Market Morsel: Iranian grain gains gone

Market Morsel

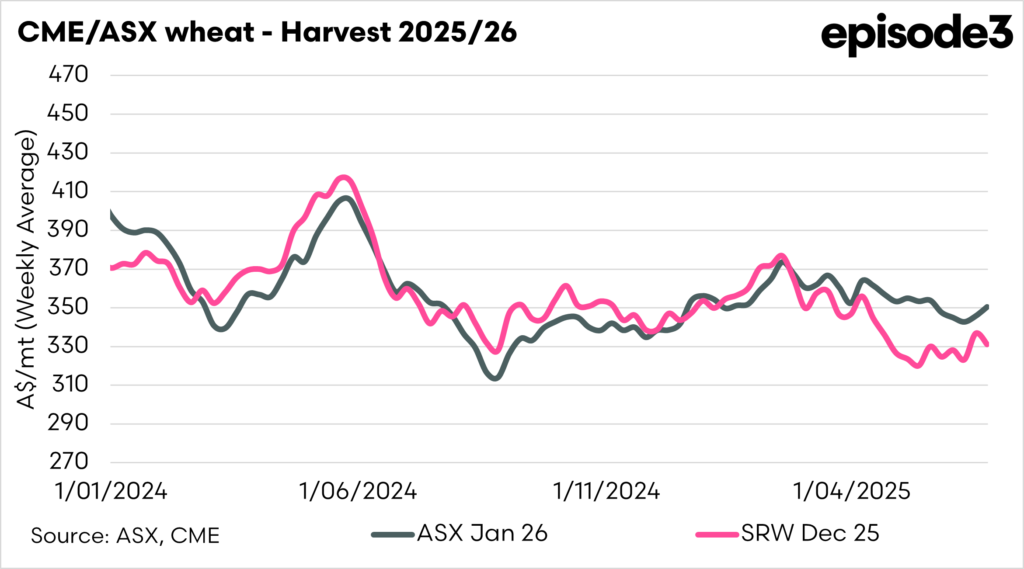

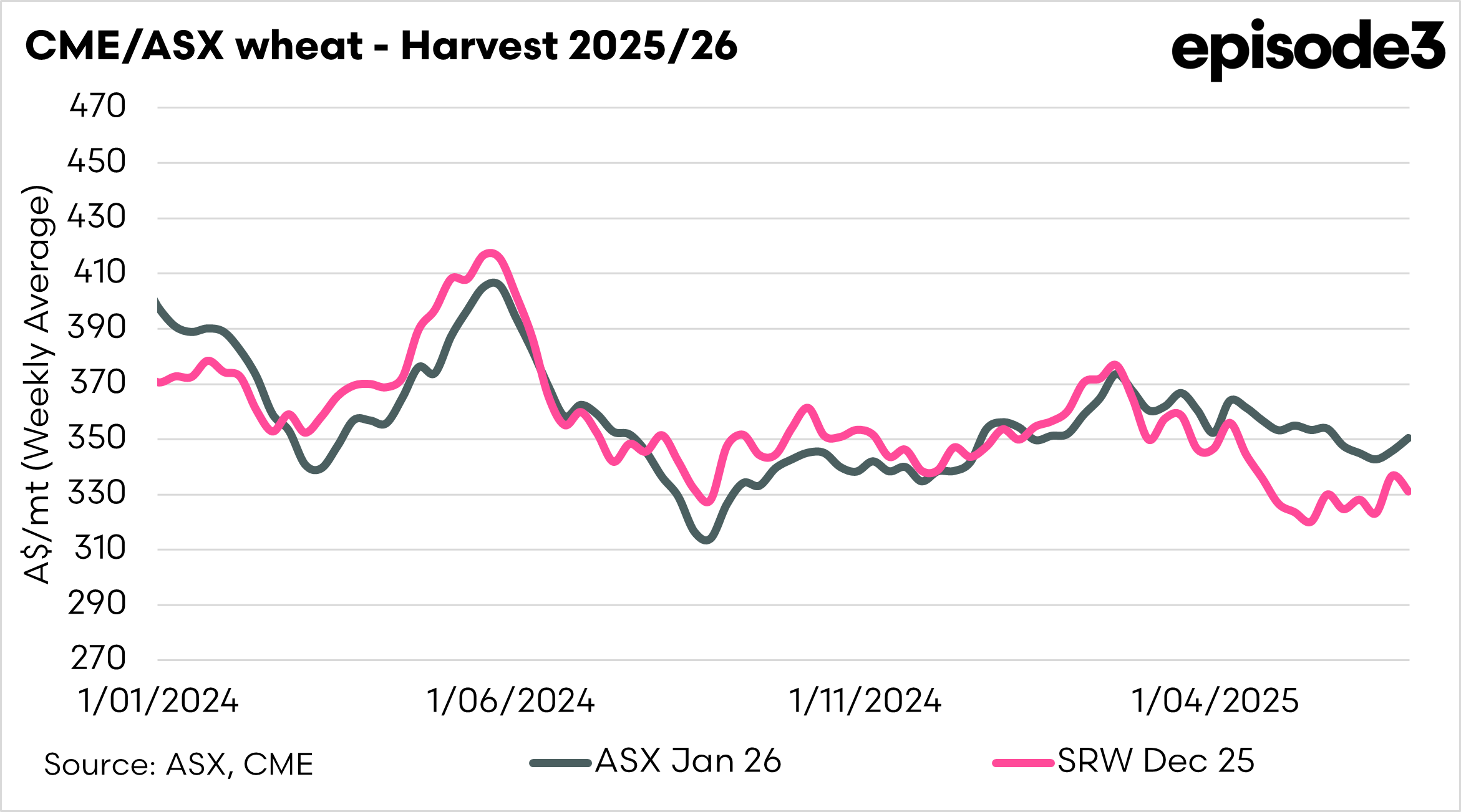

The Israel/US–Iran conflict has come and gone, and with it, so have the price premiums.

As discussed in previous articles, the wheat market had rallied due to concerns about access to energy from the Middle East. The crude oil price rose dramatically, but has since fallen to pre-conflict levels.

