Market Morsel: Russian tax woes

Market Morsel

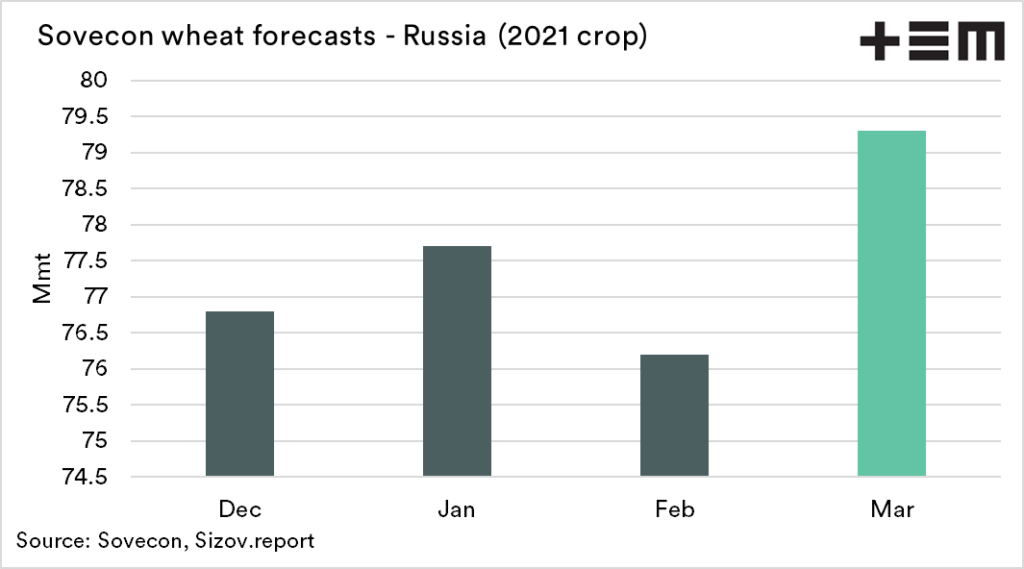

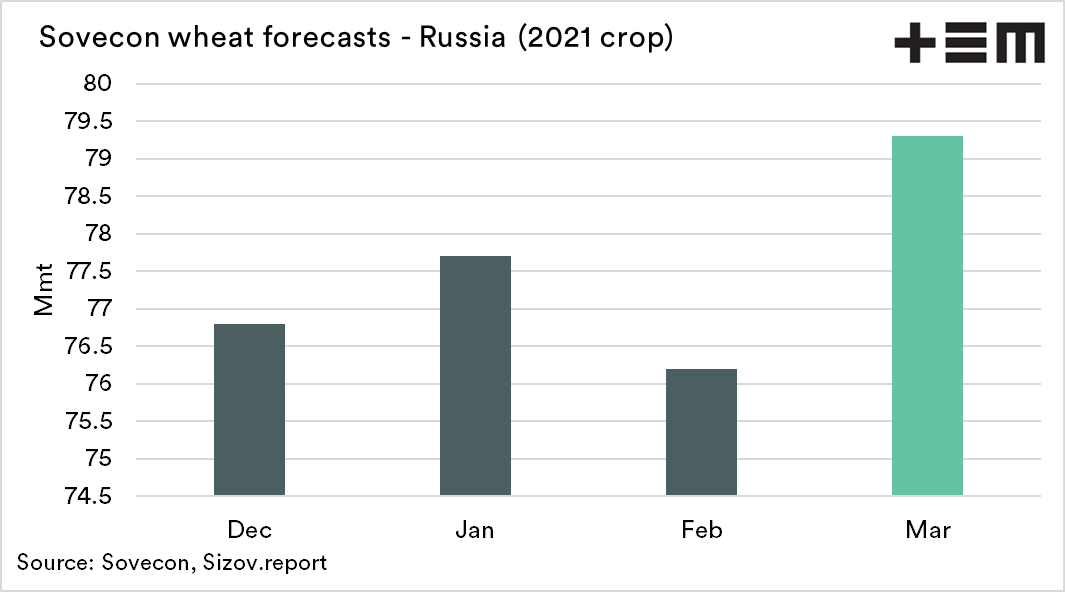

SovEcon, a leading Black Sea agricultural markets research firm, cut Russia’s 2020/21 wheat export estimate by 0.2 MMT to 38.9 MMT. Barley export estimate was upped by 0.9 MMT to 5.9 MMT, corn — by 1.1 MMT to 4.1 MMT. The total export of grains, pulses, and processed products is estimated at 50.3 MMT (+1.6 MMT).

