Market Morsel: Russian grain and oilseed no longer competitive (into EU)

Market Morsel

For years, Australian grain farmers have been impacted by tariffs on grain exports. We have had them impacting pulses into India and barley into China.

It is now the turn of another country to be impacted by negative tariffs – this time Russia and Belarus.

Overnight, the European Commission has agreed that on the 1st of July, imports of oilseeds and cereals (and derivatives) will be hit with a tariff, which will be an effective block on trade.

Cereals will be hit with 95 euros per tonne (A$155), and oilseeds will attract a 50% tariff. These make Russian and Belarusian exports no longer viable.

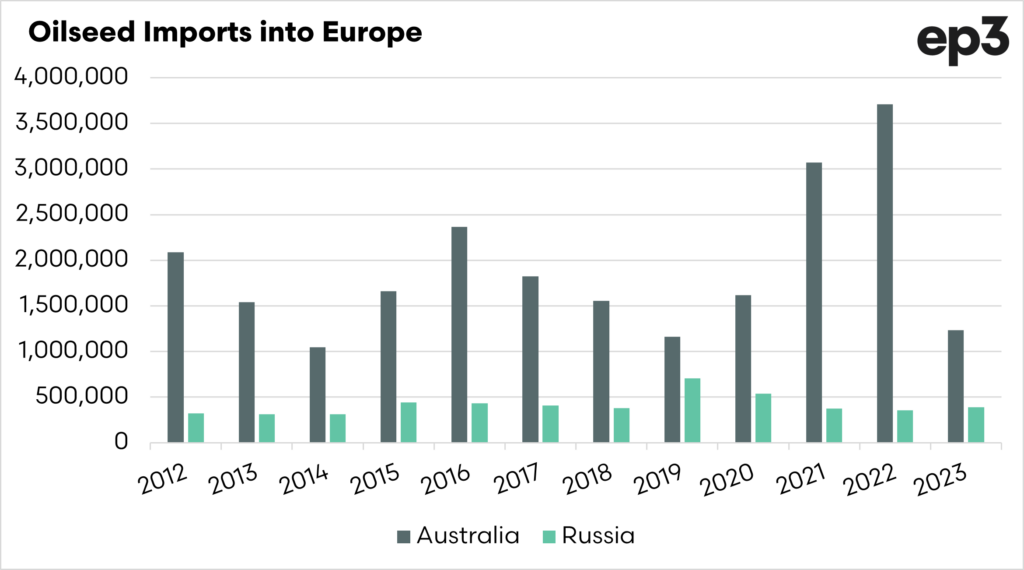

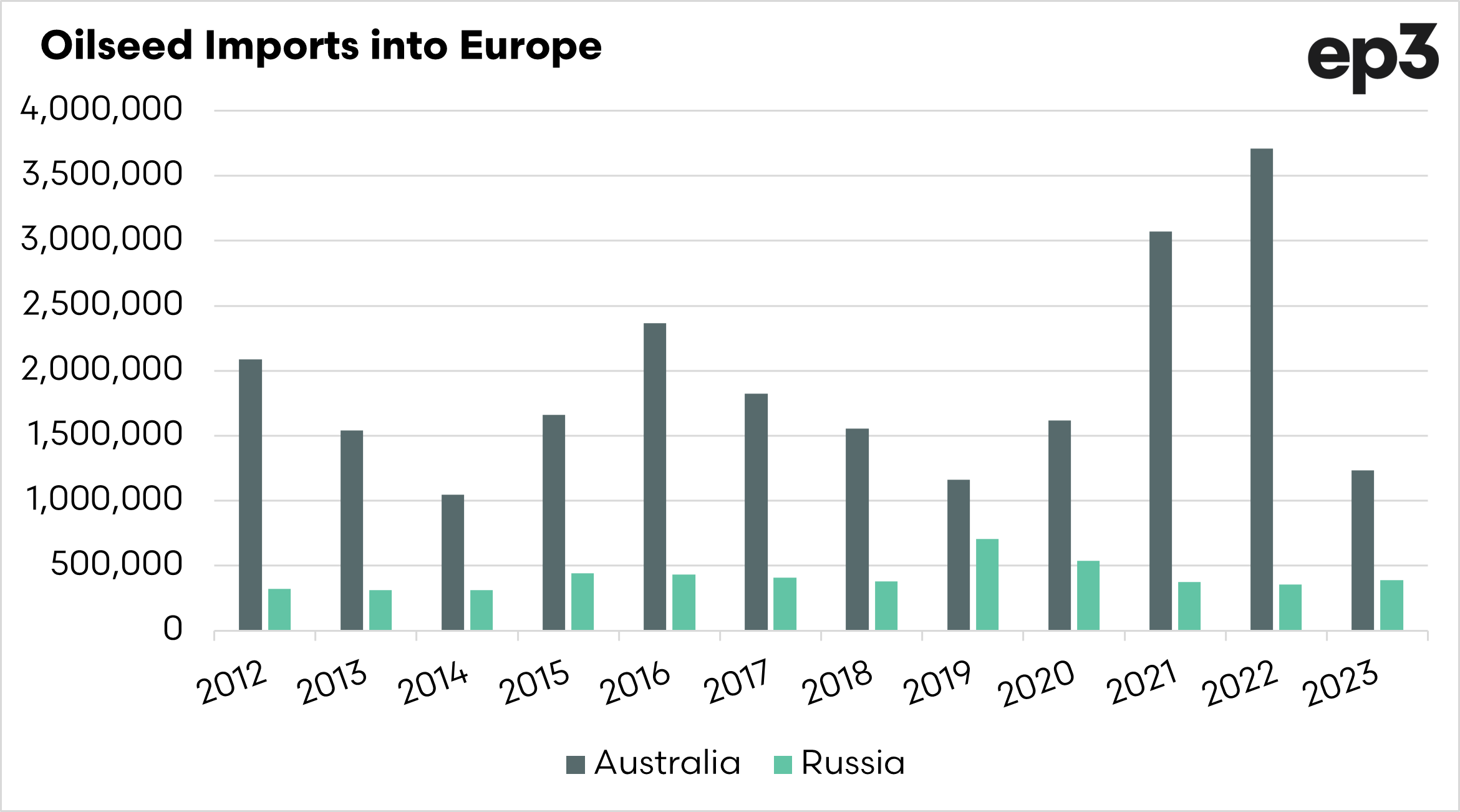

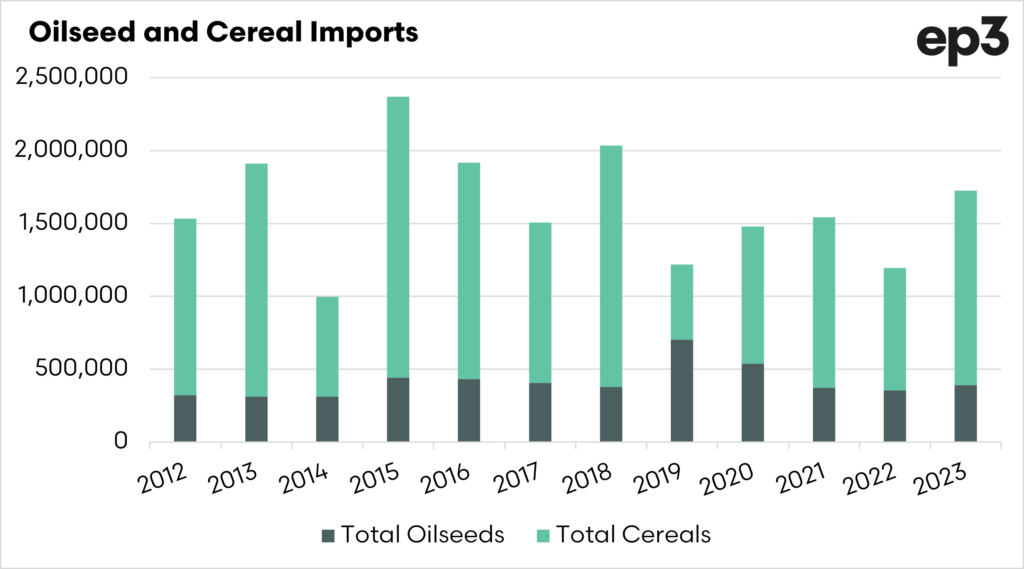

