Market Morsel: GM canola not keeping up.

Market Morsel

The majority of Australian canola is Non-GM, and our biggest customer is into Europe. GM canola does not have as much demand into Europe as Non-GM, which causes GM canola to generally trade at a discount to non-GM.

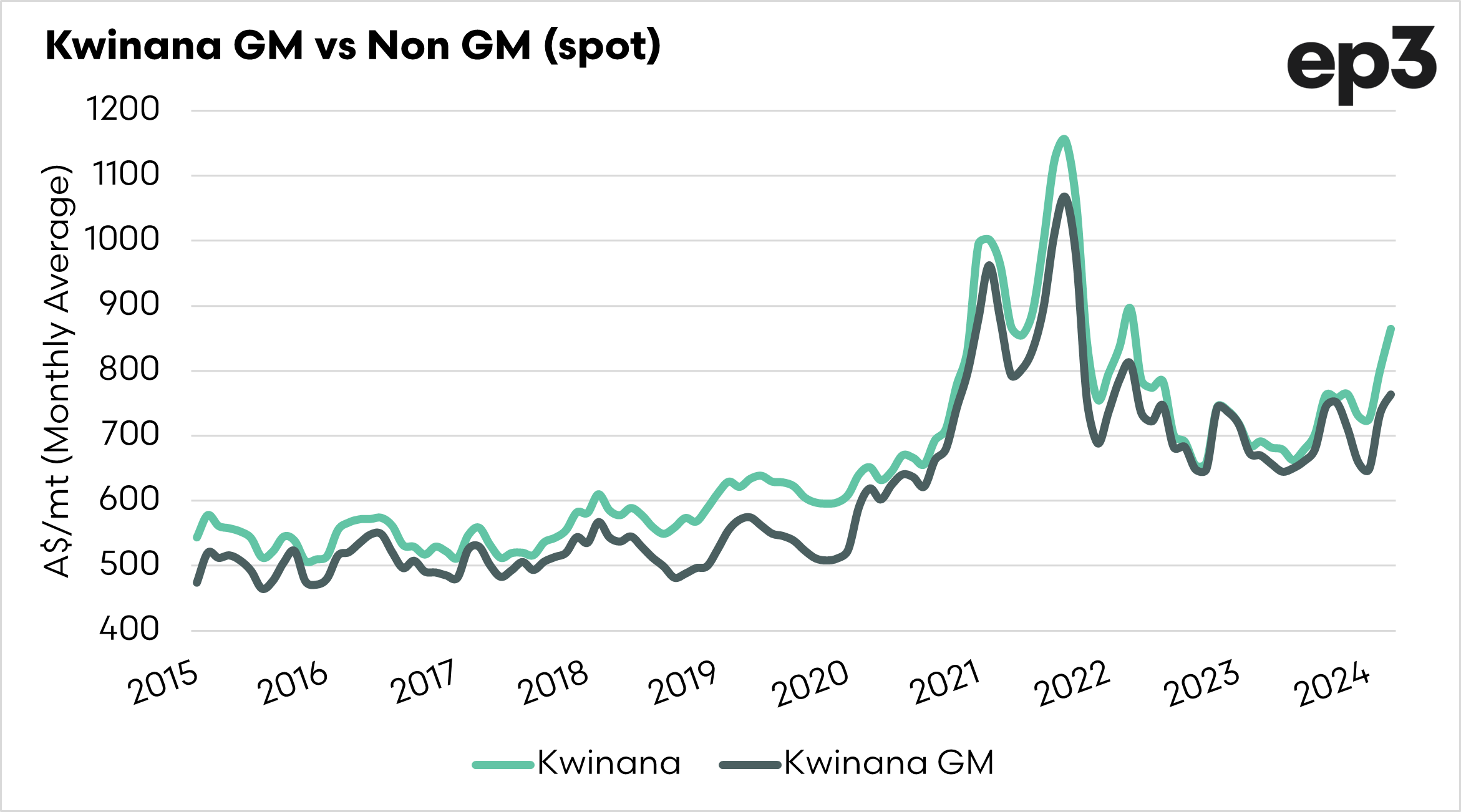

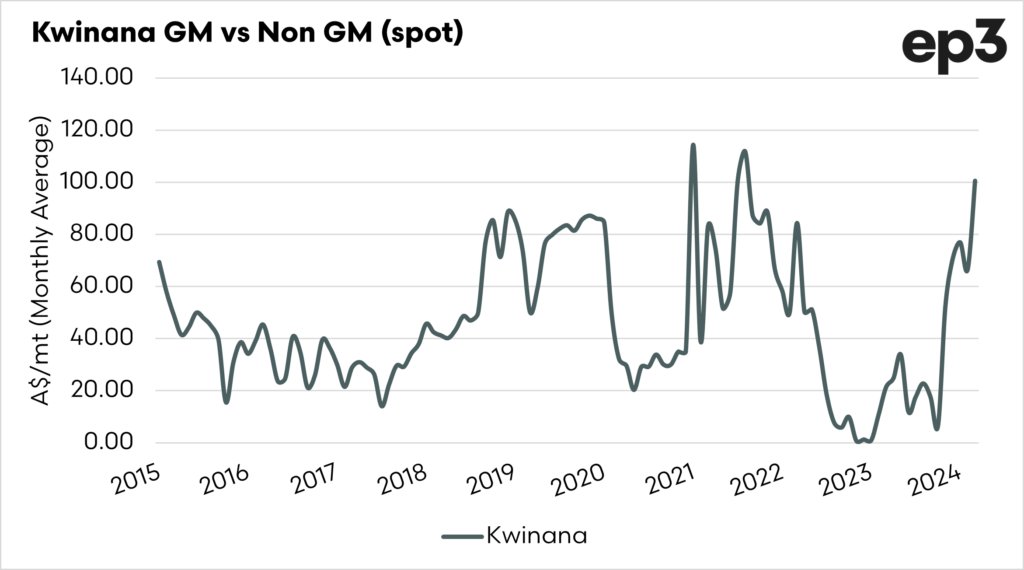

