Market Morsel: ‘Smart’ money changing on wheat?

Market Morsel

The Commitment of Traders report provides insight into the views of speculators in the grain market. It lets us know whether they are overall bullish (expecting rises) or bearish (expecting falls).

It is an important report to glance at when it is released. Speculators in the market can speed up the directional movement through trading in and out of large positions.

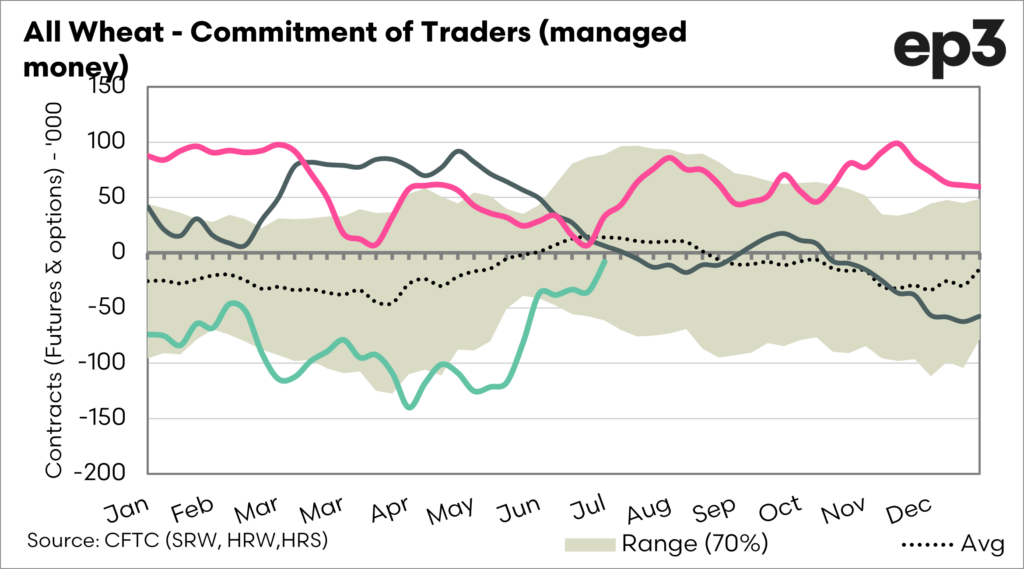

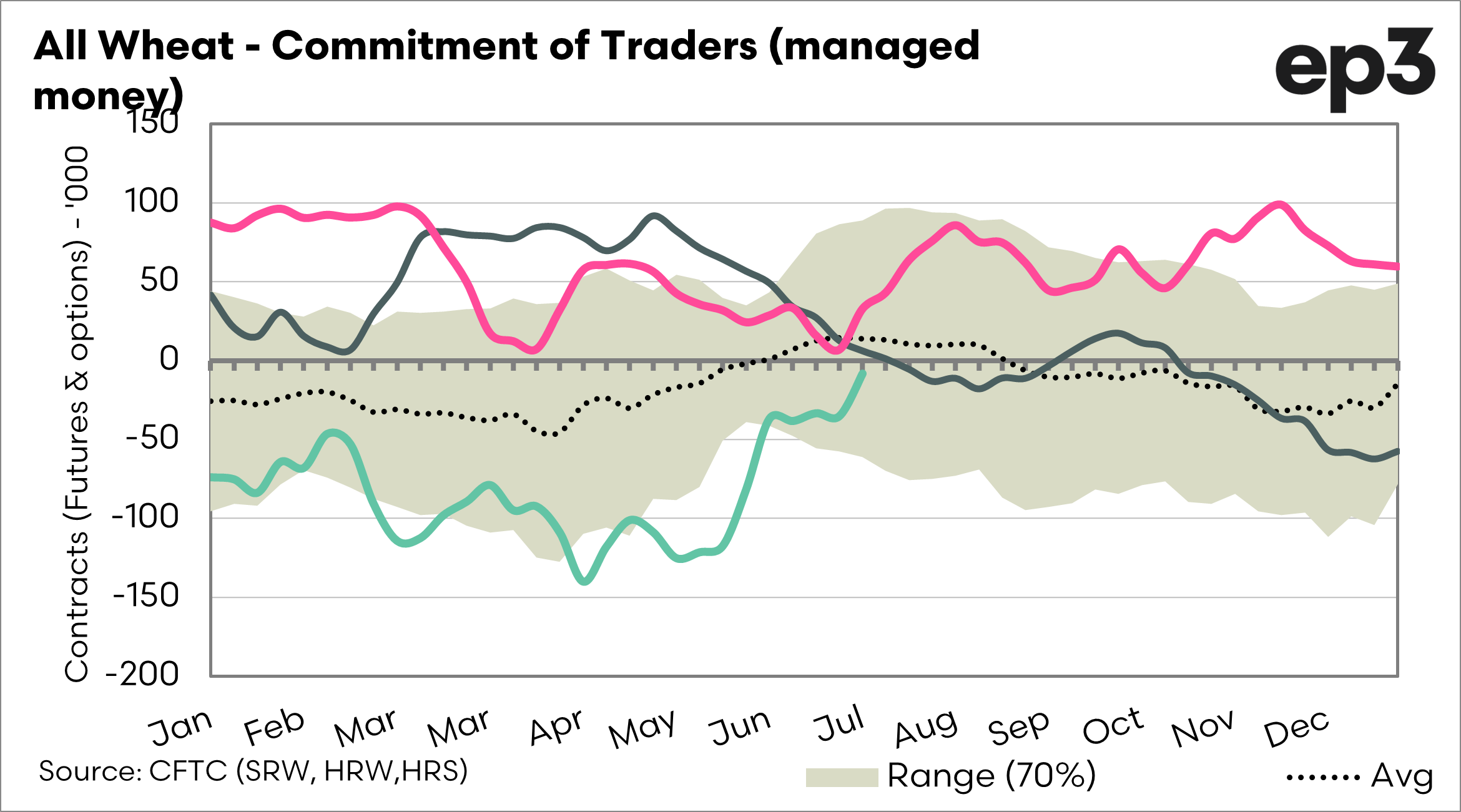

The overall position of speculators across all wheat has seen them move to a more neutral position in the last few weeks.

