Market Morsel: Stuck in a maize?

Market Morsel

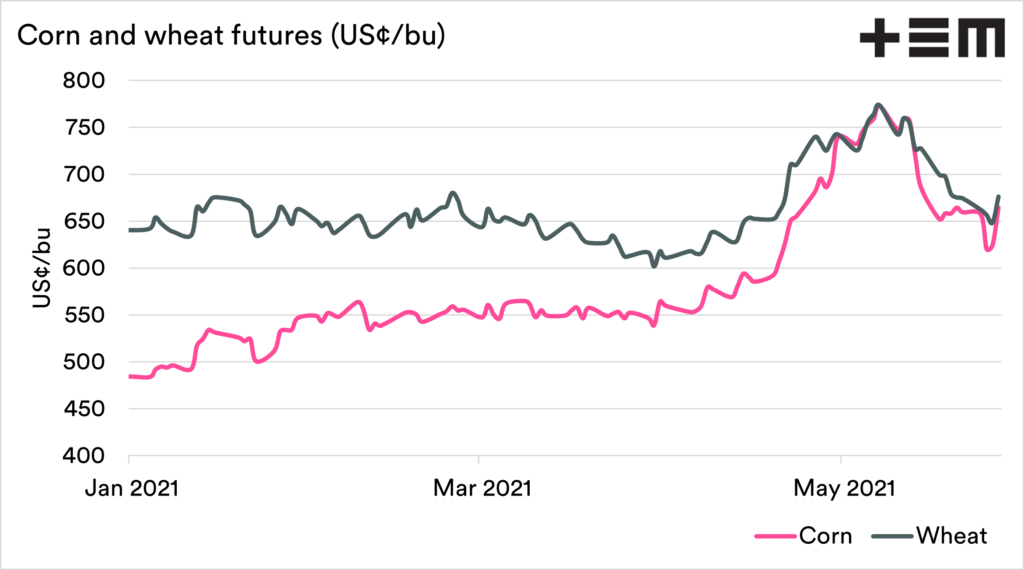

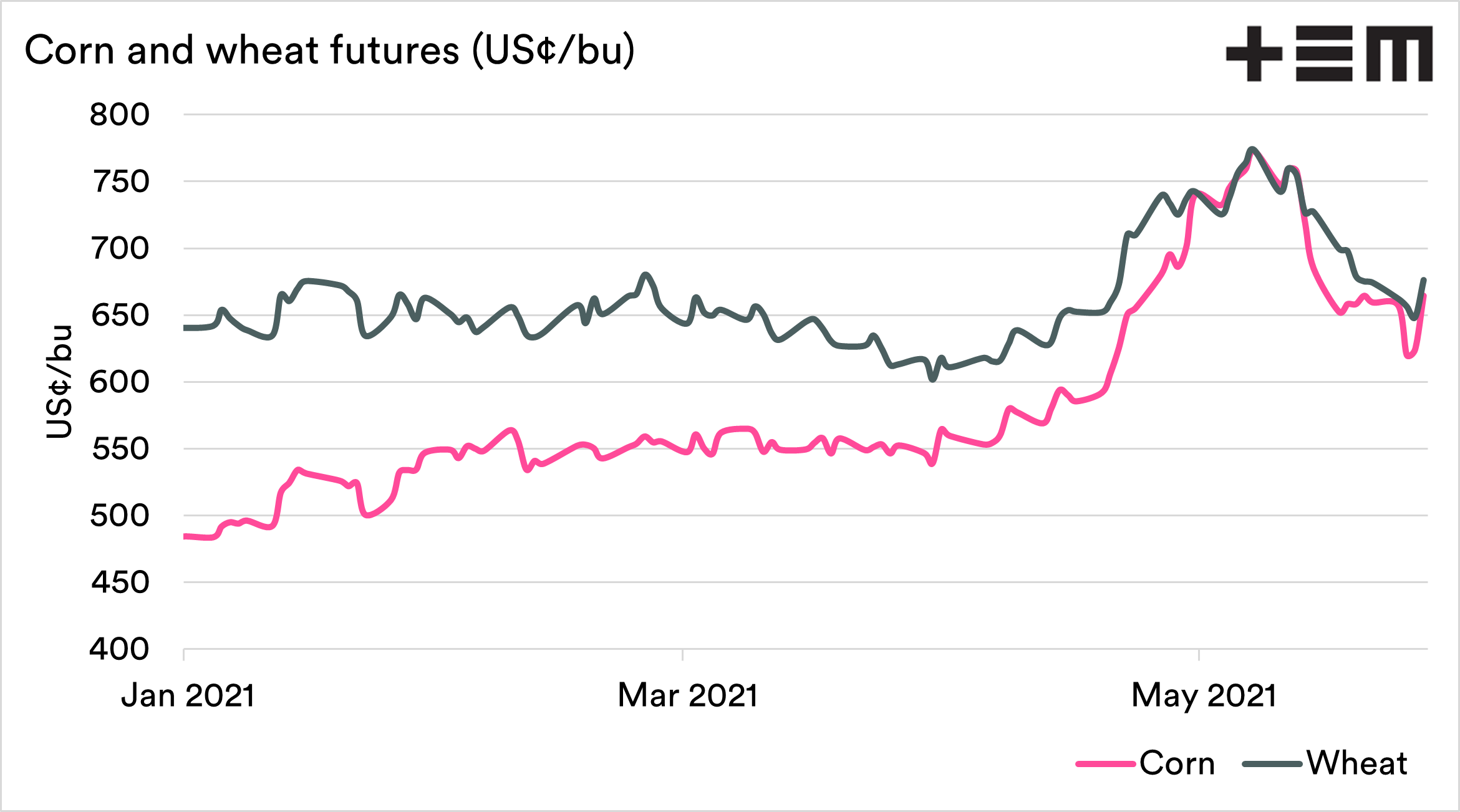

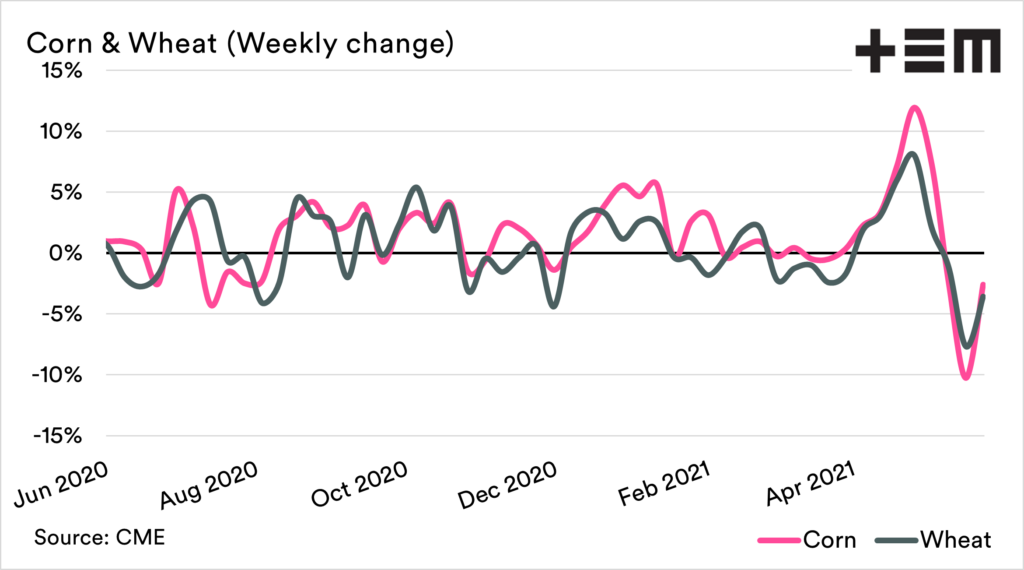

The relationship between corn and wheat pricing is a known factor. We are going to be stuck following corn. The corn market is the driver of the wheat market these days.

