Market Morsel: Feeling the pulse of India.

Market Morsel

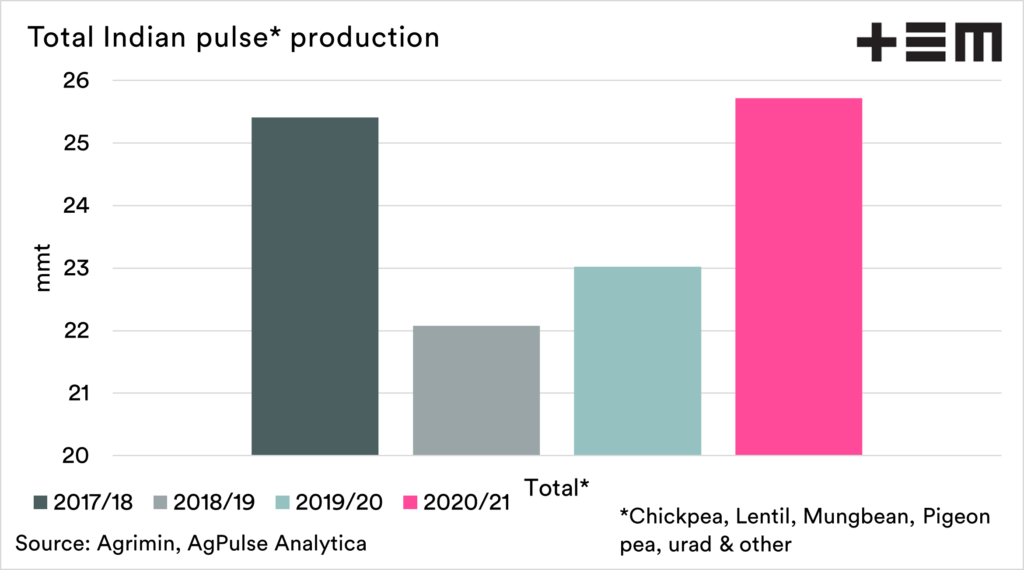

For the crop harvested in late 2020 (kharif*) and early 2021 (rabi**), the Indian federal government has released the fourth advance estimate. As per these estimates, the total pulses crop in MY 2020/21 is at a record high of 25.72 MMT; 150 KMT higher than the third estimate and 11.73% (2.7 MMT) higher than last year.

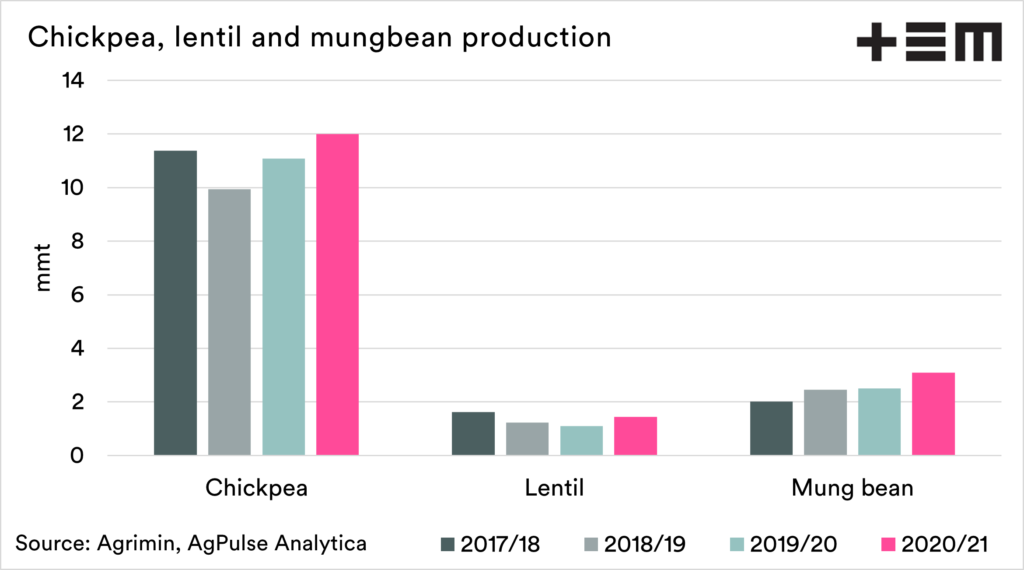

Chickpea production is at an all-time high level of 11.99MMT, short by 0.62 MMT from the last estimate but 8.2% higher year on year. The crop was harvested in Feb-Apr of this year, and arrivals were slow in APMC’s for COVID-19 shutdowns.

Lentil crop is at 1.45 MMT, 15% up from the last estimate! The country has recently reduced import duty and is expected to buy upward of half a million tonnes in the rest of 2021. Production of other pulses is up by 5% from the Third Estimate and 13% y-o-y.

Interesting is that the broader market does not believe in either of these numbers and sees a much smaller crop. At the start of the year, with weather-related losses, private forecasters started chickpea crop estimate at around 7 MMT, while government number always stayed above 11.5 MMT. Similarly, for pigeon peas, the trade has never believed the government numbers. Subsequent releases from agrimin made it clear that the notions of very poor crops were baseless.

It is difficult to ascertain absolute numbers for Indian production, and like many other market participants, we also see the values as year-on-year change.

Since the start of 2021, we believe that the Indian pulses crop size this year is ‘not smaller’ than the previous year. Our view remains that the production is not lower; it is in the hands of large corporates and farmers, who will sell only at higher prices and/or later in the year.

The price rise at the start of harvest resulted from the market realising that NAFED and other government agencies are low on stocks and can’t exert pressure on the market in case of a price rise.

The Indian government is unlikely to make changes in its chickpea and pea import policy. Domestic prices for lentils are a tad below import parity, and these estimates will keep the domestic prices stable/down.

*Kharif = monsoon/summer crop

**Rabi = winter crop

Gaurav will be publishing regular articles on pulse markets in agreement with EP3 and if you are interested in discussing the underlying fundamental story in different pulses, reach out to him at gaurav@agpulse.net or subscribe to the weekly reports via http://agpulse.net