Market Morsel: Lack of commitment to wheat.

Summary & key takeouts

Where is the ‘smart’ money on grain? I am a little sarcastic when I use the term smart money for speculators. The speculators in the market are as often wrong as they are right.

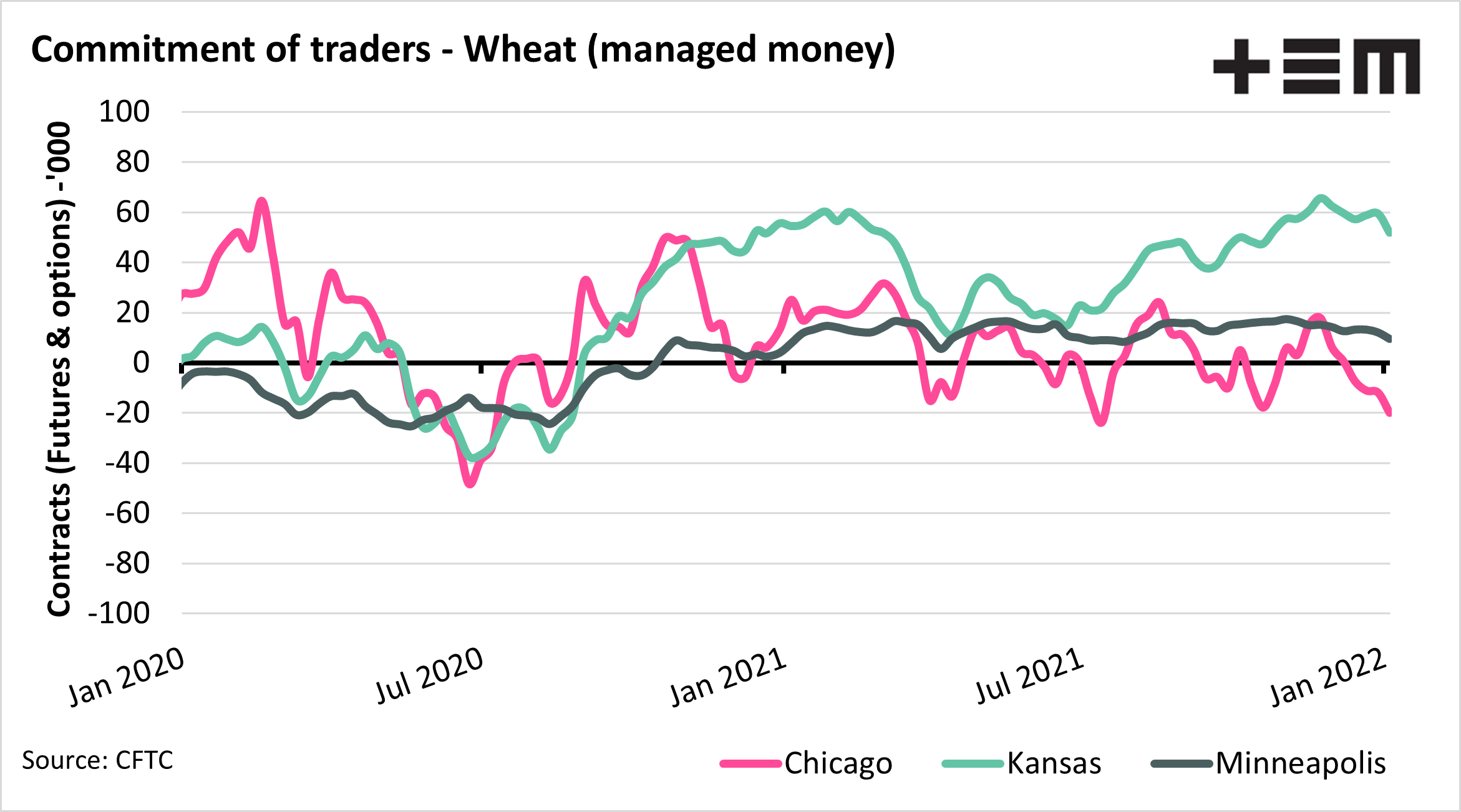

The commitment of traders (COT) report is a valuable tool for understanding how different actors in the grain trade view the market. The main category of interest is managed money, which is considered a proxy for speculators.

If management money is long, i.e. have bought contracts, they are bullish on the market, making money if the market continues to rise. Conversely, if they are short, then they are bearish as they will make money on a falling market.

A more detailed explanation is available here. A series of charts below provide some insights into the COT report and, therefore, the speculator’s thoughts.

