Market Morsel: Keep one eye ahead on wheat.

Market Morsel

We always say that keeping an eye on close and forward pricing levels is essential. Opportunities can present themselves, especially if the market is offering a premium in the forward periods.

If you are forward selling wheat, one of the ways is through a futures contract. This can be many different markets, but ASX (Australia) and CBOT are good ones to look at.

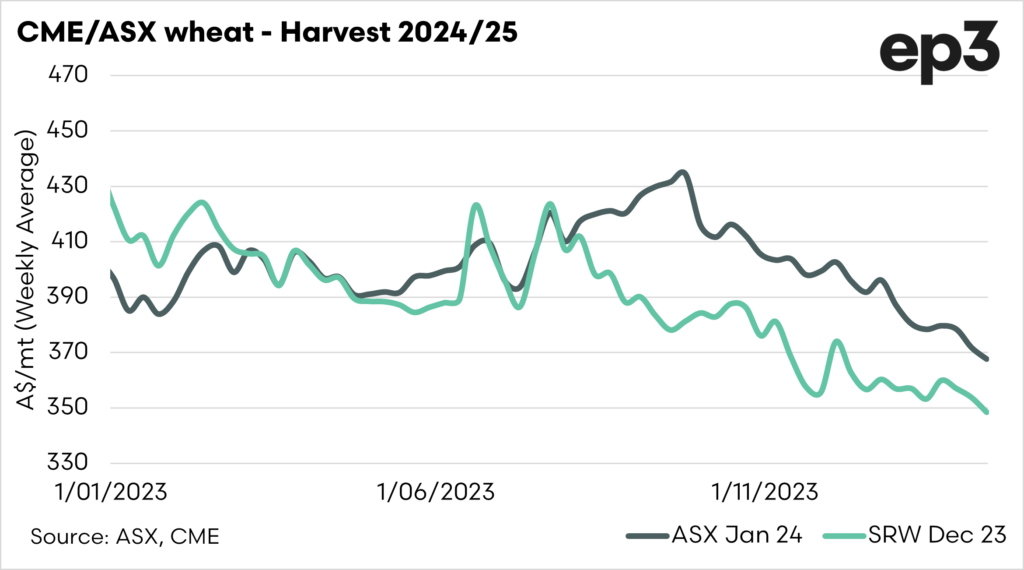

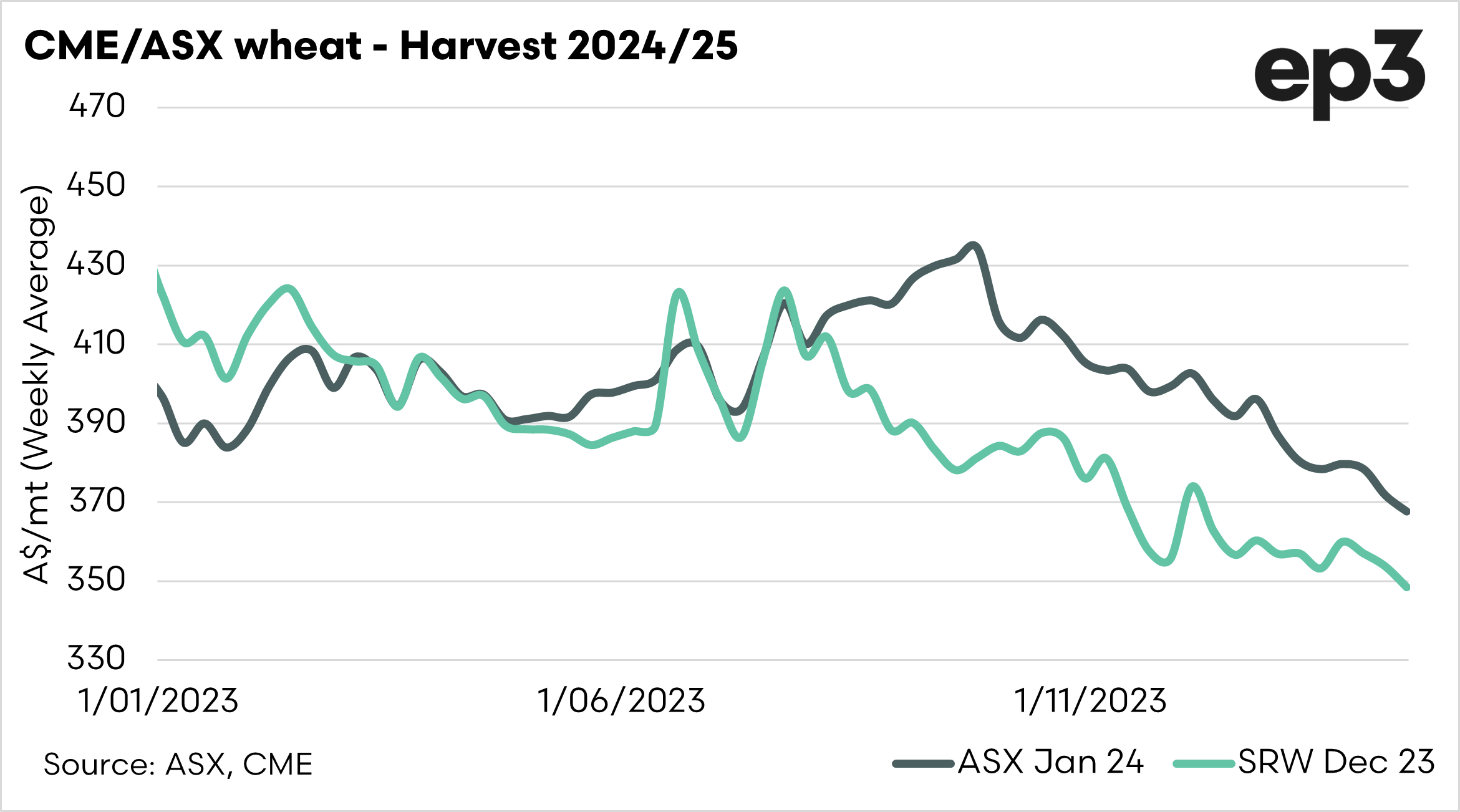

The charts below show the contracts for the coming harvest. They have come under pressure in the past four months. There are increased supplies coming into the market from Russia and higher production prospects in France.

