Market Morsel: Feeling the love

Market Morsel

Speculators, love them or hate them, they are important. We hate them when they drive the market down, but we don’t mind when they are driving the market higher.

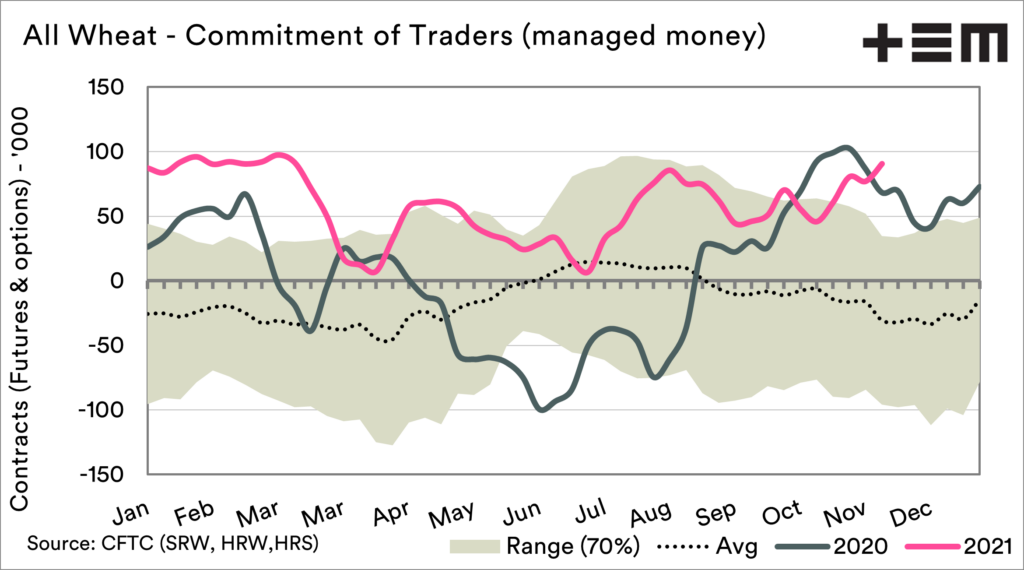

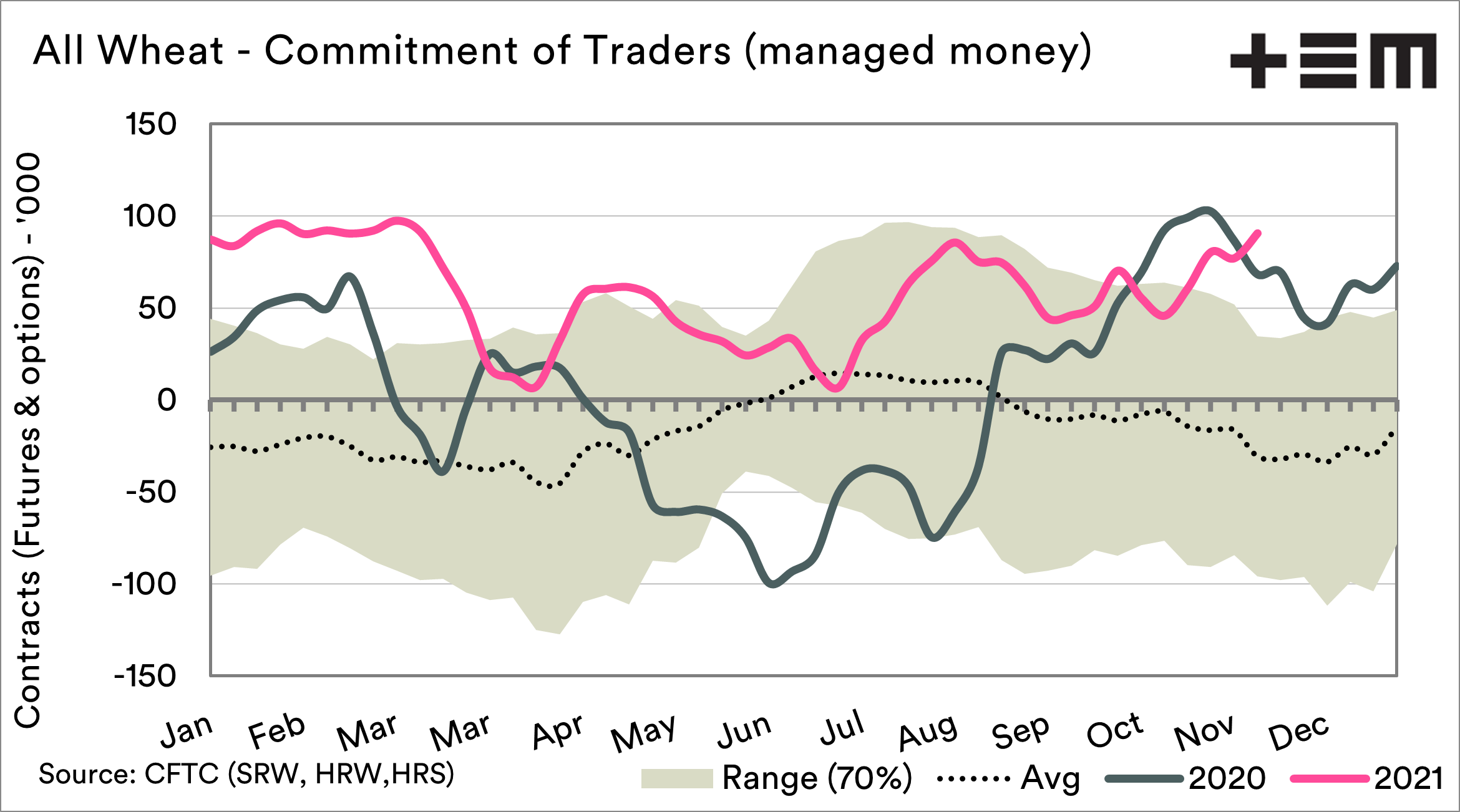

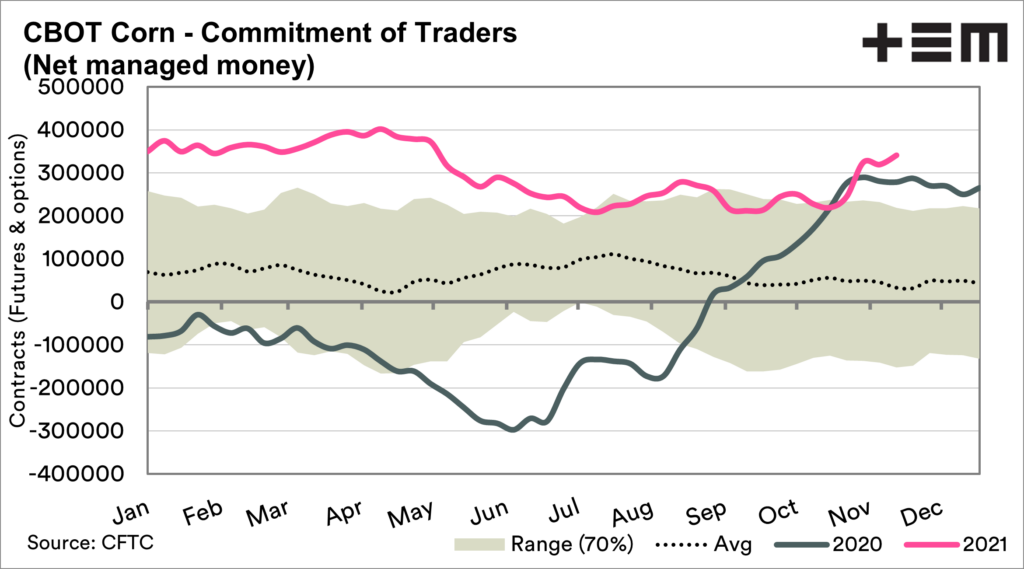

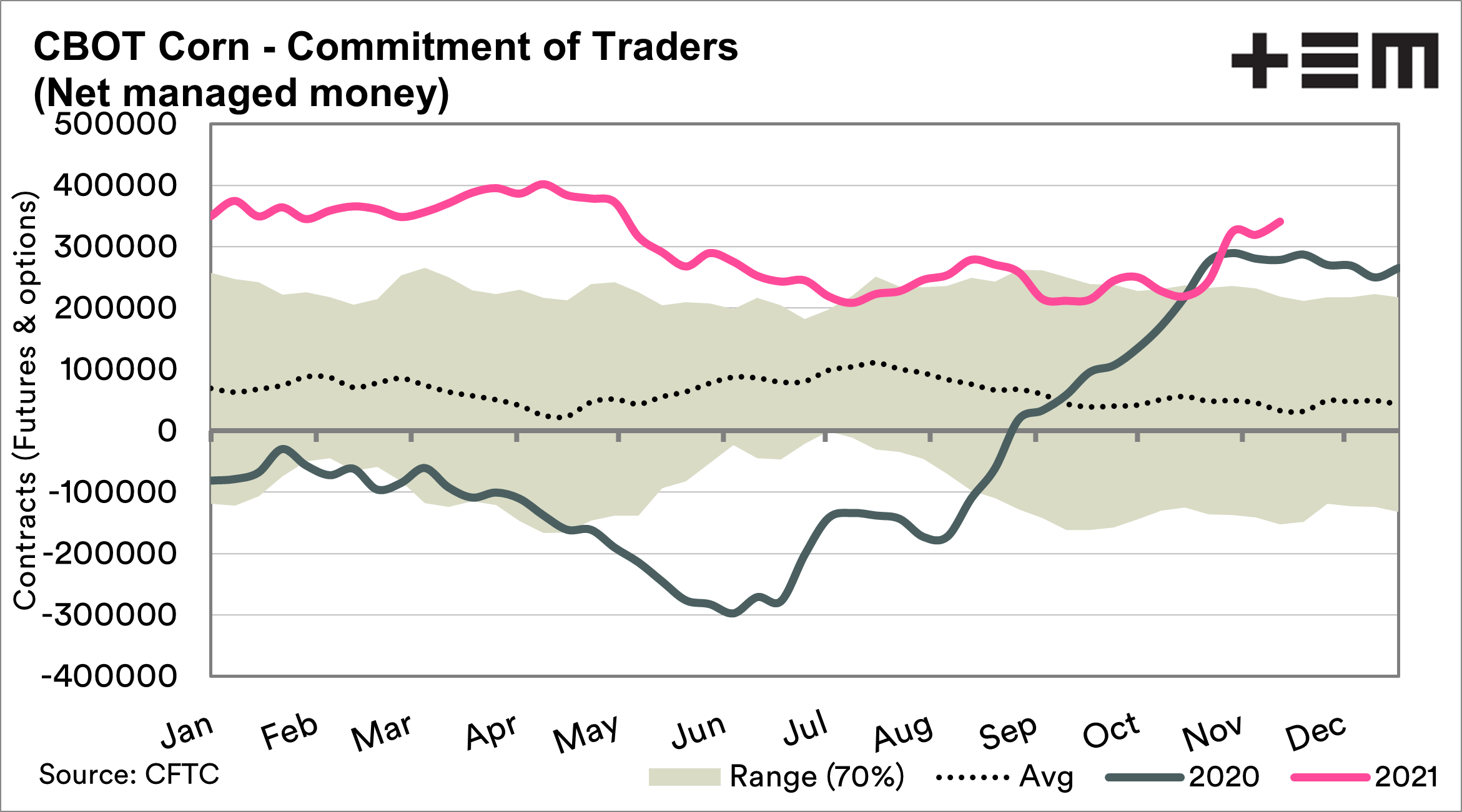

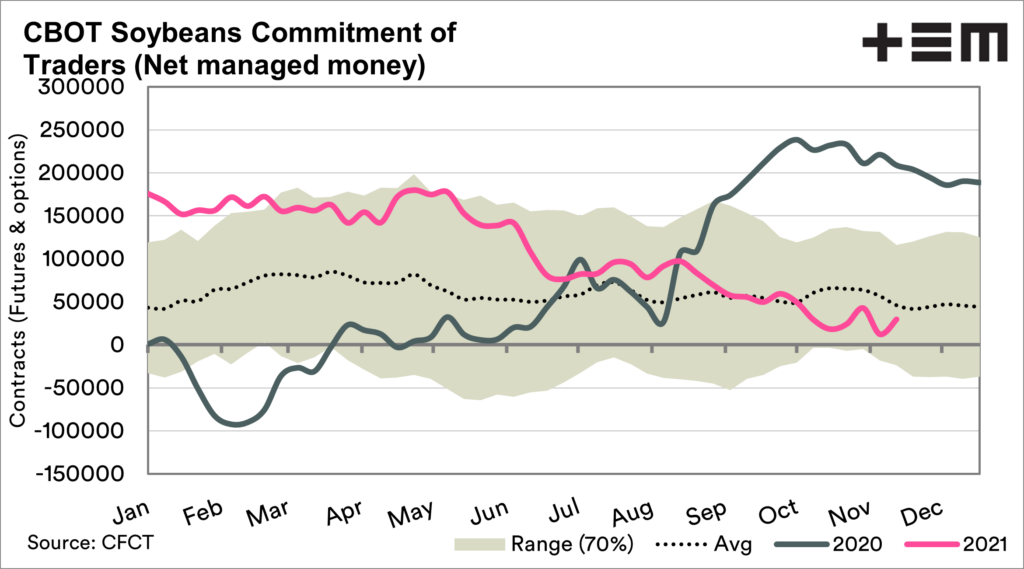

