Market Morsel: Fickly speculators

Market Morsel

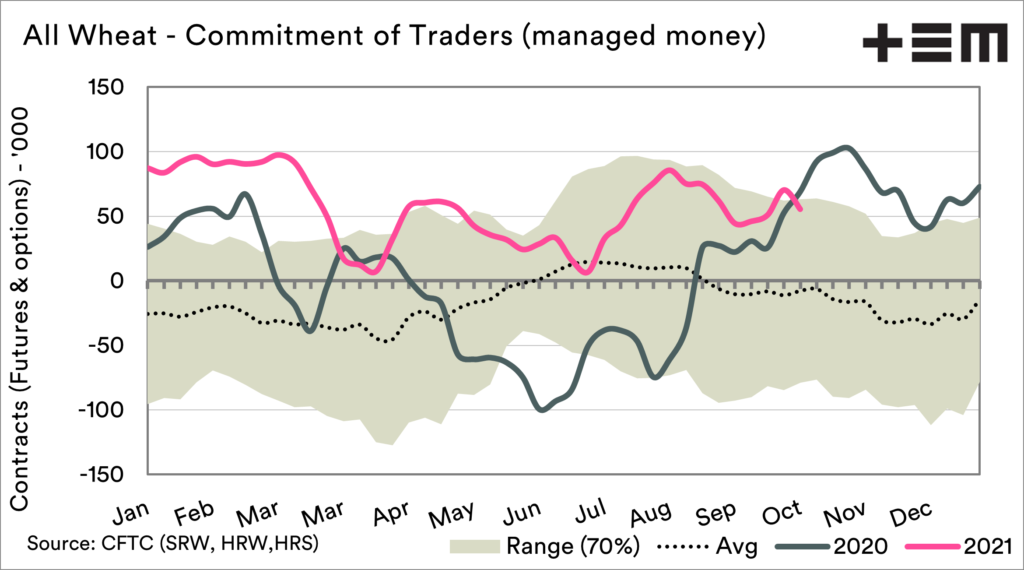

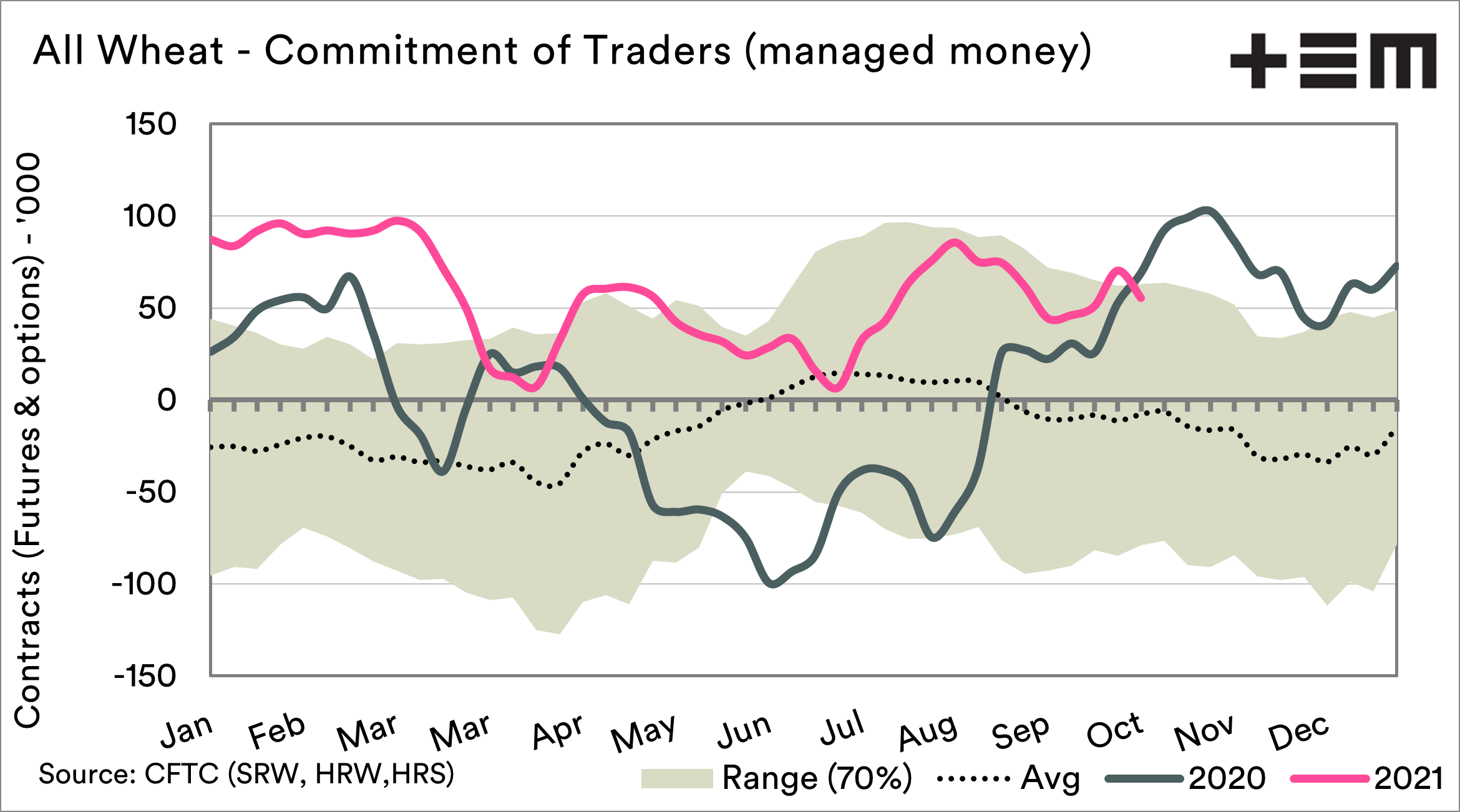

The commitment of traders report provides an insight into the views of speculators in the grain market. It lets us know whether they are overall bullish (expecting rises) or bearish (expecting falls).

It is an important report to glance at when it is released.

