Market Morsel: Stop looking at the Yanks for wheat.

Market Morsel

CBOT is up by x, CBOT is down by x. Around the world, the grain industry has been focused heavily on what is happening with US wheat futures. We probably should be looking elsewhere as well.

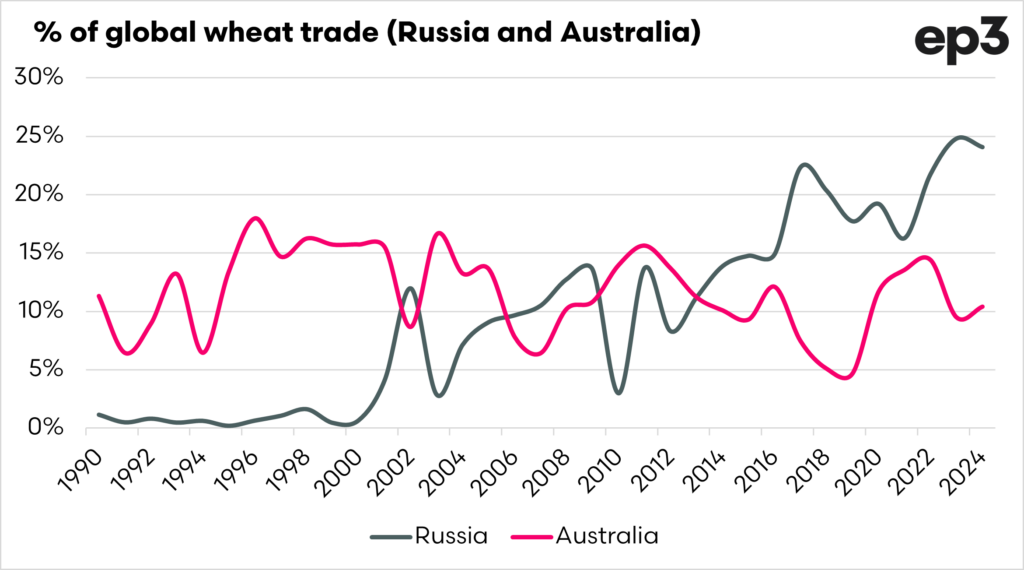

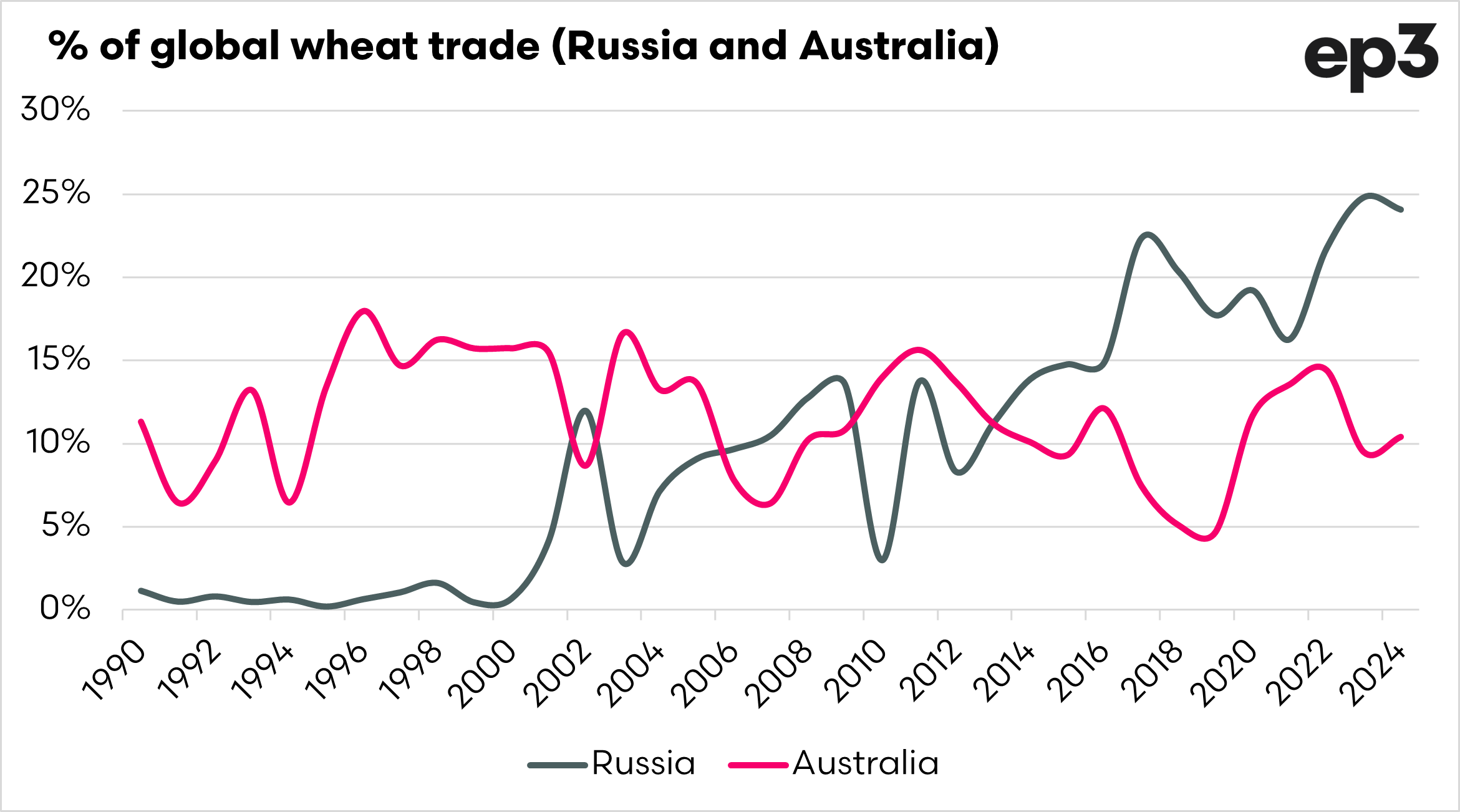

We regularly discuss the importance of Russia. The chart below highlights Russia’s rise, from around 1% of the global trade in wheat in 1990 to 25% in recent years. During 2022, Australia provided around 15% of the world’s wheat in one of our highest years of production.

If Russia is the big player in the global wheat market and is likely to remain so, maybe we should look closer to Russia for price direction, but they don’t have a futures contract that works?.