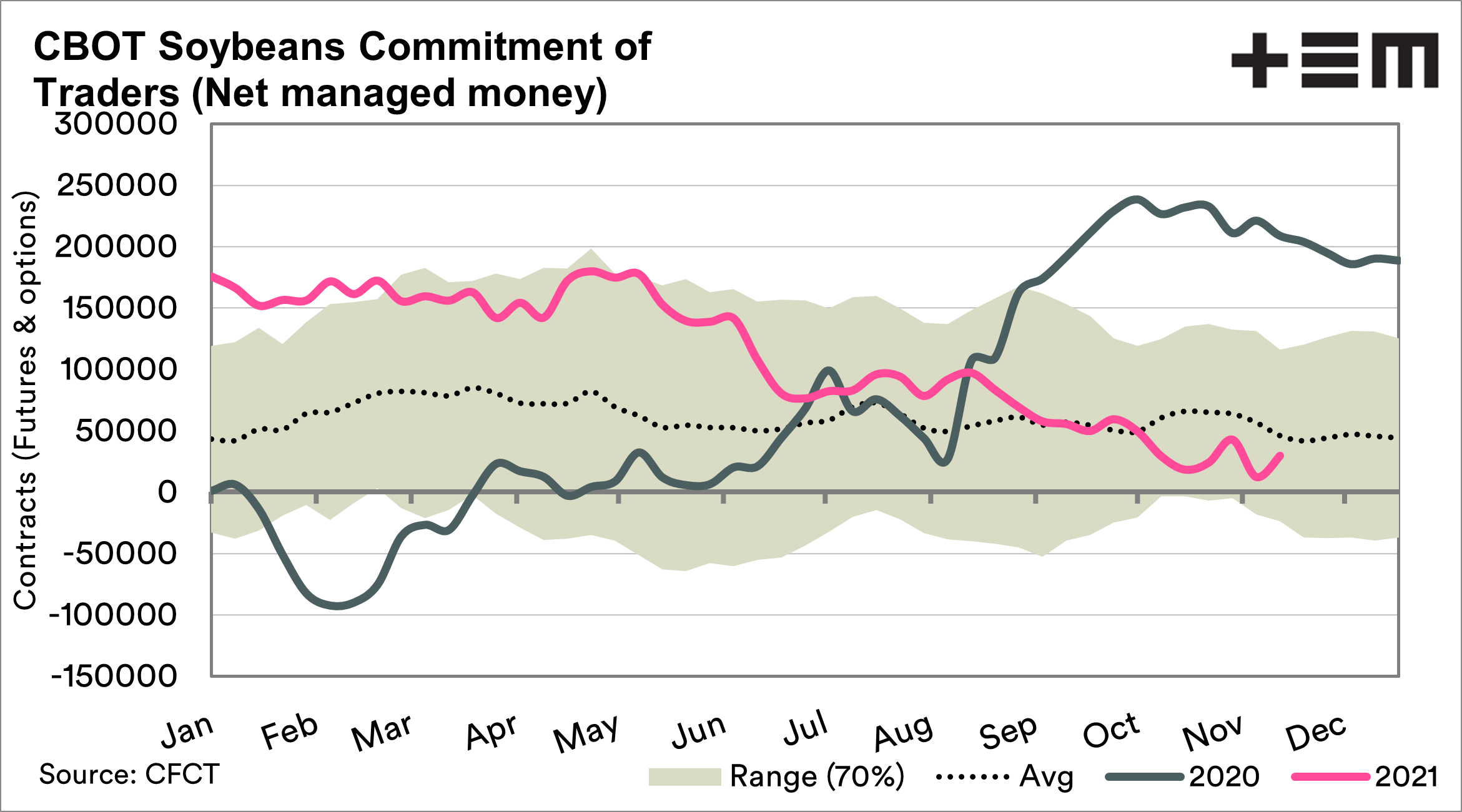

The commitment of traders report gives an indication of their sentiment on a weekly basis across a range of commodities. The net position of speculators is what we tend to focus on, whether they are long or short.

If their position is short, then they are hoping to profit from a falling market. If they are long, they are betting on a rising market.

Speculators have hit the highest net-long since the first quarter of the year on wheat. This shows that they see it as an attractive investment.

Interestingly, despite relatively benign fundamental data, they also have increased their positions in corn. Their position had been long all year and ahead of the standard deviation. In the past month, they have also increased back to first-quarter levels.

Soybeans have been on the rope in recent months after being strongly long for most of 2020 and 2021; they have a low net long compared to corn and wheat.

It is important to note that speculators are not always right. We have seen in the past large rises in their positions followed by crashes as they ‘profit take’. At present, they are another factor helping push our pricing higher.