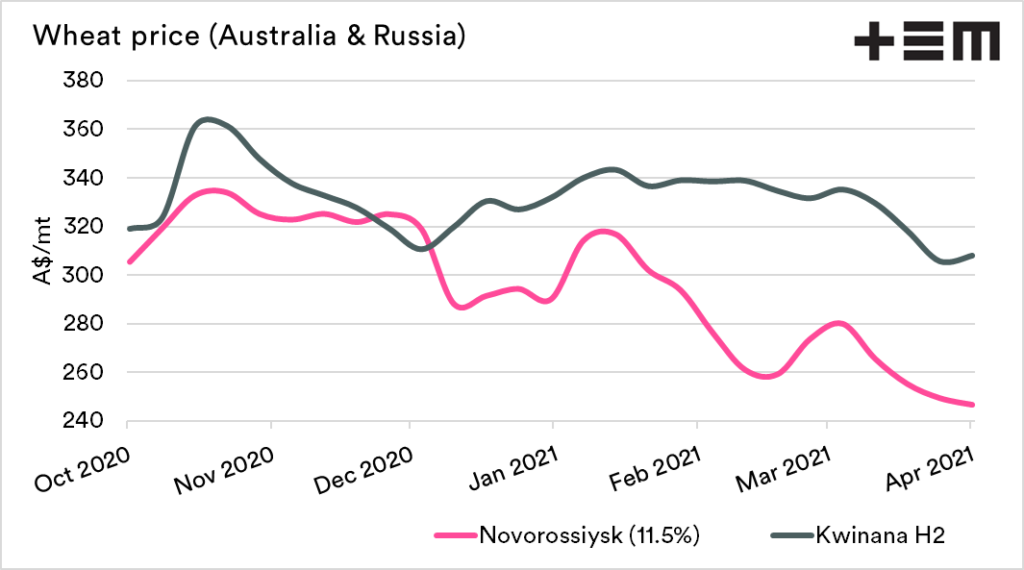

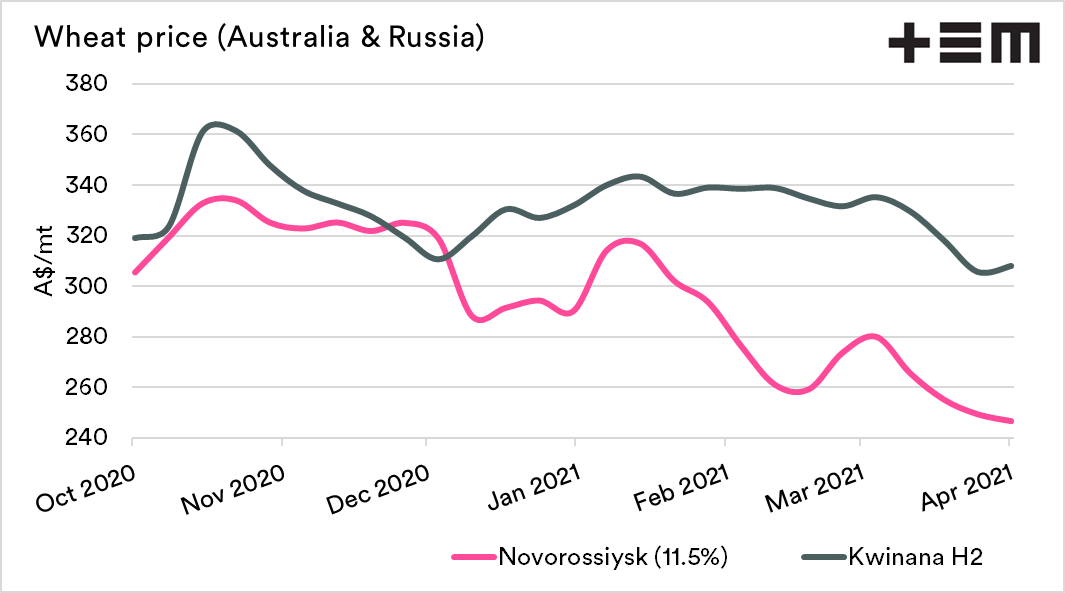

The wheat export estimate is down amid the current low pace and the fall in export prices in March. The domestic market is adjusting to the new taxes more slowly than expected. An additional factor is an uncertainty about the practice of calculating the new tax from June.

On the other hand, if the current export prices are maintained, the real tax volume may significantly decrease from June compared to the current one. For example, when selling in June at $235/mt, the tax may be $24.5/mt (0.7*($235-$200)) against the current fixed €50/mt (~$60/mt). It may support exports at the end and beginning of the season.

The main reason for the increase in estimates for barley and corn is the extremely high exports in March. In the future, it will decrease but will remain relatively high, primarily for barley. We cannot exclude that in the next 1-2 months we will see the emergence of active demand for Russian corn amid the extremely tense global balance and limited stocks in neighbouring Ukraine.

Market participants should also consider the change in the parameters of taxes for these crops from June. Unlike wheat, the introduction of floating taxes here is likely to mean a serious increase in them. For example, the current tax for corn is €25/mt (~$30/mt), from June at $260, it could jump to $52.5 (0.7*($260-$185)).

Uncertainty about tax implications complicates business for traders both in 2020/21 and 2021/22. At the same time, we feel that at the current stage, the global wheat market isn’t taking into account that Russia’s tax could be cut substantially from June. This could boost exports at the very end of the season and in early 2021/22.

It looks like large buyers, like Egypt, wants to test how the tax will work holding a tender next week with shipment only in August (+3 months to tender) while it’s typically around +1.5-2 month.

Sizov.report: we are helping funds, traders, and buyers to trade and manage their risk better by providing consistent data and accurate analysis of the Black Sea grain market.