Market Morsel: Keep an eye on Russia.

Market Morsel

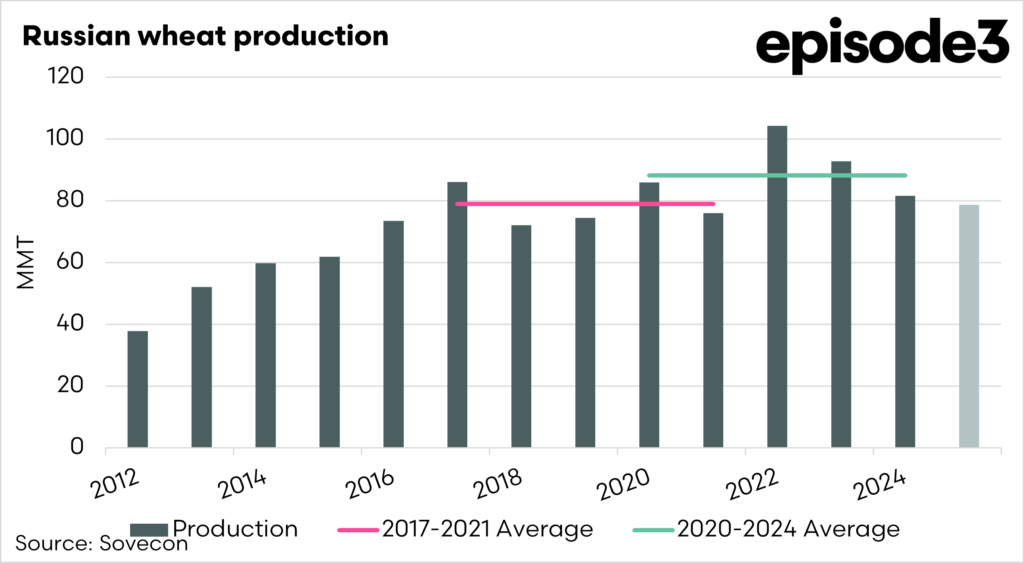

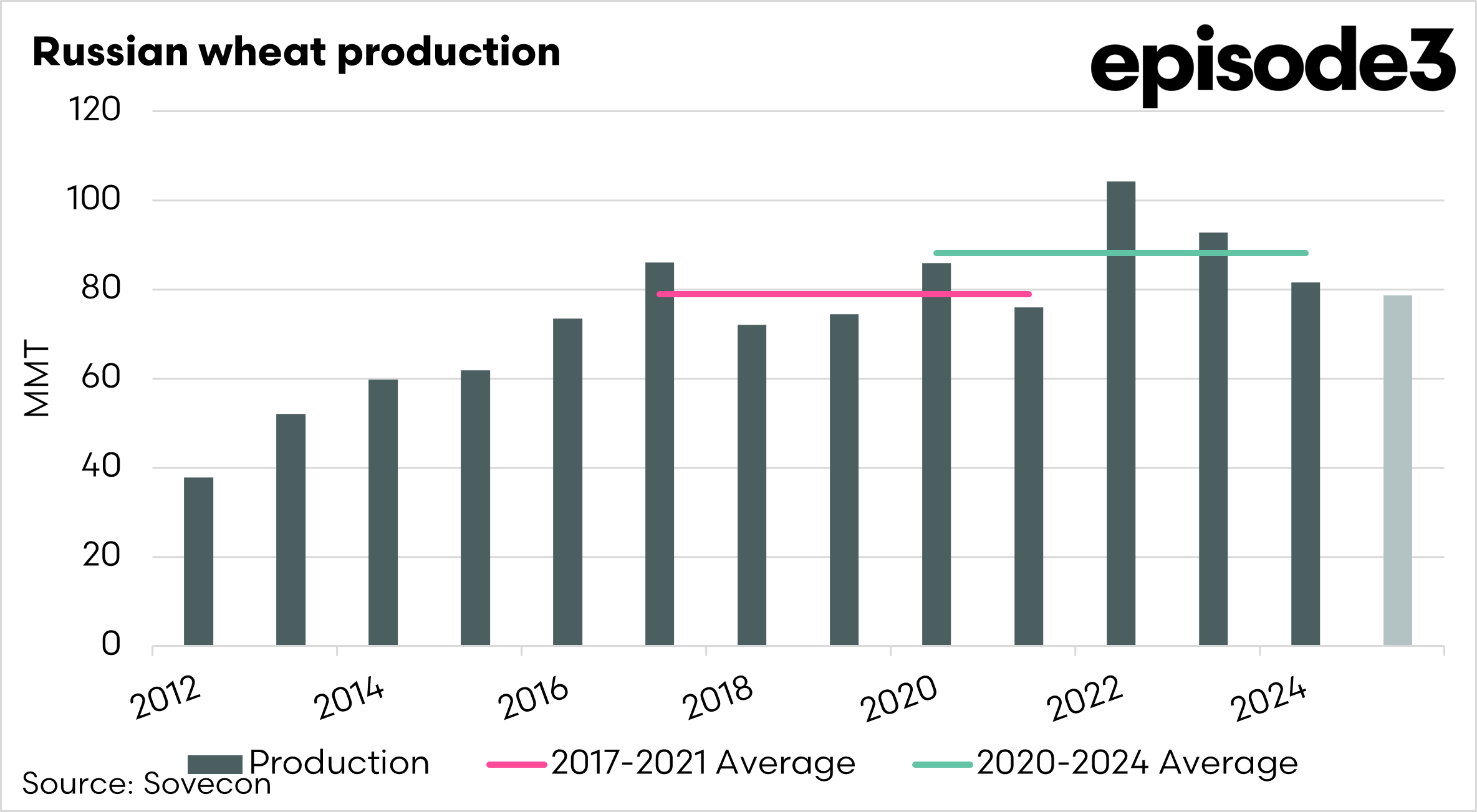

Last week, I wrote about concerns about the Russian crop. This week, renowned Russian analyst Sovecon announced that they were reducing their expectations of the Russian wheat crop from 3mmt to 78.7mmt.

