Market Morsel: What should grain farmers be doing?

Market Morsel

It’s that time of year, seeding is beginning and that’s the priority. An eye should still be focused on the market, and what pricing opportunities are available.

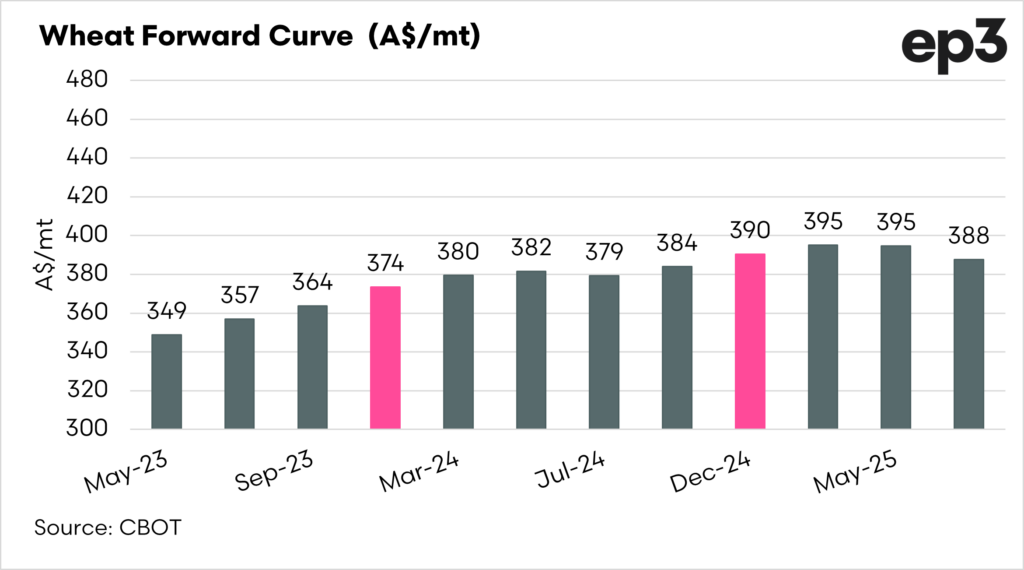

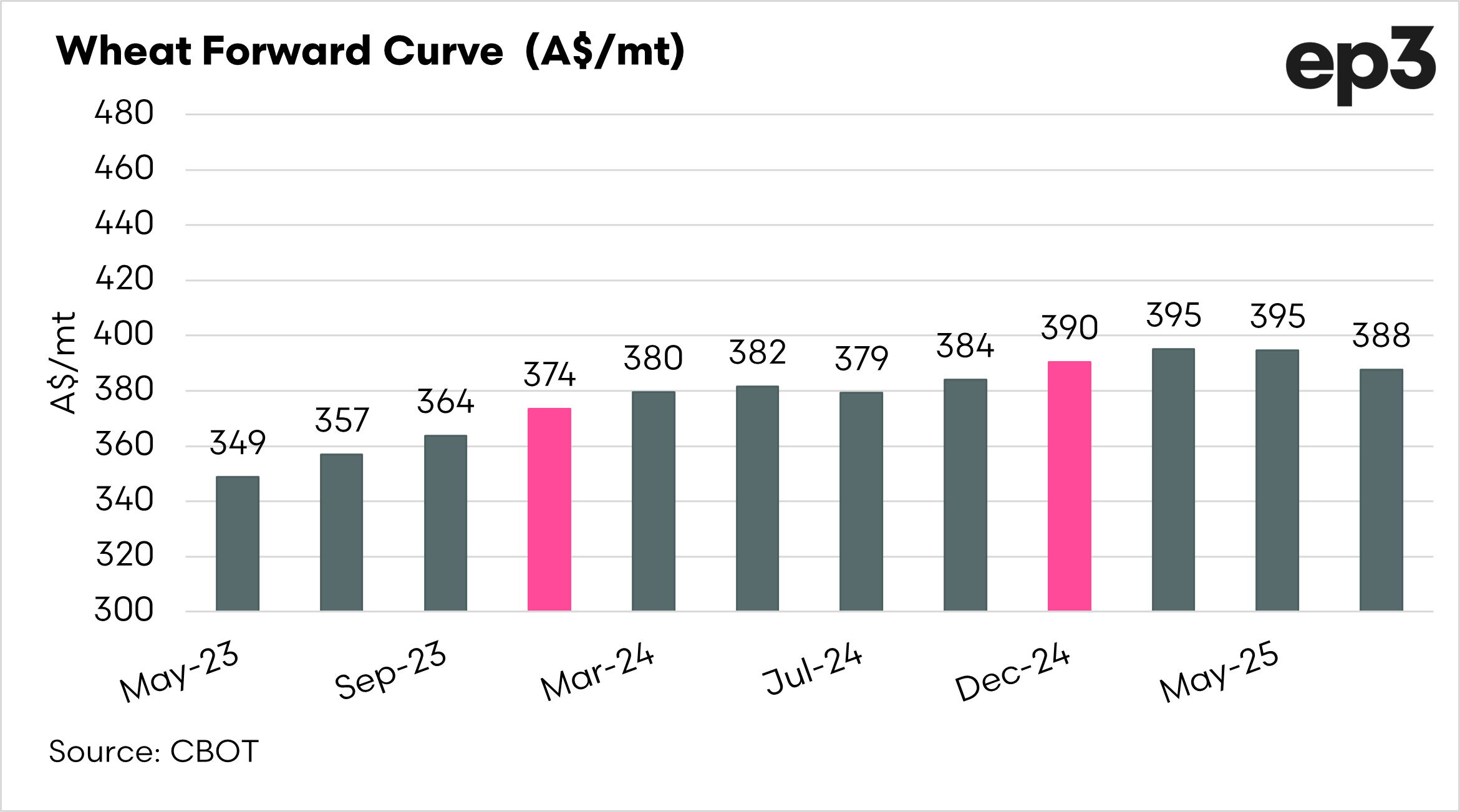

The first chart below shows the forward curve for CBOT wheat. I have highlighted the next two contracts which correspond with the Australian harvest. The coming harvest is pricing at A$374/mt.

It is important to remember that this value still has to have basis included. In the past we would typically have expected basis to run at a premium. That means Australian pricing being at a premium to CBOT pricing. In recent years with the large crops, we have seen our basis turn to a negative.

This year is an unknown, will basis turn to a negative or return to a premium? If basis returns to a more normal premium, then locking in this futures value could return a high A$300s level. Well above A$400 if Australia turns to drought, although admittedly that looks unlikely for this season.

