Market Morsel: ‘Smart’ money getting back into wheat.

Market Morsel

As a grower, you are naturally ‘net long’. You are going to grow a commodity which will at some point in time, be sold; you have a supply (long) of a commodity. Conversely, if you are a consumer of grain, you are generally ‘net short’, you need to buy a commodity.

A speculator can be either long or short. Speculators trade the market based upon their viewpoint. They have no interest in the physical production or consumption of the commodity, they just want to make money from a position.

Gaining an understanding of how speculators are positioned is valuable. It provides us with a market signal and gives an insight into their sentiment of the market. The Commodity Futures Trading Commission (CFTC) provides a weekly report called The Commitment of traders (COT), which provides this insight.

The COT report is released every week, on a Friday. The weekly data is the positions held as of Tuesday; therefore, there is a delay.

If speculators are short, this means that they are ‘betting’ on the market falling, if they are long the converse applies.

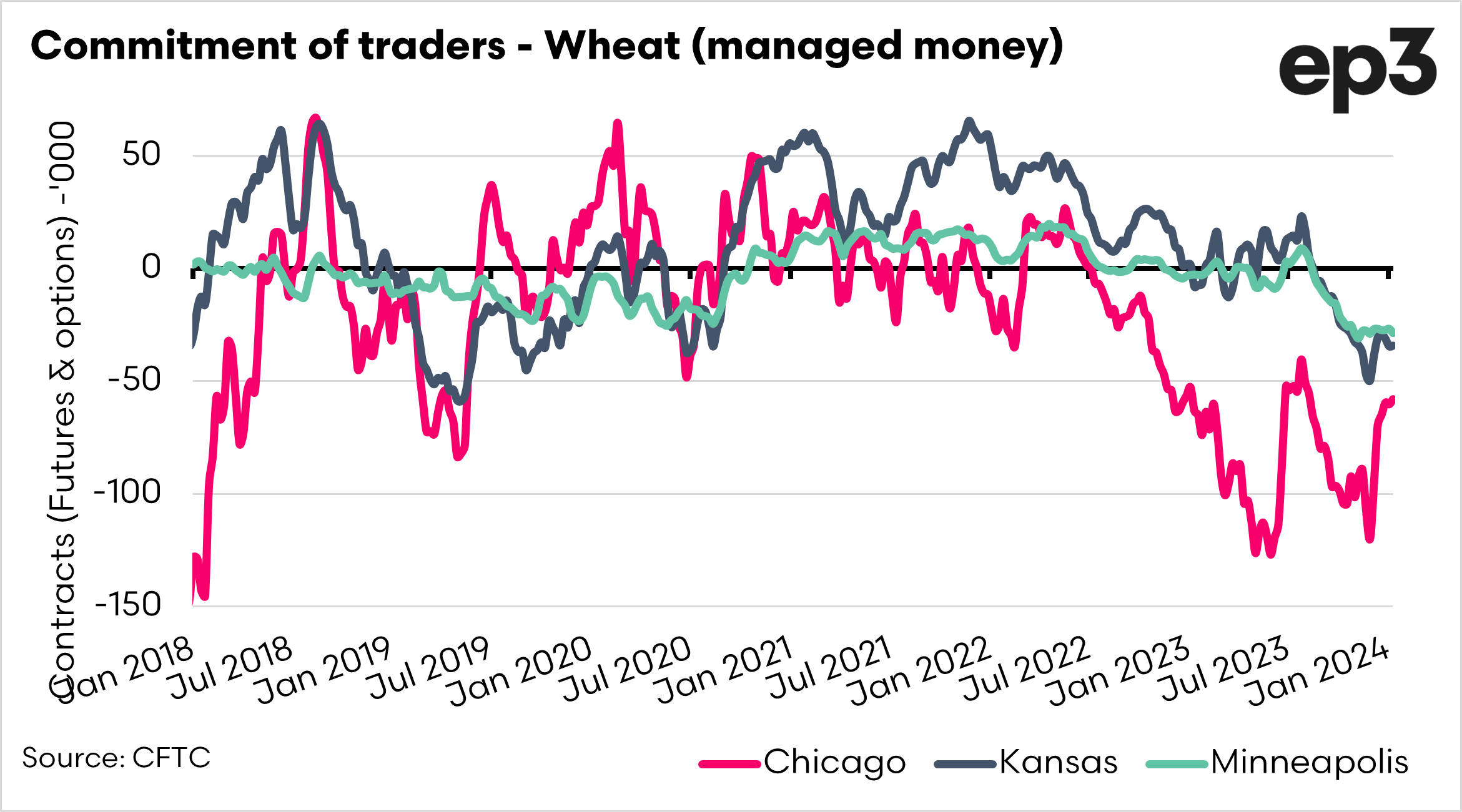

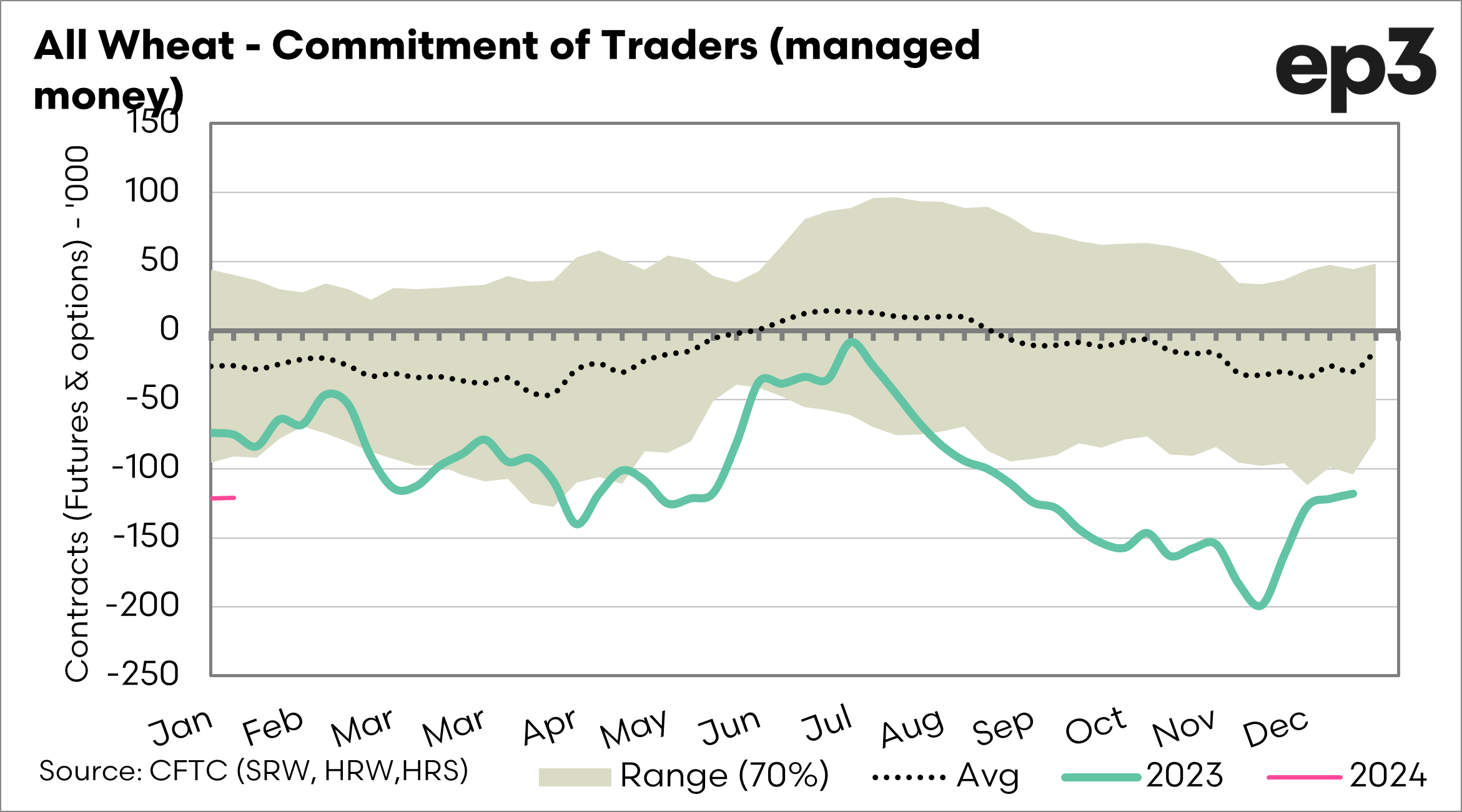

The chart below shows the positioning of traders since 2018 for each US futures market. Throughout 2022 and 2023, the most traded wheat contract, Chicago wheat has seen speculators holding a new short position.

This indicates speculators’ overall view that the market would fall and that they would benefit from a falling market through selling contracts.

In recent weeks, we have seen speculators reduce their net short, and whilst they are still overall short – it is moving closer to neutral.

The speculators in the marketplace have a large influence on the marketplace by providing liquidity. This liquidity can make the market move very quickly, especially if these speculators have to close their positions.

As an example, a speculator who is short of a commodity loses money as prices rise. If there is an event which causes speculators to ‘cover their shorts’, then this can cause a sharp rise as many attempt to close their contracts.