Market Morsel: Rotten wheat

Market Morsel

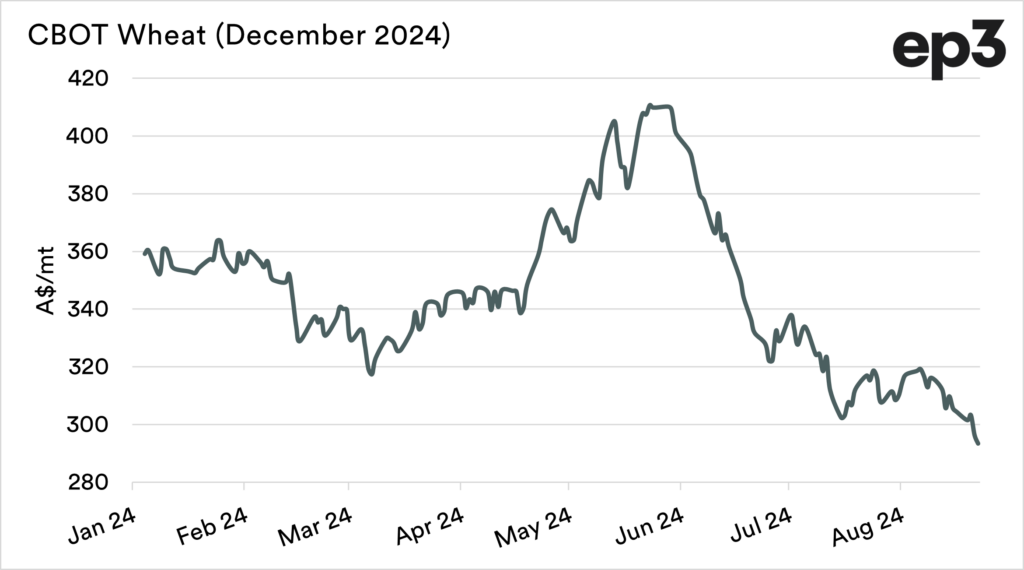

The wheat market is coming under incredible pressure. CBOT wheat has fallen from A$410 at the end of May to A$293 as of this morning.

This is a very sharp fall in a short period of time, and many growers will be asking why this has occurred.

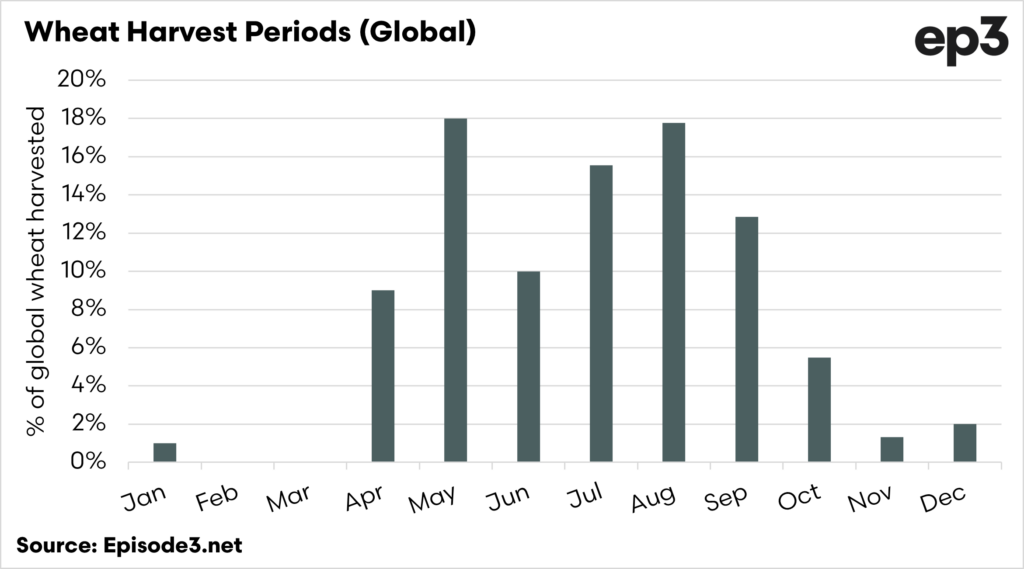

A big movement downwards during the northern hemisphere harvesting season is not unusual.

Most of the world’s harvest is during the middle of the year, which seems to be when the direction is set for the following six months.

If there is a major issue, our prices will rise or vice versa. The trade is not concerned about access to wheat; they believe they can access the wheat they require. This is despite issues in Western Europe.

The market rallied in May/June because there was an expectation that Russia would fail; this wasn’t as bad as expected.

It is important when selling our grain that we take a strategic perspective. If the market rallies strongly, we need to be prepared to sell, whilst taking into account production risk. A reasonable strategy is to run your own personal ‘grain pool’ and sell little and often.

