Market Morsel: The positive news from the tariffs – Canola

Market Morsel

Australia was among the countries that got the best deal and largely dodged a bullet. The indirect effects, or the ricochet, are now where the risks and opportunities arise, and today, we see one of the benefits, and it has to do with Canada and Canola.

The best news from ‘liberation’ day was that Canadian canola is seemingly exempt from tariffs due to the existing Canada-United States-Mexica (CUSMA) agreement. Trump has exempted products from tariffs provided that they are CUSMA compliant.

The CUSMA is a trade deal between Canada, the U.S., and Mexico that started in 2020, replacing the old NAFTA agreement. It makes it easier for the three countries to buy and sell goods and services with each other by reducing taxes (tariffs) and trade barriers. To get these benefits, products must follow certain rules. The major one is that they must be mostly made or grown in one of the three countries. It’s meant to support fair and smooth trade across North America.

To be compliant, the products must be:

- Originate in Canada, the U.S., or Mexico.

- Meet the rules of origin specified in the agreement.

- Be shipped directly between the parties without further processing in a non-party country.

- Have proper documentation, like a certification of origin.

This means Canadian canola oil/meal will flow across the border into the United States and not into the countries we send it to. The most significant impact should be felt on GM canola, as the tariff uncertainty most impacted this.

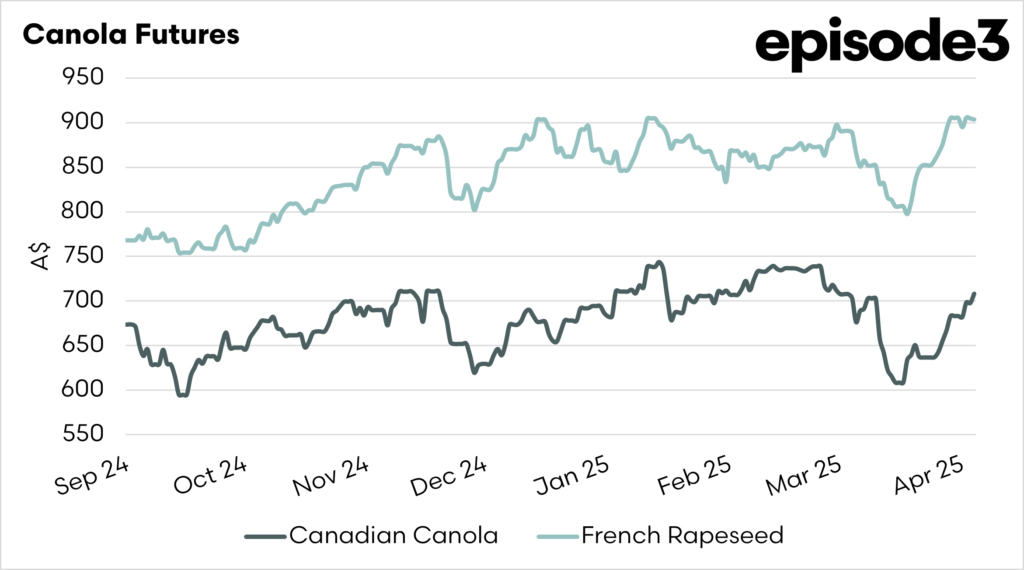

The GM spread in Australia has grown to its most significant spread since at least 2015, causing a great deal of angst to producers who have experienced a much bigger discount to non-GM than expected, significantly reducing their profitability.

The large spread in the past year has resulted from three main reasons. The European crop was reduced, increasing demand for imports of non-GM canola and pushing up the non-GM premium. The rest of the fall was due to the speculation and eventual introduction of tariffs on canola products supplied by Canada to China and the same from the USA.

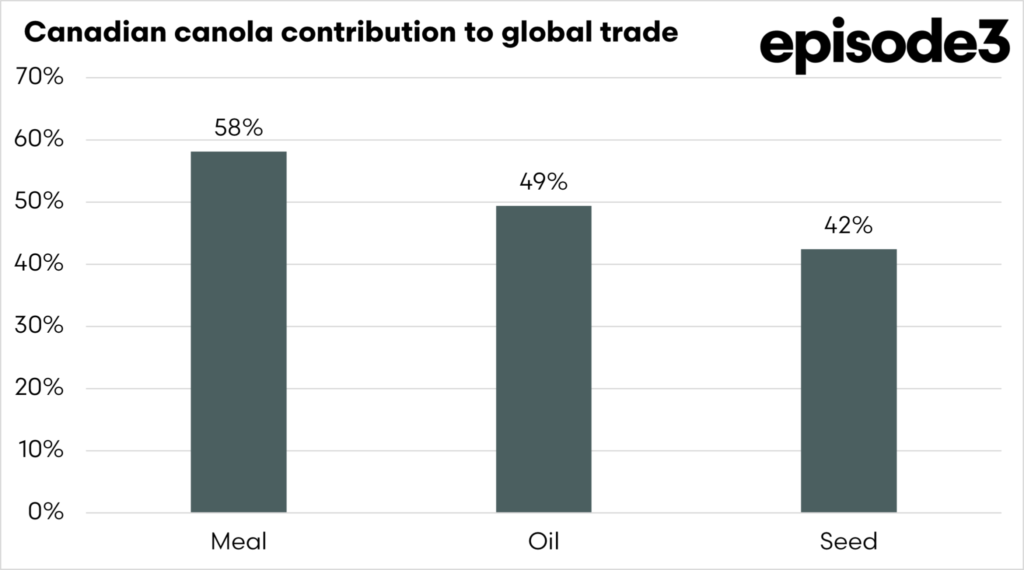

Canada is the largest exporter of canola seed and its derivatives; however, much of it is sent to both the USA and China. The fears were that they would have to find alternate markets and compete with Australian exports. At present, the Australian canola trade no longer has to worry as much about Canada finding alternate markets for their canola going to the USA. However, they still need to worry about tariffs on Canola in China affecting both meal and oil.