Market Morsel: We trust Europe but not China?

Market Morsel

In recent months, we have returned our barley trade with China, and we got concessions for our hay trade last week.

When we had lost our barley trade and were scrambling around to find new markets, the talk was of diversification. We needed to find new markets so that we were not too reliant on one trading partner.

I have discussed this in many forums, from the Agwatchers podcast to articles on here. The reality is that traders are the ones who decide where the grain will go – not nations. Governments help open the doors for traders to gain access; the grain will go where the best money is.

We don’t seem to have the same concern for canola.

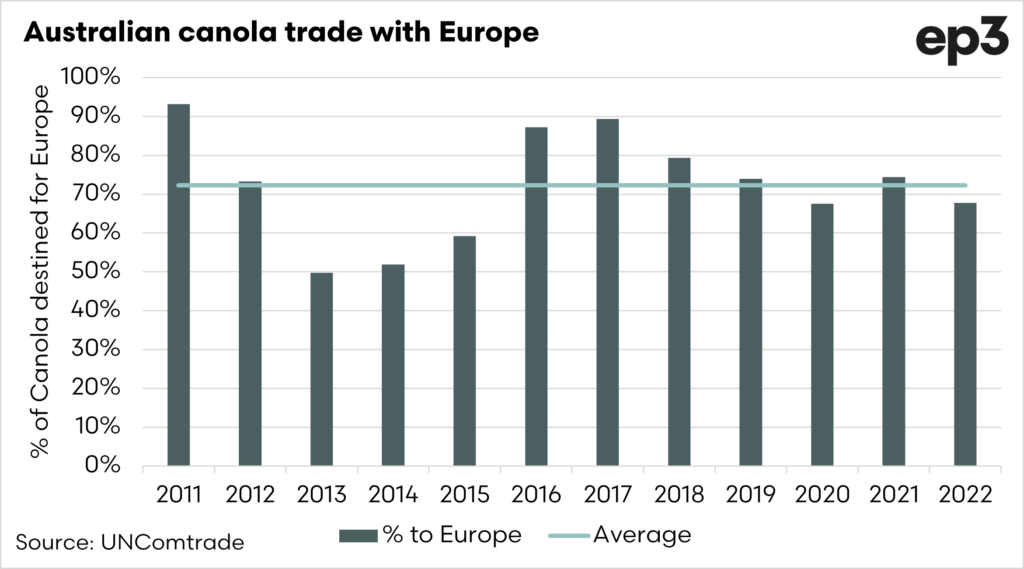

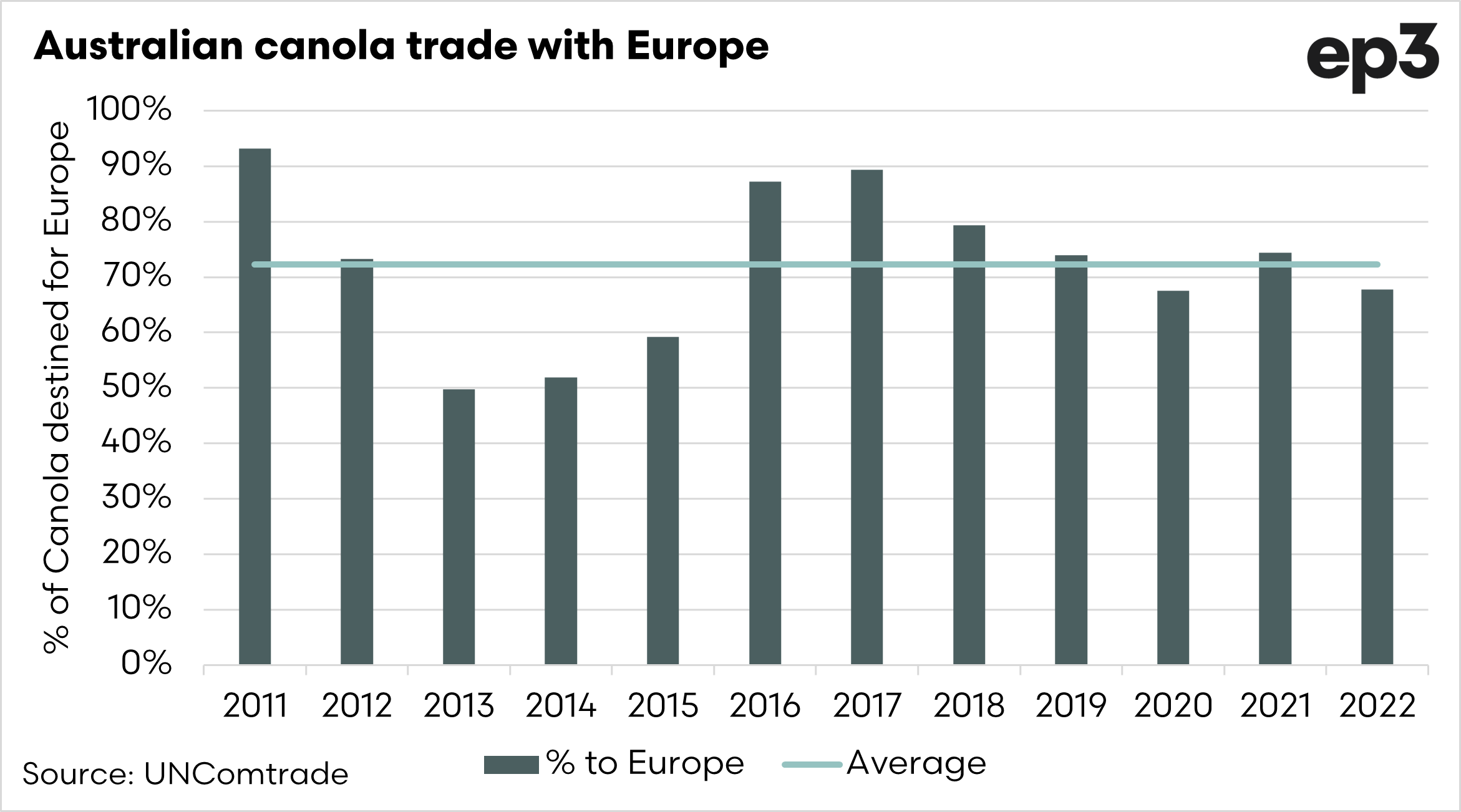

Let’s look at the first chart below, which shows the percentage of our canola exports that were destined for European nations. Over the period 2011 to 2022, this equated to 72%. , and on three occasions, courting 90% of our exports.

There is a reason why this is the case. We produce canola that Europe uses for its biofuel programs, and our canola is in demand over Canadian due to the price achievable for the by-product of non-GM canola meal (or rapemeal).

