Market Morsel: Wheat back to a premium

Market Morsel

It’s human nature to compare ourselves, whether positively or negatively. From a market perspective, we want to compare the prices we are receiving versus other origins.

This is important for commodities, especially wheat. By and large, wheat is wheat. The prices around the world should be largely the same, and any price differences are largely a slight quality differential or logistical costs.

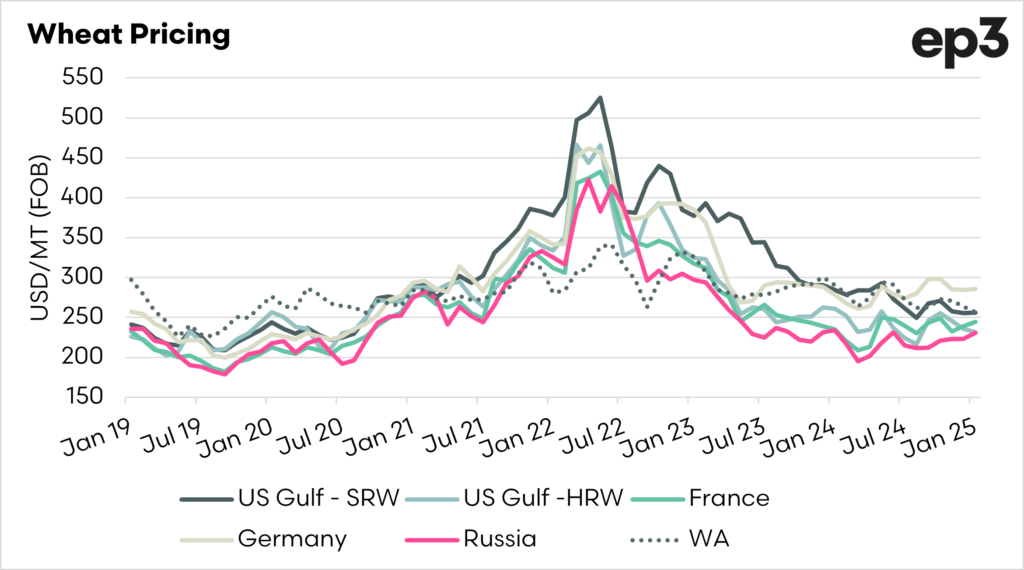

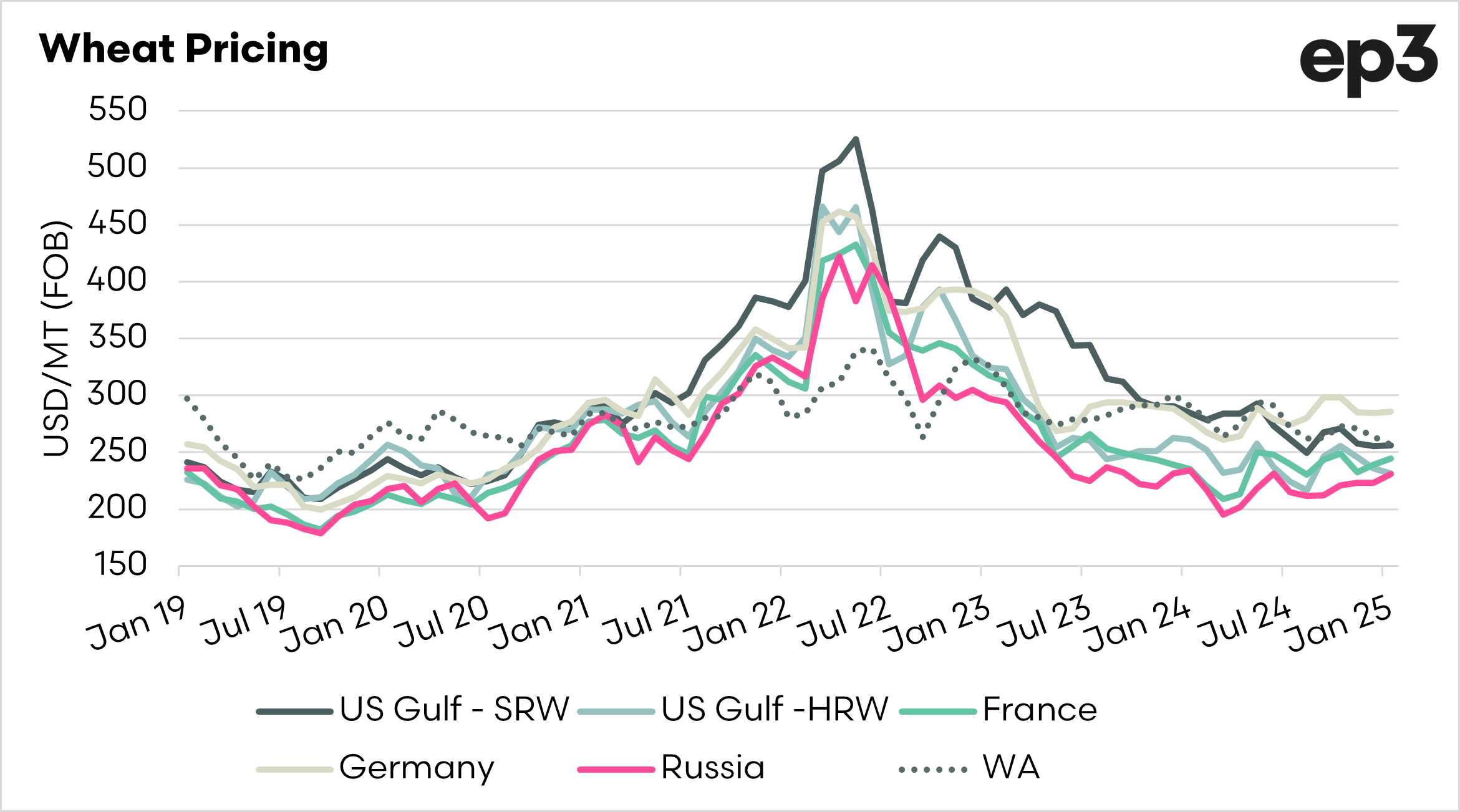

The first chart below shows wheat prices from a range of origins from 2019 to the present. We can see that there was a huge peak in 2022.

A striking feature of the chart is the sharp price increase between mid-2020 and mid-2022. This period aligns with major global disruptions, including COVID-19-induced supply chain challenges and the Russia-Ukraine conflict, significantly impacting wheat exports from two of the world’s largest producers. This reflects the critical role geopolitical tensions play in influencing global commodity markets.

Post-2022, wheat prices show a clear downward trend, with gradual stabilization closer to pre-2020 levels by 2025

