Market Morsel: The year that was for grain.

Market Morsel

Happy New Year. The clock has turned over, and we are now in 2025. It is going to be an interesting year, especially from a geopolitical lens.

The weather will also be a determining factor of the global grain crop; there are some concerns about dry weather impacting the Russian crop, which we have mentioned on the website and the AgWatchers podcast a few times. The rest of the world is pretty much anyone’s guess at this point.

At the start of the year, I like to look at how our pricing compares to the previous year. It has been a mixed bag for grain producers in 2024.

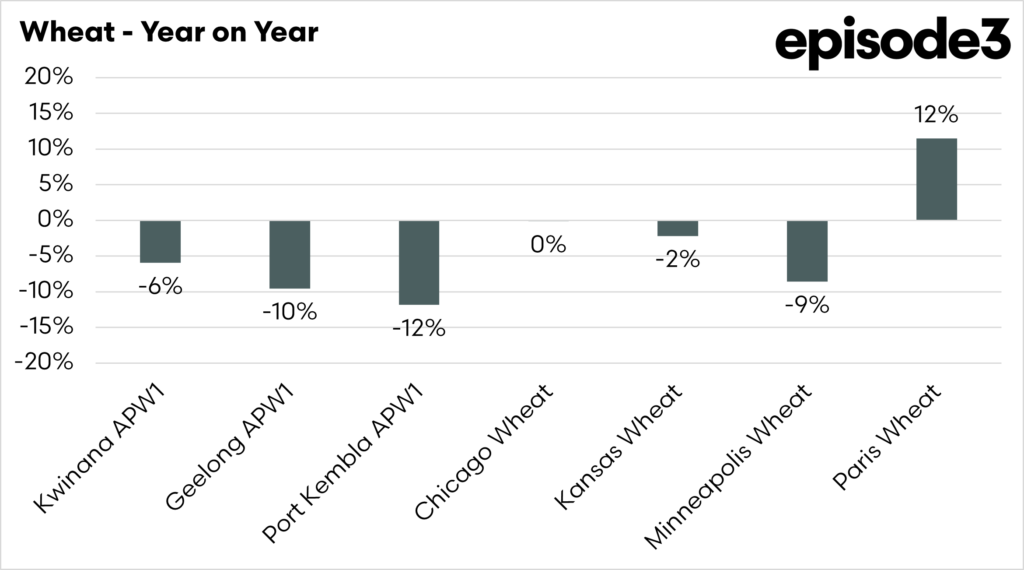

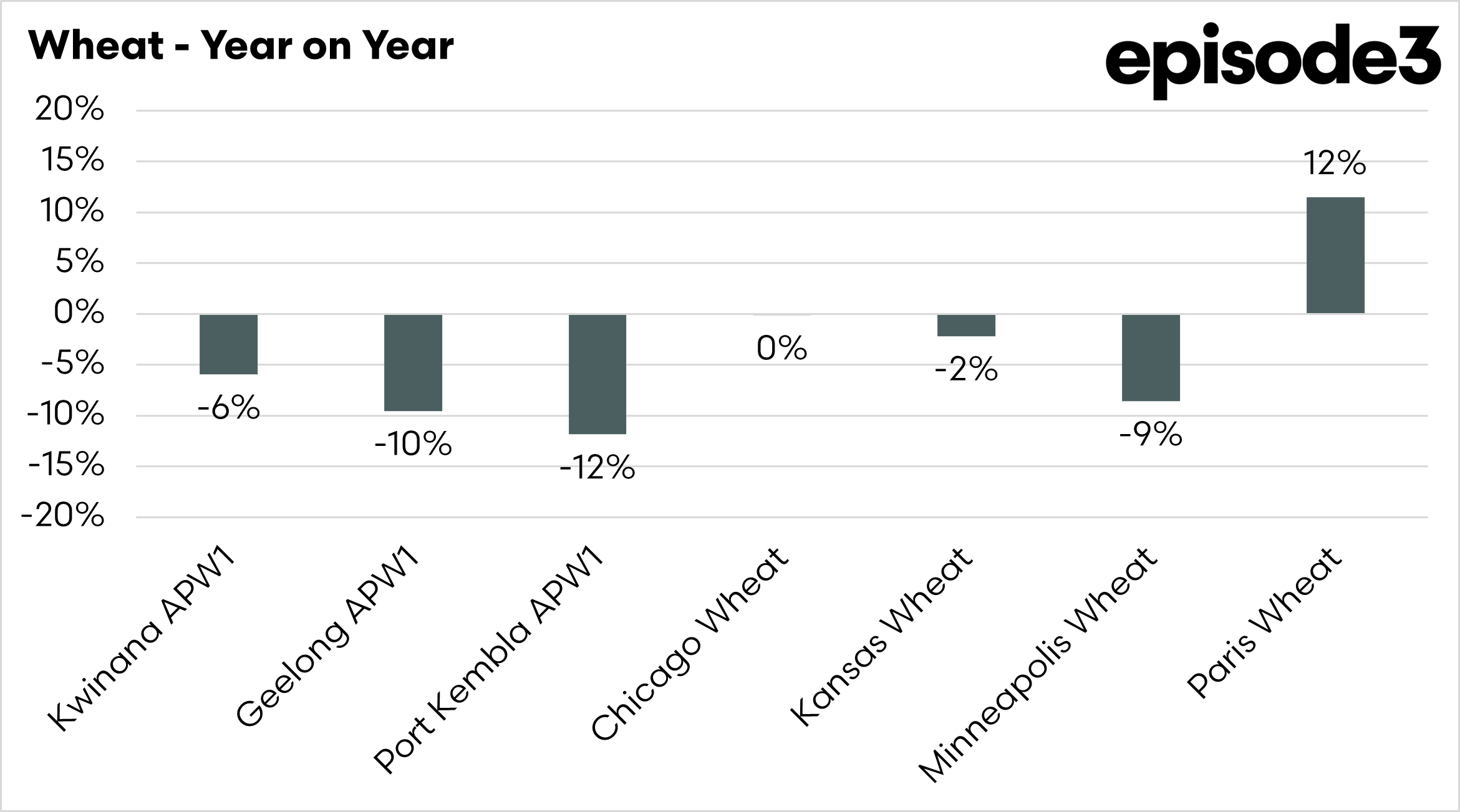

Let’s look at the first chart, which shows wheat. The APW price across much of the country is lower than it was a year ago, with futures in the US also down. The Paris wheat futures contract hower was up, as they had poor crops, and concerns about the coming Russian crop persisted.

