Market Morsel: The good, the bad and the neutral

Market Morsel

SovEcon, a leading Black Sea agricultural markets research firm, assessed the implications of the new floating permanent wheat export tax which could become effective in Russia in several months. The proposed tax formula is 70% of the difference between the export price and $200 (i.e. $300 wheat export price means $70/mt tax – $300 less $200 and multiplied by 70%).

New export tax implications:

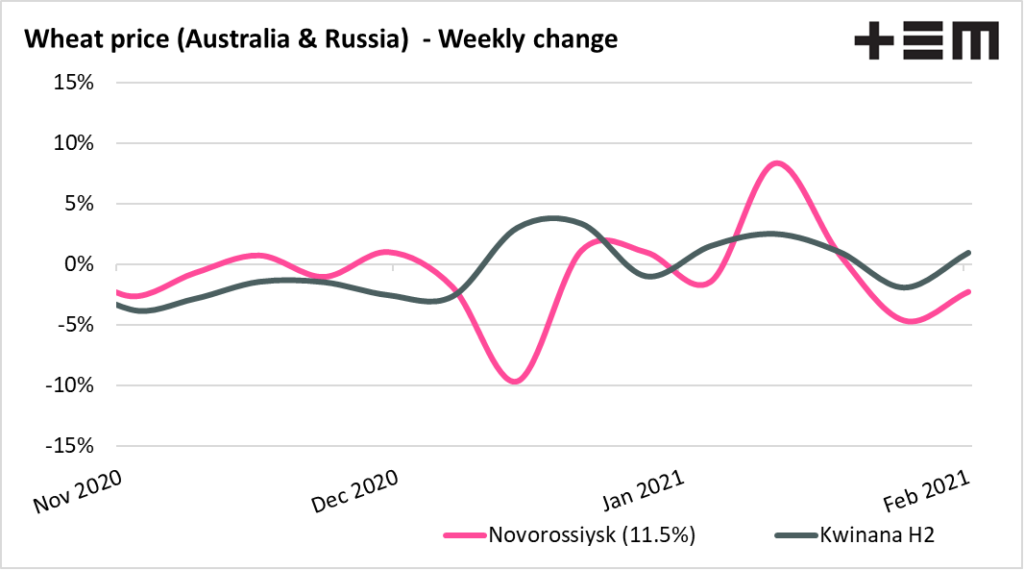

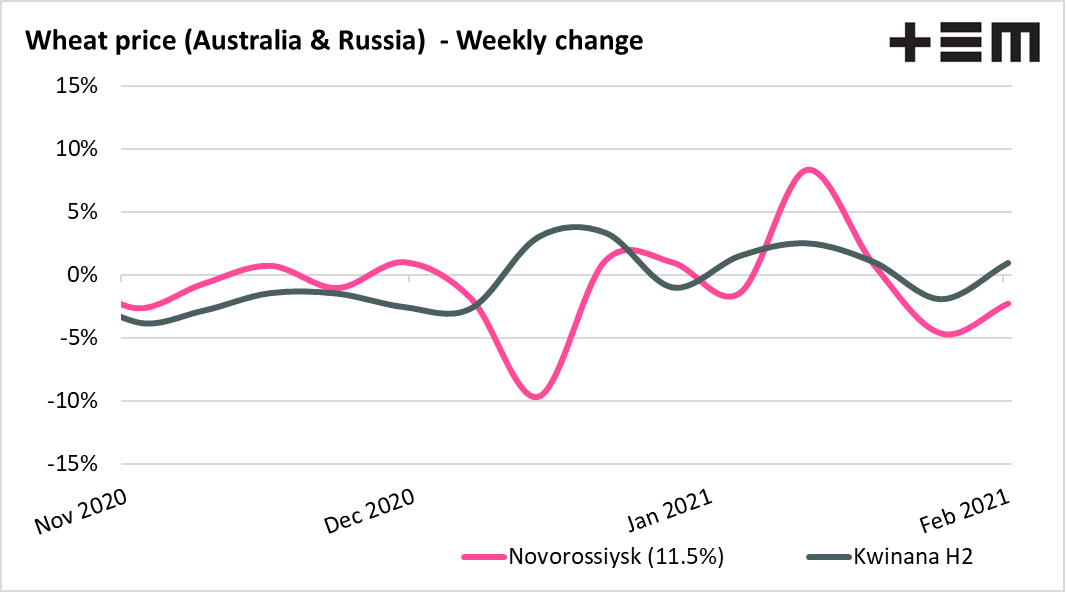

Bullish short-term for wheat as the market could be expecting lower exports from Russia on new restrictions

Neutral fundamentally/slightly bearish for the wheat market in 2020/21. In fact, this tax could stimulate farmers to sell more aggressively in the domestic market and boost wheat exports closer to the end of 20/21. This has been