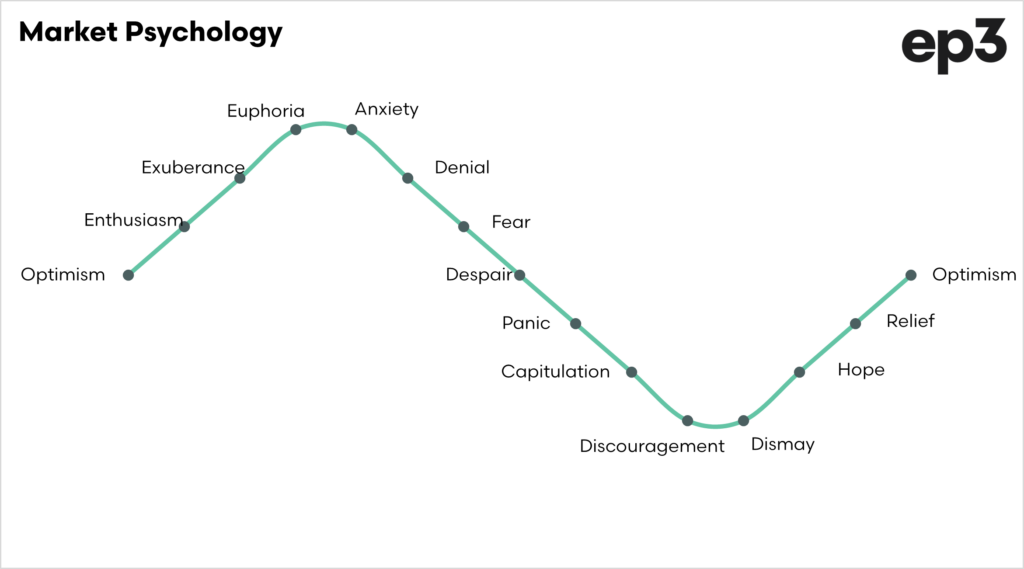

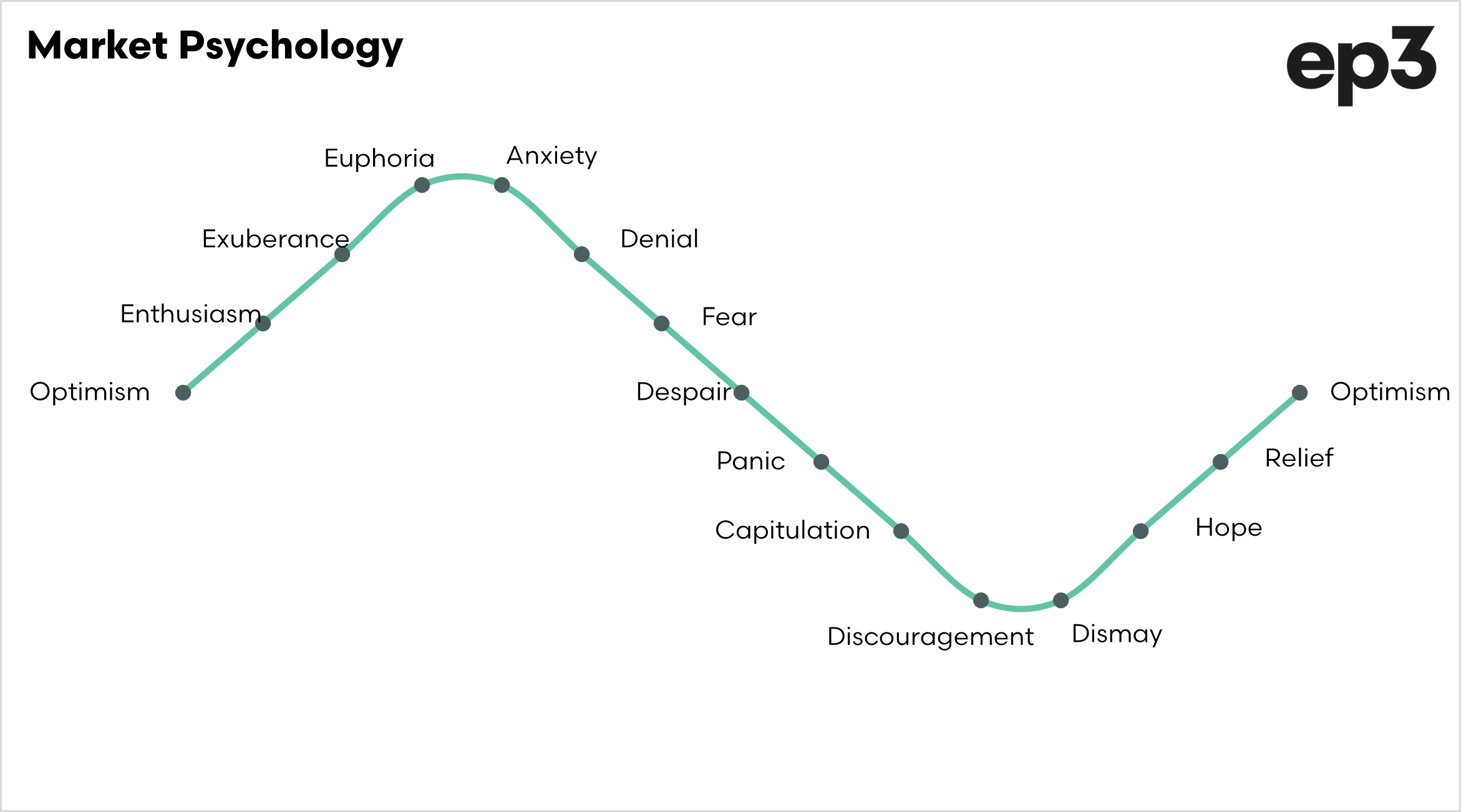

Looking at the market, we can get stuck in a loop. If the market is rallying, we don’t sell because we don’t want to fell that we have lost if the market continues rising. The market never rallies forever, and anyone who has been in grain markets for a while tends to see that the peaks don’t last long before a crash comes.

I recommend looking at the third chart, which is the most important chart when thinking about any market.