The Russian winter wheat crop accounts for 70-80% of the total wheat crop in Russia. Farmers are likely to have to replant paddocks, and with lower spring wheat yields, they may switch to oilseeds/pulses.

It is important to note that this downgrade in Russia places production around the 5-year (pre-2022) average, whereas in recent years, production has been exceptionally above average, with the past five years at 88mmt. Prior to 2022, only twice had Russia produced a greater than 80mmt since at least the end of the USSR. We can’t always rely on huge Russian crops.

Conversely, Ukrainian crops were forecast to be in good condition.

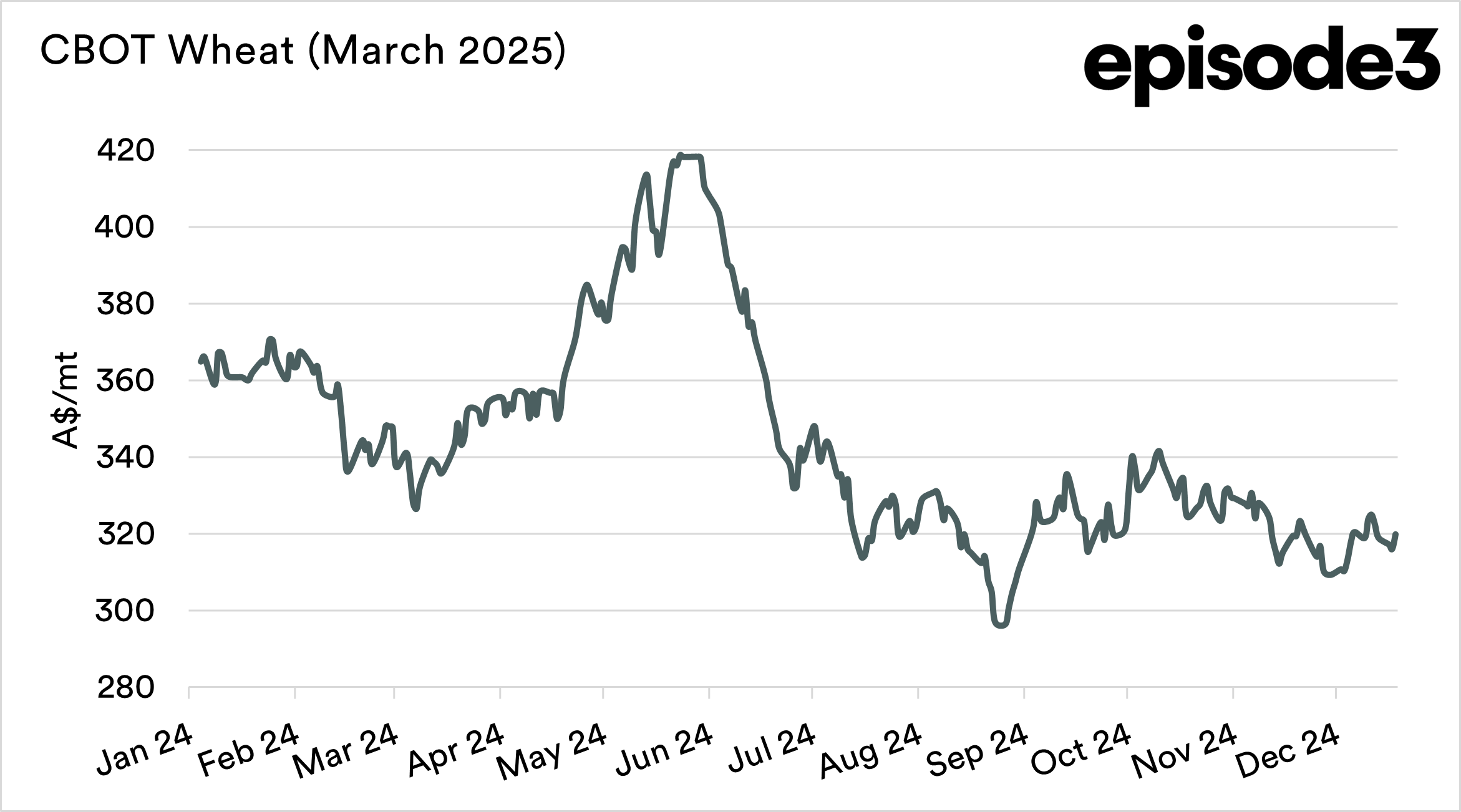

As discussed in our podcast and another article last week, the world’s available wheat stocks at the end of this marketing season are set to be low. A further fall in Russian wheat production will potentially place a fire under wheat pricing. Pricing globally has been significantly lower than in recent years, and speculators have large bets on the market falling lower. We just need more concerning information to drive it higher.