Market Morsel: Offally expensive.

Market Morsel

At EP3, we look at a wide range of markets on behalf of our clients. One of those commodities, important but often forgotten about, are the co-products from animal processing: namely tallow and blood/bonemeal. They have gotten expensive!

Meat and bone meal (MBM) is produced from abattoir waste products that are not suitable for human consumption. MBM is used extensively in animal feed. Tallow is rendered fat and is also used for feeding animals and making a wide range of soaps and lubricants.

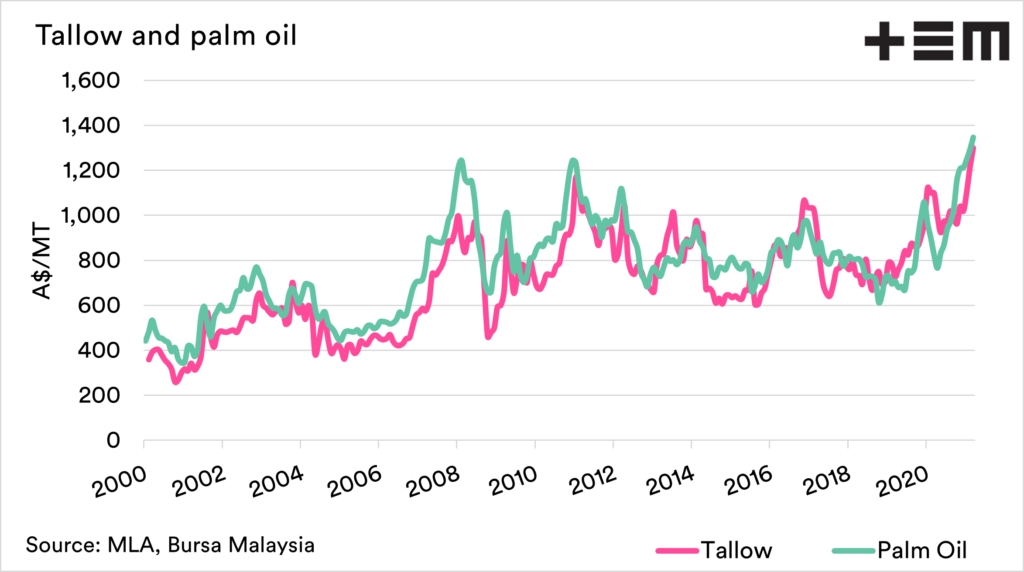

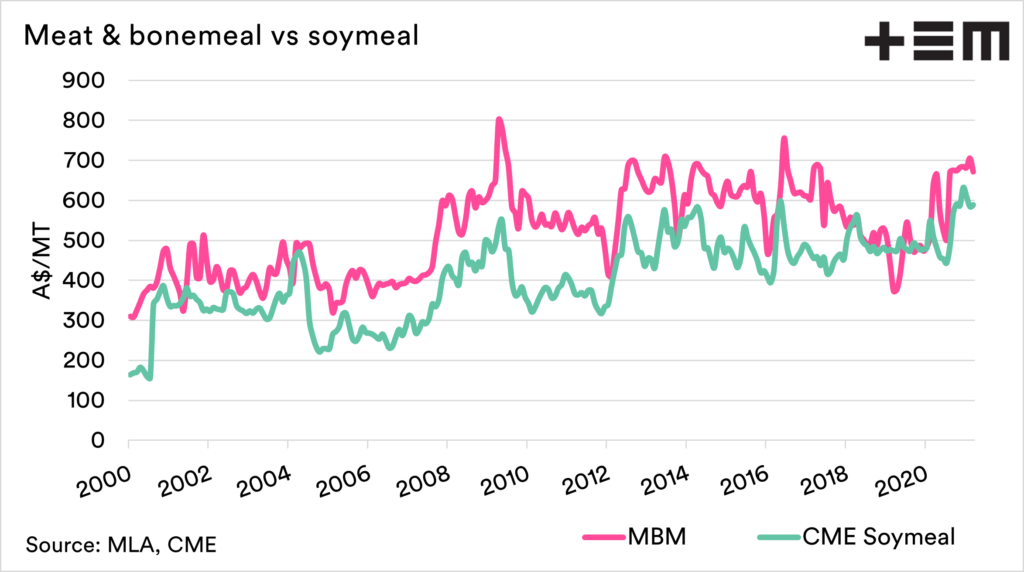

The offals share relationships with other commodities in a similar fashion to wheat and corn. Tallow as oil is in the same basket as the oilseeds, and blood/bone meal is in the same basket as the oilseed meals such as canola and soymeal.

This can provide an opportunity to use these alternate and more heavily traded markets to indicate the likely performance of offal pricing.

The oilseed market has been going gangbusters in recent times, which has flowed through to tallow prices. As of the end of April, tallow prices have hit record levels since 2000. During May, oilseed prices drove higher, so when data is available for May, it is likely that tallow will reach a new high.

Meat and bone meal (MBM) has also shown some great strength in recent months, but not to record levels as tallow has. The MBM is strong at the 90th percentile. MBM and Soymeal (SBM) tend to follow quite similar patterns of movement.

The correlation between MBM and SBM is 0.78, and between Tallow and Palm is 0.88. A perfect correlation is 1, and no correlation is 0. These commodities clearly have a very strong relationship.

The offal markets are not always the easiest to get a handle on, but by looking at commodities with similar attributes, we can infer price movements.