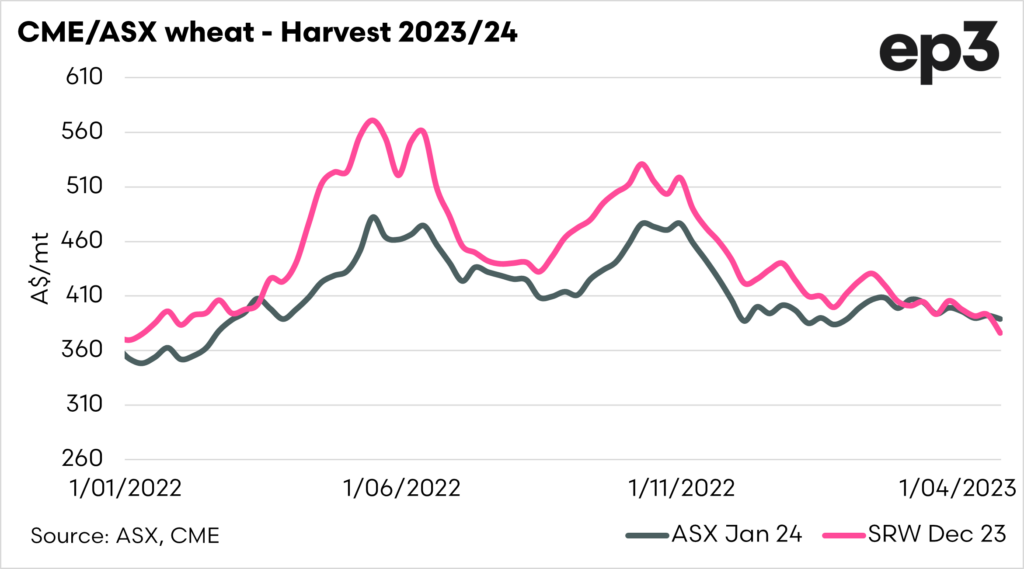

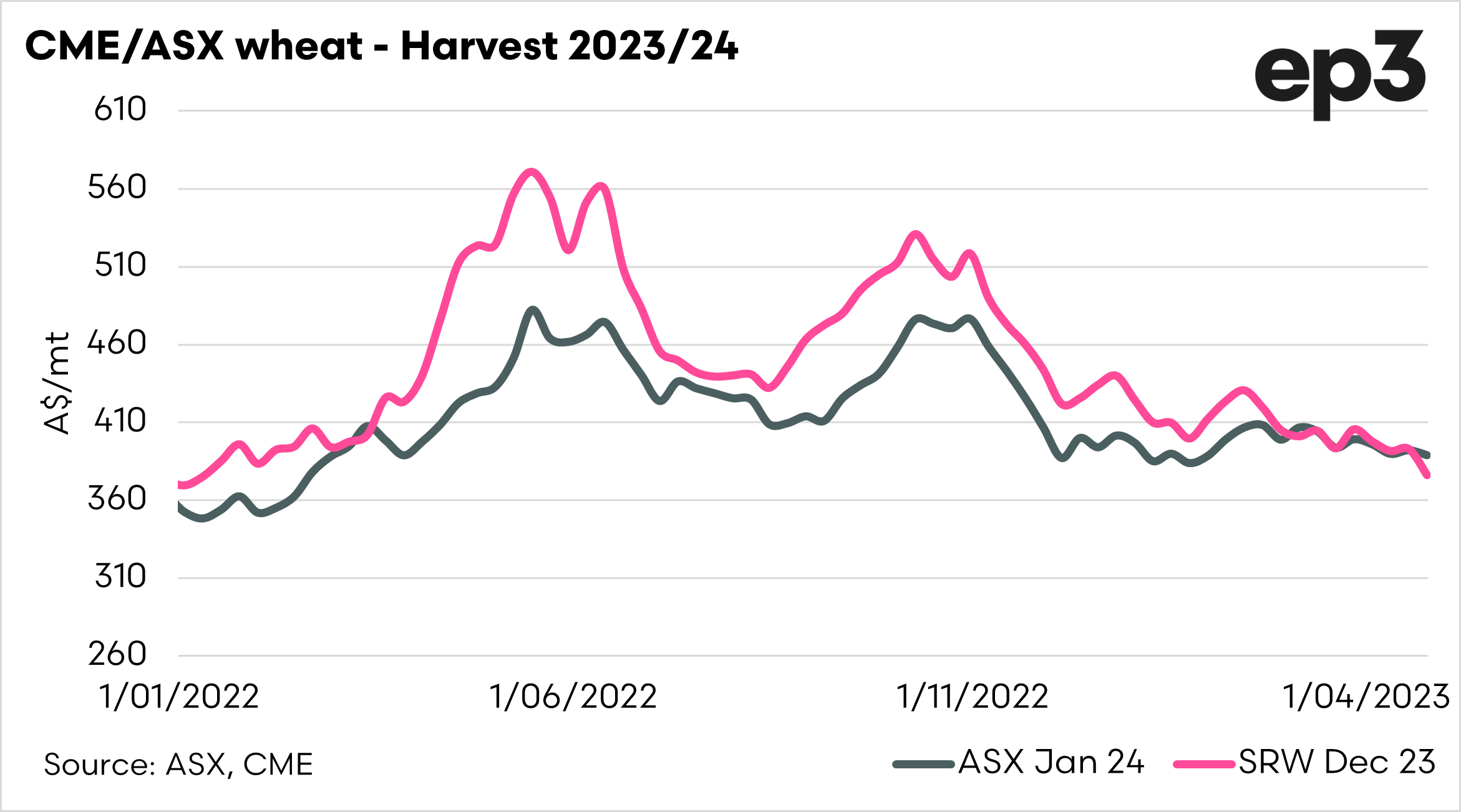

The second chart shows the ASX and CBOT wheat price for the coming harvest. At the moment the ASX contract is pricing at A$389, a premium to CBOT. If you lock in the ASX price, you would effectively be locking in a large proportion of the basis to Australia, although not all to your local price.

At the moment pricing levels remaining historically attractive, however there are a lot of unknowns in the marketplace. The northern hemisphere for one, what happens there drives the world market. There is also a risk emanating from Russia with their threats to end the grain export corridor from Ukraine on the 18th of May.

We believe that no-one should be chasing the top, as you’ll likely miss it, but we need to be pricing when good opportunities come along. How do you eat an elephant, one bite at a time.