Market Morsel: The great barley wall of China.

Market Morsel

This month, China is set to return its response to Australia regarding it’s accusations of anti-competitive dumping. Any day now, either China will state their position to remove the tariffs, or the action will go back to the world trade organisation.

The effective ban on Australian barley commenced in May 2020 and was due to staff in place for five years. Only two years are left before the tariff was set to be removed.

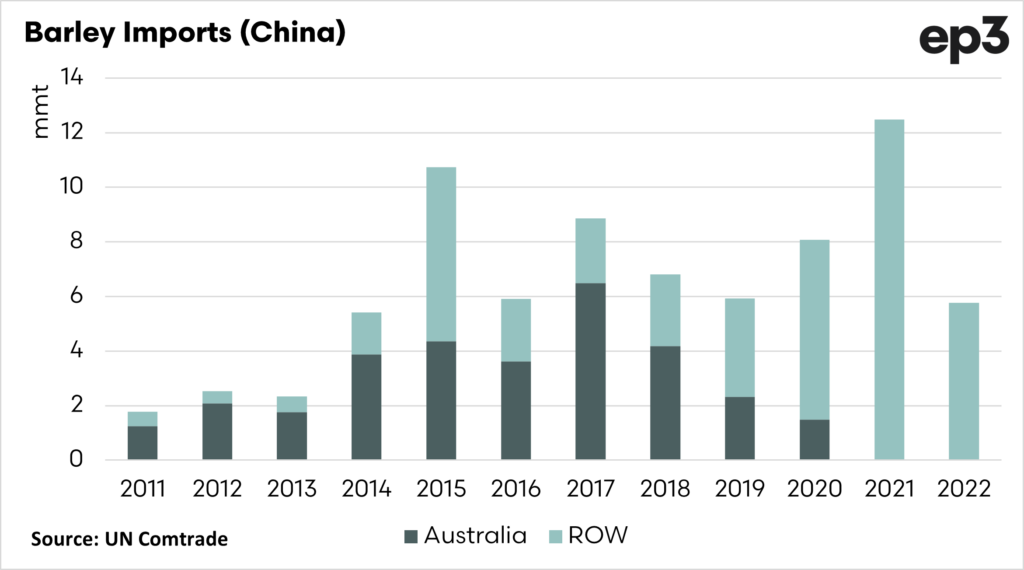

Australia provided the lion’s share of barley into China until this dispute started. We can see in the chart below the Australian exports vs the rest of the world. Chinese imports have been strong in recent years, something we have covered many times.

China could do without Australia; they could import from a whole gamut of different nations. Argentina and France were the main winners from the loss of the Australian barley trade to China. In reality, China also lost out by limiting their options of who they could purchase from.

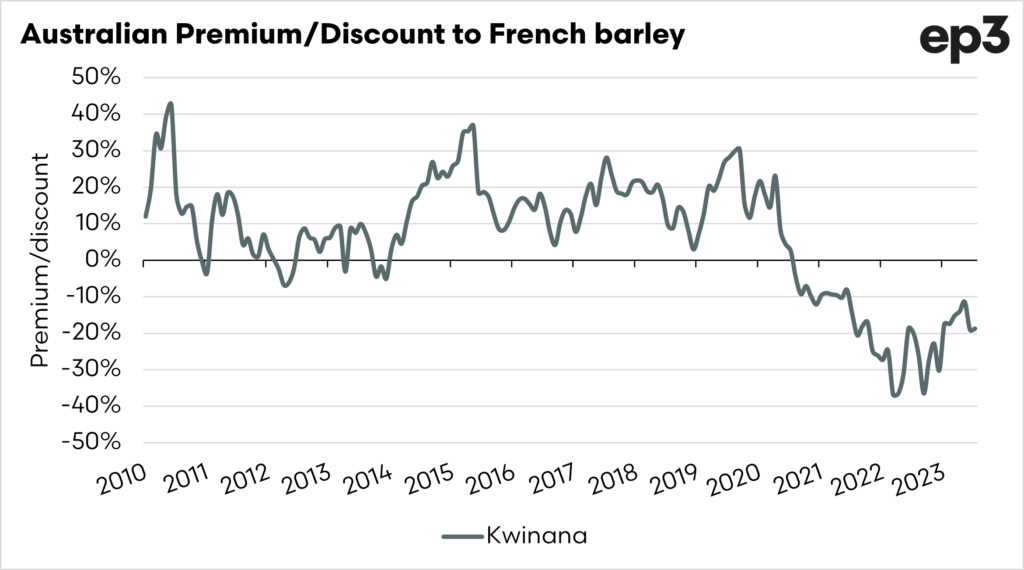

The second chart below shows the premium/discount between Kwinana barley and Rouen in France. For most of the past decade, Kwinana has traded at a premium. Since the start of the tariff, Australian barley has stayed at a discount.

I expect that the Chinese tariff will be removed, and we will have access again. It wouldn’t surprise me to see Australia back at the top of the rankings for Chinese imports and our price starting to reduce the gap.