Market Morsel: The new year – the new horizon.

The Snapshot

- The wheat market has been up and down over the past year.

- There were two large peaks in pricing during May and October.

- It is important when marketing grain to ensure that we take advantage of opportunities when they present themselves.

- We do not advocate for picking the market – as you’ll lose.

- Run your own personal pool and get an average (or preferably above average!)

The Detail

Welcome back to 2023. It’s been a very ‘interesting’ few years, and it will likely continue in a similar vein in 2023.

It’s always hard to look forward. We’ve only just finished, or in many cases still going through the 2022 harvest – but is it time to start looking at the new season?

My view is that when it comes to marketing grain, farmers should always look with a keen eye on the future, as this can provide opportunities for pricing opportunities. There are many hold out on their selling until harvest, and there is nothing wrong with that, but it doesn’t always provide the best opportunities.

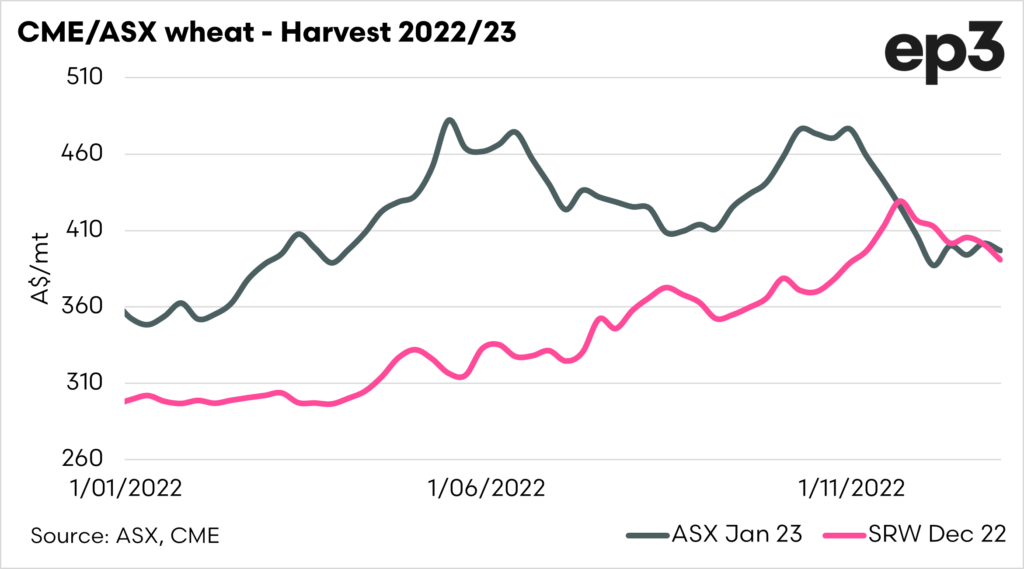

There are plenty of examples where high prices have been on offer throughout the year prior to the market falling at harvest. 2022 is a great example. There were two very stong pricing opportunities in May and October.

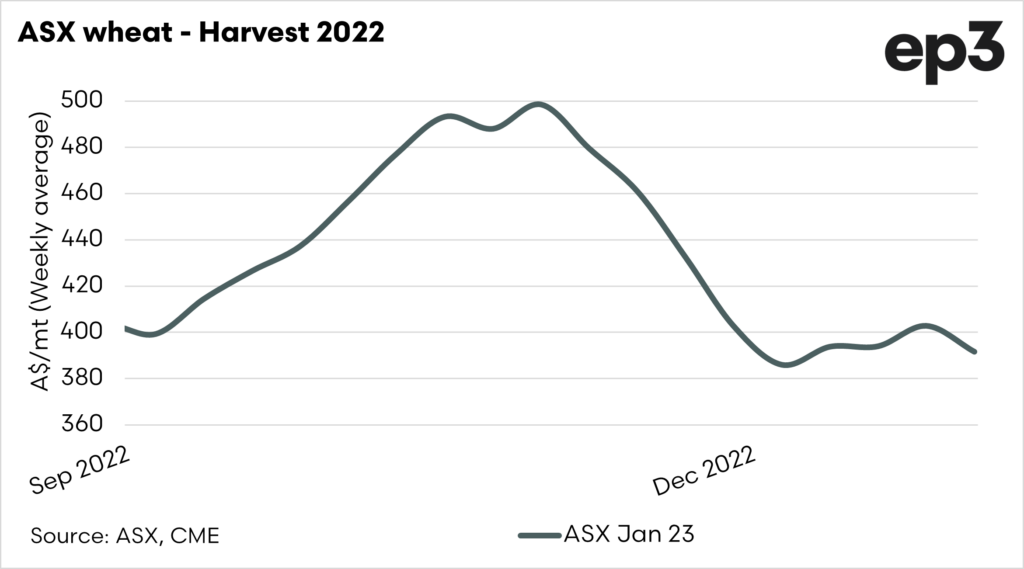

There are many farmers who didn’t take advantage of these opportunities, and to give an example ASX wheat fell from A$499 during the last week of October to A$386 by the first week of December as harvest pressure started to hit.

Selling early sounds like common sense obviously. The market is high, so sell. That sounds easy – in hindsight, that is.

In reality we never know where the market is going to go, whether it will maintain its highs and strengthen or whether it will fall.

I like to think of markets as averages. If the market is high, and we are uncertain of the direction (commonly we are), we start to sell little bits in the market.

How do you eat an elephant? One bite at a time. If we aim for the top of the market, we’ll generally miss it. If we are buyers and trip to pick the bottom, we’ll end up with stinky fingers.

So if the price is historically good, hit it, and average your pricing. Effectively run your own personal mini-pool.

That being said what is happening in the market.

The first chart above shows the CBOT and ASX wheat contracts which correspond with the harvest at the end of 2023. The trend has been downward in recent months since the highs in October.

At the moment, we can book in just shy of A$400 for either ASX or CBOT wheat for next harvest. This still has basis at a relatively small premium compared to the long-term average.

Dependent upon your view on basis, you may be more inclined to hold off on locking in the basis on your forward contract.

The reality is that we don’t yet know what the market will do. A few factors to think about over the coming months:

- We don’t know how the Australian weather will be. It’s been three good rain years – is a fouth possible?

- Ukraine has lower winter crop acres in this year

- US winter wheat conditions are not great.

- The global economic situation is dicey.

My view is if we see large swings higher – especially above A$450 or 500, then you should be considering a bite.