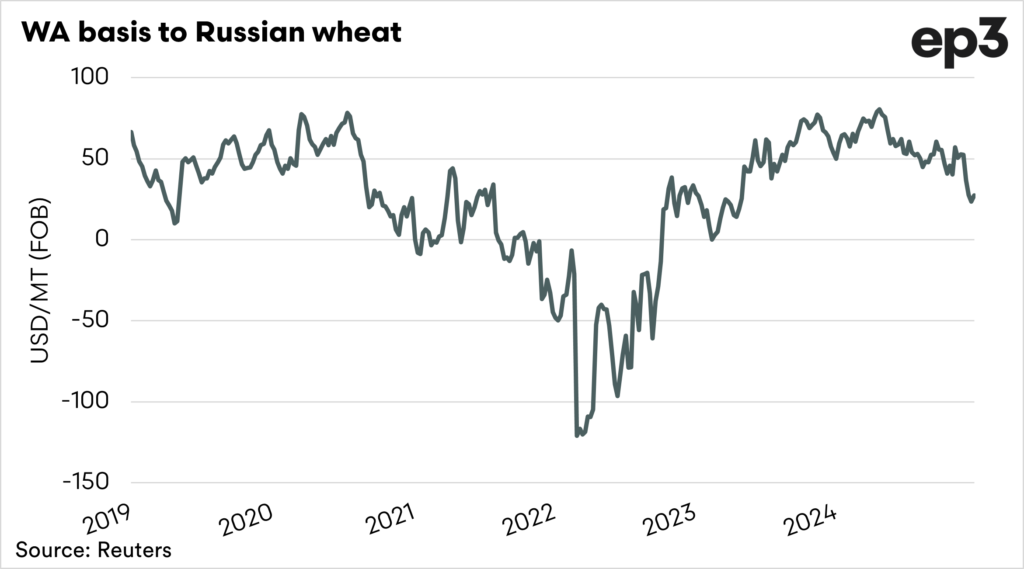

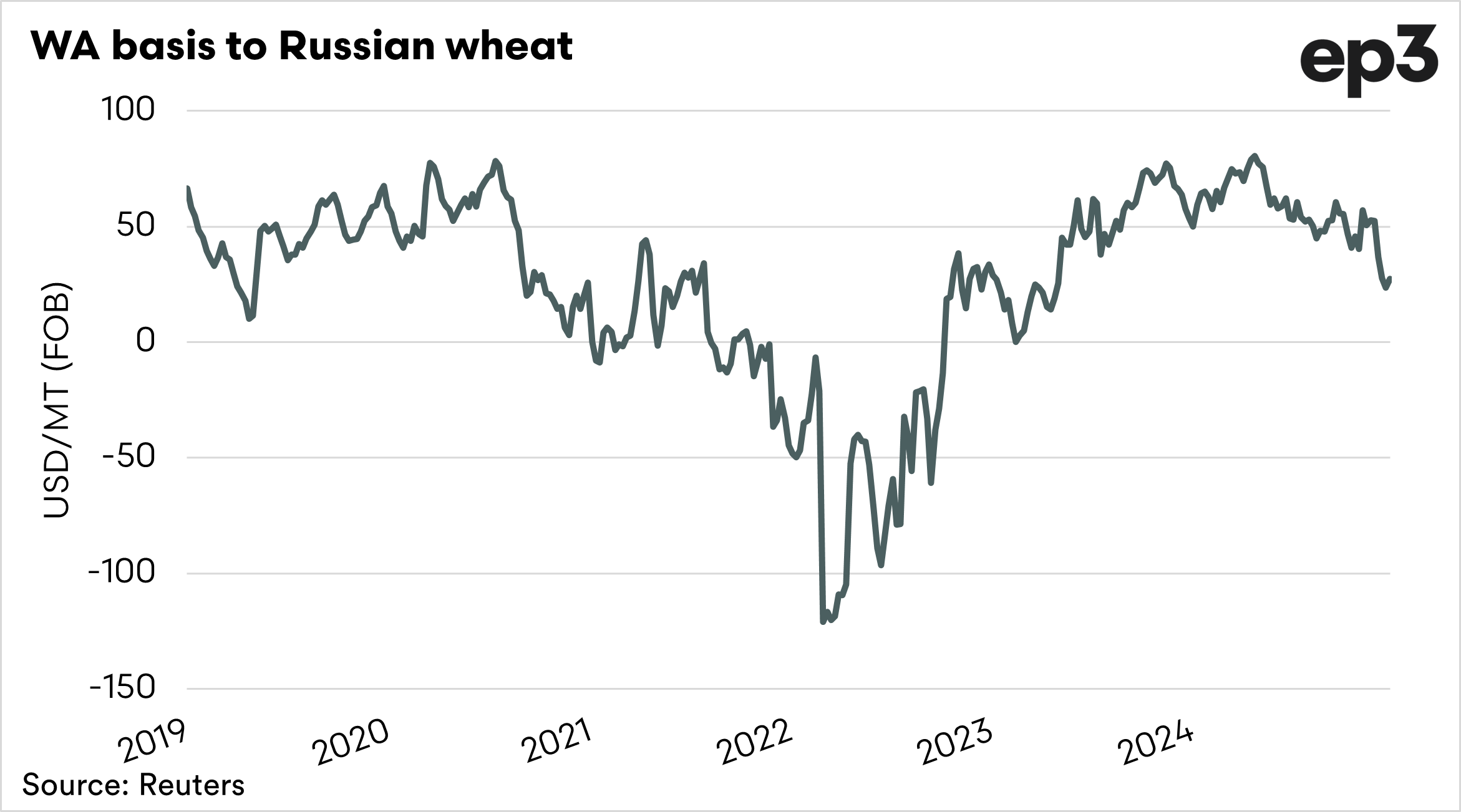

Currently, our pricing is trading at a substantial premium to that of our biggest competitor (Russia). We were heavily discounted to the rest of the world in 2022 due to issues overseas (Russian invasion) and because we had such a huge crop.