Market Morsel: Highest wheat futures price since 08.

Market Morsel

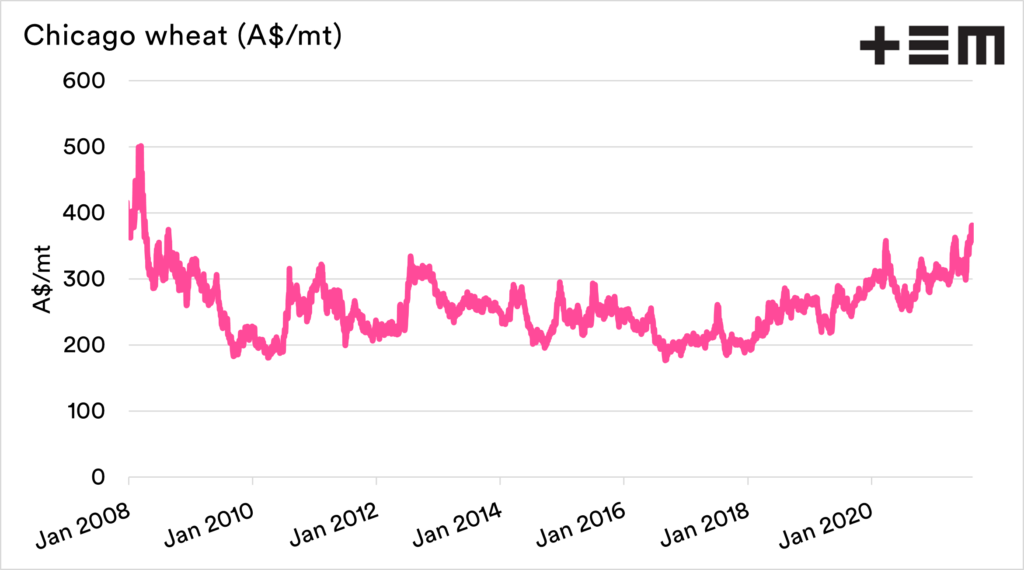

This week, we saw Chicago wheat futures hit A$380. On the spot contract, this is the highest price in A$ terms since August 2008. This is excellent news, as the majority of our pricing is based on the futures price. The current high futures price is a result of issues overseas, not here.

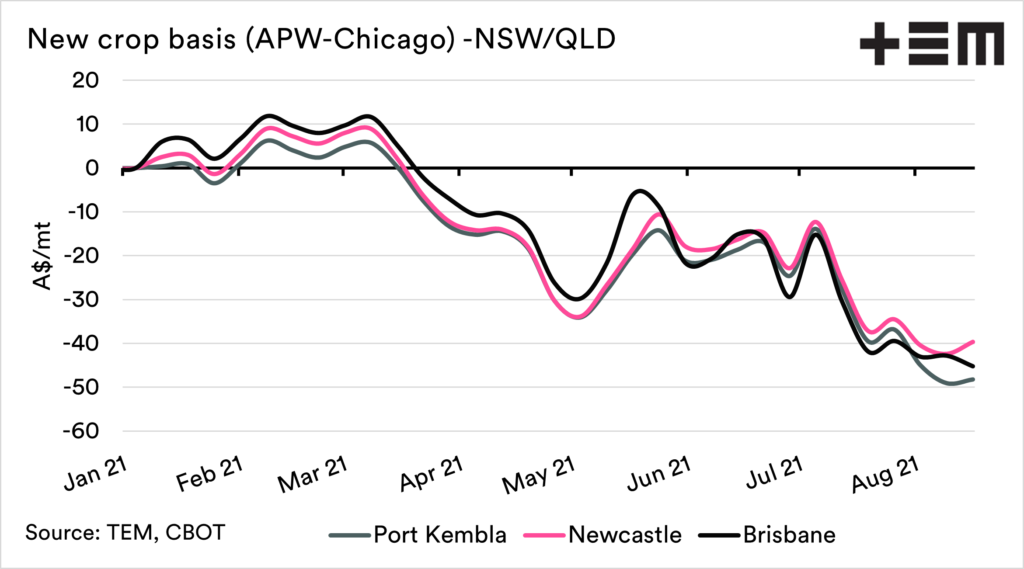

I’d generally pick low basis and high futures. This typically means that we have plenty to sell, and the overall price is still relatively attractive.

The second chart below shows the price composition, which is made up of futures and basis, on an annual average between 2010 and 2020 for NSW. As we can see, basis made its biggest impact in 2018 and 2019 – during the drought when grower production was in a sorry state.

The third chart below shows the basis between CBOT wheat and physical APW for the coming harvest, as we can see our premium trending down for most of the year.

Expectations of a large crop & expected higher than average stocks has lead to a situation where this basis level is under pressure.

Whilst it would be great to have high futures and a high basis level, the reality is that pricing locally would be far worse if we didn’t have overseas issues giving us a floor.