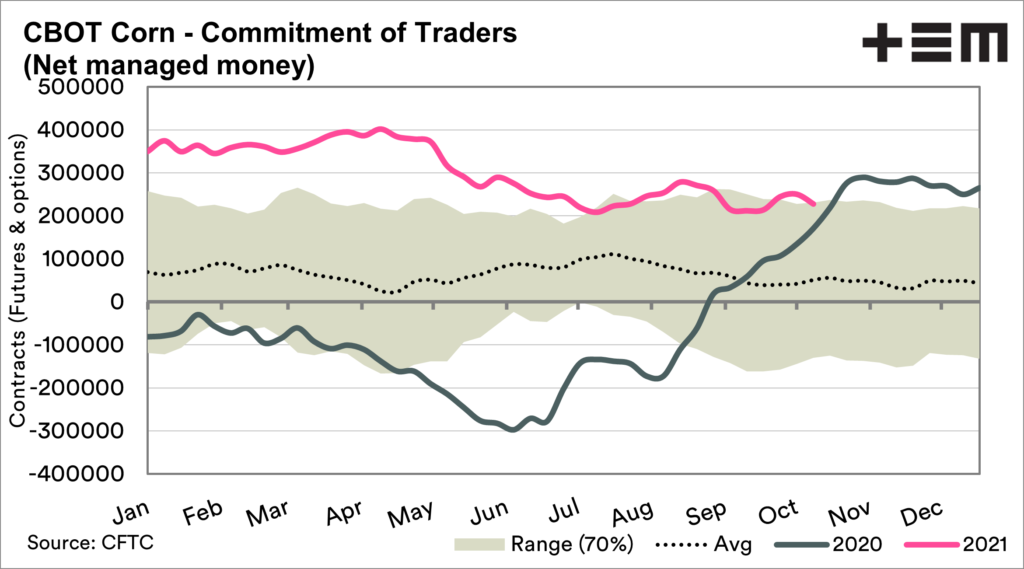

The corn market has been under pressure in recent months as production improves. This has seen the net long (bullish) position decrease in recent months. In April, speculators were close to the largest net long position since 2010. Their position has become more bearish, albeit remaining at the top end of the seasonal levels.

