Market Morsel: In one hand a wheat premium……

Market Morsel

The past two years have seen Australian grain prices trading at a discount to overseas values. In recent weeks, we have started to see our discount narrow to a premium.

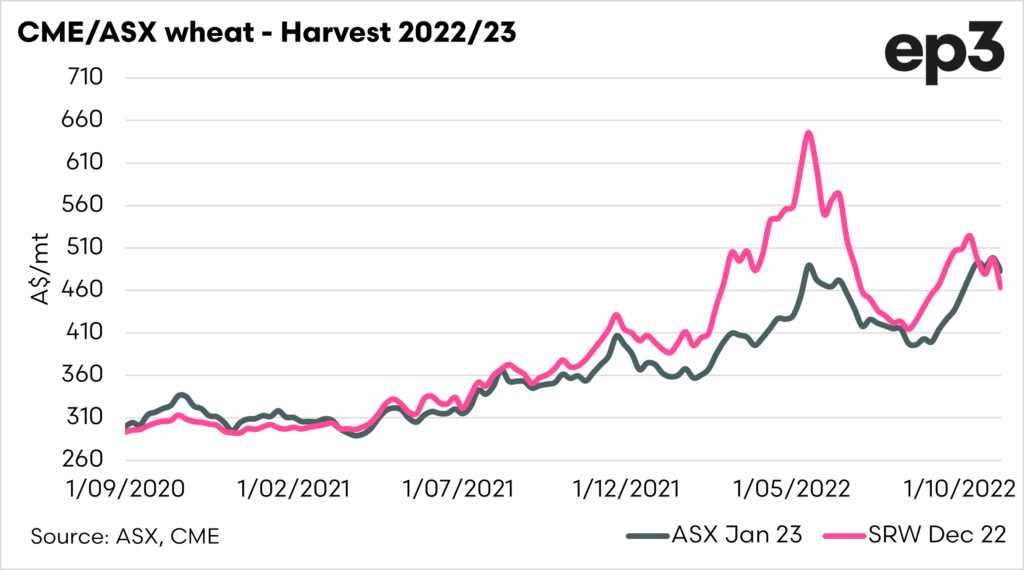

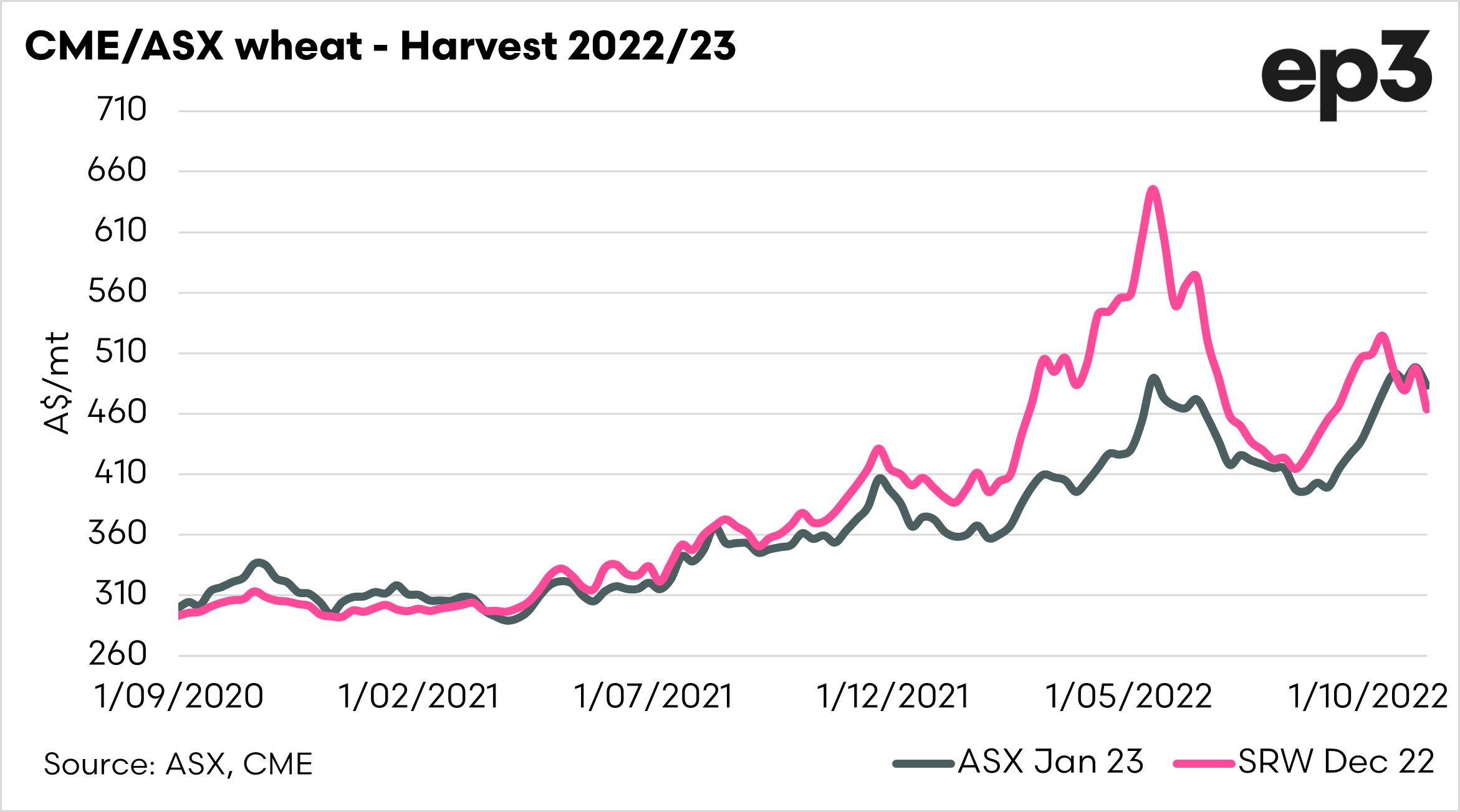

The first chart below shows the ASX and CBOT wheat price converted to A$ for the coming harvest. We had some substantial discounts, especially in the middle of the year.