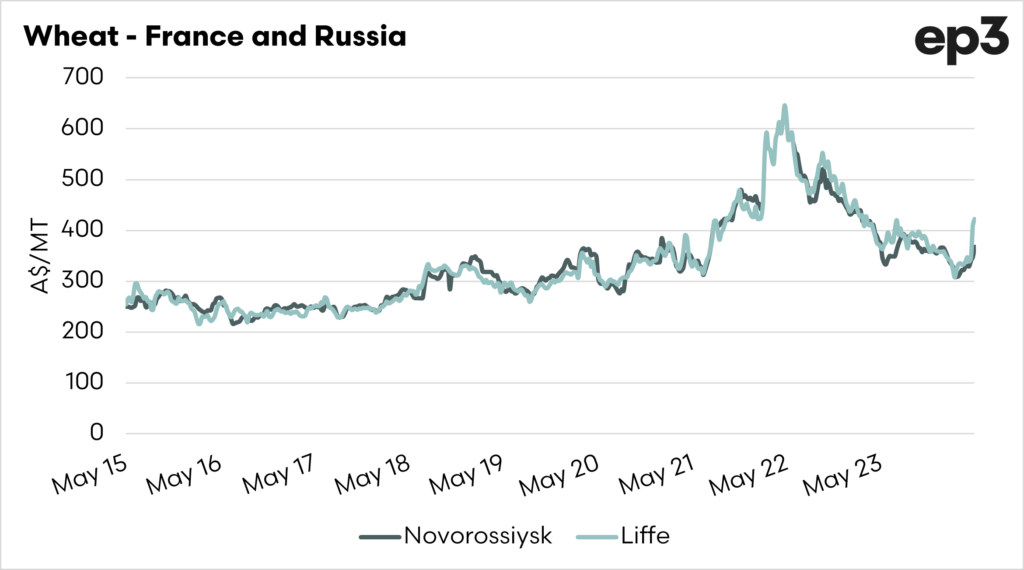

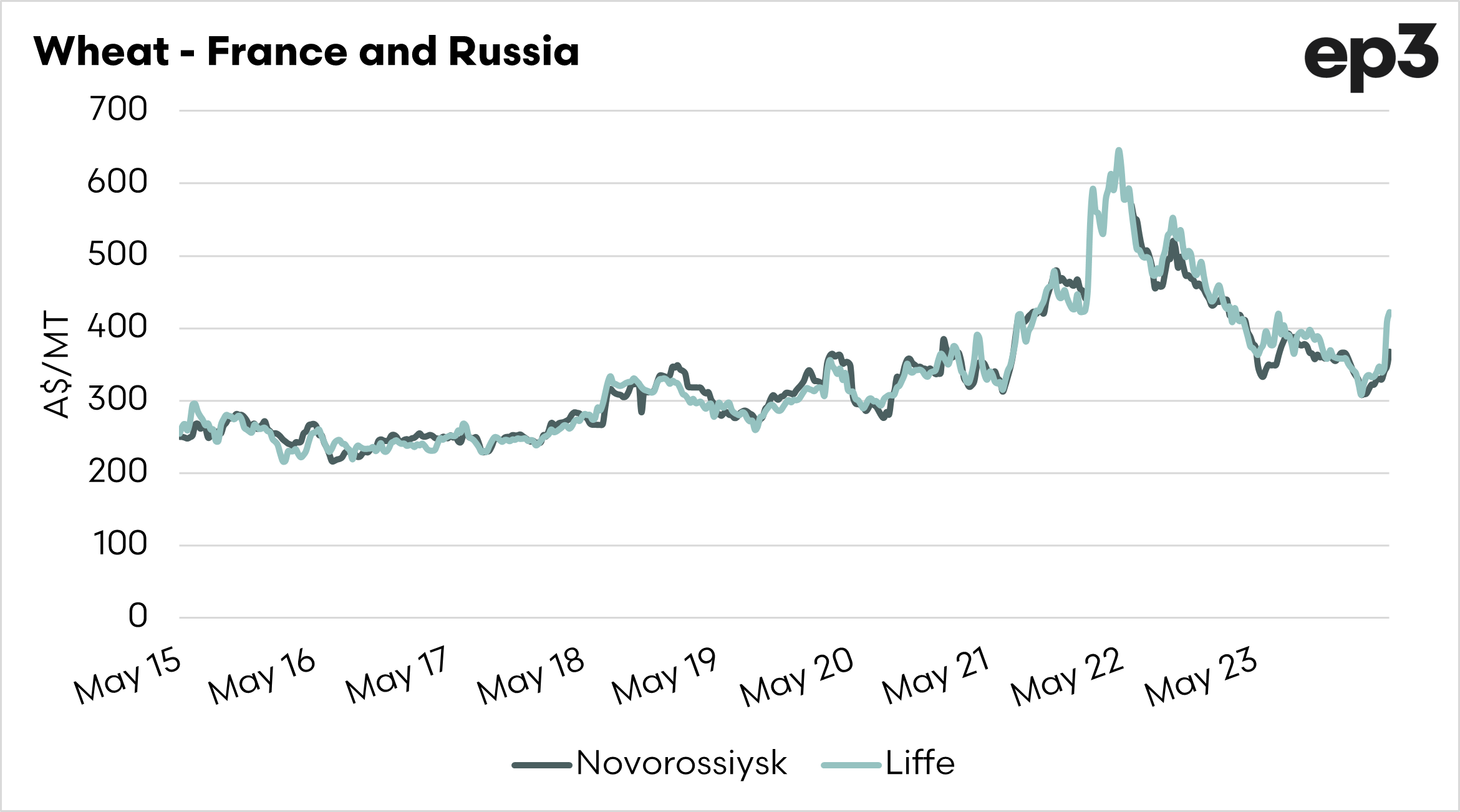

The MATIF wheat contract is based in France, and is generally used as a proxy for European wheat. As all wheat markets are interconnected, we can expect to see a relationship between Russian and French wheat pricing.

The second chart below shows the relationship between the two markets. There was a period in 2022 when pricing was unavailable, the time when Russia invaded Ukraine.

This chart shows that prices for both markets strongly correlate and tend to follow each other very strongly.

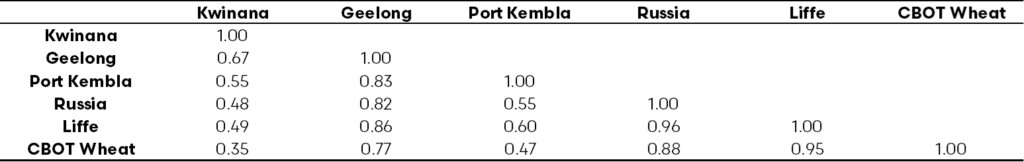

The table below shows the correlation from June 2022 to the present. The correlation between Australian prices and overseas can be quite divergent between ports.

Later in the week, we will analyse which futures contracts are the most appropriate for Australian producers/consumers.

In this analysis, we can see that MATIF wheat futures strongly indicate the price in Russia.

The good news is that weather concerns in Russia are continuing to push up pricing around the world.