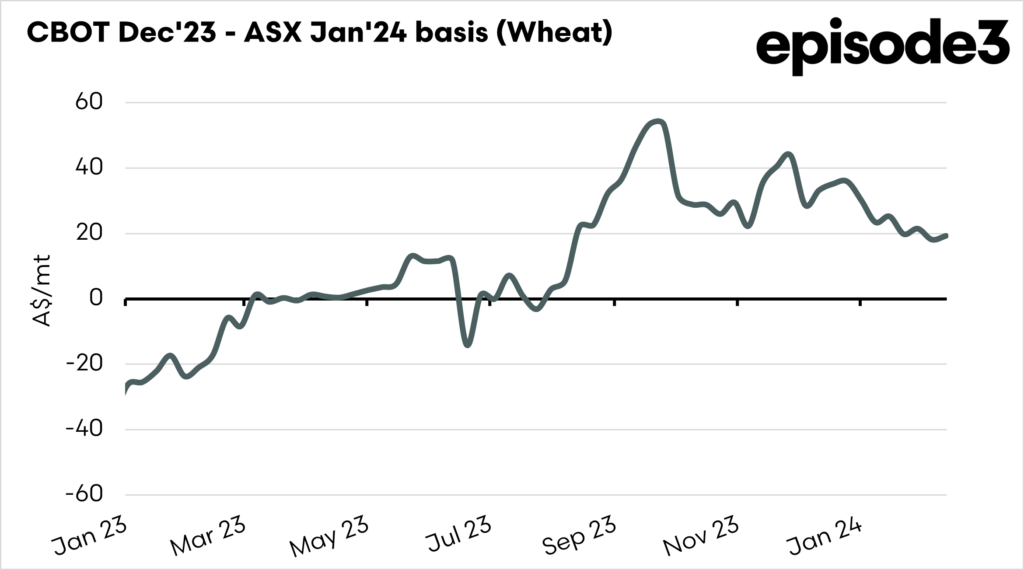

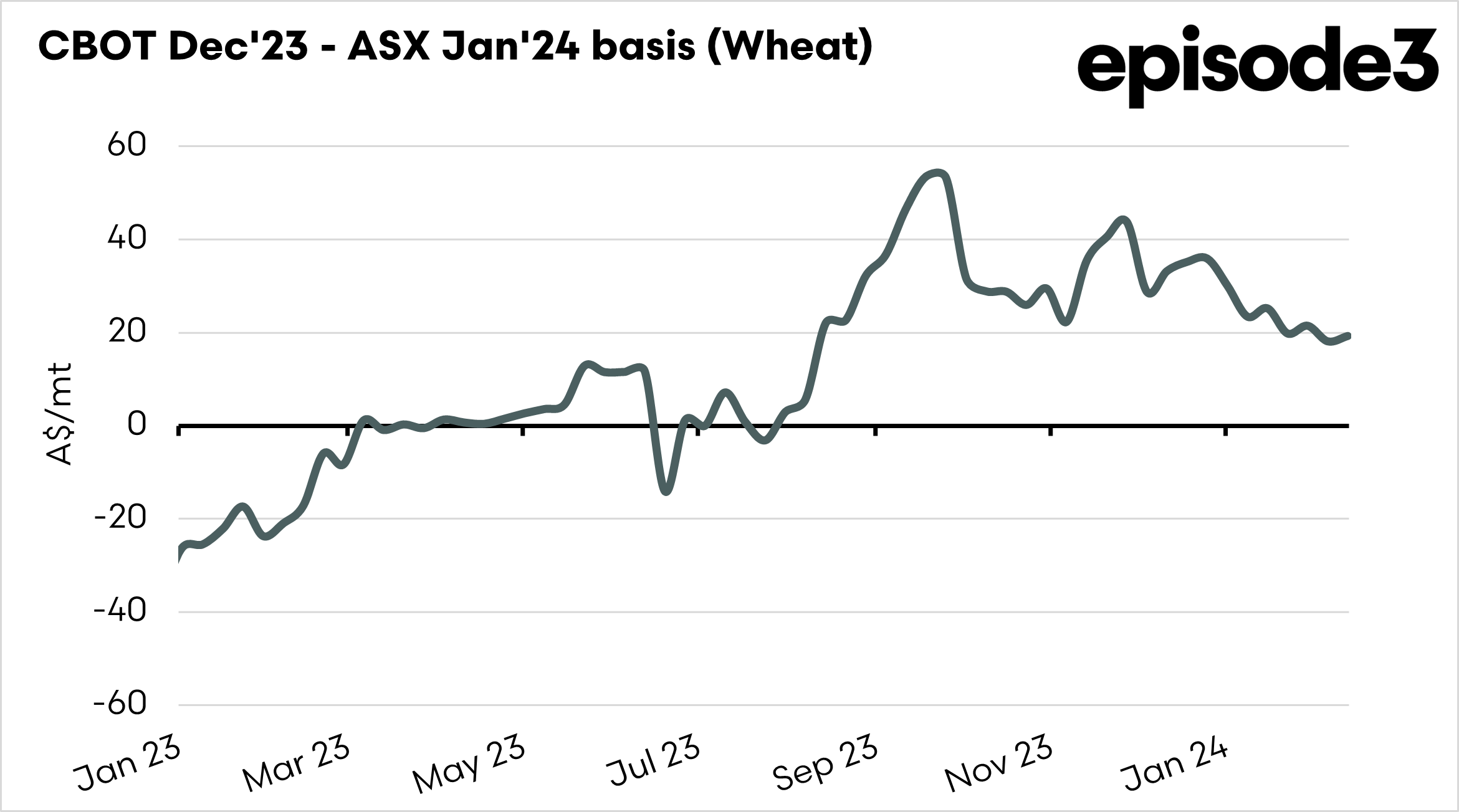

ASX, which is representative of Aussie prices, has moved to a premium. The ASX price is A$368 for the coming harvest, and the premium is A$19 over Chicago wheat.

Whether or not this is a good price is down to you as an individual enterprise. Just remember that marketing your grain isn’t a set and forget, little and often and building an average is a solid strategy.