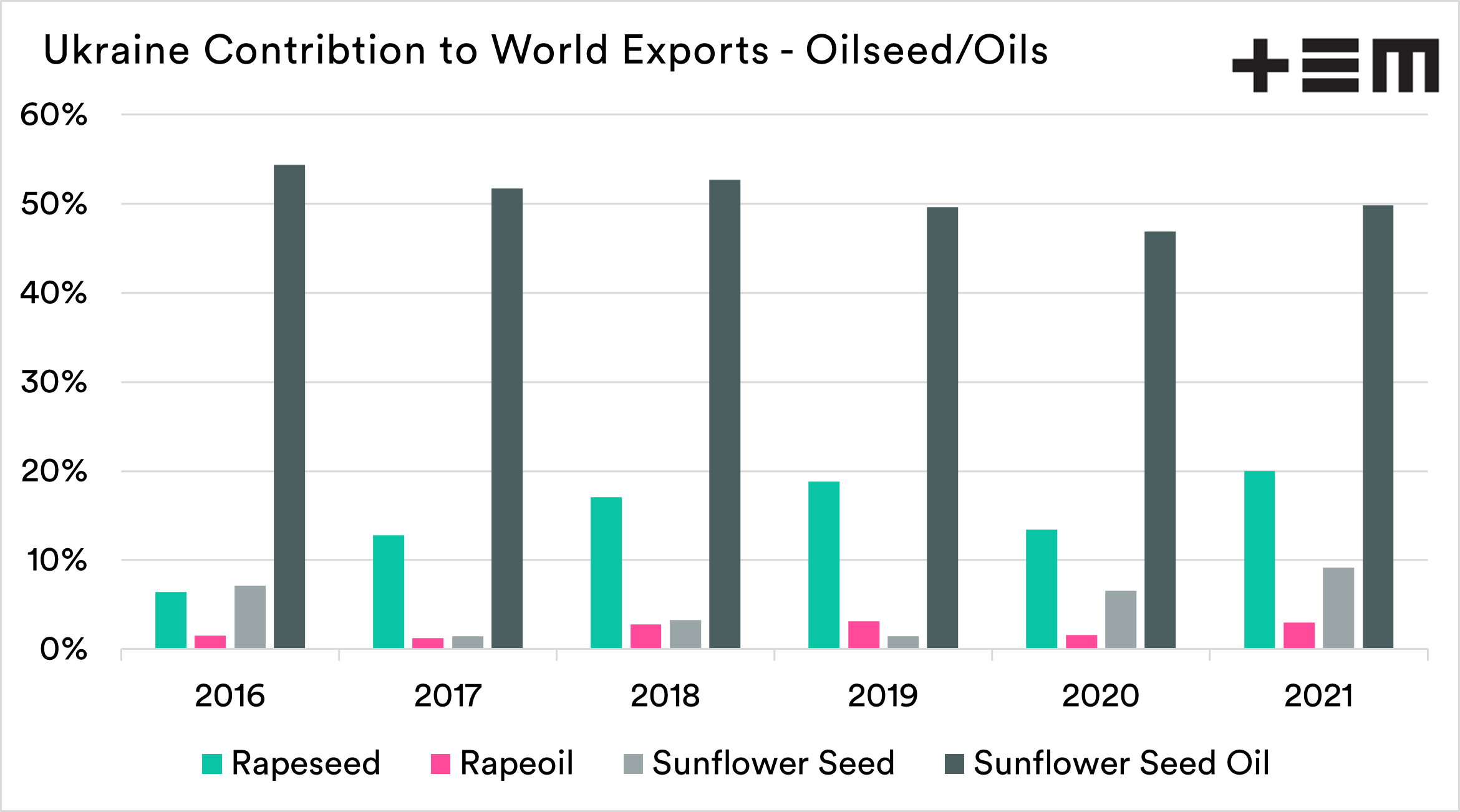

The first chart below shows the relationship between corn and ethanol, and the corn price strongly correlates with wheat.

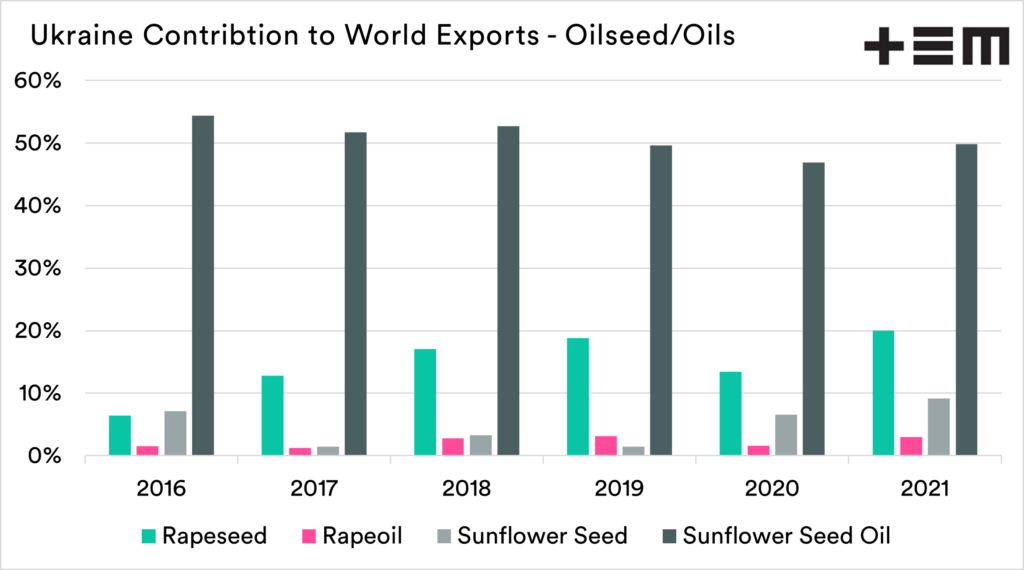

It is tough for policymakers to make large volumes of food available instantly. In places like the US and EU, the quickest way to increase supply is to change how grain is used. As an example, vast volumes of palm oil are used for biodiesel in Europe. The removal of palm oil as a biofuel would lead to it being diverted to the food industry and reduce prices. This as an example would supplant much of the requirement for sunflower oil (or canola).

Bring back land

This week, the EU ag minister made a very interesting comment: “Those plans were peacetime plans. And now it’s wartime”

The EU commission has always had a very strong environmental focus. One of the plans of the EU is to allow the production of crops on land that was set aside. This is land is left fallow each year, and bringing this back into production would massively increase production.

The addition of set aside, along with access to a 500m Euro fund to assist farmers with increasing input costs, would likely result in a replacement of a large volume of grain that is missing from the market due to the absence of Ukraine.

Australia?

Australia doesn’t have much domestic biofuel production or conservation set aside. Still, changes in these two policy areas overseas are risks to grain prices on a global level. When you add supply onto the market (or reduce demand), prices will fall.

It’s going to be an interesting year as governments balance their positions on inflation vs food production vs environmental protection.

There will be a lot more debate in the coming months about securing food around the world, especially as pricing starts to bite.