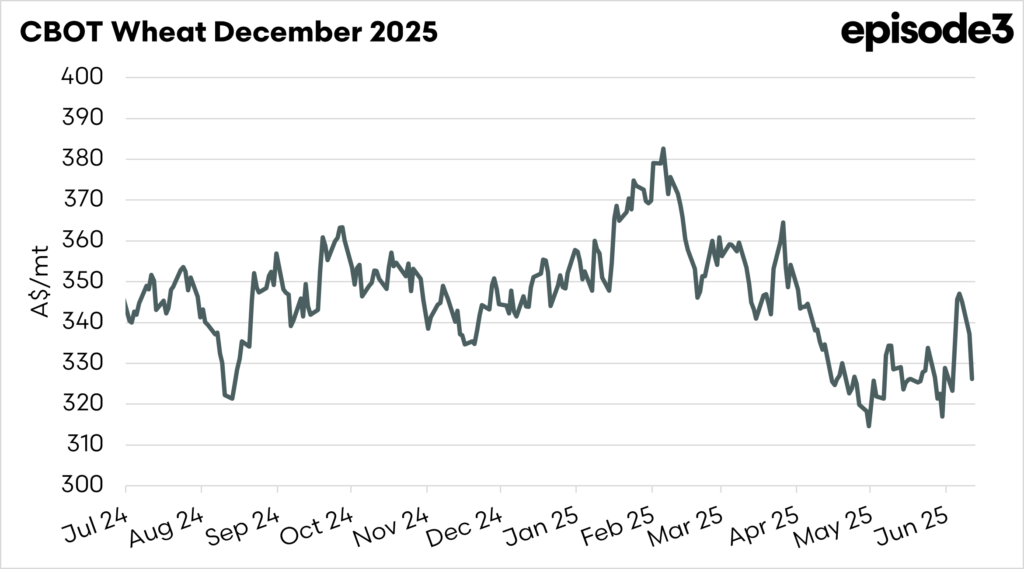

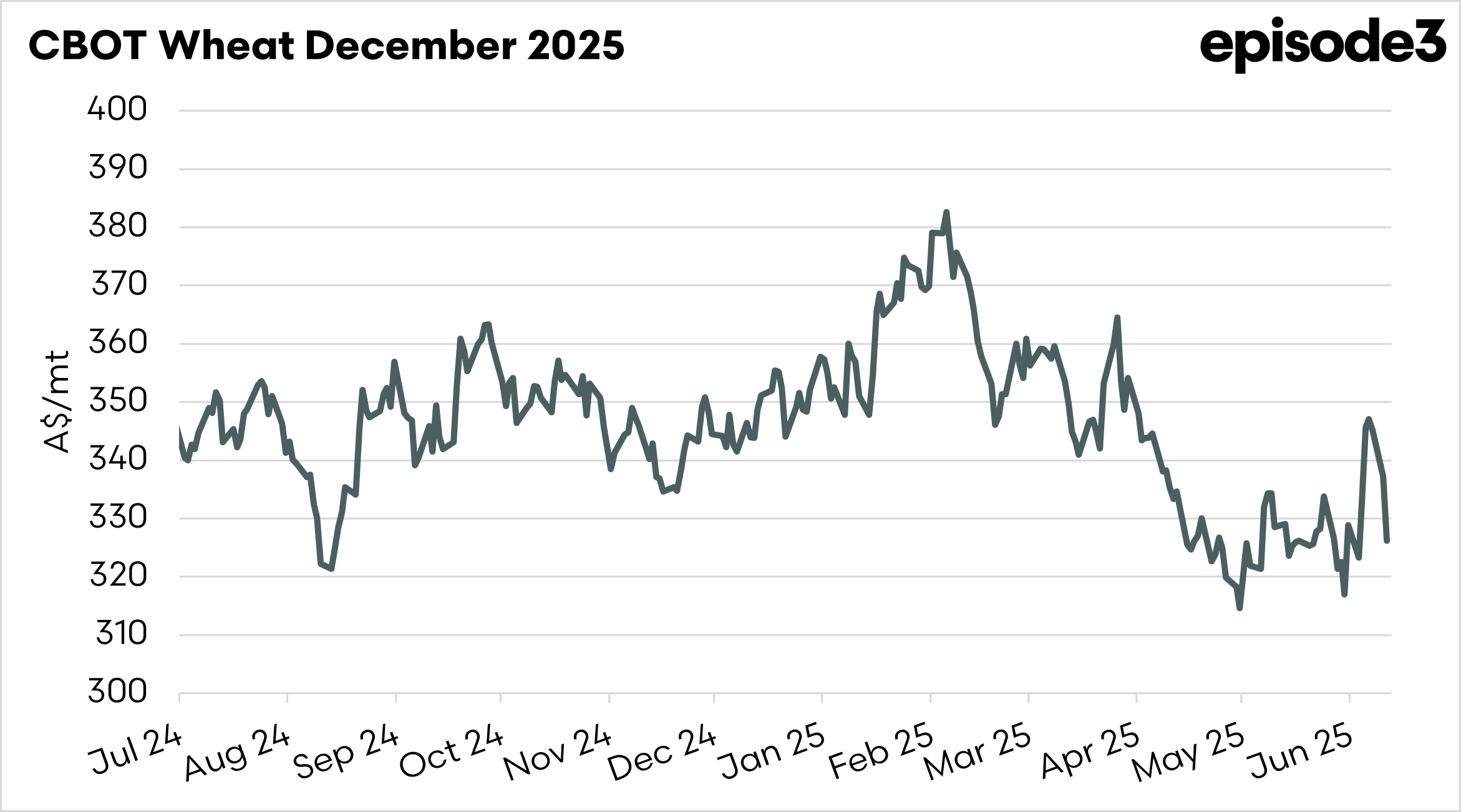

CBOT Wheat for the coming harvest rose from A$316 to A$347, it has now fallen back to A$326.

These types of geopolitically driven rises in the market can be short-lived, and we warned in our report last week that if cooler heads prevailed, the rally would evaporate. This is the case.

The ceasefire is currently a little shaky, but the market no longer holds the same concerns that it did previously.

To get higher wheat prices, there needs to be problems in the northern hemisphere. Currently, expectations are for solid crops in the US, Europe, and the Black Sea region.