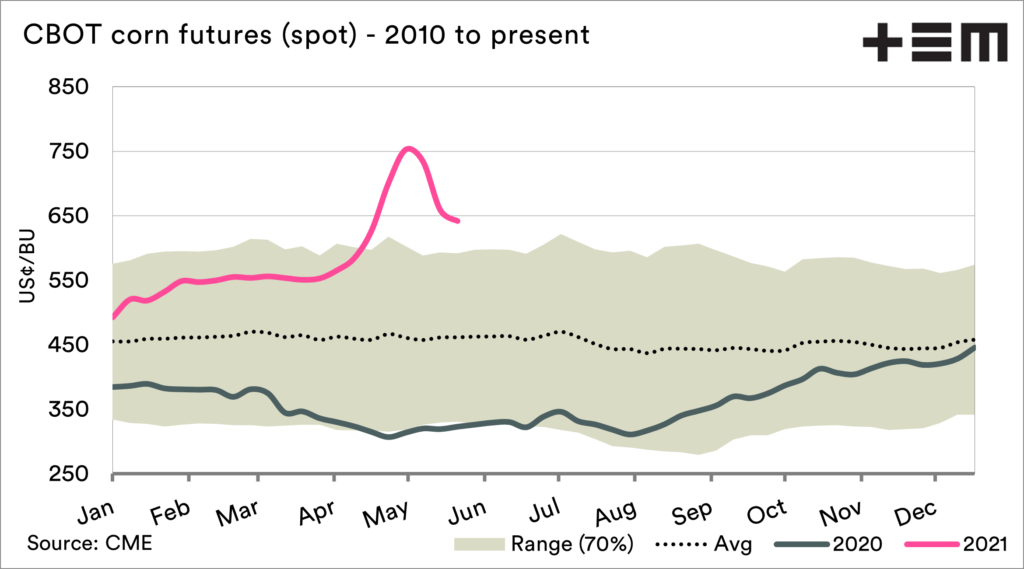

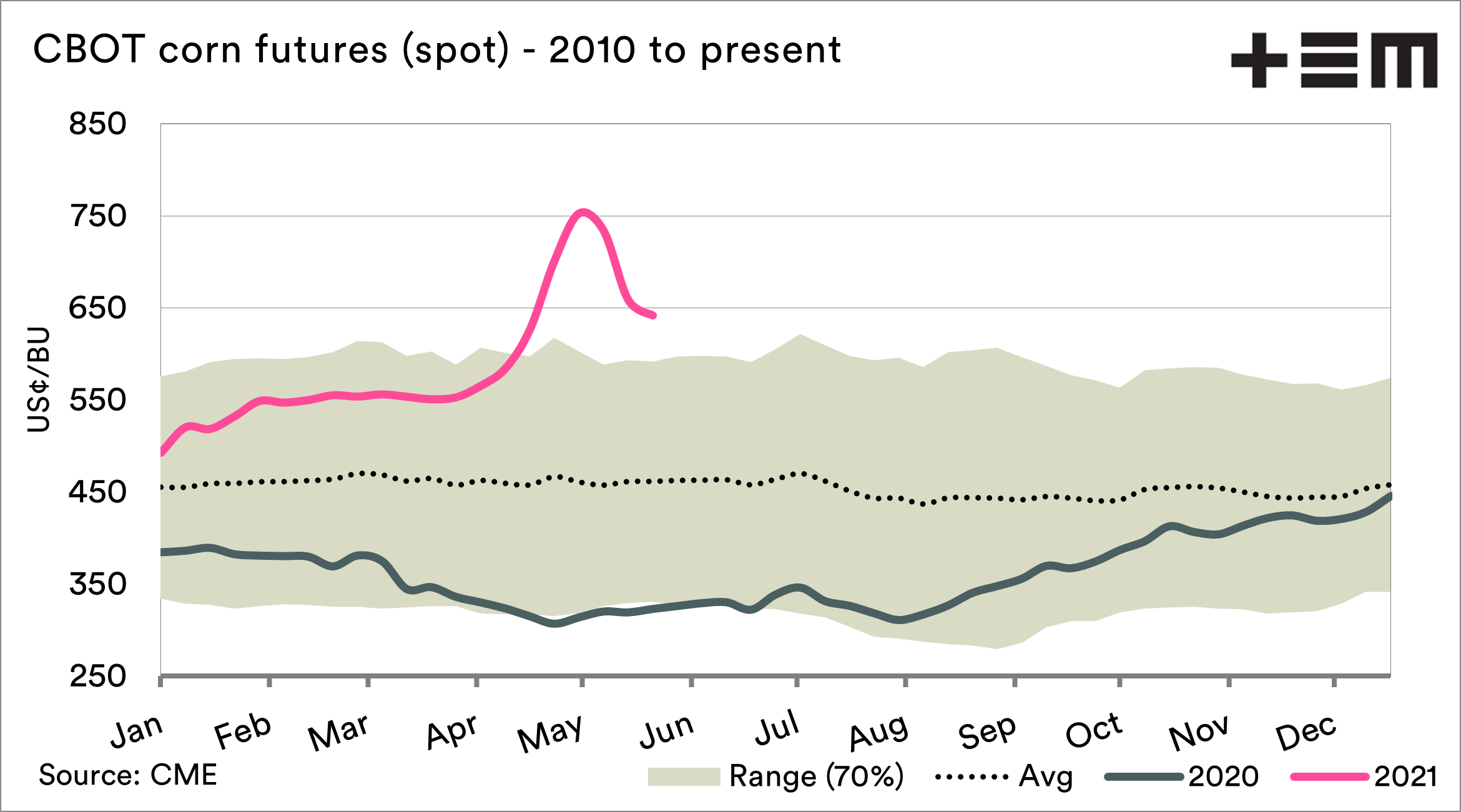

The first chart shows the seasonality of corn pricing since 2010, with last year and this year overlaid. Over the past eight weeks, the rise and fall has been phenomenal, but last night we got a turnaround.

Last week I had spoken about Chinas massive corn purchase program (see ‘China buying the dip’). China has been rampantly purchasing large volumes of corn whilst the market had fallen.

It’s important to note that not all purchases will actually be executed; many will end up being cancelled. There were rumours this week of Chinese cancellations of some purchases, and that China was concerned about some imports.

