Market Morsel: The highs and lows of wheat.

Market Morsel

Wheat markets are volatile, they go up, and they go down. That can be scary for many, making it difficult to know when to make the right decision.

The volatility can provide opportunities; when the market has a sharp rally, you can start to sell and take advantage of it. When the market falls, grain consumers can take advantage and lock in some pricing.

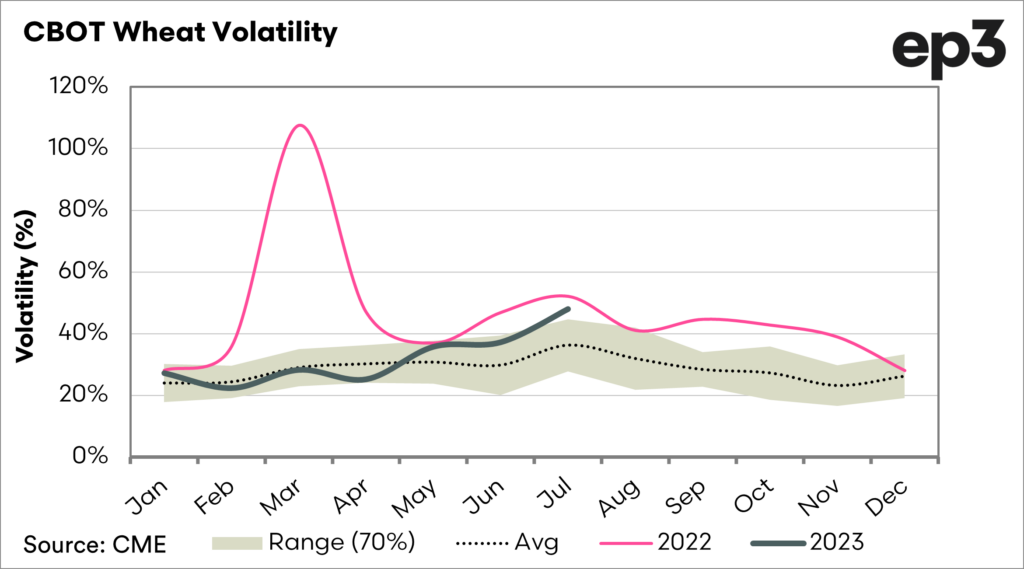

The first chart below shows the volatility in the market for this year and last, along with the range of where volatility has typically been over the past ten years.

Last year was extremely volatile, especially during the early months of the invasion of Ukraine. The volatility was low at the start of the year but has increased to above the standard deviation over the past three months.

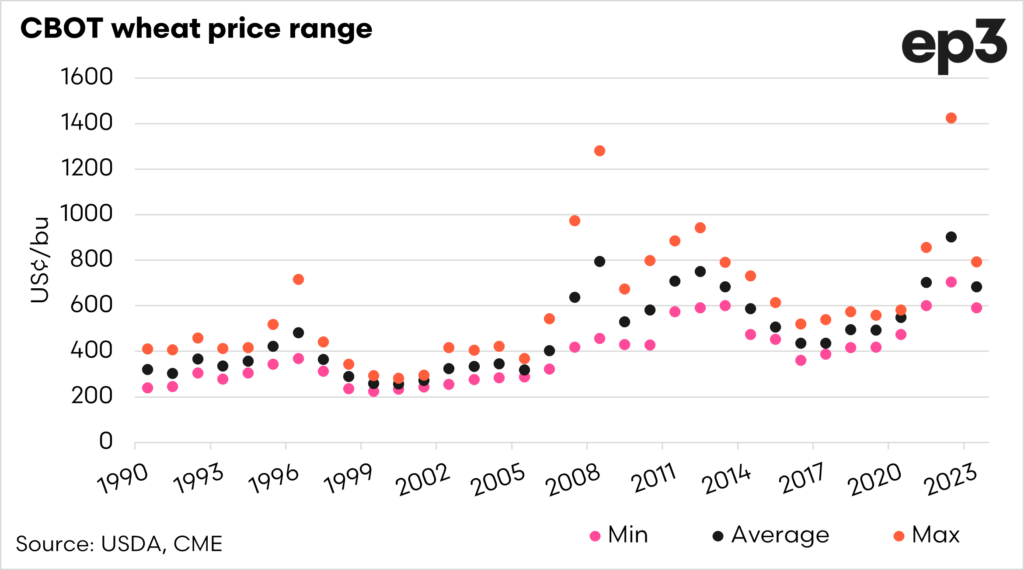

The second chart below shows wheat’s annual max, min and average price (in US¢/BU). Typically the range is relatively close.

There are years when the spread between the min and max price can blow out, and last year was a prime example.

We are already beyond the mid-point of the year and moving into a period where there will be an element of certainty of what is being produced worldwide (late Aug onwards).

Typically this can result in lower volatility. We are in a year with a major conflict between two of the world’s major grain exporters – so anything is possible this year.