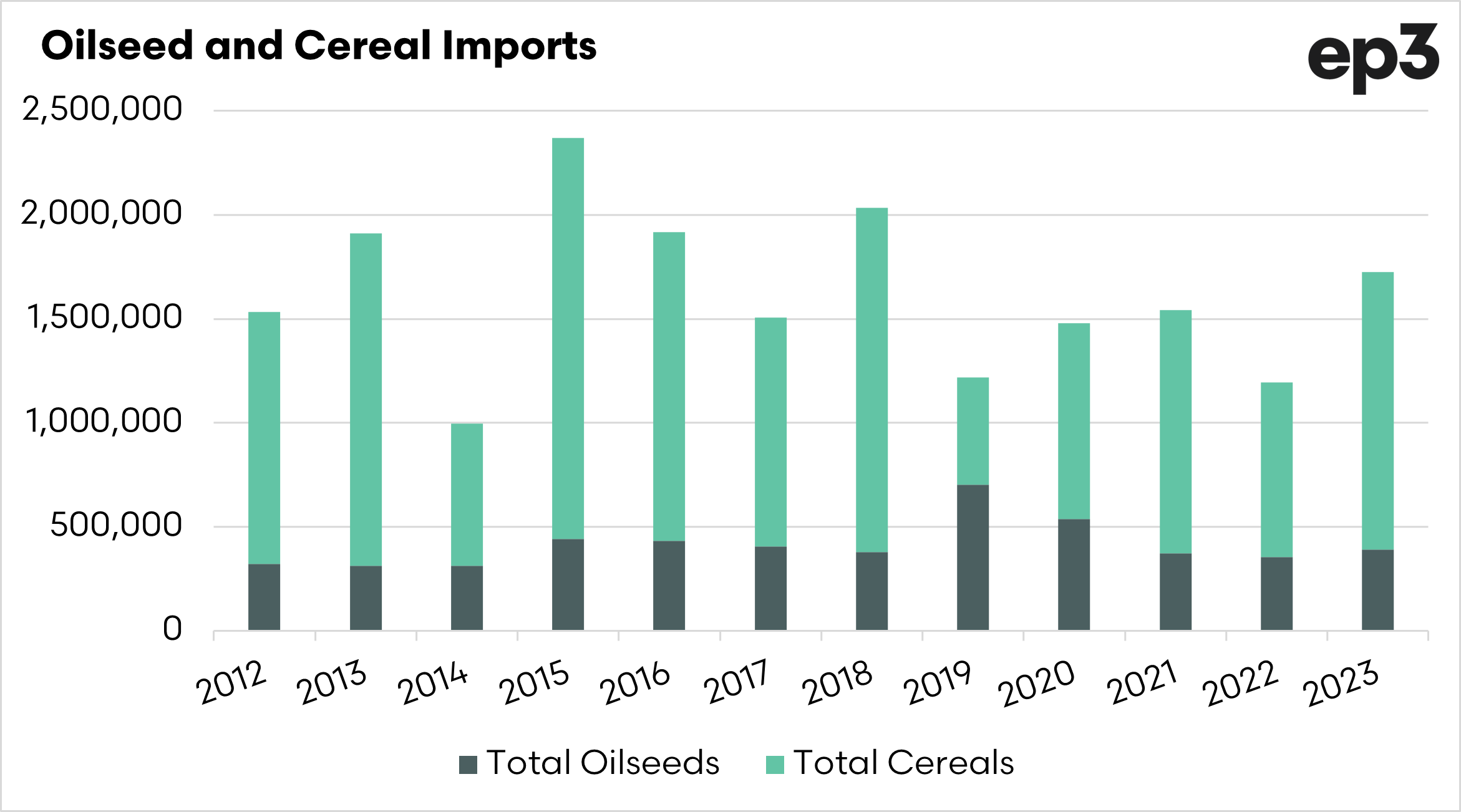

What trade does Russia and Belarus conduct with the EU? The first chart shows the total imports of oilseeds from Australia and Russia into Europe. These are all oilseeds, and the majority of the Australian exports are of canola.

The average exports of oilseeds from Russia to the European Union are 414kmt. European Union buyers will have to look for alternate origins for this volume.