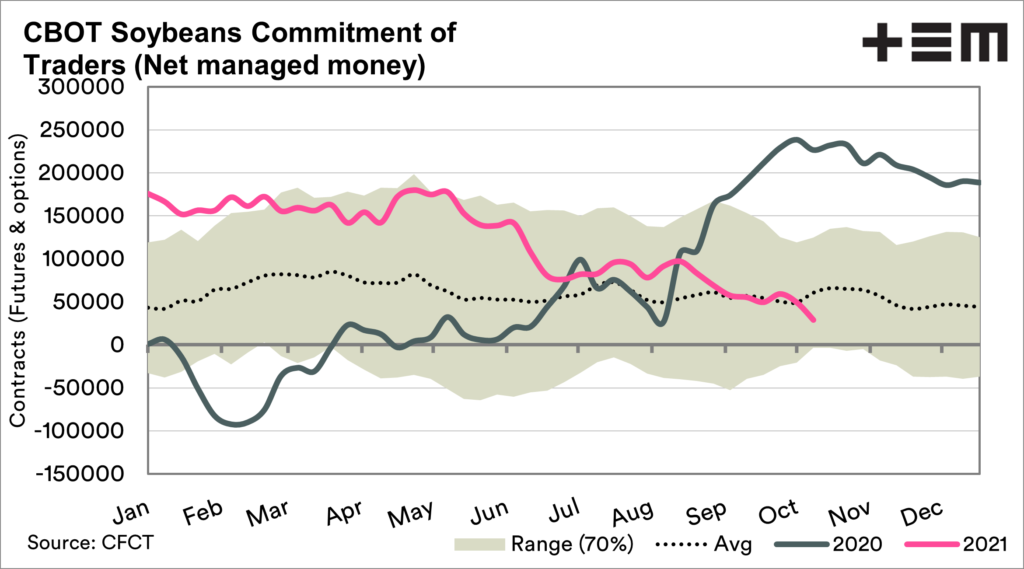

They have also fallen out of love with Soybeans. In the past season, they were also at close to record levels. Speculators have reduced their position, and they now are sitting below the long term average for this time of year.

