Market Morsel: Get driving America and help our wheat.

Market Morsel

Last week, I put together a quick article on why rising crude oil could be a good omen for grain pricing (see ‘Don’t be crude’).

The article discussed the relationship from Crude oil to wheat via ethanol and corn. The basic premise is that increasing crude pricing impacts fuel pricing, which can be into other commodities.

I thought it might be a worthwhile exercise to look into ethanol. Ethanol is mandated in the US for inclusion in road fuels.

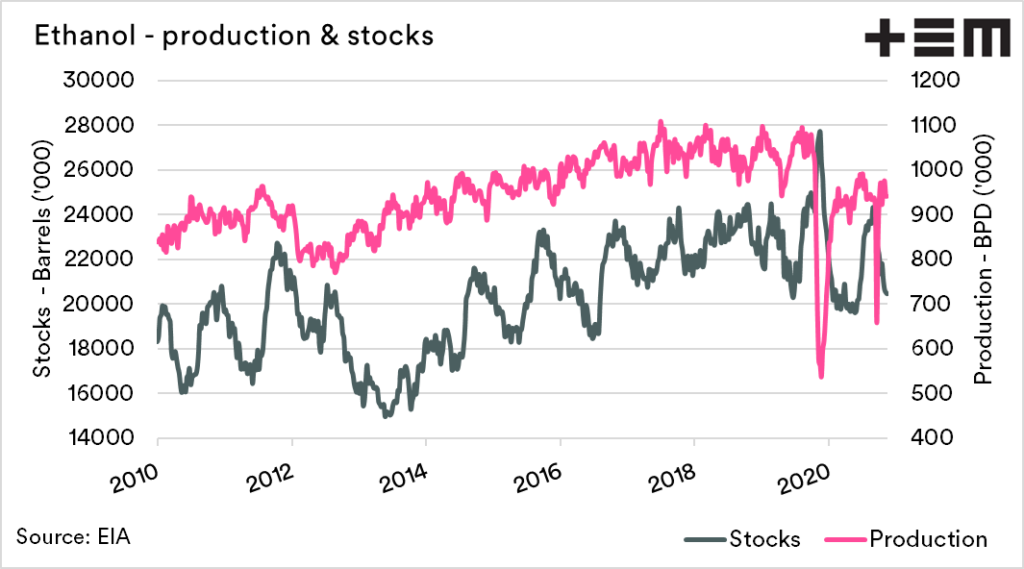

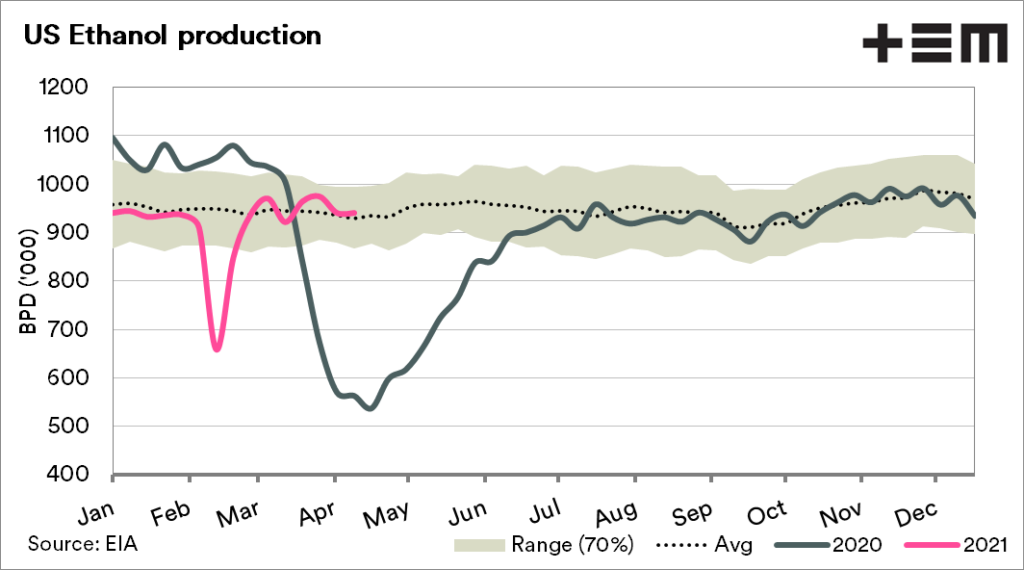

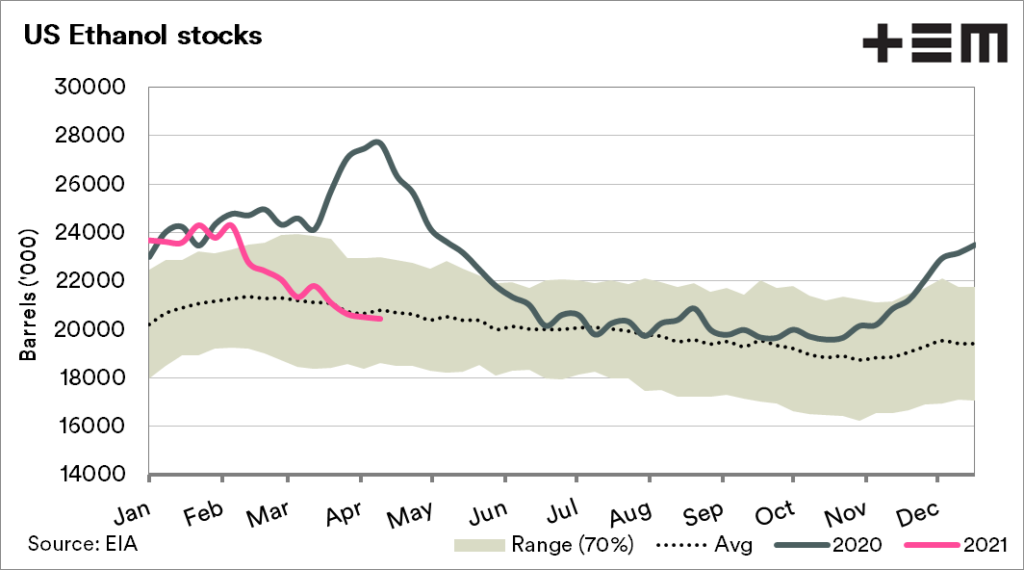

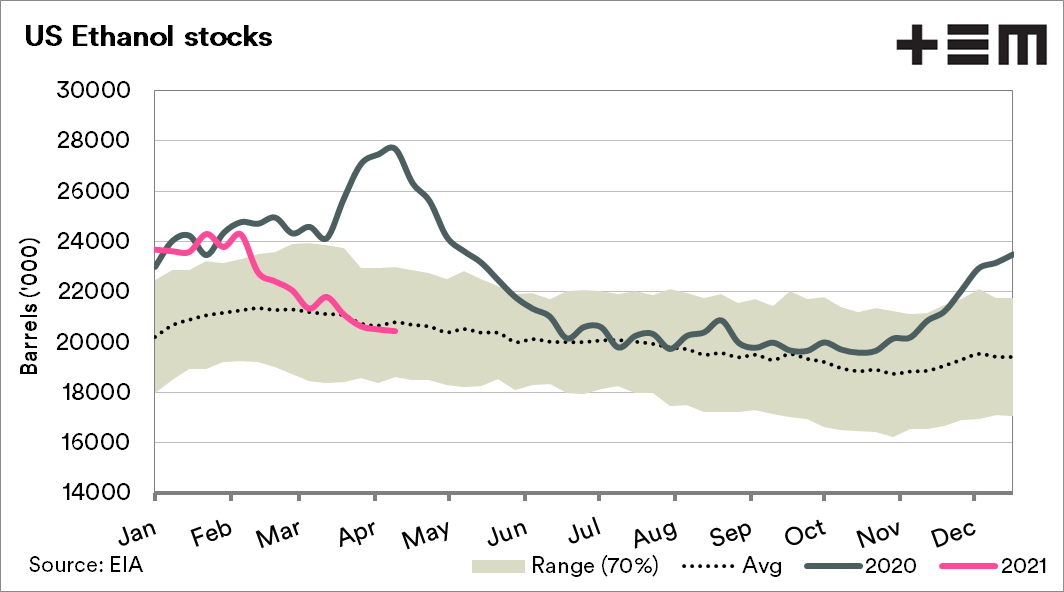

The lockdown during the second quarter of 2020 in the US resulted in a drop in demand. Less cars on the road, less need for fuel.

This resulted in stocks rising around that time (and the same pattern later on in the year). As with all commodities, the lack of demand resulted in lower production.

Ethanol production had been rising year on year for most of the last decade. While output is now back at the long term seasonal average, it still lags behind the recent pre-covid levels.

As the world starts to be vaccinated, and Americans start travelling for their summer holidays and back into commuting on a more regular basis – we should see a further resurgence of demand.

In turn, this helps corn, and corn helps wheat.