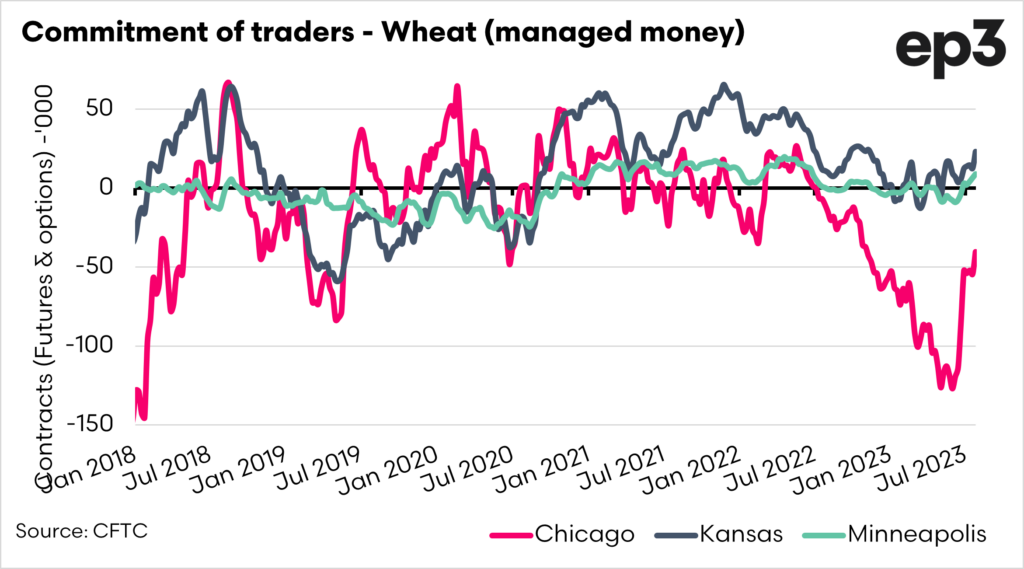

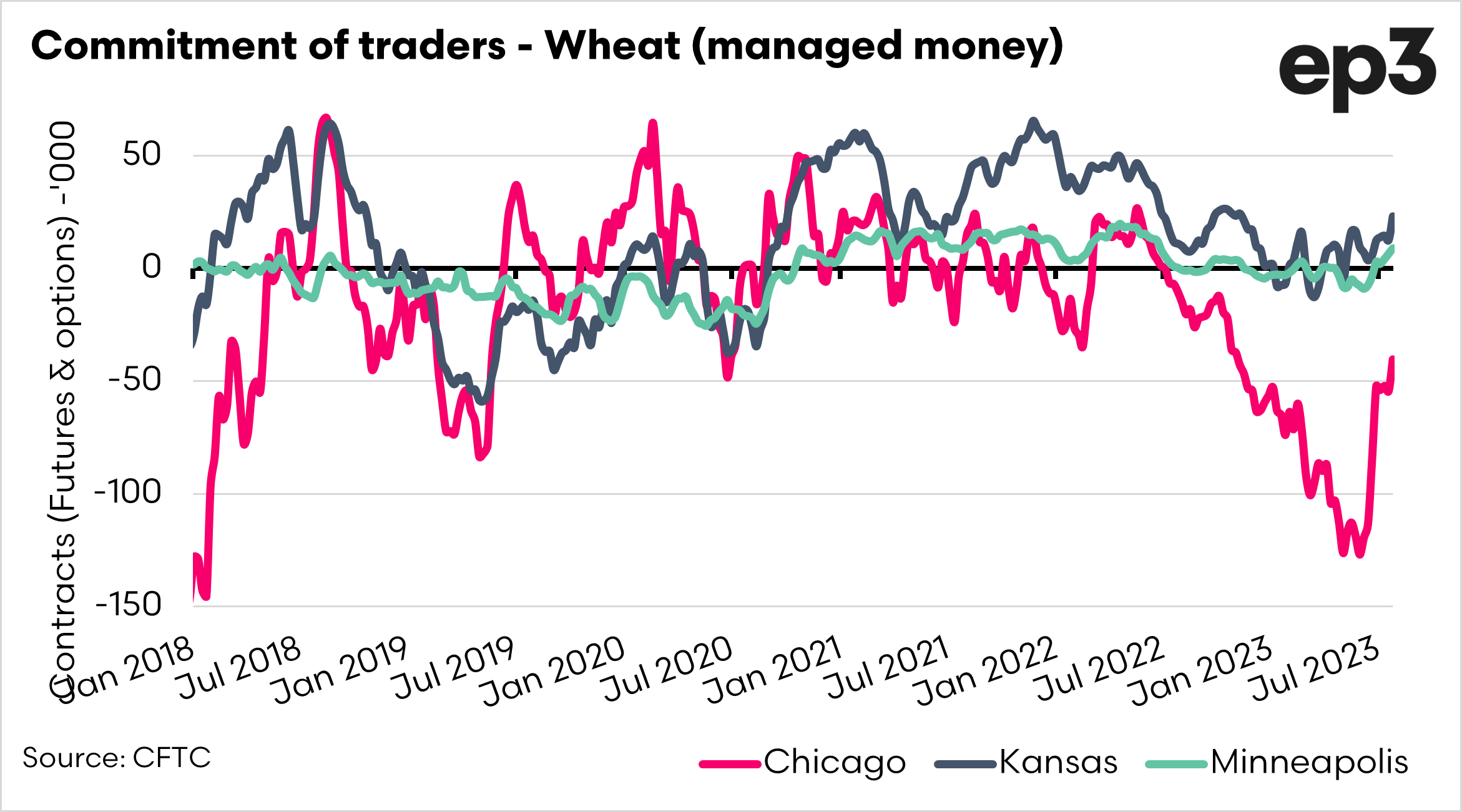

The second chart below shows the speculator position for each of the futures contracts in the US. Speculators have been more bullish on the higher-grade Kansas and Minneapolis wheat this year, with Chicago wheat positions being bearish for most of the year.

In May, speculators were the most bearish they had been since 2018. They have sharply revised this position in recent weeks.

It isn’t surprising to see this positional change. This time of year is when market news that can drive the market is at its height. This has been exacerbated by the actions of the Russian government.

The speculators with a short on the market must cover their shorts and buy in contracts to stem any losses. These sharp changes in position can create a ‘short covering rally’, which partly explains the recent rally in grains followed by a retracement.