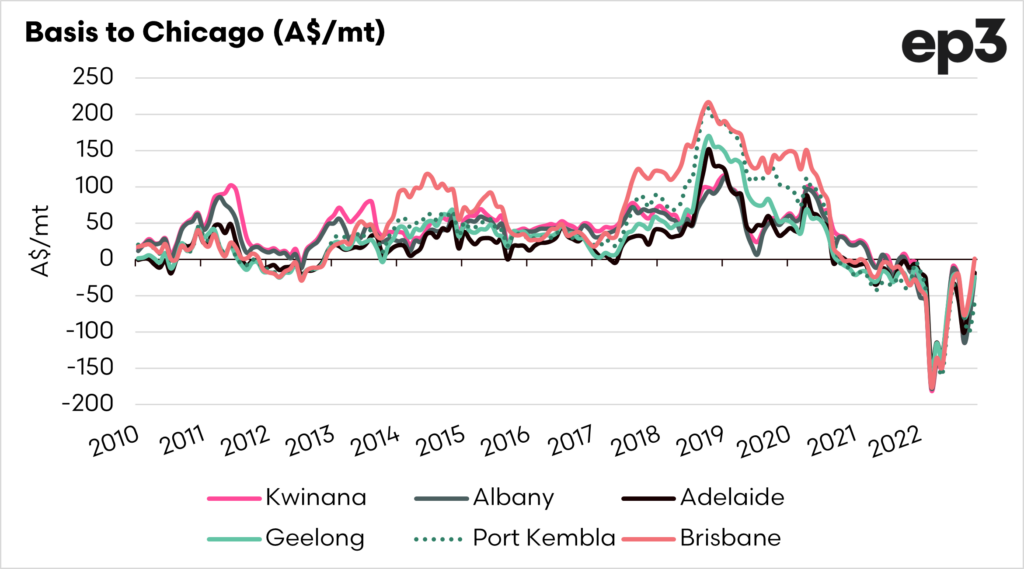

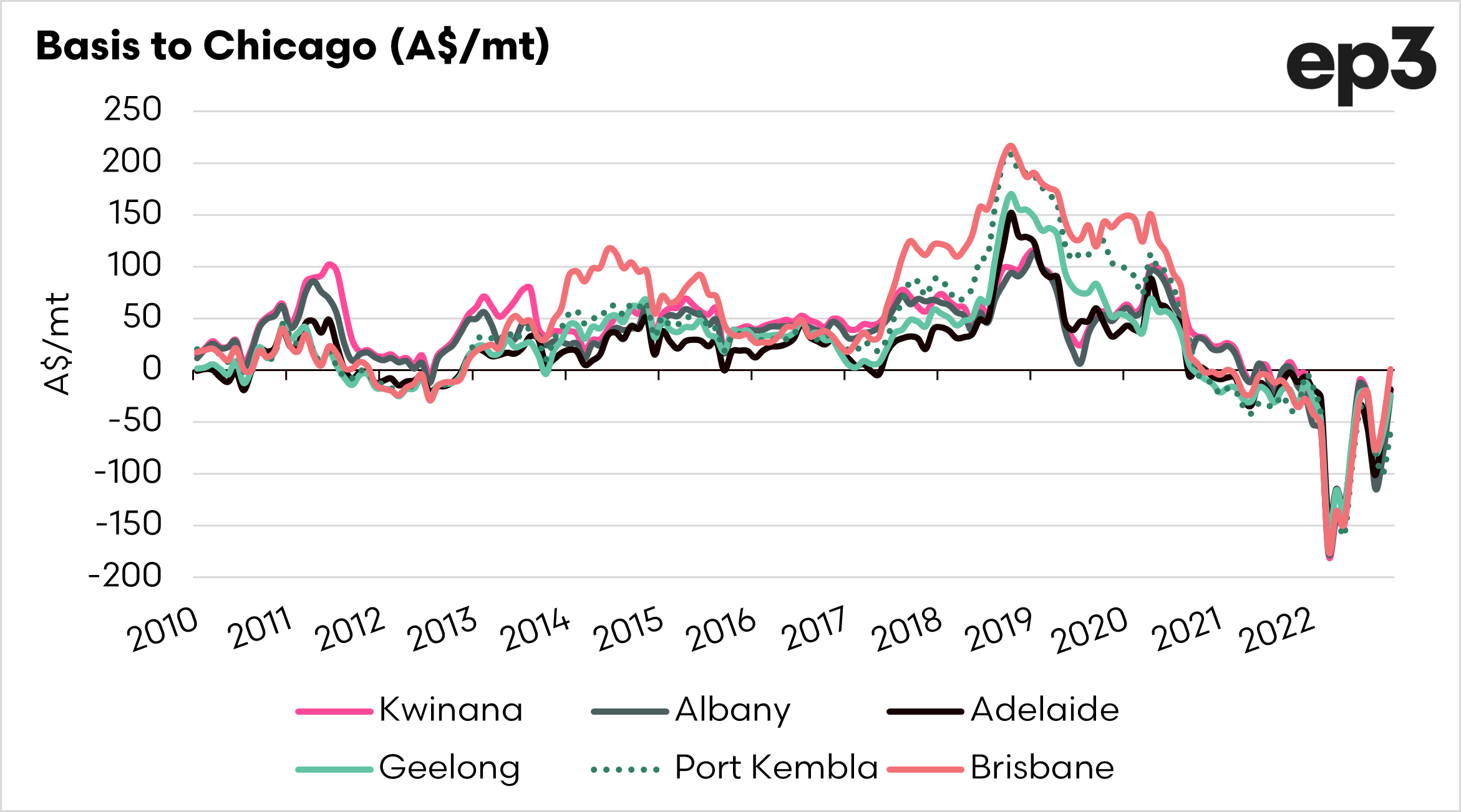

The second chart shows the APW1 basis to CBOT over the past 12 years. We can see that it is moving back into its normal territory.

What has happened? First, we have seen the impact of the wet weather on the crops in the eastern states. It is inevitable that the crop is going to be poor quality due to inclement weather.

It is important to note that these two charts represent APW1. This is a grade that many are looking to accumulate at present to get access to milling grades.

So whilst it is good to see the basis level return to a premium, it is a basis level to a grade that is going to be in shorter supply.

The majority of concern for most people is going to be how our lower grades are performing relative. The third chart below shows the basis level for AGP1 to CBOT for November since 2005.

This shows that our basis for lower grades is at a very large discount. This is probably more important for most, especially on the east coast.

It’s basic supply and demand. A large surplus of low quality is going to see large discounts to lower grades.