Market Morsel: Using corn to protect barley risk?

Market Morsel

Hedging barley. It’s not an easy task for Australian farmers. What are the options available?

Firstly there is the ASX barley contract; however, it has very low liquidity. The price for spot ASX has not changed in the past eight days, despite changes in the physical market. It would be great if the ASX contract had more volume, but it doesn’t.

The other route that is often mentioned is hedging Australian barley by using corn futures. This definitely gets rid of the liquidity issue, as corn has huge volumes traded on a daily basis.

We often talk about the relationships between commodities and their impact on one another. However, discussing the trend and cross-commodity hedging is another matter altogether.’

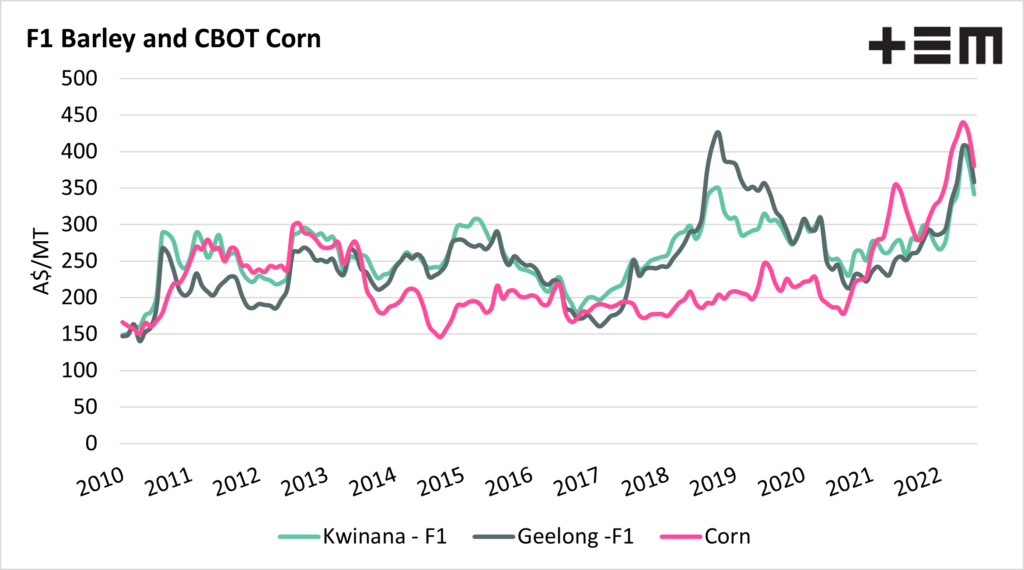

The first chart below shows the relationship between corn and feed barley pricing in Australia since 2010. There are times when corn and barley have a close relationship, in recent times and in the early part of the last decade.

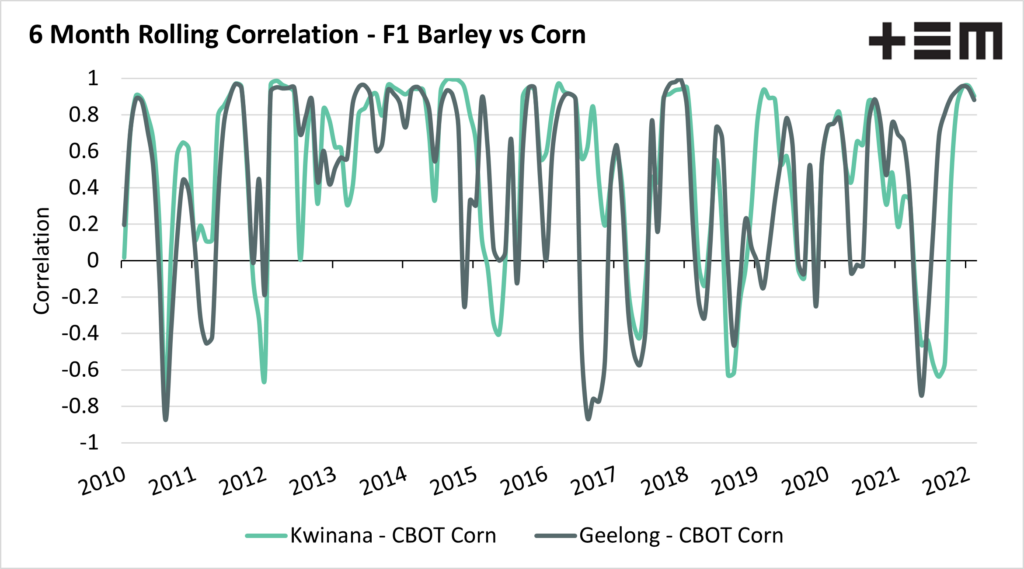

The second chart shows the rolling 6-month correlation between F1 barley and corn. The problem is that the relationship doesn’t always hold. The corn and barley market can show a very strong correlation, but ultimately, it can switch to being uncorrelated.

Hedging grain is about reducing price risk, through using corn, there is the potential that the two markets can move out of sync and, therefore, could add rather than remove risk.