Market Morsel: The horizon offering better pricing for wheat?

Market Morsel

It might seem like a long way until the next harvest, but we should always be thinking about what we are going to do.

The weather forecast for the next couple of week probably means that the headers are going to be parked up. So, you might have some spare time to think about markets.

When looking at prices in the far horizon, we generally have to look at futures markets and be aware that liquidity is lower the further down the horizon.

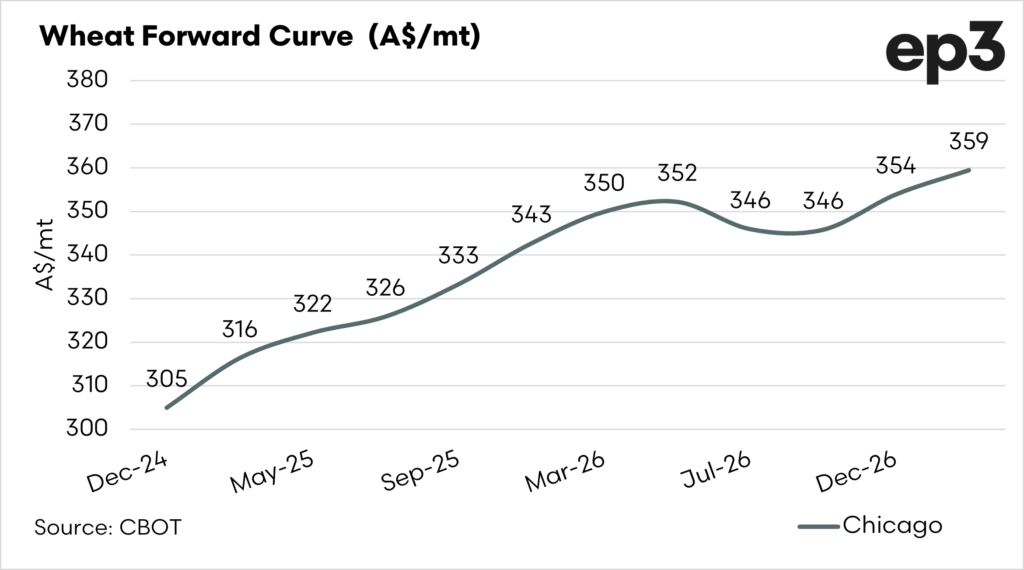

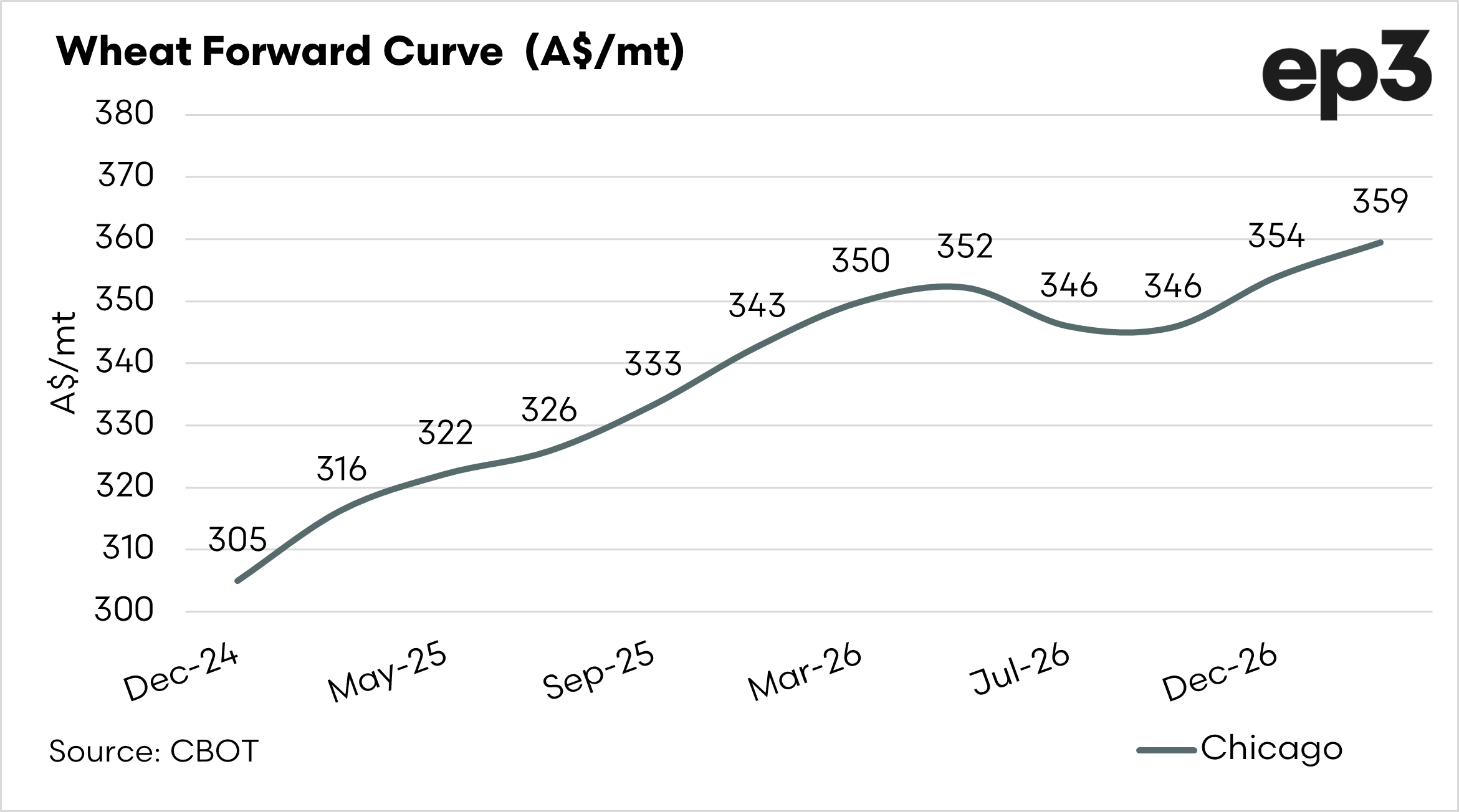

Let’s first take a look at the forward curve. The forward curve in wheat futures markets represents the prices of wheat contracts for delivery at various future dates. It shows the market’s expectations of future wheat prices and can indicate whether the market is in contango (future prices are higher than spot prices, reflecting storage costs or expectations of rising prices) or backwardation (future prices are lower than spot prices, often due to high demand or low supply).