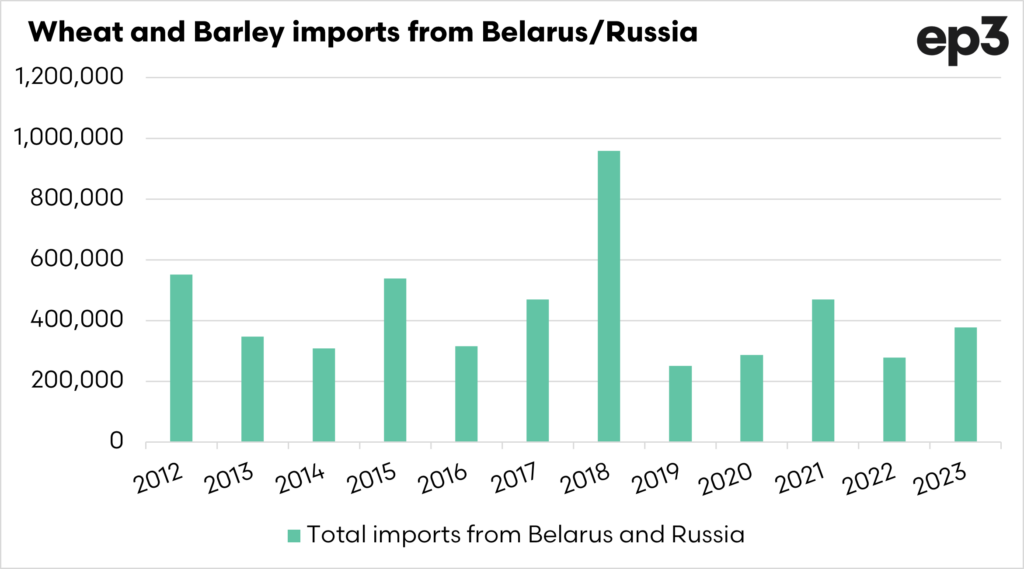

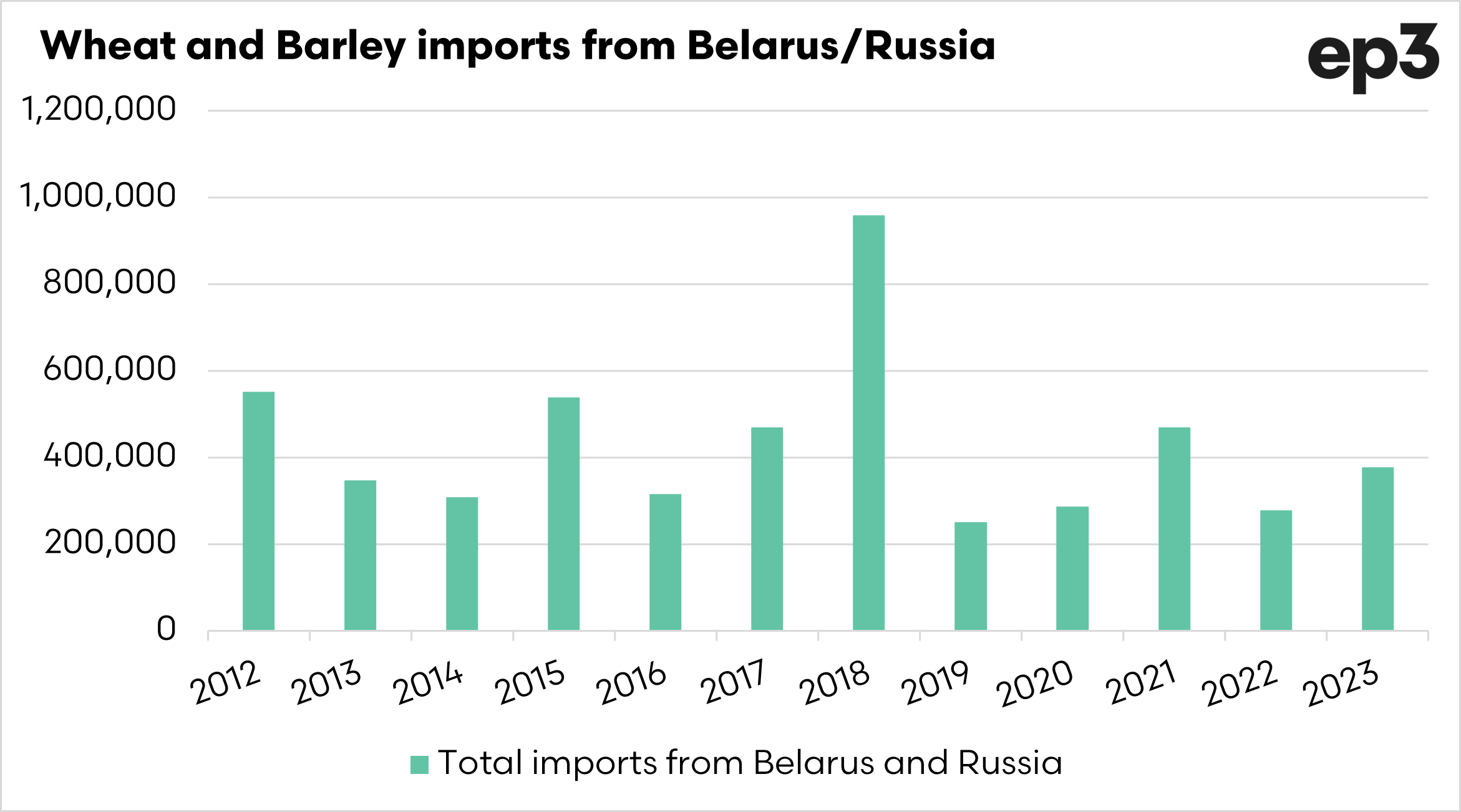

Belarus/Russia are also exporters of wheat and barley into the European Union, in the past ten years, on average, 430kmt has been exported.

Overall, oilseeds and wheat/barley imports from Russia/Belarus into Europe are relatively small. The overall cereals and oilseeds of other types are significantly higher, as seen in the third chart.

The loss of the European market has generated a lot of angst from the Russian government. It may not be a great direct benefit to Australian grain growers, but it makes us more competitive and makes EU buyers look away from Russia/Belarus.