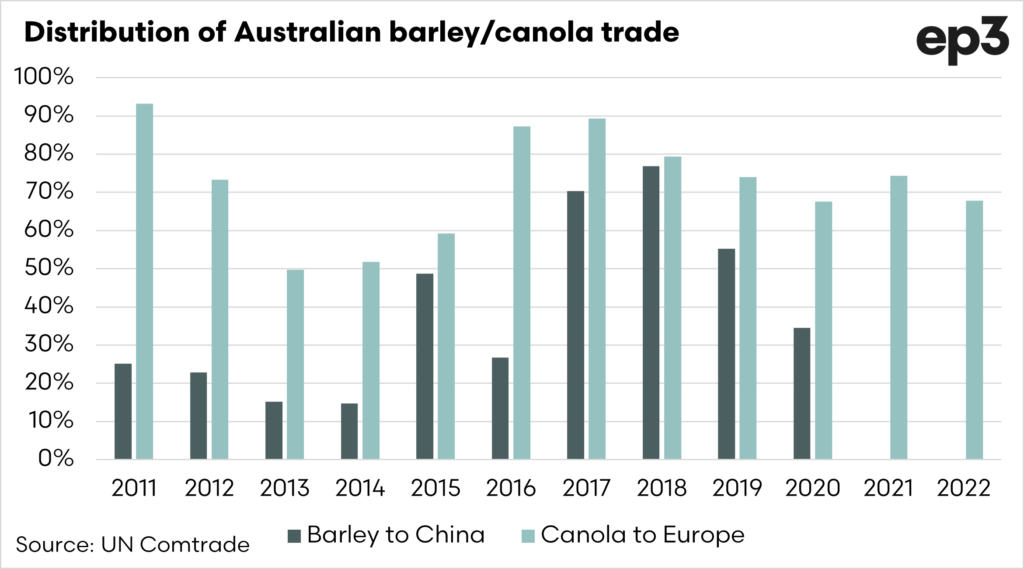

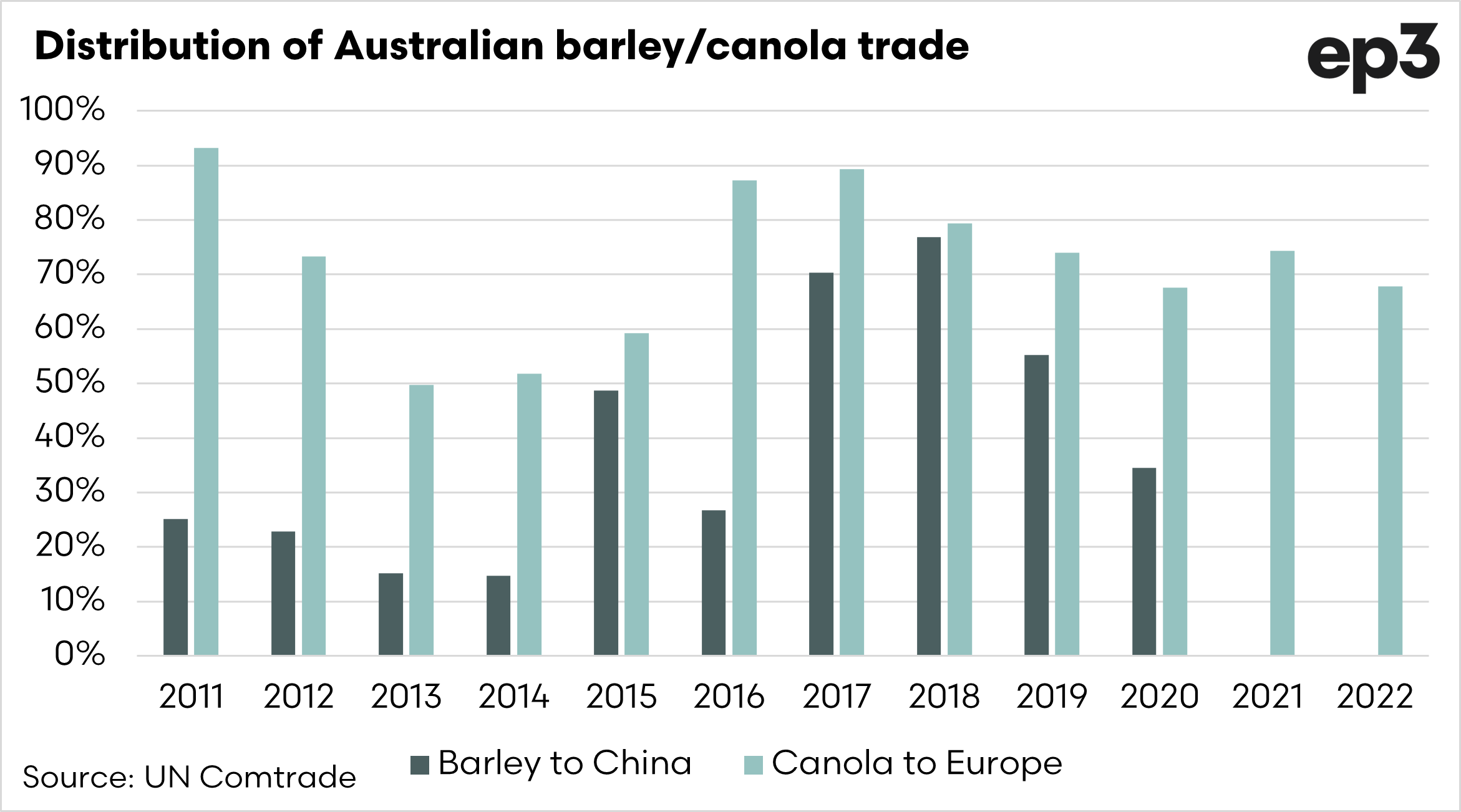

Let’s look at it in comparison with our barley trade. The second chart shows both our canola trade to Europe and our barley trade with China as a percentage of the total. In the period 2011 to 2019, China was a customer for, on average, 40% of our barley.

That being said, we had some very strong years of demand immediately before the anti-dumping ban.

Australian croppers have a much more significant reliance on Europe for the trade of our canola than we do for barley into China. Should we be worried?

Yes, we should. Europe isn’t free from instability; they have policies that may place our canola trade at risk over the coming decade, a topic of which we will be covering on EP3 in the coming weeks and months.