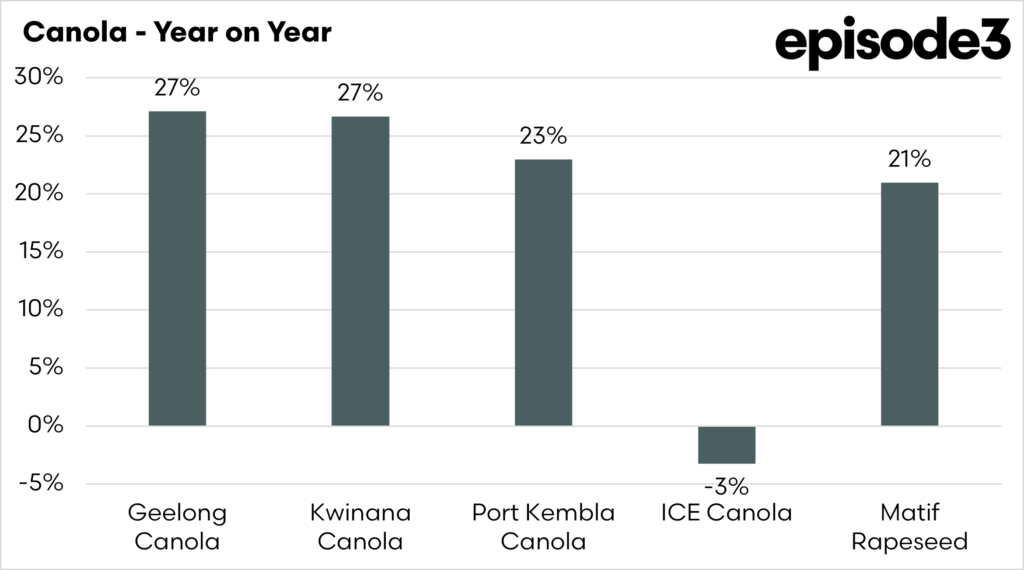

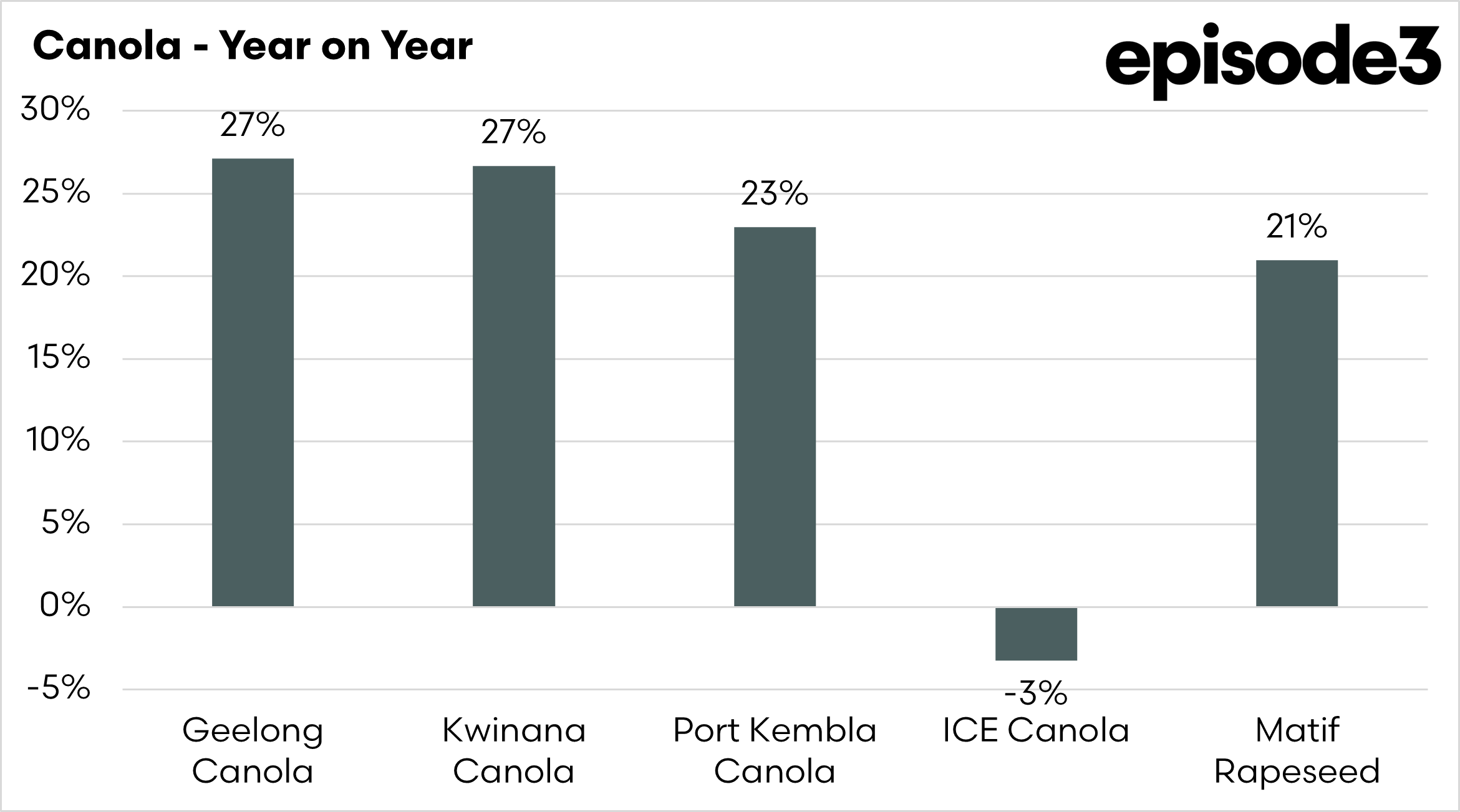

The Canola market, however, trended up futures across the country up a very nice 20%+. This followed French futures after a poor crop in Europe. Australian values tend to follow French values more closely due to our non-GM status and their being our largest market. On the other hand, ICE futures are where they were last year.

It is too early to say how the year will pan out, but as we have mentioned many times, stocks of the major exporters are tight, and a few crop disasters (elsewhere) would be beneficial for wheat pricing.

I am more confident about pricing at the moment than I was last year.