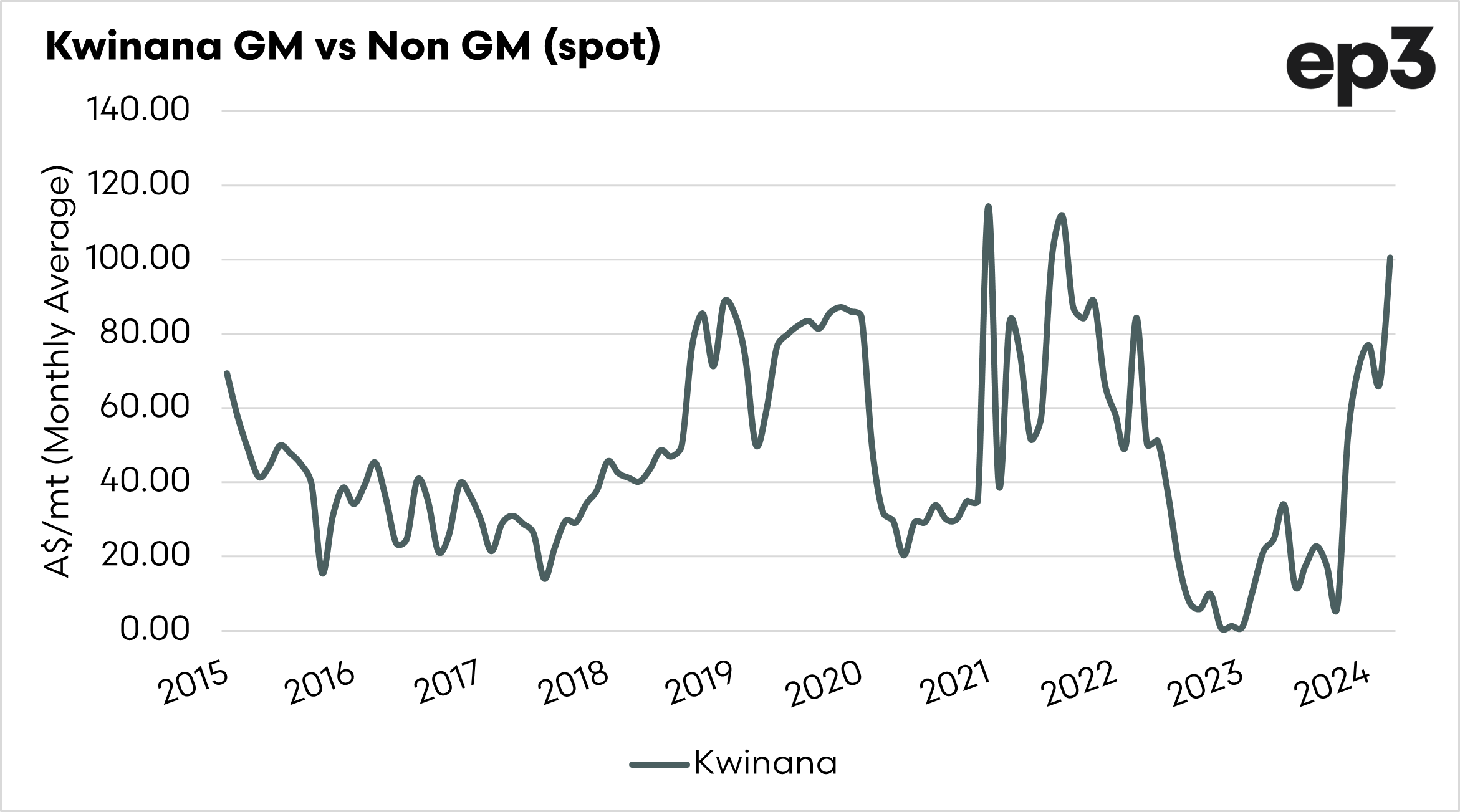

The GM price will largely follow the non-GM price in terms of upward and downward movements, which we can see in the first chart. The second chart shows the spread between GM and Non-GM, in A$.

The average discount to GM (or premium to Non-GM) since 2015 has been A$46, but this does vary, from as low as parity with Non-GM to over A$100.