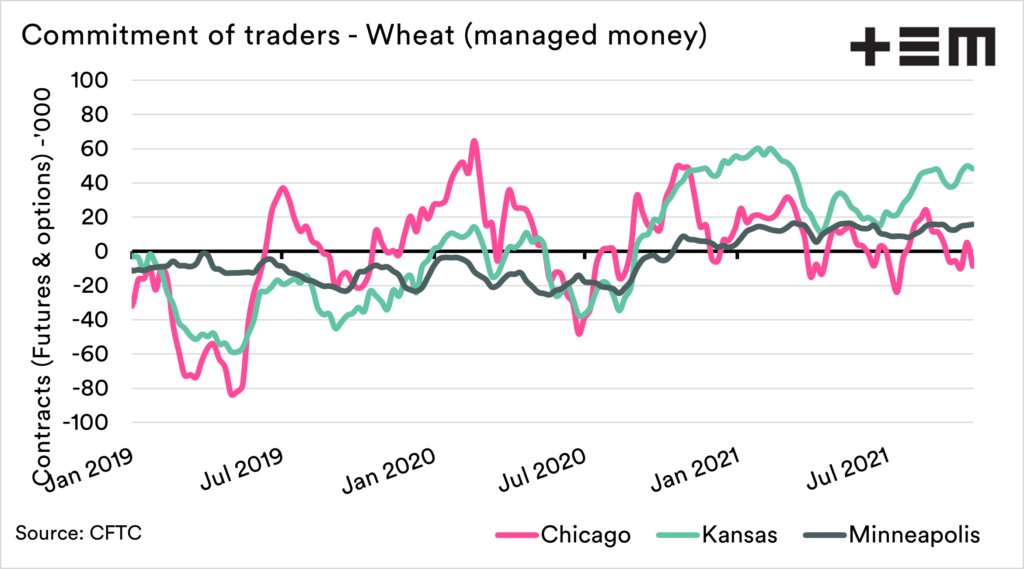

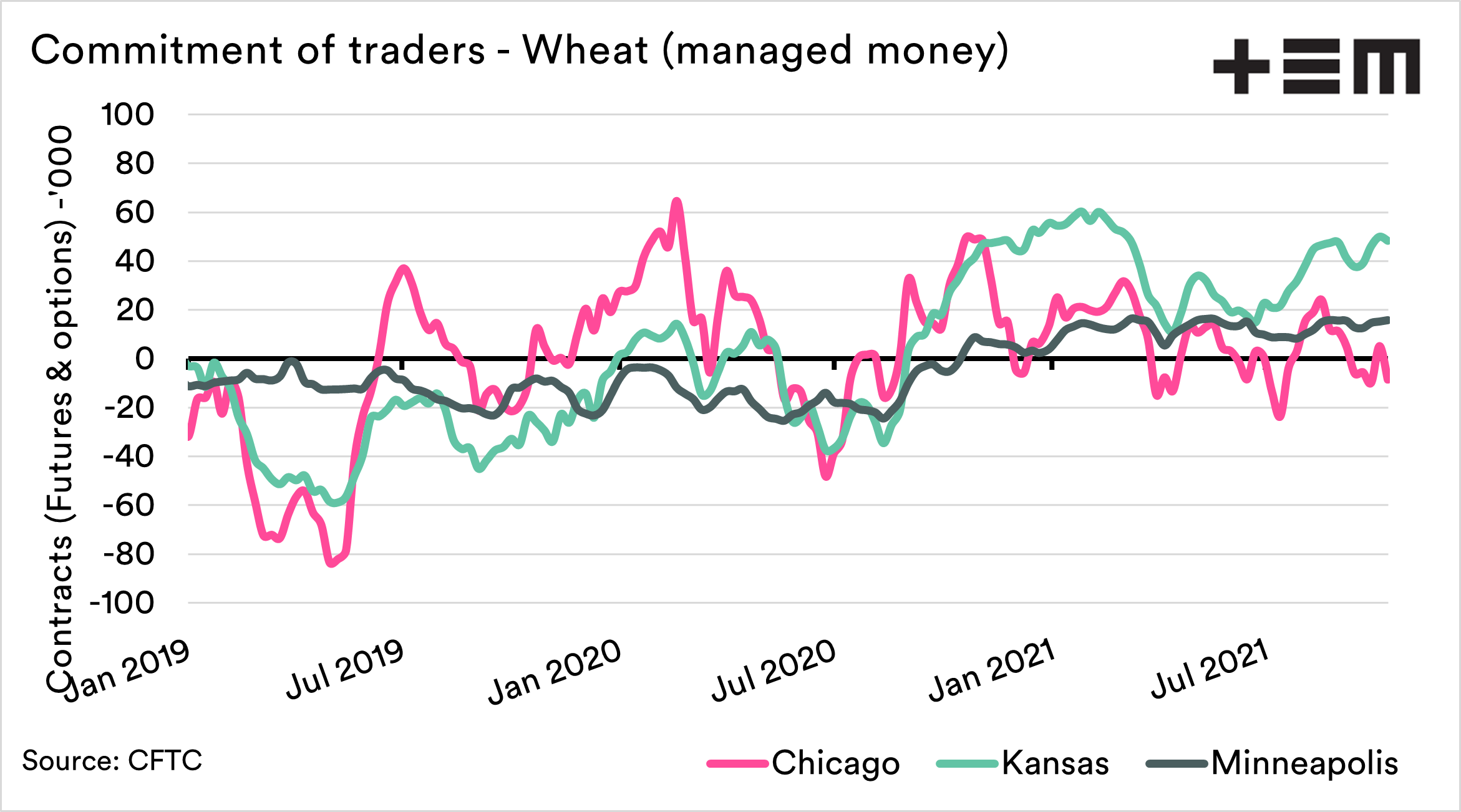

Overall speculators are bullish wheat, however, wheat is more than one market. We have seen that in the speculator positions for the different wheat contracts (Minneapolis, Chicago and Kansas). Chicago wheat has fallen into an overall short position. This means that overall, speculators are ‘betting’ that the market will fall further.

Their positions in Kansas and Minneapolis (both higher proteins class) have remained strong, with speculators ‘betting’ on making money from higher pricing levels.

It’s important to understand that speculators are not always right, and a speculator sentiment doesn’t necessarily always flow through to a long term price direction.