Market Morsel: Russian exports to be sluggish

Market Morsel

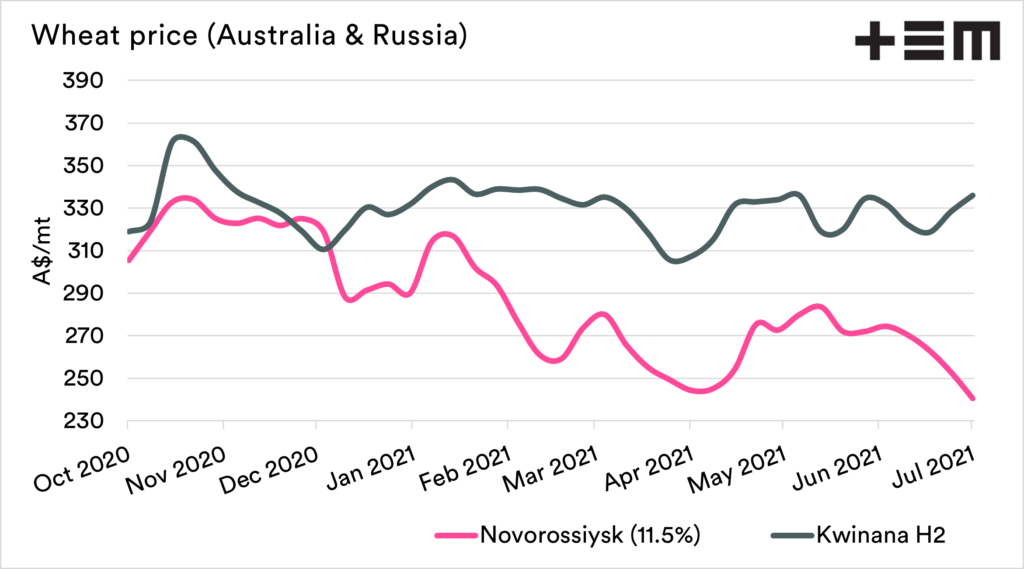

SovEcon, the leading Black Sea agricultural markets research firm, upped Russia wheat exports estimate in 2021/22 season. Russia is #1 world wheat exporter.

The wheat exports estimate in 2021/22 was upped by 1.8mmt to 38.4mmt reflecting the earlier increase in production estimate by 2.2mmt to 84.6mmt.

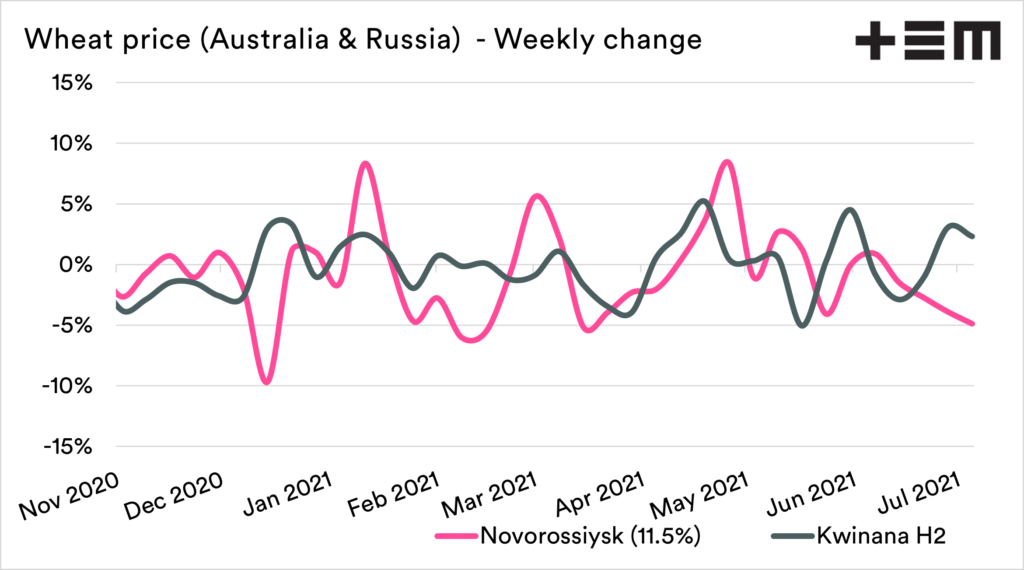

SovEcon expects a sluggish wheat export pace at the beginning of the season, which will lead to the fact that at the end of the season export volume will be relatively low for such supply.

The main factor is the floating weekly export tax and an untransparent mechanism for calculating it. Active competition with the EU and Ukraine in the wheat market is an additional factor. In the second half of the season, competition in Asia with Australia may increase, which can again harvest a high crop.

The increase in domestic consumption thanks to the growing livestock sector, which is seen as the biggest export tax beneficiary, also contributes to a relatively modest export number.

The export estimate is based on the assumption that the current export tax mechanism will remain in place during all or almost all 2021/22.

The wheat export estimate for 2020/21 was reduced by 0.2mmt to 37.5mmt.USDA estimates Russia’s wheat exports in 2021/22 at 40 mmt.

The Russian wheat crop is getting bigger, and farmers are sitting on record-high stocks from the previous season. However, during the nearest several months exports shipments could be very modest for such a large supply.

The export tax and farmers’ hopes that it could be lifted soon will be big barriers for the export.

Sizov.report: we are helping funds, traders, and buyers to trade and manage their risk better by providing consistent data and accurate analysis of the Black Sea grain market.