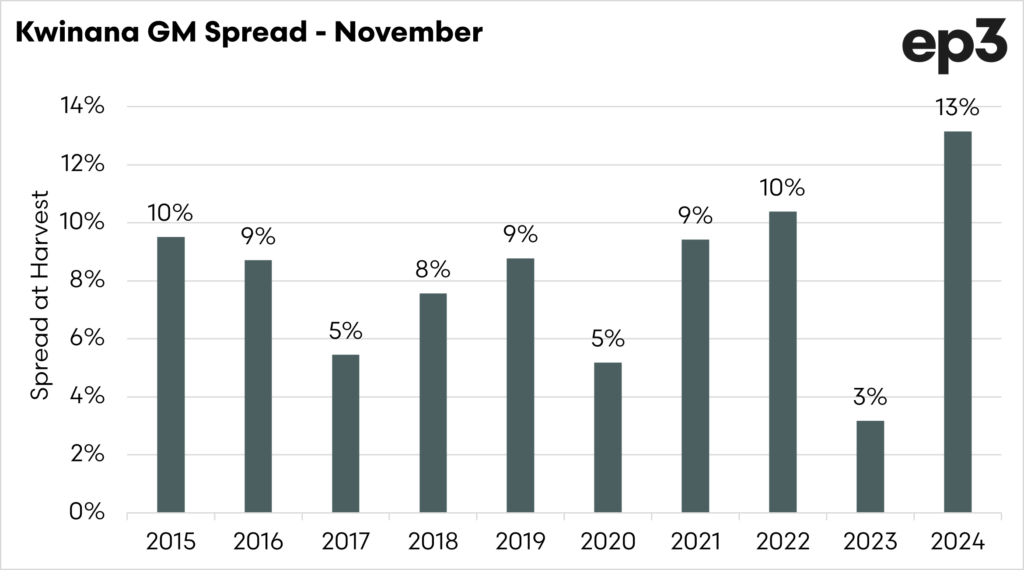

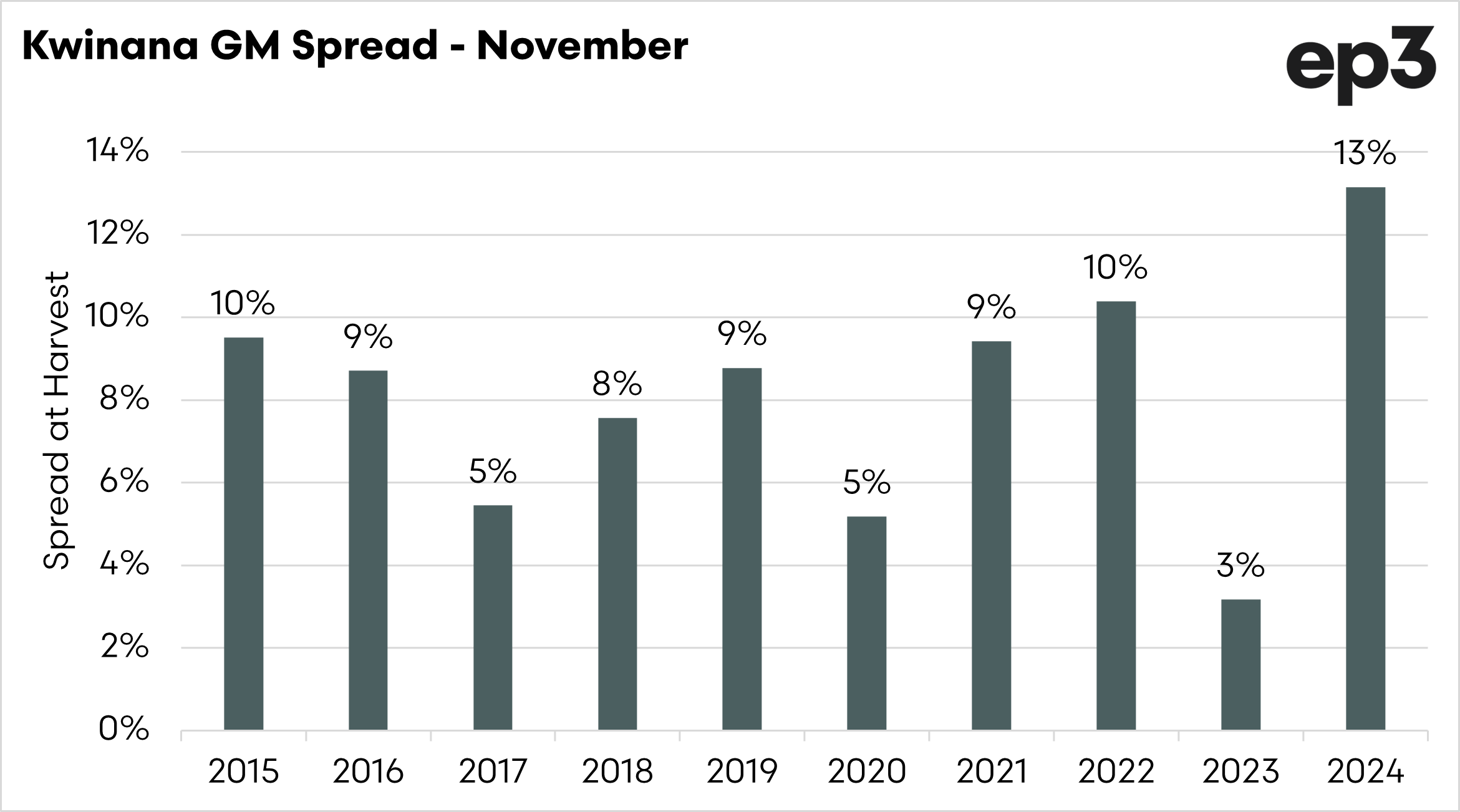

The majority of canola is sold during harvest, and the third chart represents the percentage difference between non-GM and GM as the November average since 2015.

At the moment, the November discount is the highest that it has been (in % terms). Is this a discount to GM or a premium to Non-GM.

I’d argue that one of the reasons for the large spread is the demand for Non-GM canola into Europe after their crop has fallen in size.

The non-GM price around the country has risen dramatically in the past month, but GM hasn’t had the same rise.

Farmers growing GM canola have to consider that they will, in most instances, have a discount for their canola, and they need to calculate the economic benefits of using it as an agronomic tool.