Market Morsel: Iran – Israel and the impact on grain?

Market Morsel

On Sunday, I woke up early to do my normal routine: a cup of coffee, then run 20k. Just kidding, I woke up to have a fry up, sit on the couch and watch UFC. When I was doomsrolling through Twitter, it was blowing up because of the attack by Iran on Israel.

This attack was in response to an Israel missile killing an Iranian Guard general. The attack seemed to be quite telegraphed and similar to a previous missile attack on a base in Iraq. I can speculate that this attack was less about hurting Israel and more about showing the people of Iran that they have done something.

Anyhoo, this was an escalation and brings in actors in the conflict who were previously in the background.

One of the impacts of a larger conflict in the Middle East is the impact on energy pricing. The Middle East is responsible for about a third of the world’s crude oil production. If this production is impacted, it can have a huge impact on the world’s energy costs.

Other than higher fuel and energy costs, why does this impact farming?

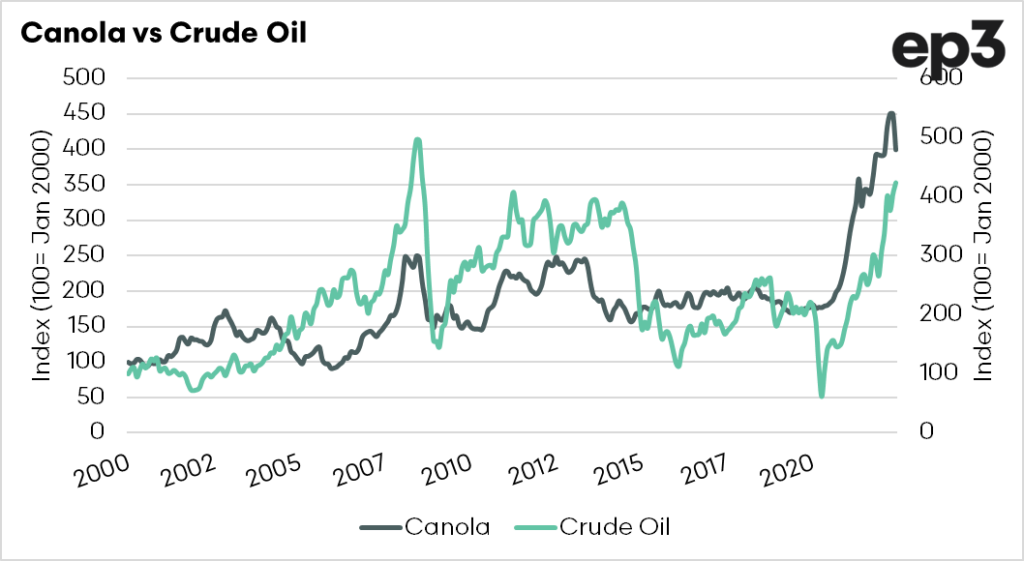

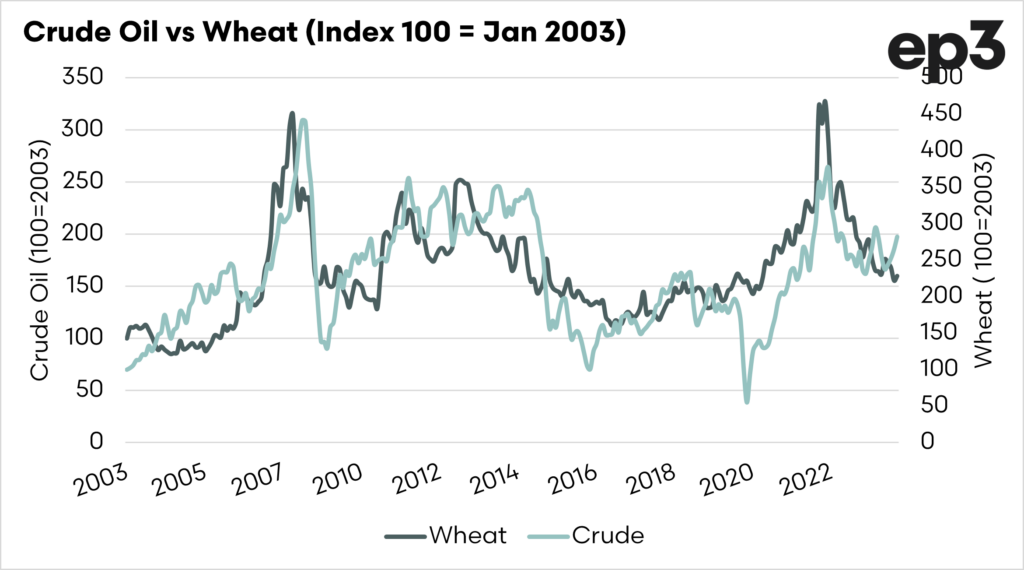

The grain and oilseed markets tend to have a very strong correlation with crude oil. As crude oil rises, oilseeds and grains will tend to rise, and vice versa.

Many grains/oilseeds are used for biofuel purposes; therefore, they are a replacement for crude oil. The relationship between canola and wheat with crude oil can be seen in the charts below.

If the conflict becomes larger in the Middle East, then we can expect higher fuel pricing for our equipment, but there is a chance that we may see higher grain pricing for our outputs. Swings and roundabouts.

This current attack will likely have little if any, impact on markets, but it is more of a risk if it escalates.