The wheat forward curve is currently in contango, where the future months are at a premium to the present. The nearby contract is currently at A$305, but the contract for next December is at A$343.

So what does this mean? Theoretically, we could sell a wheat futures contract for next December at A$343.

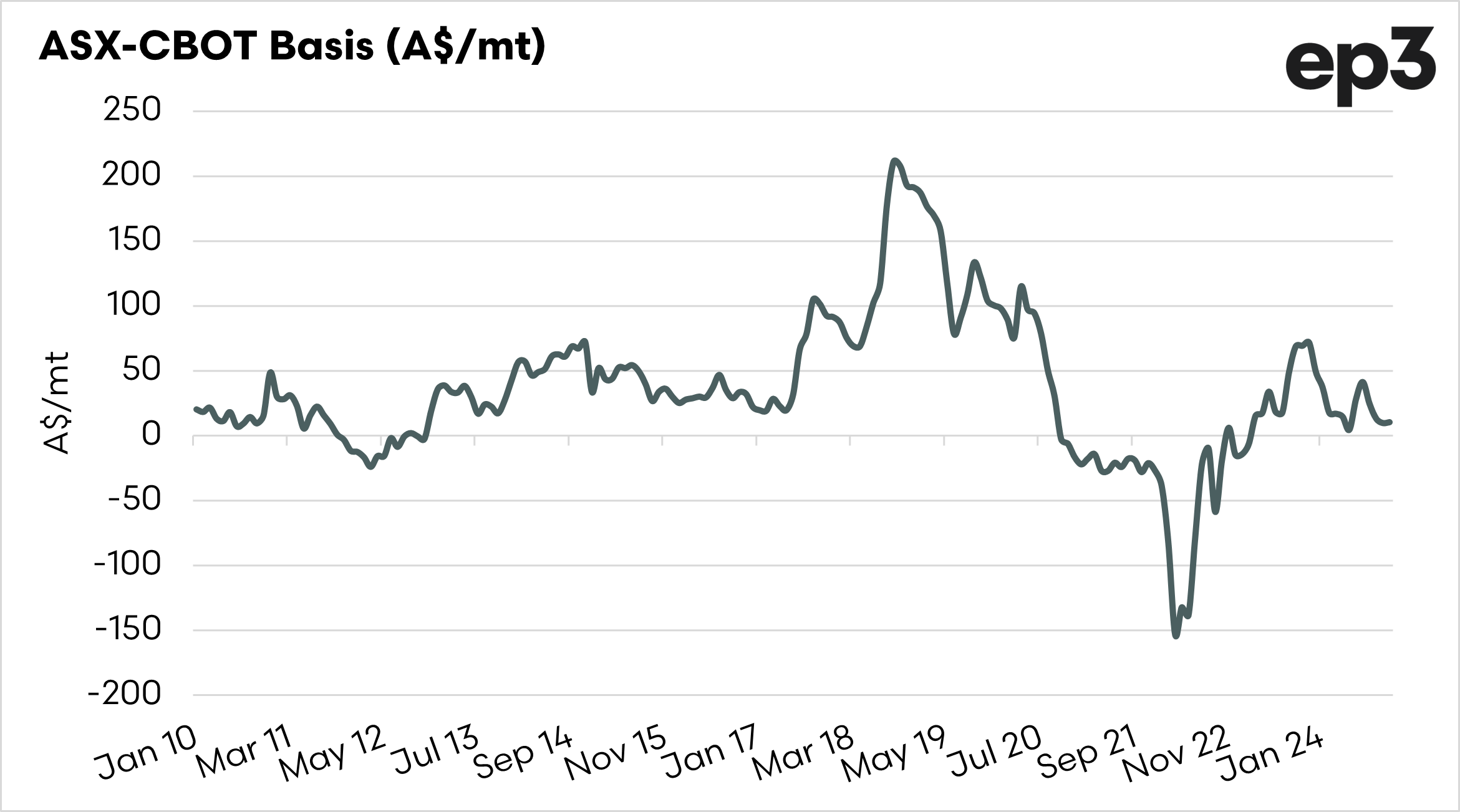

That isn’t the end of it, though. We would have to consider basis then. Our basis is our premium or discount over the chosen wheat futures contract.

Historically, Australian wheat has traded at a premium to Chicago wheat, and many advisors used to assume a premium.

However, that theory has been tested in recent years, with basis declining to a discount during our years of large production.

So it is important when thinking about hedging your wheat further down the horizon to be very conservative with your expectations for basis. It could be A$50 giving you an end price of A$393 or it could be -A$50 providing a result of A$293.

The one major tip, though – is never to do too much volume. Be conservative this far out.