Chart 1. This chart shows the net position of the speculators for the three main US wheat contracts. The biggest change that we see is the decrease in the long position of Chicago wheat. The speculators are overall the most bearish on Chicago wheat since July 21.

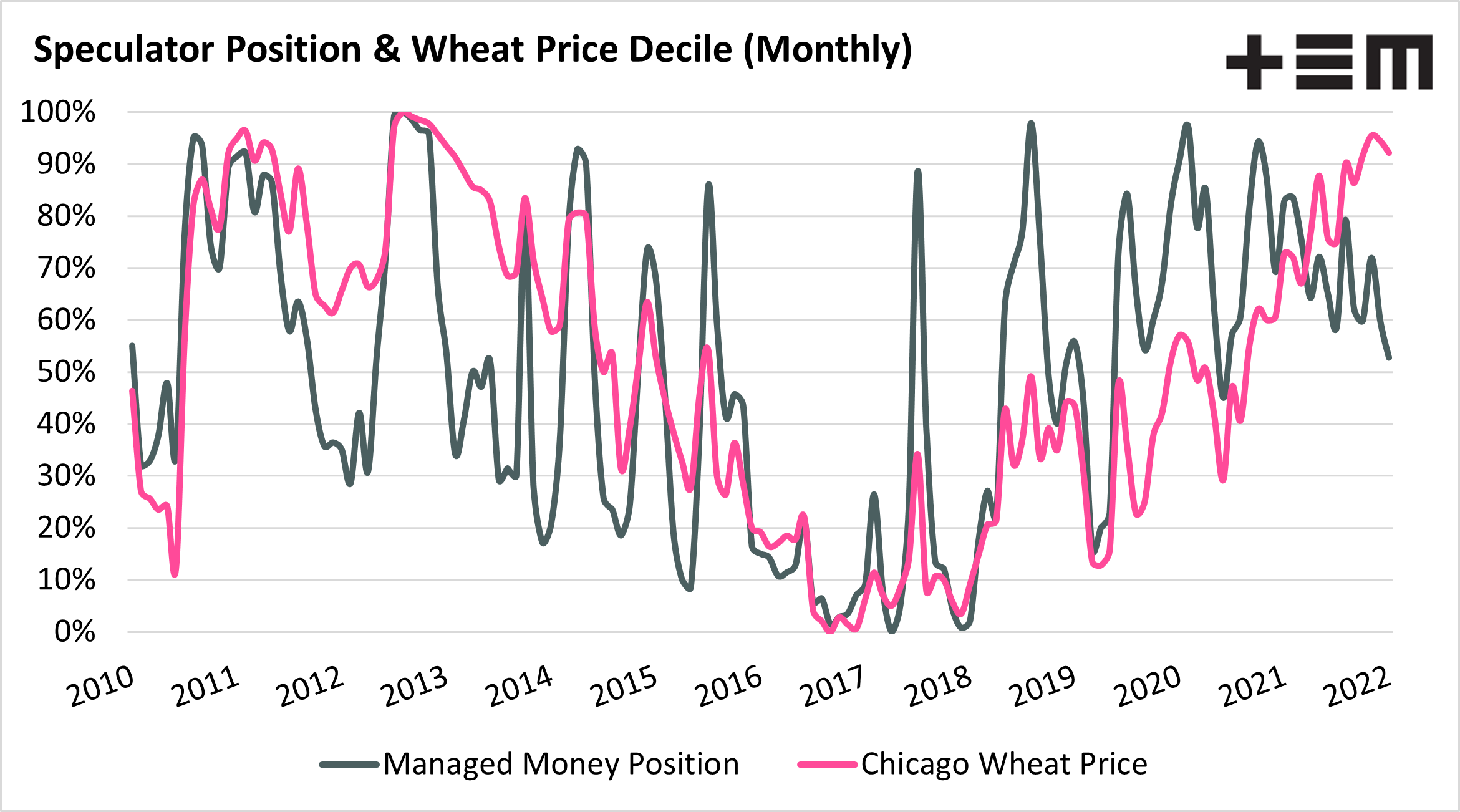

Chart 2. This chart shows the percentile rank for each month (from 2010) for both Chicago wheat and speculator positioning. A relationship between the two (correlation 0.72) shows that speculator position and price follow closely. The question is which follows which.

At present, speculators are betting on lower wheat (at least for Chicago). This doesn’t mean that they will be right. The reality is that they influence the market, and in this case, not a positive effect.