already reflected in our recent 2020/21 Russian wheat export forecast when we upped our estimate of exports from 36.3 MMT to 37.9 MMT on expectations of floating tax news

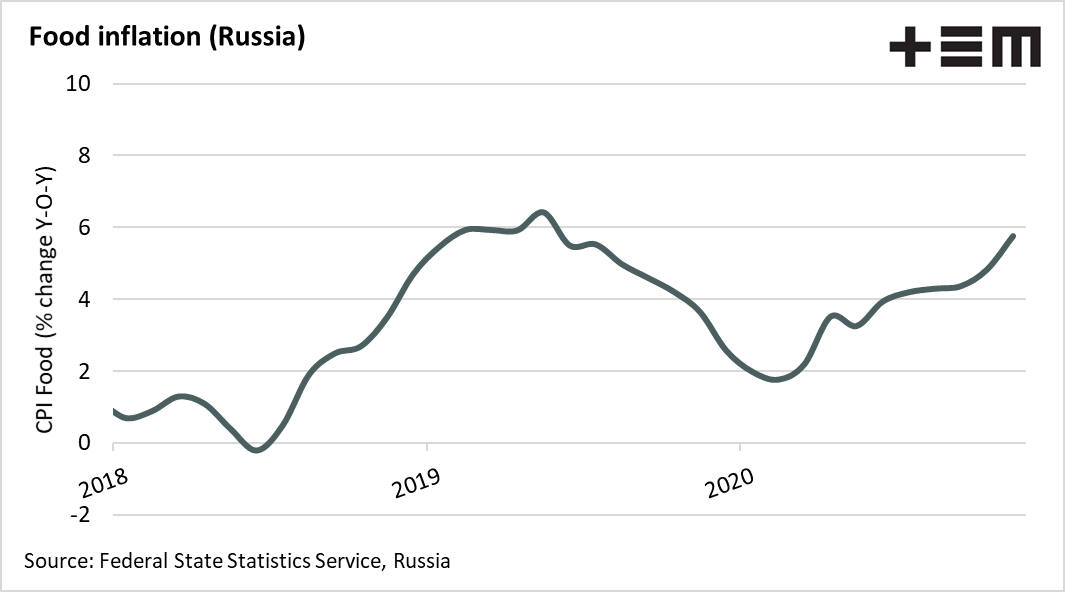

Bullish 2021/22 wheat prices. The tax is likely to lead to a smaller than expected spring wheat area in 2021. SovEcon’s 2021 wheat crop estimate of 77.7 MMT could be cut by 1.5-2 MMT

Starting from 2022, Russia’s wheat production uptrend could reverse sharply. The area under winter wheat during 2021 autumn planting for the next year crop could decline by around 5-10%

New tax regime implies that Russia’s crop growing industry could lose around $4.8 bln of revenue (360 bln rub; USDRUB 75) in 2021/22 (estimate is based on 76 MMT wheat crop assumption and $290 average price). In 2020/21 farmer’s losses thanks to grain taxes are estimated a $2.8 bln (211 bln rub; USDRUB 75).