The imports which they are concerned about are those into their free trade zones. China has a tariff rate quota (TRQ) of 7.2mmt. All corn imported has a tariff rate of 1% until 7.2mmt is breached. After this, the rate increases to 65%. Some importers have been processing in the free trade zone into feed products to get around the tariff. Extra scrutiny may hinder some appetite.

Last night though, we saw a strong recovery in pricing levels in corn, as export sales for new crop are very strong compared to historical levels. The rumours weren’t able to negate the large sales on the books.

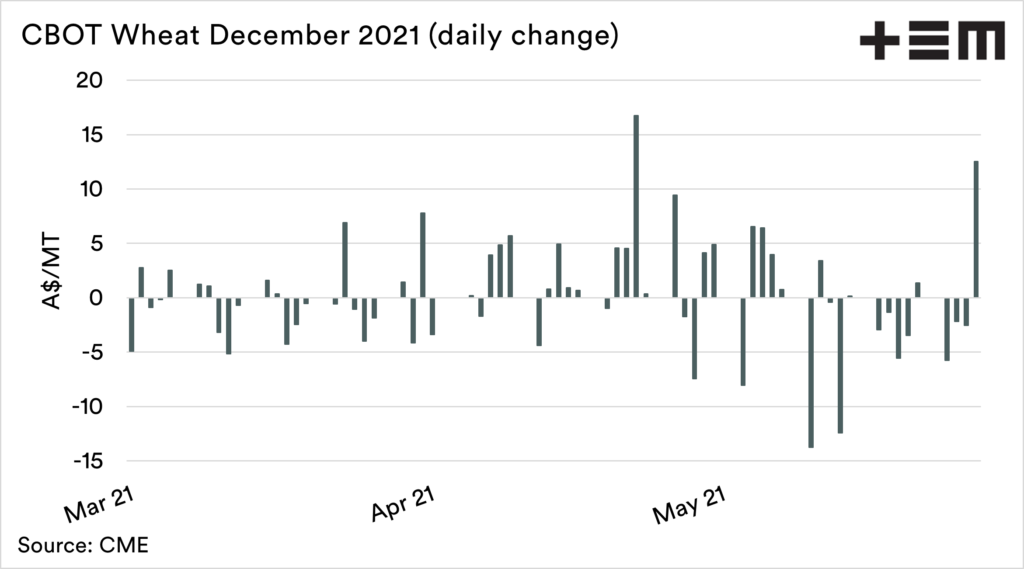

The wheat price followed in step with corn, gaining A$12.5/mt for the December contract. We are caught in the corn maze, and it will likely be corn continuing to drive our market for quite some time.