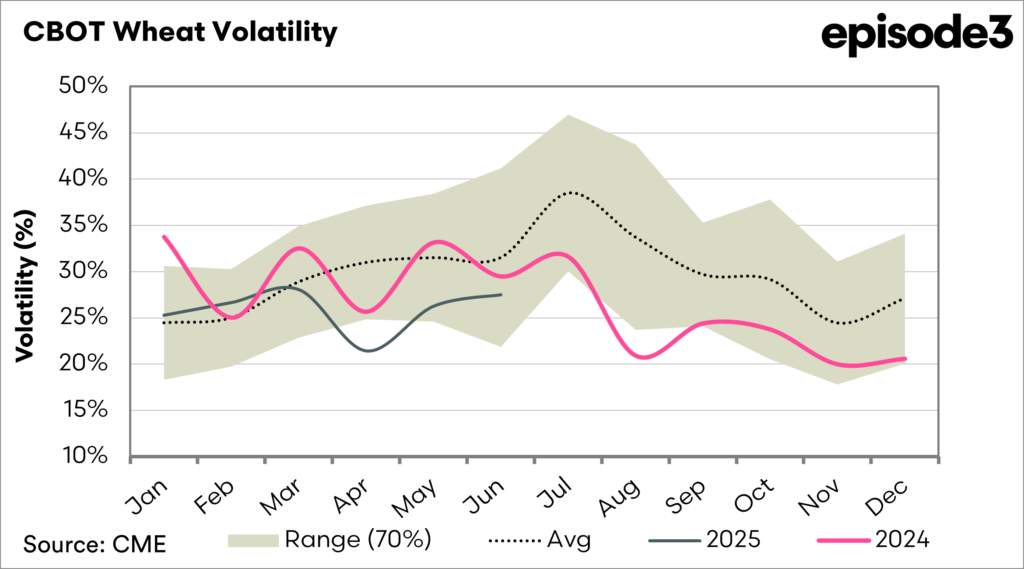

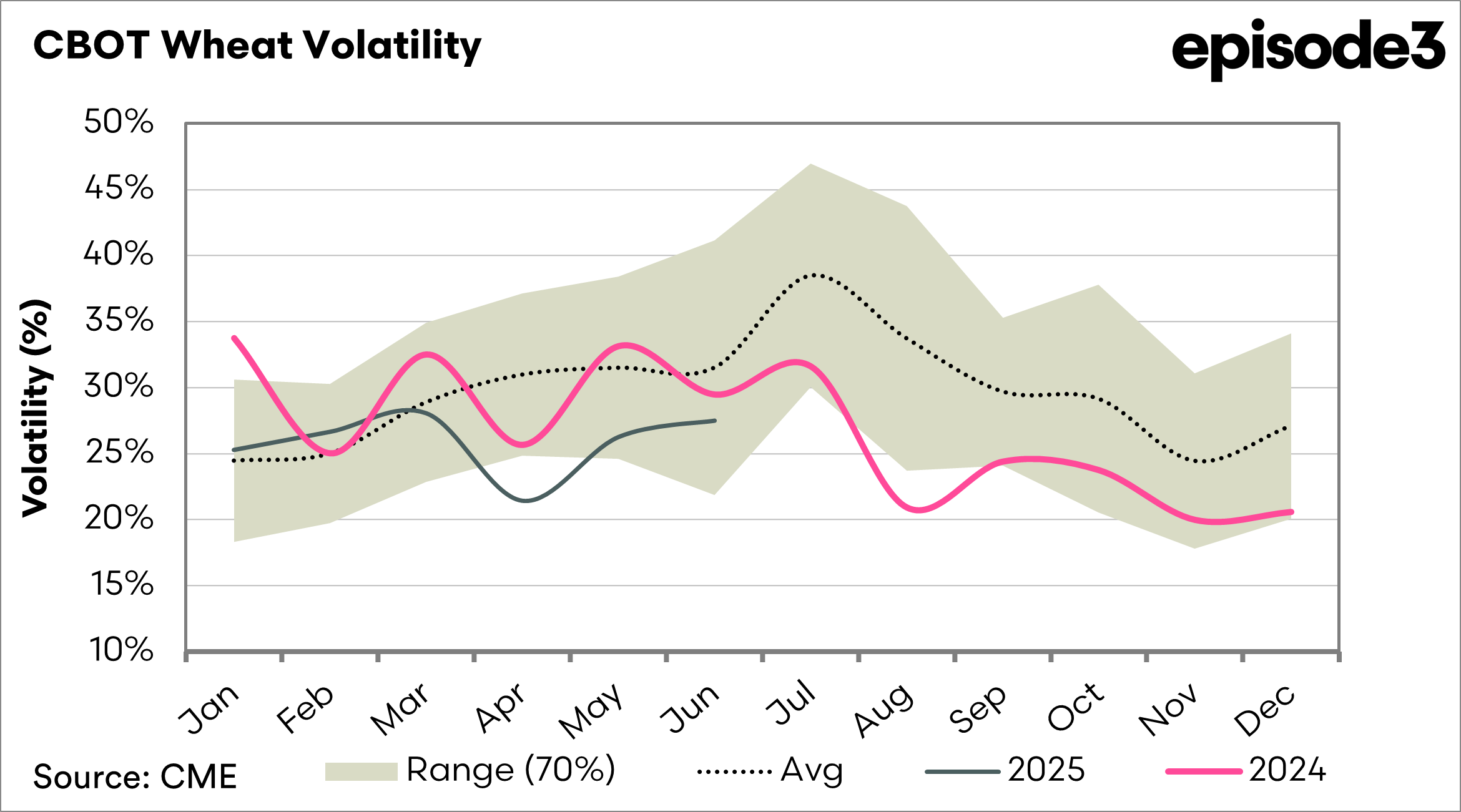

This time of year is typically when volatility increases in the wheat market, but in 2025, volatility has been lower than expected.

It’s not good news for Australian farmers that the jump in the wheat market has gone, but I guess on the flip side we might avoid WW3 for a few months.

We should also see urea pricing eventually returning to prior levels, if production gets back online.